An Introduction to Ecological Economics: Chapter 4

| Topics: |

Contents

- 1 Policies, Institutions, and Instruments

- 2 The Need to Develop a Shared Vision of a Sustainable Society

- 3 History of Environmental Institutions and Instruments

- 4 Successes, Failures, and Remedies

- 5 Policy Instruments

- 5.1 Regulatory Systems

- 5.2 Incentive-Based Systems: Alternatives to Regulatory Control

- 5.3 Three Policies to Achieve Sustainability

- 5.4 A Transdisciplinary Pollution Control Policy Instrument

- 5.5 Appropriate Policies, Instruments, and Institutions for Governance at Different Levels of Spatial Aggregation

- 6 ConclusionsIn retrospect, some obvious conclusions can be drawn about the human efforts to date to manage our global habitat (An Introduction to Ecological Economics: Chapter 4) . The adoption of industrial technology has both satisfied and, with positive feedback, accelerated human appetites for material consumption, thereby generating throughputs of materials and energy far in excess of the capacity of the earth’s ecosystems to assimilate sustainably. Exponential expansion of human populations has crowded out other species. The 40-year armament race during the Cold War both absorbed resources which might have been devoted to environmental protection and weakened the resolution needed for reversing centuries of damage to the global habitat. The end of the Cold War has unveiled a heritage of nuclear (Nuclear waste management) and toxic wastes that leaves vast areas at risk or even uninhabitable in both the East and the West.

- 7 Related Links

- 8 Notes (An Introduction to Ecological Economics: Chapter 4)

- 9 Further Reading

Policies, Institutions, and Instruments

"...while purity is an uncomplicated virtue for olive oil, sea air, and heroines of folk tales, it is not so for systems of collective choice."

—Amartya Sen[3]

In this section we discuss some general and specific policy ideas that follow from the previously discussed principles, and introduce instruments that may be useful in implementing these policies. We advocate a broad, democratic process to discuss and achieve consensus on these important issues. This is distinct from the polemic and divisive political process that seems to hold sway in many countries today. What is needed is deep discussion and consensus about long-term goals, not constant quibbling over short-term details.

Democracy is not merely the process of voting. The two are far from the same thing. Voting, without broad-based discussion, information exchange, and, most importantly, agreement on shared goals and visions for the future, is merely the façade of democracy. We have a long way to go to actually achieve the kind of participatory, “living democracy” which Frances Moore Lappé and Paul DuBois, and many others advocate[4]. It is within this context of living, participatory democracy that the policies and instruments we describe below need to be evaluated. They are not answers, they are inputs to the process of living democracy, which must involve all of society in a meaningful way. The starting point is the development of a shared vision of the goals of society.

A broad, overlapping consensus is forming around the goal of sustainability, including its ecological, social, and economic aspects as described above. But movement toward this goal is being impeded not so much by lack of knowledge, or even lack of “political will,” but rather by a lack of a coherent, relatively detailed, shared vision of what a sustainable society would actually look like. Developing this shared vision is an essential prerequisite to generating any movement toward it. The default vision of continued, unlimited growth in material consumption is inherently unsustainable, but we cannot break away from this vision until a credible and desirable alternative is available. The process of collaboratively developing this shared vision can also help to mediate many short-term conflicts that will otherwise remain irresolvable. There has actually been quite a lot of success in using envisioning and “future searches” in organizations and communities around the world[5]. This experience has shown that it is actually quite possible to get disparate (even adversarial) groups to collaborate on envisioning a desirable future, given the right forum. The process has been successful in hundreds of cases at the level of individual firms and communities up to the size of large cities. The challenge is to scale it up to whole states, nations, and the world.

Meadows[6] discusses why the processes of envisioning and goal-setting are so important (at all levels of problem solving); why envisioning and goal-setting are so underdeveloped in our society; and how we can begin to train people in the skill of envisioning and begin to construct shared visions of a sustainable society. She tells the personal story of her own discovery of that skill and her attempts to use the process of shared envisioning in problem solving. From this experience, several general principles emerged, including:

| Really Want |

Settle For |

| Self-esteem | Fancy car |

| Serenity |

Drugs |

| Health |

Medicine |

| Human happiness |

GNP |

| Permanent prosperity |

Unsustainable growth |

- In order to envision effectively, it is necessary to focus on what one really wants, not what one will settle for. For example, the lists below show the kinds of things people really want, compared to the kinds of things they often settle for.

- A vision should be judged by the clarity of its values, not the clarity of its implementation path. Holding to the vision and being flexible about the path is often the only way to find the path.

- Responsible vision must acknowledge, but not get crushed by, the physical constraints of the real world.

- It is critical for visions to be shared because only shared visions can be responsible.

- Vision has to be flexible and evolving.

Probably the most challenging task facing humanity today is the creation of a shared vision of a sustainable and desirable society, one that can provide permanent prosperity within the biophysical constraints of the real world in a way that is fair and equitable to all of humanity, to other species, and to future generations. This vision does not now exist, although the seeds are there. We all have our own private visions of the world we really want and we need to overcome our fears and skepticism and begin to share these visions and build on them, until we have built a vision of the world we want.

In the previous sections we have sketched out the general characteristics of this world—it is ecologically sustainable, fair, efficient, and secure—but we need to fill in the details in order to make it tangible enough to motivate people across the spectrum to work toward achieving it. The time to start is now.

Nagpal and Foltz[7] have begun this task by commissioning a range of individual visions of a sustainable world from around the world. They laid out the following challenge for each of their “envisionaries”:

Individuals were asked not to try to predict what lies ahead, but rather to imagine a positive future for their respective region, defined in any way they chose—village, group of villages, nation, group of nations, or continent. We asked only that people remain within the bounds of plausibility, and set no other restrictive guidelines.

The results were revealing. While these independent visions were difficult to generalize, they shared at least one important point. The “default” Western vision of continued material growth was not what people envisioned as part of their “positive future.” They envisioned a future with “enough” material consumption, but where the focus has shifted to maintaining high-quality communities and environments, education, culturally rewarding full employment, and peace.

Much more work is necessary to implement living democracy and within that to create a truly shared vision of a desirable and sustainable future. This ongoing work needs to engage all members of society in a substantive dialogue about the future they desire and the policies and instruments necessary to bring it about. In the following sections we discuss the history of some current Western institutions and policy instruments that have been used to address environmental issues, and offer some new ideas to expand this range. They are not “solutions” to the problems of environmental management or sustainability, but rather inputs to the broad democratic discussion of options and futures. They need to be used in various combinations and modified to fit different cultural contexts. They also can serve as the starting point for development of new policies and instruments which are better adapted to unique circumstances.

History of Environmental Institutions and Instruments

As noted above, severe anthropogenic damage to some regions of the earth began as soon as humans learned to apply entropy-increasing technology processes to agriculture, and was sharply escalated by factory production in Europe during the industrial revolution. Massive loss of life from the spread of water-borne disease continued to be accepted as part of the human condition until advances in scientific knowledge concerning the role of microorganisms prompted public health research to develop sewage treatment systems. Vast urban expenditures on such systems eventually reduced the enormous loss of human capital from the uncontrolled discharge of sanitary waste into waterways. The application of appropriate science, appropriate technology, and community will was necessary to reduce the costly loss of human capital which had resulted from unprecedented population expansion, concentration of humans into unplanned urban areas, and uncontrolled appropriation of open-access resources.

In the U.S., pollution of harbor waters, fear of human disease, and financial loss from contamination of oyster fisheries in the Chesapeake Bay finally forced the city of Baltimore to become the first major city in the nation to construct, during the period from 1909 to 1912, a municipal sewage treatment plant, with Washington, D.C., not following suit until the late 1930s[8]. The Bethlehem Steel Company persuaded the State of Maryland to permit the company to run Baltimore City’s sewage effluent through the company’s plant as coolant. This was arranged on terms very favorable for the company, but to the considerable discomfort of the labor force in the plant[9].

Unfortunately no such zeal was applied to the removal or treatment of toxic wastes from this steel plant or other factories polluting the Chesapeake Bay and the estuaries, rivers, lakes, and oceans of the earth until late in the last half of the 20th century. Appropriate policies and management instruments had been discussed by physical and social scientists, but the political will necessary to confront the economic power of the dominant industrial establishment was unequal to the task. Under the federal system in the U.S., the central government left environmental management to the states. This was a system which virtually guaranteed environmental degradation, since competition among states for economic growth was a convenient excuse for avoiding effective regulation. Nor, in the face of abdication of environmental responsibility by all levels of government, could victims of environmental damage count on redress in the court system. Although award of damages for injury was a time-honored principle of common law, the burden of proof was on the plaintiff and it was formidable. Victims had to prove not only that they had suffered injury, but that a specific party had caused the injury, to the exclusion of other sources of the injury.

This combination of institutionalized pollution permissiveness and lack of recourse from government or courts, combined with the global expansion of energy and material throughput into a finite environment following World War II, set the stage for a series of ecological catastrophes. These events not only energized the then small community of those concerned about the ecological health of the earth, but they also increased the awareness of some leaders that ecological damage could reduce the profitability of economic systems, which had been their primary concern. Although academic scientists and even a small minority of economists were on record with their serious concerns about what they perceived as a collision course with ecological catastrophe, it took a best-seller authored by a scientist, Rachel Carson’s Silent Spring[10], to capture the public imagination. Silent Spring presented a dramatic message in a lyrical form which alerted the public to the long-run ecological consequences of the toxics-laden waters, urban smog, and accumulating litter, which were becoming all too evident to increasing numbers of citizens. Local but increasingly severe and frequent environmental catastrophes such as the Cuyahoga River catching fire in Cleveland, the near death of Lake Erie, ubiquitous toxic spills, toxic dumps, fatal smog incidents in Pennsylvania, and smog in the Grand Canyon gradually convinced the majority of Americans that action was needed. Similar reactions followed in Western Europe. Finally a new and intensive inquiry into the state of the earth and the policies and instruments needed for its protection could begin. The public awareness of the need for innovation in policy, however, moved far in advance of recognition of the need for innovation in instruments for carrying out these policies.

The U.S. legislative response to accelerating environmental damage was President Richard Nixon’s National Environmental Protection Act of 1969. The goal was to halt the accelerating environmental degradation, and the policy instrument for implementing this objective was the traditional recourse to direct regulation. Reflecting the conventional wisdom of the time, the federal government legislated broad policy guidelines in general terms, leaving implementation primarily to the states. State compliance was sought through the pragmatic U.S. practice of offering generous federal grants for participation combined with potential federal intervention in cases where states failed to formulate effective plans. This federal approach had served the nation well since the early federal period when it was introduced by President Thomas Jefferson in the era of “internal improvements”[11].

Given the legislative history of the U.S., as polluters were forced to recognize that some form of control was inevitable, they reluctantly accepted the familiar regulatory approach as that with which they were most familiar, and which they could most easily manipulate to their own advantage. Legislators and bureaucrats recognized new opportunities for funding, power, and careers at both the federal and state levels, which was the time-honored formula and quid pro quo for gaining acceptance of innovative programs.

Unfortunately, the new environmental regulations, though designed for acceptance by the major interest groups, lacked two dimensions that were essential for adequately confronting the accelerating pollution problems: sound scientific grounding and economic efficiency. Predictably, environmental protection lagged behind the expanding throughput of pollutants into air and water, and onto the land.

The major objection to the inefficiency of the regulatory approach came initially from the economics profession, in which a small minority had broken with the traditional preoccupation with promoting economic growth to focus on evaluating and ameliorating the unanticipated detrimental side effects of growth, especially pollution. The existence of these spillover phenomena, now termed externalities, had been recognized in the economics literature since their identification by A. C. Pigou[12], but were regarded as more of an academic anomaly than a real-world problem. Ayers and Kneese[13] confronted the economics profession with the proposition that pollution externalities, far from being an anomaly, were actually pervasive in industrial economies with their massive throughputs. Furthermore, regulatory approaches were not proving equal to the task of coping with the vast throughput of mass and energy with which industrial economies were converting low-entropy inputs into high-entropy pollutants. More-efficient instruments of pollution control were needed.

The scientific basis for this phenomenon had actually been worked out in impressive detail by another economist, Nicholas Georgescu-Roegen[14], who, as noted above, argued eloquently for the need to reformulate economic thinking and models for consistency with the fundamental physical laws of thermodynamics and entropy, hitherto almost totally neglected by the profession. Casting the environmental problem in terms of externalities, a concept familiar to economists, focused attention directly on policy instruments since Pigou had demonstrated that an offsetting tax on detrimental externalities, such as pollution, could restore economic efficiency and increase welfare in otherwise competitive economies. Thus, a large literature emerged in support of replacing inefficient regulations with economically efficient taxes on pollution. This notion failed initially to gain wide support outside of the economics profession, but, because of its compelling potential efficiency gains, has begun more recently to become imbedded in U.S. and other management programs, as will be explored below. As society was forced in Western nations to expand the amount of real resources allocated to protecting their populations and resources, the need for greater economic efficiency in the use of these scarce resources became more urgent. However, strict application of the efficiency principle appeared to neglect distributional issues and to threaten the now vested interests of polluters and regulators alike, delaying and limiting its acceptance in the political arena. And, as we have previously noted, the issue of sustainable scale had not yet been recognized and incorporated.

As the U.S. and other nations began curbing some of the grosser environmental insults from point source emissions of pollutants, ecologists and resource managers could begin to address more subtle but more ominous phenomena, such as sharp declines in species diversity, natural habitats, and ecosystem health. Ecologists and others began to point out that the human economy was a subsystem of the earth’s total ecology, and could not long function sustainably or even efficiently without a healthy life-support system[15]. This brings us to ecological economics’ efforts to reintegrate social and natural science around the three goals of sustainable scale, fair distribution, and efficient allocation.

Despite this growing awareness of threats to the global ecology, the intensity of the Cold War simultaneously accelerated the generation of nuclear (Nuclear waste management) wastes, along with other long-lived toxic wastes, and diminished the will to contain or to control them. The greater openness in both the East and the West since the end of this 40-year arms race is beginning to reveal the appalling extent of the chemical, nuclear, and biological wastes produced, stored, and discarded both deliberately and accidentally. Without drastic and costly remedial action, vast areas of the earth will remain contaminated and unfit for habitation for long periods. The seriousness of this problem and its complexity demonstrate the need for a new generation of policies and instruments which will be based upon science, which is sufficiently sophisticated to deal with the complexity of the problem, economically efficient enough to accomplish the goals with the funds available, and socially equitable enough to win the consensual, democratic support required nationally and internationally. Ecological economics offers just such a transdisciplinary approach for approaching these formidable challenges.

Various conclusions can be drawn from this brief overview of the evolution of thinking about environmental policy instruments. The management structure developed by a society for protection of its environment tends to reflect the distribution of economic and political power of interest groups within that society. However, without the inclusion of broader scientific perspectives such as ecology, thermodynamics, uncertainty, and sustainability, and without broader social concepts such as fairness, equity, and ethical values, the most well-intentioned efforts at environmental protection will be overwhelmed by the continued exponential growth of production, consumption, technology, and population (Human population explosion). The magnitude of remedial work to be accomplished means that the instruments used must be economically efficient. But they must at the same time be fair and lead to an ecologically sustainable scale of activity. The following sections investigate these issues in more detail.

Successes, Failures, and Remedies

For purposes of achieving the environmental and other social values identified here, society has created an array of interlocking institutions. For satisfying material needs and wants, competitive markets have evolved as efficient though not perfect institutions. For addressing market failures, pursuing equity goals, and other community purposes, governmental institutions have evolved, though few would defend them as totally satisfactory. Therefore, in order to address the intervention failures of government, citizens have banded together to form voluntary non-governmental organizations. However, it should come as no surprise that even these NGOs have their failures and shortcomings, as will be examined below. These formal institutions, markets, governments, and voluntary organizations, though potent forces, should not cause us to overlook the most fundamental source of power in an open society, namely, the actions and values of individuals.

Individual actions and values are the ultimate determinants of environmental quality and of the possibility for sustainability. Individual decisions about what to purchase, consume, wear, and drive, about where and how to live, what jobs to seek, how many children to have, will decide the future. Each of these consumption decisions determines what resources, renewable or irreplaceable, must be used in its production, and what pollutants will be emitted when they become waste, as all produced goods inevitably must become sooner or later. It is individual and family choices about family size, lifestyle, residential style, career paths, and voting choice that will determine the viability of the environment, the life span of our natural resources, the diversity of the biosphere, and the possibility of global sustainability. Obviously, the amount of freedom and latitude we have in making these choices varies widely and is a function of affluence and education. Therefore it follows that the responsibility for wise choice (and example) falls most heavily on the rich, the privileged, the educated, the famous, and the powerful. Choosing sustainability is thus ultimately a matter of moral, ethical choice and thus a result of individuals’ fundamental values. Although these human values are basically independent of the biophysical constraints that limit their realization, we nevertheless believe that they are affected in part by knowledge. Knowledge about ecology, about economics, and about their interrelationships will help modify some of the values that lead to excessive consumerism, to the search for satisfaction in materialism, and to the search for social salvation through quantitative [[growth] of economic throughput].

The Policy Role of Non-Government Organizations

Although governments are now (since the 1970s) staffed at many levels with agencies nominally charged with environmental protection, it is difficult, upon close examination of the performance of these agencies, for those working for effective environmental management to avoid disillusionment. Indeed, it would be naive to have any other expectation than that these agencies will faithfully reflect the distribution of political and economic power of the society in which they are embedded. Therefore, environmental agencies have not only been limited in their ability to achieve environmental improvement, they have at times obstructed it and even dismantled environmental programs. James Watt as Secretary of the U.S. Department of Interior and Ann Gorsuch Burford as Administrator of the U.S. EPA are examples of officials who were appointed to turn back the clock on environmental protection, and who succeeded in creating damage that will be difficult to repair. The 1996 “contract with America,” despite good intentions, envisions even greater environmental retrogression.

It is one of the strengths of a pluralistic society that alternative institutions emerge in order to protect vital interests. One response to governmental intervention failures in managing the environment is the emergence of NGOs (non-governmental organizations). Work by Buchanan[16] and others in the public choice field helps explain this phenomenon of intervention failures. While there are many able, idealistic public servants who are dedicated to the public interest, with Watt and Burford being extreme examples of those serving special interests, few would argue that government alone, relying upon current practices, can be depended upon for environmental protection. However, some steps should be taken in order to make existing institutions more effective in carrying out their legal responsibilities for protecting and managing environmental resources. One, for example, would be to establish awards that would provide additional financial and professional incentives with which to reward resource managers who perform outstandingly efficient, innovative work in environmental protection.

Another step would be for citizens to provide more support for conservation groups such as the Sierra Club, the Nature Conservancy, the Chesapeake Bay Foundation, and the Natural Resources Defense Council which have responsible records in providing environmental protection where public agencies have failed, and for these groups to coordinate their programs.

Adaptive Ecological Economic Assessment and Management

It is undeniable that technological innovation has generated significant advances in human welfare. However, in retrospect, not all technologies have resulted in positive net improvements in human welfare. Nor have advanced technologies been managed responsibly. The most obvious cases of technologies without which humanity would be better off are the military technologies of mass destruction, such as nuclear and biochemical weapons, which society is struggling to ban. Additionally, it is possible to cite some nonmilitary technologies, such as nuclear energy, agricultural chemicals, and even the internal combustion engine, which have had large unintended negative environmental consequences. Certainly the final judgment of history has yet to be rendered on these technologies, but at the minimum, all but the most doctrinaire libertarians would concede that there is room for better management of these technologies. However, once these technologies are introduced, it is difficult to squeeze the genie back into the bottle. A reasonable inference to be drawn from experience is that lessons might be gained from history that can guide and manage the introduction of massive technological systems which potentially have far-reaching consequences for humanity.

Granted that the law of unintended consequences makes it impossible to anticipate all of the impacts for better or for worse of technology, this does not mean that it is totally impossible or undesirable to devise minimal guidelines in advance of introduction for assessing and managing technologies, especially those having global implications. While technological laissez faire may have been appropriate in a relatively empty world, now that humans have the capability of rendering the earth uninhabitable, we no longer can afford to let survival depend upon the benevolence and wisdom of naive technological enthusiasts.

The shaping of policies and instruments for technology assessment is a difficult task requiring transdisciplinary research of a high order, but some minimal guidelines can be offered[17].

- Exceptional caution should be exercised before the introduction of high-entropy systems, such as fossil fuels and nuclear energy.

- Low-entropy systems, such as solar energy, are less irreversible and less damaging than high-entropy systems.

- Technologies that depend upon a high ratio of human intelligence and information to material and energy throughput have a higher probability of advancing human welfare than do high-entropy technologies.

Examples of low-entropy technologies depending upon high input ratios of intelligence and information to mass and energy include notably the telescope, the microscope, reading glasses, the compass, the sextant, the chronometer, and other navigational instruments that literally opened up new worlds to humanity. It remains to be seen whether the much higher entropy exploration of space will bring comparable benefits to humanity. Other examples of benevolent technologies are transistors and silicon chips, which have made possible the computer, yet save energy.

Obviously, any technology, even that characterized by lowest entropy can be applied to antisocial purposes of crime and warfare, so no guarantees of benevolence can be realistically expected, and the distinction must be made between the potential environmental impact of the technology and the purposes to which it is applied. What technology essentially does is to extend the power of humans to accomplish constructive or destructive ends. Thus the mastery of technology requires both its assessment before adoption and the responsible social control of its application as well as a realistic understanding of human motivation.

Several guidelines for the management of technology can be drawn from regrettable lessons of history. We should have now learned that before adopting new systems, it would be desirable to examine the full life cycle of the technology. This elementary precaution could save us from such disasters as making major commitments to nuclear energy before understanding the problems of storing radioactive wastes, safeguarding them from terrorists, and decommissioning contaminated plants.

Another guideline for the management of technologies is to require, before the acceptance and adoption of new systems, the implementation of mass balance and energy balance accounting systems so that a comprehensive tracking of wastes is assured.

Habitat Protection, Intergenerational Transfers, and Equity

Many options exist for habitat protection, including purchase, easements, and gifts, each having a role[18]. Protection should begin as soon as possible, before adverse uses and property rights are established. This section explores priorities for acquisition and relates habitat protection to equity across regions, groups, and generations.

The central point of this section is that in selecting the stock of environmental resources to be passed along to future generations, emphasis should be given to such resources as large-scale living ecosystems containing species diversity, complex interrelationships between species, and, above all, the capability of supporting evolutionary processes over sufficiently long enough time frames that species can evolve and adapt to both man-made and natural changes in climate and other environmental conditions. Obvious candidates include rain forests, estuaries, wetlands, lakes, river basins, grasslands, polar regions, and coral reefs. However, the ultimate selection of the highest priorities for protection of sustainable ecosystems should be made by transdisciplinary teams including not only ecologists, but other representatives of life sciences, earth sciences, physical sciences, and social sciences preferably with insights also from the arts and humanities.

After the identification of the scientific principles and priorities for selecting sustainable ecosystems for intergenerational transfer, the challenge of designing the most effective policy measures for acquiring and protecting these ecosystems will remain.

A major challenge will be gaining acceptance for large-scale current sacrifices that will produce uncertain benefits in an uncertain future. Another complicating factor is the need for consensus on goals for global cooperation in implementation. The fact that serious intragenerational inequalities exist in the distribution of current income and wealth will make it difficult to achieve consensus on the need for intergenerational transfers and will complicate the problem of apportioning sacrifices. A related problem is that, in an uncertain future, the continuity of a commitment to pass on ecological resources cannot be guaranteed for future generations that are not parties to the agreement. Therefore, intermediate generations may be tempted to consume all or part of an inheritance that was intended for the more distant future. There is the danger of a prisoners’ dilemma in which uncertainty about the action of intermediate generations could reduce the welfare of more distant future generations. However, as successful experience is gained in protecting intergenerational transfers, uncertainties could be reduced and welfare gains increased.

Well known public goods problems could pose additional difficulties in making intergenerational transfers, to the extent that future benefits will be shared by all regardless of which group made the sacrifice to provide them. In the case of global public goods like the atmosphere and oceans, those groups making current sacrifices to protect the resources could not reap the entire benefits. This free-rider problem could reduce incentives to sacrifice unless measures could be designed to spread the burden widely.

Therefore, in choosing policy instruments for acquiring and protecting sustainable ecosystems, new courses must be charted utilizing what limited insights are available from the fields of public choice and policy science. It is unlikely that acceptable policies can be derived from any one discipline such as economics, with its primary focus on efficiency, or ecology with its limited institutional content, or from any other single discipline. Therefore, it seems self-evident that policy instruments for intergenerational transfers must be drawn from a transdisciplinary approach.

Given the fact that making bequests requires sacrifices and therefore involves scarcity problems, economic efficiency concepts can be helpful in achieving the maximum amount of resource protection for a given amount of resources available, or they can assist in achieving specified resource endowments at minimum total cost. The field of economics can also offer some limited insights into problems of distribution and equity. An especially important concept is that of Pareto improvement, which suggests that policies are most likely to gain acceptance if they can be designed so that there are no losers, or alternatively so that the gains from the policy are great enough to compensate the losers, and that compensation actually occurs.

The criteria for ecological bequests must be based upon good science which should emphasize protecting species diversity and minimizing entropy increase. Finally, in order to gain acceptance, policies for making intergenerational transfers must be realistically based upon acceptance by the major interest groups involved. Society has already begun the process of making intergenerational environmental transfers in the form of wilderness areas, wildlife sanctuaries, protected parts of the polar regions, and similar set-asides. These programs have been initiated not only by local, state, national, and international governmental organizations, but also by non-governmental organizations (NGOs) such as the Nature Conservancy. Significantly, many families and individuals have demonstrated the value they place upon intergenerational environmental transfers through their willingness to bear the opportunity cost of holding land and resources in their natural state. These public and private initiatives in protecting living ecosystems offer guideposts for the much greater future efforts that will be necessary for achieving sustainable global environments.

In cases where governments already own very large tracts, such as in the western United States, the task of acquisition and set-aside can be relatively easily accomplished. Setting aside tracts currently held by governments has the advantage of not requiring additional expenditure, but it must be recognized that there is an opportunity cost equal to the value of the highest alternative use to which the asset could be put. The least-cost way of protecting valuable ecosystems is through simple appropriation, but this approach may fail the equity test. In cases where high-priority ecosystems are in private hands, a wide array of policy instruments for acquisition is available. The most straightforward method is through purchase, which has the equity advantage of fully compensating current owners, but has the budgetary disadvantage of being very costly. The funds available for acquiring ecosystems can be stretched through the purchase of easements strong enough to protect the desired ecological feature but sufficiently permissive to grant current owners lifetime estates or limited use in return for long-run protection.

In the cases where funds are raised by the government for acquisition, the cost to current generations is made explicit through the taxing and budgeting process, and in democratic societies can be achieved only through consensus. Transfers of funds from the general public to the current owners of the ecologies are made explicit under this procedure. An important economic consideration is what the taxpayers must give up in order to make the transfer possible, and what the recipients of the funds do with the proceeds. Thus, when government purchases of ecological assets occur, redistribution occurs not only between generations, but within current generations.

Policy Instruments

An important element in the evolution of ecological economics has been a serious concern not only with the goals, policies, and programs needed for environmental sustainability but also with the design of improved and innovative policy instruments needed for the successful accomplishment of these goals. Thus far, we have emphasized the basic principles of ecological economics and derived from them an agenda of programs that seem to us to be essential in changing our course from the current policy of looting the planet to that of protecting species diversity and of building a sustainable human society on earth with concern for equity among groups, regions, and generations.

However, one critical factor which is often given short shrift in discussions of environmental protection is analysis of the policy instruments which are fundamental to the achievement of program objectives. For example, Gore’s Earth in the Balance[19] provides a visionary set of programs which, if implemented, could advance us significantly toward the goal of a sustainable society. However, he gives much less attention to the policy instruments needed for achieving the admirable goals he enumerates. This is not intended as criticism, but as an observation that even some of the most serious and dedicated environmentalists, among whom Gore has certainly been in the forefront, are more comfortable in dealing with the large issues of goals and purposes than with the technical aspects of instruments for achieving them. We, on the other hand, believe that a serious approach to environmental management must include analysis of the management instruments to be used as an integral part of the program to be implemented.

One reason for the typical neglect of policy instruments is the widespread dependence, especially in the U.S., on a regulatory approach to environmental management. Beginning with the National Environmental Protection Act of 1969 which established the EPA, the primary approach to environmental protection has continued to be the promulgation of regulations intended to achieve the desired objectives. This approach has achieved a great deal and unquestionably has left the U.S. in a much better position than we would have been in without it. However, few would agree that the results have been entirely satisfactory, and questions must be raised:

- Might some other approaches have given better results?

- Are present approaches inadequate for dealing with the growing problems of the future?

- Can improved policy instruments be designed to provide better results, or lower costs, or both?

Many who have studied these problems have concluded that all of these questions can be answered in the affirmative.

Although pollution is only one of the many causes of environmental damage, it is the one that best illustrates the evolution of policy instruments, and from which insights can be drawn for addressing related environmental issues. For controlling pollution, policy makers have devised a wide menu of instruments, ranging all the way from moral exhortation to imprisonment. Some of the most important include regulating emissions, taxing emissions, taxing products whose use pollutes, requiring permits to pollute, paying polluters to abate, labeling products as to contents, educating consumers, and imposing deposit-refund systems on polluting products. One useful way of classifying this wide range of options is to divide them into two general categories: conventionally defined as either regulatory or the incentive-based (IB) use of economic measures.

The regulatory approach is sometimes referred to, especially by those who disapprove of it, as the command-and-control or CAC approach. However, the CAC terminology is more appropriately applied to central planning for an entire economy, such as that of the former Soviet Union, rather than as a description of a subset of environmental policy instruments, which are entirely consistent as a correction to market failures in a predominantly market economy.

Rather than casting the evaluation of policy instruments in terms of regulatory versus incentive systems, a more constructive approach is to investigate the conditions under which incentives yield better results as compared with conditions under which regulations make more sense. Cropper and Oates[20], among others, have provided much needed insight into this issue.

Incentive systems are potentially more appropriate for the control of some pollutants rather than others. For example, regulation will continue to be the preferred instrument in the case of severe threats to human health, such as radionuclides and severely toxic carcinogens, where the optimal level of emission approaches zero. The prevalence of scientific uncertainty about all but the most simple damage functions is a powerful argument for explicitly recognizing the limitations on knowledge and for acknowledging them in formulating pollution control policies. Therefore environmental policies such as the precautionary principle and instruments such as assurance bonding, which are discussed further on, have been developed in order to preserve the advantages of economic incentives in the face of incomplete scientific knowledge about the effects of pollutants and about the interactions among them.

In the face of uncertainty, appropriate public policy is to prevent emissions (which is usually much cheaper than cleaning them up), and thus to limit exposure initially. This can be achieved by ending the assumption of safety for emissions unless damage has been proven, and by shifting the burden of proof to emitters by requiring the demonstration of safety by the emitter before use, rather than the more costly procedure of requiring regulators to prove damage. Economic incentives can be effective instruments for this purpose, particularly when used in conjunction with regulations.

Policy instruments based upon economic incentives can be powerfully efficient methods for achieving allocation objectives, but it is important to avoid the error in logic into which the economics literature often lapses of assuming that markets, just because they can be such powerful guides in achieving allocative goals, are equally valid for determining the other two critical goals: sustainable scale and equitable distribution. We need to put in place separate instruments for achieving the prior goals of sustainable scale and equitable distribution before applying efficient methods of reaching them.

Regulatory Systems

Environmental management in the U.S., as noted above, is based upon a federal regulatory system under which the Congress has enacted national guidelines for regulations, with implementation left largely to the states. This approach evolved from growing recognition in the second half of this century that serious environmental damage could not be prevented by relying exclusively upon state and local governments, whose competition for economic development was an impediment to effective local environmental management. Federal efforts to implement environmental management have been characterized as the regulatory system to distinguish them from alternative approaches such as the use of economic incentives, or incentive-based (IB) systems. In the United States, the regulatory approach predominates. For stationary sources of air pollution each state is required to develop a State Implementation Plan (SIP) to ensure that emissions of particulate matter, sulfur oxides, and nitrogen oxides are in compliance with national air quality standards. In all these cases, enforcement is left primarily to the states. In theory, failure to meet local air quality standards is penalized by termination of federal subsidies for major highway and other programs. However, continued failure to achieve local air quality goals in many major metropolitan areas with strong political and economic power has resulted in repeated postponement of deadlines for meeting air quality goals. The Clean Air Act of 1990 was intended to provide an improved approach to these problems.

U.S. water pollution control also relies upon a state–federal division of responsibilities with emphasis upon both emissions and ambient quality. Ambient quality is defined not in terms of quantitative standards but in terms of more qualitative objectives, such as fitness for supporting swimming and fishing.

The regulatory approach has had only limited success in achieving the desired levels of environmental protection in the U.S. market economy and the system has failed disastrously in the centrally directed economies of the former USSR[21] and Eastern Europe. In general, the regulatory system can work well where there are clear environmental goals with overwhelming political consensus, similar costs of abatement across all actors, relative certainty about what is being emitted, and easy and effective enforcement. These conditions hold in all too few cases and we have already identified and controlled many of them (i.e., large industrial point sources and sewage treatment plants). Making further progress with only the regulatory system will be much more difficult.

The limits of the regulatory approach in achieving acceptable levels of environmental protection and the high cost of these traditional policies have led economists and others to propose less costly, more effective incentive-based management instruments, such as pollution charges, marketable emission permits, and performance and assurance bonds. The lack of widespread acceptance to date of alternatives to regulation suggests that current practices are viewed as possessing superior political and historical acceptability, or at least of not being as unacceptable as the proposed innovations. Among the nominal advantages of regulation are:

- Simplicity, familiarity, and acceptance.

- Historical U.S. reliance upon legislative regulation in order to deal with perceived problems.

- Acceptance by major emitters and interest groups.

- Long-term incorporation into the legal system.

However, despite these advantages, the regulatory approach has failed to meet rising expectations for environmental quality and contains numerous inherent disadvantages, especially in the case of diffuse, chronic, non-point-source pollution. These disadvantages include:

- Effective regulation requires a level of technical and proprietary information which is seldom available to regulators.

- Successful enforcement of regulation requires high monitoring and enforcement costs.

- The costly bureaucracies associated with regulation result in high expenditure per unit of pollution reduction.

- Environmental regulations are easily evaded or avoided.

- The lack of strong incentives to reduce pollution below the mandated level reduces motivation for technological advance and for preventing pollution before it is generated.

- Polluters are permitted to ignore the costs their actions impose upon society at the time decisions are made.

In addition, the regulatory system, having its roots in the legal system, is based on a presumption of no damage on the part of polluters until they can be proven to have violated the regulations or to have caused demonstrable damages. Given the high degree of uncertainty about the fate and effects of pollutants, this presumption can lead to significant difficulties, especially in those cases where this uncertainty is high.

Despite these limitations associated with regulatory systems, especially with respect to problems like pollution where incentives are significant, regulatory systems still have a major role to play in addressing the basic environmental problems of concern here: population, technology, habitat, and species diversity. Our point is that the efficiency of regulatory systems can be substantially enhanced by incorporating economic incentives within them.

Incentive-Based Systems: Alternatives to Regulatory Control

The urgent need for alternative approaches to environmental management that are less costly and more efficient than traditional approaches has long been recognized[22]. The major, but not only, alternatives suggested to the regulatory approach have been based on some form of economic incentives[23].

The accumulating evidence suggests that the present regulatory approach to environmental management in the U.S. and throughout much of the earth, though leaving us better off than we would have been without any management system, does not inspire confidence in its adequacy for addressing the twin challenges of explosive global population growth coupled with growing expectations of exponential increases in per capita consumption by the growing billions of passengers on spaceship earth. We therefore emphasize that problems of achieving sustainable scale and distributional equity are basic to the human condition. Once these goals have been addressed, it becomes important to devise efficient instruments for accomplishing them. Unfortunately, it is inefficiency that characterizes most of the regulatory environmental control instruments now in place, though they have gained grudging acceptance. These shortcomings of the current regulatory approach are evident in the limited results from the excessive levels of bureaucracy and expenditures involved, compounded by the inadequate scientific basis for current programs. Reform efforts must therefore aim at improving both the efficiency of environmental protection programs and the scientific bases upon which they rest. We turn first to the role of economic efficiency, and to its limitations.

The Role of Economic Efficiency

From the perspective of economic efficiency, the regulatory approach appears to be both cumbersome and costly. Indeed, now that most of the nations on earth have rejected command and control methods in favor of competitive markets for guiding economic policy, it seems anachronistic to rely so heavily upon regulatory techniques for organizing environmental policy rather than attempting to reap in the policy arena some of the efficiency advantages that economic incentives have demonstrated in the organization of markets.

Proposals for economic incentive-based (IB) instruments for environmental management encompass a wide range of alternatives, including:

- taxes on pollution emissions (Pigouvian taxes or charges)

- product charges (levied on products whose use causes environmental damage, such as CFCs, carbon fuels, agricultural chemicals, and fertilizers)

- subsidies for pollution abatement (similar to taxes in concept but not in distributional consequences), especially for agriculture and sewage treatment

- marketable permits for pollution emissions

- creation of property rights for open access and other environmental resources

- creation of economic incentives for acting in the common interest

Several themes run through the literature that advocate more extensive use of these IB instruments as alternatives or supplements to current regulatory policies. The most important is the achievement of economic efficiency through correction of market failures such as:

- externalities, especially pollution

- inadequate provision of public goods (because of nonexcludability and nondepletability)

- poorly defined property rights

- uncertainty and incomplete information

- myopic time discounting

IB instruments are designed to correct or offset these market failures as shown below.

Pollution Fees and Subsidies

The classic incentive-based alternative to regulation of pollution is a tax, fee, or charge per unit of pollution emitted, known as a Pigouvian tax after A. C. Pigou[24]. However, the intellectual foundation for the incentive approach is Adam Smith’s concept of the invisible hand operating in free, competitive markets. In this model, which emphasizes economic efficiency, rational utilitarian consumers attempting to maximize utility, and competitive producers attempting to maximize profits, will automatically generate optimal allocation of scarce resources. Thus free competitive markets are assumed to permit the pursuit of self-interest by producers and consumers to result in socially desirable outcomes, except where the (rigorous) conditions for competitive markets are not achieved and any of a number of well-defined market failures (listed above) are present.

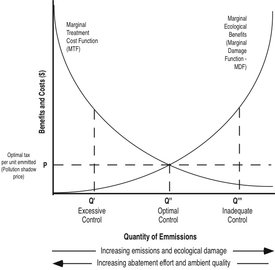

The significance of this approach for environmental management is that if markets existed, or could be created, for environmental goods and services, consumers could purchase the types and quantities of environmental quality and sustainability they desired relative to their means and their competing wants, just as they do now for marketed goods and services. Obviously, for the true believer the market approach is a compelling one since, if it could be made to work, it would effectively dispose of the environmental problem, which would then be reduced to a level of seriousness no greater than, say, of selecting one’s household detergent. For readers interested in economic theory and graphics, a simple diagram typically found in texts on environmental economics (a version of which is presented and discussed in Figure 4.1) is provided.

Popular Critiques of the Incentives for Efficiency Approach

Given the strong theoretical case in favor of IB pollution controls[25], it is appropriate to inquire into the reasons for their low level of acceptance in the U.S. Some objections to IB pollution controls are based upon popular misconceptions, myths, and imagery, and interest group pressures. Other objections to IB policies are more firmly based upon legitimate concerns, and merit thorough analysis. They include concerns about data requirements, spatial differentiation, gaps in scientific knowledge, and inadequate transdisciplinary research. These are valid objections, but they may also be raised with respect to regulatory instruments or any other environmental control instruments.

As we have discussed, a criticism to which economic efficiency policy instruments are vulnerable is that of inadequate sensitivity to issues of sustainability, equity, welfare, and fairness. Indeed, much of the economics literature explicitly accepts the dichotomy and trade-off between equity and efficiency, recognizing that while efficiency is the proper concern of economics, it generally speaks with less credibility about equity, and has until recently ignored sustainability. We have noted, however, one principle dealing with equity that appears throughout the economics literature and which is relevant to policy analysis. This is the concept of Pareto fairness. This concept is drawn from the more general notion of Pareto optimality worked out by the Italian sociologist Vilfredo Pareto[26], dealing with the necessary conditions for efficient general equilibrium solutions[27]. However, inherent in the more general case of Pareto optimality is the concept of Pareto fairness, which in its simplest form requires that changes in policies or other arrangements should not be undertaken unless they make some people (or even one person) better off without making any party worse off. Although this theorem has extensive and significant implications for the analysis of human welfare[28], we only note here that policy changes are more likely to be acceptable and successful if they can be designed to make no one worse off.

This Pareto fairness principle is one reason for proposing that marketable pollution permits be given without charge to existing polluters, even though there may be objections to this course on both efficiency and ethical grounds. The same principle can be used to justify compensating property owners at public expense for potential losses resulting from zoning changes, and for other “takings.” Compensation, though costly to the public, may be a valid price to pay in other cases where the general welfare is improved by a policy change. These are all examples of the equity vs. efficiency conflict emphasized above.

In terms of popular misconceptions, real and imaginary, opponents of incentive-based systems have persuaded large elements of the public that emission charges constitute a “license to pollute” and that this is somehow reprehensible. Actually both pollution charges and the current system of regulations represent “licenses to pollute,” or property rights to pollute, but these rights now are free to the polluter in the case of the regulatory system and there are no dynamic incentives for polluters to reduce pollution below the currently permitted levels. The IB system would require payment for each unit of emission and thus would generate the appropriate continuous dynamic economic incentives to reduce pollution further, develop new pollution control technologies, and generate public revenue which could be used for mitigation of the remaining pollution or for other public purposes.

In terms of interest group pressures, emitters object to emission charges because they would then have to pay for the privilege of expropriating common property resources (the assimilative capacity of air and water) which they now enjoy without charge. Estimates of the costs of emission permits and revenue raised from emission charges on only particulate and sulfur oxides from stationary sources range from $1.8 to 8.7 billion in 1984 in 1982 dollars[29]. Initially, the switch from free emissions to charges would amount to a transfer of income and wealth from emitters to the general public. The political and economic obstacles to such an innovation are obvious. In the long run, however, since the IB system leads to a improvement of economic efficiency, both the emitters and public would benefit. It is this initial short-run hurdle that must be overcome if IB systems are ever to be implemented.

One way of addressing this interest group problem, as noted above, would be to give, rather than sell, emission permits to present emitters. This has the ethical disadvantage of “grandfathering in” present polluters who would stand to benefit in direct proportion to the damage they are currently imposing upon the environment but it also has the advantage of creating property rights which could generate incentives to reduce pollution in that unused permits could be sold, adding efficiency to the system thereafter[30].

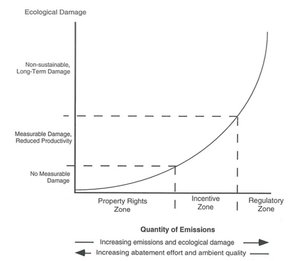

In addition to the political and interest group objections to incentive-based pollution control methods, there are also substantive scientific problems of knowledge and uncertainty, especially in terms of optimizing approaches. Derivation of optimal pollution charges (Figure 4.1) requires knowledge of the marginal treatment cost function and the marginal damage functions. Conceptually, marginal treatment cost functions should be computable from engineering and other data[31]. Computing marginal environmental damage functions is more difficult and involves at least three steps even in the simplest case of damage to a single species from a single pollutant at one point:

- Estimating the reduction in ambient concentrations associated with reductions in emission levels.

- Estimating biological damage functions associated with levels of ambient concentrations.

- Assigning economic values to the relevant levels of biological damage.

Early assumptions by economists about the existence of damage functions for individual pollutants derivable by scientists from dose–response relationships and relevant for efficiency-based policy, appear to have been overly optimistic, now that ecological economists are learning actually to develop transdisciplinary working relationships with physical scientists. Clearly, the more realistic case of multiple emission sites, multiple species, plus positive and negative synergism between multiple pollutants involves formidable problems of research, analysis, and uncertainty[32]. The formal information requirements for deriving optimal water quality standards and optimal emission charges for ecologies as complex as estuaries are so demanding that they may never be fully met.

Epidemiological research on human exposure to toxic chemicals has revealed some of the limits of science in determining safe standards, given problems of gender, age, concentration, genetic heritage, synergism, and other variables. However, this situation need not preclude efforts to establish standards based upon best current scientific judgment. This is particularly essential in the case of multiple pollutants, as in an estuary, where interrelationships among toxic substances are most likely to be synergistic and nonlinear. In such cases, damage functions could be estimated on the basis of best current judgment for the total mix of pollutants, and average emission charges applied to the discharge of every pollutant. The use of economic incentives could provide a least-cost (i.e., cost-effective) route to achieving environmental goals, however they are set, and thus is not dependent upon achieving an improbable level of scientific certainty (i.e., optimization).

Advantages and Disadvantages of Incentive-Based Systems of Regulation

In a realistic, dynamic situation, the use of IB pollution charges has several potential efficiency advantages over regulation. The most important advantage is that there are differences in the costs of pollution control between firms and the regulatory approach gives inadequate incentives to abate for lower-cost firms. With an IB system, more modern firms with lower-cost pollution control technologies will undertake more abatement rather than pay the charges, while firms with higher pollution control costs will prefer to pay the charges rather than abate. Society will then obtain more pollution control at lower total costs than if all firms, including those with higher abatement costs, are required to impose the same level of control, as is typical under a regulatory approach.

Comparable cost savings and efficiency increases might be achievable in water pollution control as well. Under the effluent charges system, more of the total clean-up is performed by low-cost firms than is the case under regulation. The potential cost savings are greatest when there are significant differences in treatment costs among polluters. Incentives are greater for continual improvements in pollution abatement technology under a pollution charge system than under a regulatory system under which all firms abate equally or under which abatement technology is specified.

Under an alternative IB system based upon transferable pollution permits (TP), firms have economic incentives to find cost-saving abatement technology because of the property rights they then have in their unused abatement permits which can be sold to firms having higher cost abatement technologies. These cost-reduction incentives have the merit of shifting the marginal treatment cost curve downward and to the left (Figure 4.1), further increasing the optimal level of environmental quality. If competitive markets could be created for transferable pollution permits, their price per unit of emission would approximate the same shadow price as that for pollution charges (P in Figure 4.1).

Incentive-based pollution control policies have many other potential advantages over regulatory approaches:

- They have the ethical advantage of consistency with the OECD “polluter pays” principle.

- They raise public revenues.

- They pass the cost of pollution control along to the consumer of pollution-intensive products, providing the public with the proper signals for modifying consumer behavior and imposing the costs of environmental damage upon those who cause it and those who benefit from it.

- They provide polluters with economic incentives to prevent pollution, thus saving society the much greater cost of attempting to clean up the pollution after it occurs.

- Marketable permits do not require that regulators have the level of technical proprietary information required for efficient regulation.

- They can provide incentives for shifting the burden of monitoring from the government to the polluter.

- They offer profitable opportunities for industry to undertake development projects for improvements in pollution abatement technology.

- They can shift the incidence of tax burdens away from socially desirable objectives (incomes and jobs) toward reducing socially undesirable phenomena (pollution).

On the other side of the balance sheet, a number of substantive problems limits the applicability of the market approach to environmental management. Among the most serious are that market theory does not directly address the issues of:

- sustainable scale;

- income distribution, or equity, and therefore of unequal access to environmental protection among individuals, nations, regions, and generations;

- limitations of scientific information and of knowledge by individuals may impair their ability to make wise choices; and

- additionally, the market failures that would need correction in order to make markets work for environmental quality are numerous and pervasive. They include externalities, excessive time discounting, common property resources, open-access resources, public goods, and noncompetitive markets.

Recognition in recent decades of the pervasiveness of market failures has resulted in much effort by economists to develop a wide range of compensatory methods for offsetting market failures. The conventional economic wisdom has been that, although market failures are serious impediments to economic efficiency, most markets are sufficiently robust that with the judicious application of corrective measures such as taxes on pollution, the overwhelming efficiency advantages of market economies can be retained and are well worth saving.

The major problem with the strictly efficiency-based economic approach to environmental management is that even if all market failures could be corrected or offset by compensating countermeasures such as pollution taxes, the resulting outcomes, though economically efficient, would not necessarily be universally perceived as an improved state of affairs. Society does not exist for or by economic efficiency alone. Though economic efficiency is important, and should be an element in any successful management approach, society will also insist upon the protection of other crucial, deep-seated values such as fairness, equity, scientific validity, democratic pluralism, and political acceptability. Therefore one lesson that can be drawn from environmental management practices to date and from efforts to reform them, is that unidimensional approaches, whether regulatory, efficiency-based, or science-dominated, have a low probability of success as compared to more broadly based, multiobjective, eclectic, transdisciplinary approaches. It is for this reason that ecological economists have developed a range of policy instruments that meet all of the above criteria of equity, efficiency, scientific validity, and political acceptability. Examples of policy instruments designed to meet these multiple public policy criteria are given in the following sections.

Three Policies to Achieve Sustainability

In this section three fairly broad, interdependent proposals are described and discussed. Taken together they would go a long way toward achieving sustainability. The market incentive-based instruments suggested to implement the policies are intended to do the job with relatively high efficiency and effectiveness. They are not the only possible mechanisms to achieve these goals, but there is considerable evidence that they could work rather well in certain cultural and legal circumstances. By focusing on specific policies and instruments, we can also address the essential changes that need to be made in the system and begin to build a broad enough consensus to implement these changes.

Various aspects of the proposals have appeared in various other forms elsewhere[33]. This section represents an attempt to synthesize and generalize them as the basis for developing an “overlapping consensus”[34] . A consensus that is affirmed by opposing theoretical, religious, philosophical and moral doctrines is most likely to be fair and just, and is also most likely to be resilient and to survive over time.

In summary, the policies are:

- a broad natural capital depletion tax to assure that resource inputs from the environment to the economy are sustainable, while giving strong incentives to develop new technologies and processes to minimize impacts[35];

- application of the precautionary polluter pays principle (4P) to assure that the full costs of outputs from the economy to the environment are charged to the polluter in a way that adequately deals with the huge uncertainty about the impacts of pollution and encourages technological innovation[36]; and

- a system of ecological tariffs as one way (short of global agreements that are difficult to negotiate and enforce) to allow countries to implement the first two proposals without putting themselves at an undue disadvantage (at least on the import side) relative to countries that have not yet implemented them.

Natural Capital Depletion (NCD) Tax

One way to implement the sustainability constraint of no net depletion of natural capital is to hold throughput (consumption of total natural capital) constant at present levels (or lower truly sustainable levels) by taxing natural capital consumption, especially energy, very heavily. Nobel Laureate Robert Solow has emphasized the importance of replacing depleted natural capital by an amount of human-made capital sufficient to maintain the aggregate social capital intact in order to ensure sustainability and intergenerational equity[37]. Not everyone would share Solow’s optimism about the extent to which other forms of capital can be substituted for natural capital, but to the extent that this is feasible, a NCD tax would be an efficient instrument for achieving it. Society could raise most public revenue from such a natural capital depletion tax, and compensate by reducing the income tax, especially on the lower end of the income distribution, perhaps even financing a negative income tax at the very low end. Technological optimists who believe that efficiency can increase by a factor of ten should welcome this policy which raises natural resource prices considerably and would powerfully encourage just those technological advances in which they have so much faith. Skeptics who lack that technological faith will nevertheless be happy to see the throughput limited since that is their main imperative in order to conserve resources for the future. The skeptics are protected against their worst fears; the optimists are encouraged to pursue their fondest dreams. If the skeptics are proved wrong and the enormous increase in efficiency actually happens, then they will be even happier (unless they are total misanthropists). They got what they wanted, but it just cost less than they expected and were willing to pay. The optimists, for their part, can hardly object to a policy that not only allows but offers strong incentives for the very technical progress on which their optimism is based. If they are proved wrong at least they should be glad that the rate of environmental destruction has been slowed.

Implementation of this policy does not hinge upon the precise measurement of natural capital, but the valuation issue remains relevant in the sense that the policy recommendation is based on the perception that we are at or beyond the optimal scale. The evidence for this perception consists of the greenhouse effect, ozone layer depletion, acid rain, and the general decline in many dimensions of the quality of life. It would be helpful to have better quantitative measures of these perceived costs, just as it would be helpful to carry along an altimeter when we jump out of an airplane. But we would all prefer a parachute to an altimeter if we could take only one thing. The consequences of an unarrested free fall are clear enough without a precise measure of our speed and acceleration. But we would need at least a ballpark estimate of the value of natural capital depletion in order to determine the magnitude of the suggested NCD tax. This, we think, is possible, especially if uncertainty about the value of natural capital is incorporated in the tax itself, using, for example, the refundable assurance bonding system discussed below.

The political feasibility of this policy is an important and difficult question. It certainly represents a major shift in the way we view our relationship to natural capital and would have major social, economic, and political implications. But these implications are just the ones we need to expose and face squarely if we hope to achieve sustainability. Because of its logic, its conceptual simplicity, and its built-in market incentive structure leading to sustainability, the proposed NCD tax may be the most politically feasible of the possible alternatives to achieving sustainability.

We have not tried to work out all the details of how the NCD tax would be administered. In general, it could be administered like any other tax, but it would most likely require international agreements or at least national ecological tariffs (as discussed below) to prevent some countries from flooding markets with untaxed natural capital or products made with untaxed natural capital (see further on). By shifting most of the tax burden to the NCD tax and away from income taxes, the NCD tax could actually simplify the administration of the taxation system while providing the appropriate economic incentives to achieve sustainability.

The Precautionary Polluter Pays Principle (4P)

One of the primary reasons for the problems with current methods of environmental management is the issue of scientific uncertainty. At issue is not just its existence, but the radically different expectations and modes of operation that science and policy have developed to deal with it. If we are to solve this problem, we must understand and expose these differences about the nature of uncertainty and design better methods to incorporate it into the policy-making and management process.

Problems arise when regulators ask scientists for answers to unanswerable questions. For example, the law may mandate that the regulatory agency come up with safety standards for all known toxins when little or no information is available on the impacts of these chemicals. When trying to enforce the regulations after they are drafted, the problem of true uncertainty about the impacts remains. It is not possible to determine with any certainty whether the local chemical company contributed to the death of some of the people in the vicinity of their toxic waste dump. One cannot prove the smoking/lung cancer connection in any direct, causal way (i.e., in the courtroom sense), only as a statistical relationship.

As they are currently set up most environmental regulations, particularly in the United States, demand certainty, and when scientists are pressured to supply this nonexistent commodity there is not only frustration and poor communication but mixed messages in the media as well. Because of uncertainty, environmental issues can often be manipulated by political and economic interest groups. Uncertainty about global warming is perhaps the most visible current example of this effect.

The “precautionary principle” is one way the environmental regulatory community has begun to deal with the problem of true uncertainty. The principle states that rather than await certainty, regulators should act in anticipation of any potential environmental harm in order to prevent it. The precautionary principle is so frequently invoked in international environmental resolutions that it has come to be seen by some as a basic normative principle of international environmental law[38].