An Introduction to Ecological Economics: Chapter 3

| Topics: |

Contents

- 1 Problems and Principles of Ecological Economics

- 2 Sustainable Scale, Fair Distribution, and Efficient Allocation

- 3 Ecosystems, Biodiversity, and Ecological Services

- 4 Substitutability vs. Complementarity of Natural, Human, and Manufactured Capital

- 5 Population and Carrying Capacity

- 6 Measuring Welfare and Well-Being

- 6.1 The GNP and Its Political Importance

- 6.2 GNP: Concepts and Measurement

- 6.3 From GNP to Hicksian Income and Sustainable Development

- 6.4 From GNP to a Measure of Economic Welfare

- 6.5 The Index of Sustainable Economic Welfare

- 6.6 Toward a Measure of Total Human Welfare

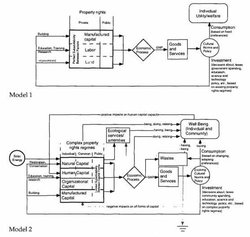

- 6.7 Alternative Models of Wealth and Utility

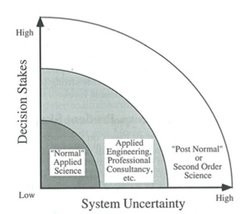

- 7 Valuation, Choice, and Uncertainty

- 8 Trade and Community

- 9 Related Links

- 10 Notes This is a chapter from An Introduction to Ecological Economics (e-book). Previous: The Historical Development of Economics and Ecology (An Introduction to Ecological Economics: Chapter 3) |Table of Contents (An Introduction to Ecological Economics: Chapter 3)|Next: Policies, Institutions, and Instruments

Problems and Principles of Ecological Economics

As described in the previous chapter, ecological economics is the product of an evolutionary historical development. It is not a static set of answers. It is a dynamic, constantly changing set of questions. It also advocates a fundamentally different, transdisciplinary vision of the scientific endeavor that emphasizes dialogue and cooperative problem solving. It tries to transcend the definition and protection of intellectual turf that plagues the current disciplinary structure of science. This transdisciplinary vision was the rule in earlier times, but has been replaced by a more rigid disciplinary vision in recent times.

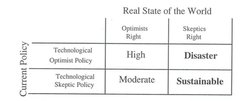

Figure 3.1 illustrates how this transdisciplinary vision differs from the now standard disciplinary vision. In the upper panel, the standard disciplinary vision is depicted as one that leads to the defining and protecting of disciplinary territories on the intellectual landscape. Sharp boundaries between disciplines, different languages and cultures within disciplines, and lack of any overarching view makes problems which cross disciplinary boundaries or which fall in the empty spaces between the territories very difficult, if not impossible, to deal with. There are also large gaps in the landscape that are not covered by any discipline. Within this vision of how to organize the scientific endeavor, one might think that the main role of ecological economics would be to fill in the empty space between economics and ecology, while maintaining sharp boundaries between what is economics, what is ecology, and what is ecological economics. But this is not really the vision of ecological economics.

The middle panel in Figure 3.1 illustrates an interdisciplinary vision of the problem. In this vision the disciplines expand and overlap to fill in the empty spaces in the intellectual landscape, but maintain their core territories. There is dialogue and interaction in the overlaps between territories, but the picture begins to look jumbled and incoherent. This vision is movement in the direction toward the transdisciplinary ecological economics vision, but it is still not quite there.

The bottom panel of Figure 3.1 illustrates the ecological economics vision, where the boundaries between disciplines have been completely eliminated and the problems and questions are seen as a seamless whole in an intellectual landscape that is also changing and growing. This vision coexists and interacts with the conventional disciplinary structure, which is a necessary and useful way to address many problems. The transdisciplinary view provides an overarching coherence that can tie disciplinary knowledge together and address the increasingly important problems that cannot be addressed within the disciplinary structure. In this sense ecological economics is not an alternative to any of the existing disciplines. Rather it is a new way of looking at the problem that can add value to the existing approaches and address some of the deficiencies of the disciplinary approach. It is not a question of “conventional economics” versus “ecological economics”; it is rather conventional economics as one input (among many) to a broader transdisciplinary synthesis.

We believe that this transdisciplinary way of looking at the world is essential if we are to achieve the three interdependent goals of ecological economics discussed below: sustainable scale, fair distribution, and efficient allocation. This requires the integration of three elements: (1) a practical, shared vision of both the way the world works and of the sustainable society we wish to achieve; (2) methods of analysis and modeling that are relevant to the new questions and problems this vision embodies; and (3) new institutions and instruments that can effectively use the analyses to adequately implement the vision.

The importance of the integration of these three components cannot be overstated. Too often when discussing practical applications we focus only on the implementation element, forgetting that an adequate vision of the world and our goals is often the most practical device to achieving the vision, and that without appropriate methods of analysis even the best vision can be blinded. The importance of communication and education concerning all three elements can also not be overstated.

The basic points of consensus in the ecological economics vision are:

- the vision of the earth as a thermodynamically closed and nonmaterially growing system, with the human economy as a subsystem of the global ecosystem. This implies that there are limits to biophysical throughput of resources from the ecosystem, through the economic subsystem, and back to the ecosystem as wastes;

- the future vision of a sustainable planet with a high quality of life for all its citizens (both humans and other species) within the material constraints imposed by 1;

- the recognition that in the analysis of complex systems like the earth at all space and time scales, fundamental uncertainty is large and irreducible and certain processes are irreversible, requiring a fundamentally precautionary stance; and

- that institutions and management should be proactive rather than reactive and should result in simple, adaptive, and implementable policies based on a sophisticated understanding of the underlying systems which fully acknowledges the underlying uncertainties. This forms the basis for policy implementation which is itself sustainable.

Sustainable Scale, Fair Distribution, and Efficient Allocation

A complementary way of characterizing ecological economics is to list the basic problems and questions it addresses. We see three basic problems: allocation, distribution, and scale. Neoclassical economics deals extensively with allocation, secondarily with distribution, and not at all with scale. Ecological economics deals with all these, and accepts much of neoclassical theory regarding allocation. Our emphasis on the scale question is made necessary by its neglect in standard economics. Inclusion of scale is the biggest difference between ecological economics and neoclassical economics.

Allocation refers to the relative division of the resource flow among alternative product uses—how much goes to production of cars, to shoes, to plows, to teapots, and so on. A good allocation is one that is efficient, that is, that allocates resources among product end-uses in conformity with individual preferences as weighted by the ability of the individual to pay. The policy instrument that brings about an efficient allocation is relative prices determined by supply and demand in competitive markets.

Distribution refers to the relative division of the resource flow, as embodied in final goods and services, among alternative people. How much goes to you, to me, to others, to future generations. A good distribution is one that is just or fair, or at least one in which the degree of inequality is limited within some acceptable range. The policy instrument for bringing about a more just distribution is transfers, such as taxes and welfare payments.

Scale refers to the physical volume of the throughput, the flow of matter–energy from the environment as low-entropy raw materials and back to the environment as high-entropy wastes (see Figure 1.1). It may be thought of as the product of population times per capita resource use. It is measured in absolute physical units, but its significance is relative to the natural capacities of the ecosystem to regenerate the inputs and absorb the waste outputs on a sustainable basis. Perhaps the best index of scale of throughput is real GNP. Although measured in value units (P x Q, where P is price and Q is quantity), real GNP is an index of change in Q. National income accountants go to great lengths to remove the influence of changes in price, both relative prices and the price level. For some purposes the scale of throughput might better be measured in terms of embodied energy[7]. The economy is viewed as an open subsystem of the larger, but finite, closed, and nongrowing ecosystem. Its scale is significant relative to the fixed size of the ecosystem. A good scale is one that is at least sustainable, that does not erode environmental carrying capacity over time. In other words, future environmental carrying capacity should not be discounted as done in present value calculations. An optimal scale is at least sustainable, but beyond that it is a scale at which we have not yet sacrificed ecosystem services that are at present worth more at the margin than the production benefits derived from the growth in the scale of resource use.

Scale in this context is not to be confused with the concept of “economies of scale,” which refers to the way efficiency changes with the scale or size of production within a firm or industry. Here we are using scale to refer to the overall scale or size of the total macroeconomy and throughput.

Priority of Problems. The problems of efficient allocation, fair distribution, and sustainable scale are highly interrelated but distinct; they are most effectively solved in a particular priority order, and they are best solved with independent policy instruments[8]. There are an infinite number of efficient allocations, but only one for each distribution and scale. Allocative efficiency does not guarantee sustainability[9]. It is clear that scale should not be determined by prices, but by a social decision reflecting ecological limits. Distribution should not be determined by prices, but by a social decision reflecting a just distribution of assets. Subject to these social decisions, individualistic trading in the market is then able to allocate the scarce rights efficiently.

Distribution and scale involve relationships with the poor, future generations, and other species that are fundamentally social in nature rather than individual. Homo economicus, as the self-contained atom of methodological individualism or as the pure social being of collectivist theory, is a severe abstraction. Our concrete experience is that of “persons in community.” We are individual persons, but our very individual identity is defined by the quality of our social relations. Our relations are not just external, they are also internal—that is, the nature of the related entities (ourselves in this case) changes when relations among them change. We are related not only by a nexus of individual willingnesses-to-pay for different things, but also by relations of trusteeship for the poor, future generations, and other species. The attempt to abstract from these concrete relations of trusteeship and reduce everything to a question of individual willingness-to-pay is a distortion of our concrete experience as persons in community—an example of what A. N. Whitehead called “the fallacy of misplaced concreteness”[10].

The prices that measure the opportunity costs of reallocation are unrelated to measures of the opportunity costs of redistribution or of a change in scale. Any trade-off among the three goals (e.g., an improvement in distribution in exchange for a worsening in scale or allocation, or more unequal distribution in exchange for sharper incentives seen as instrumental to more efficient allocation), involves an ethical judgment about the quality of our social relations rather than a willingness-to-pay calculation. The contrary view, that this choice among basic social goals and the quality of social relations that help to define us as persons should be made on the basis of individual willingness-to-pay, just as the trade-off between chewing gum and shoelaces is made, seems to be dominant in economics today, and is part of the retrograde modern reduction of all ethical choice to the level of personal tastes weighted by income.

It is instructive to consider the historical attempt of the scholastic economists to subsume distribution under allocation (or more likely they were subsuming allocation under distribution—at any rate they did not make the distinction). This was the famous “just price” doctrine of the Middle Ages which has been totally rejected in economic theory, although it stubbornly survives in the politics of minimum wages, farm price supports, water and electric power subsidies, etc. However, we do not as a general rule try to internalize the external cost of distributive injustice into market prices. We reject the attempt to correct market prices for their unwanted effects on income distribution. Economists nowadays keep allocation and distribution quite separate and argue for letting prices serve only efficiency, while serving justice with the separate policy of transfers. This follows Tinbergen’s dictum of equality of policy goals and instruments: one instrument for each policy. The point is that just as we cannot subsume distribution under allocation, neither can we subsume scale under allocation.

It seems clear, then, that we need to address the problems in the following order: first, establish the ecological limits of sustainable scale and establish policies that assure that the throughput of the economy stays within these limits. Second, establish a fair and just distribution of resources using systems of property rights and transfers. These property rights systems can cover the full spectrum from individual to government ownership, but intermediate systems of common ownership and systems for dividing the ownership of resources into ownership of particular services need much more attention[11]. Third, once the scale and distribution problems are solved, market-based mechanisms can be used to allocate resources efficiently. This involves extending the existing market to internalize the many environmental goods and services that are currently outside the market. Policy instruments to achieve the three goals of sustainable scale, fair distribution, and efficient allocation are discussed in detail in Section 2.4. First we delve a little more deeply into the scale and distribution problems.

From Empty-World Economics to Full-World Economics

Ecological economics argues that the evolution of the human economy has passed from an era in which human-made capital was the limiting factor in economic development to an era in which remaining natural capital has become the limiting factor. Economic logic tells us that we should maximize the productivity of the scarcest (limiting) factor, as well as try to increase its supply. This means that economic policy should be designed to increase the productivity of natural capital and its total amount, rather than to increase the productivity of human-made capital and its accumulation, as was appropriate in the past when it was the limiting factor. It remains to give some reasons for believing this “new era” thesis, and to consider some of the far-reaching policy changes that it would entail, both for development in general and for particular institutions.

Reasons the Turning Point Has Not Been Noticed

Why has this transformation from a world relatively empty of human beings and human-made capital to a world relatively full of these not been noticed by economists? If such a fundamental change in the pattern of scarcity is real, as we think it is, then how could it be overlooked by economists whose job is to pay attention to the pattern of scarcity? Some economists, including Boulding[12] and Georgescu-Roegen[13] have indeed signaled the change, but their voices have been largely unheeded.

One reason is the deceptive acceleration of exponential growth. With a constant rate of growth the world will go from half full to totally full in one doubling period—the same amount of time that it took to go from 1% full to 2% full. Of course the doubling time itself has shortened, compounding the deceptive acceleration. If we return to the example of the percent appropriation by human beings of the net product of land-based photosynthesis as an index of how full the world is of humans and their furniture, then we can say that it is 40% full because we use, directly and indirectly, about 40% of the net primary product of land-based photosynthesis[14]. Taking 40 years as the doubling time of the human scale (i.e., population times per capita resource use) and calculating backwards, we go from the present 40% to only 10% full in just two doubling times or 80 years, which is about an average U.S. lifetime. Also, “full” here is taken as 100% human appropriation of the net product of photosynthesis which is [[ecological]ly] unlikely and socially undesirable (only the most recalcitrant species would remain wild; all others would be managed for human benefit). In other words, effective fullness occurs at less than 100% human preemption of net photosynthetic product, and there is much evidence that long-run human carrying capacity is reached at less than the existing 40% (see chapter 1). The world has rapidly gone from relatively empty (10% full) to relatively full (40% full). Although 40% is less than half full, it makes sense to consider it as relative fullness because it is only one doubling time away from 80%, a figure which represents excessive fullness. This change has been faster than the speed with which fundamental economic paradigms shift.

According to physicist Max Planck, a new scientific paradigm triumphs not by convincing the majority of its opponents, but because its opponents eventually die. There has not yet been time for the empty-world economists to die, and meanwhile they have been cloning themselves faster than they are dying by maintaining tight control over their guild. The disciplinary structure of knowledge in modern economics is far tighter than that of the turn-of-the-century physics that was Planck’s model. Full-world economics is not yet accepted as academically legitimate, but it is beginning to be seen as a challenge. This book, based on full-world economics, challenges the empty-world economics prevailing today.

Complementarity vs. Substitutability

A major reason for failing to note the major change in the pattern of scarcity is that in order to speak of a limiting factor, the factors must be thought of as complementary. If factors are good substitutes, then a shortage of one does not significantly limit the productivity of the other. A standard assumption of neoclassical economics has been that factors of production are highly substitutable. Although other models of production have considered factors as not at all substitutable (e.g., the total complementarity of the Leontief model), the substitutability assumption has dominated. Consequently, the very idea of a limiting factor was pushed into the background. If factors are substitutes rather than complements, then there can be no limiting factor and hence no new era based on a change of the limiting role from one factor to another. It is therefore important to be very clear on the issue of complementarity versus substitutability.

The productivity of human-made capital is more and more limited by the decreasing supply of complementary natural capital. Of course in the past when the scale of the human presence in the biosphere was low, human-made capital played the limiting role. The switch from human-made to natural capital as the limiting factor is thus a function of the increasing scale and impact of the human presence. Natural capital is the stock that yields the flow of natural resources—the forest that yields the flow of cut timber; the petroleum deposits that yield the flow of pumped crude oil; the fish populations in the sea that yield the flow of caught fish. The complementary nature of natural and human-made capital is made obvious by asking: what good is a sawmill without a forest? A refinery without petroleum deposits? A fishing boat without populations of fish? Beyond some point in the accumulation of human-made capital it is clear that the limiting factor on production will be remaining natural capital. For example, the limiting factor determining the fish catch is the reproductive capacity of fish populations, not the number of fishing boats; for gasoline the limiting factor is petroleum deposits, not refinery capacity; and for many types of wood it is remaining forests, not sawmill capacity. Costa Rica and Peninsular Malaysia, for example, now must import logs to keep their sawmills employed. One country can accumulate human-made capital and deplete natural capital to a greater extent only if another country does it to a lesser extent—for example, Costa Rica must import logs from somewhere. The demands of complementarity between human-made and natural capital can be evaded within a nation only if they are respected between nations.

Of course multiplying specific examples of complementarity between natural and human-made capital will never suffice to prove the general case. But the examples given above at least serve to add concreteness to the more general arguments for the complementarity hypothesis given later (Section 3.3).

Because of the complementary relation between human-made and natural capital, the very accumulation of human-made capital puts pressure on natural capital stocks to supply an increasing flow of natural resources. When that flow reaches a size that can no longer be maintained, there is a big temptation to supply the annual flow unsustainably by liquidation of natural capital stocks, thus postponing the collapse in the value of the complementary human-made capital. Indeed in the era of empty-world economics natural resources and natural capital were considered free goods (except for extraction or harvest costs). Consequently, the value of human-made capital was under no threat from scarcity of a complementary factor. In the era of full-world economics, this threat is real and is met by liquidating stocks of natural capital to temporarily keep up the flows of natural resources that support the value of human-made capital. Hence the problem of sustainability.

Policy Implications of the Turning Point

In this new full-world era, investment must shift from human-made capital accumulation toward natural capital preservation and restoration. Also, technology should be aimed at increasing the productivity of natural capital more than human-made capital. If these two things do not happen then we will be behaving uneconomically, in the most orthodox sense of the word. That is, the emphasis should shift from technologies that increase the productivity of labor and human-made capital to those that increase the productivity of natural capital. This would occur by market forces if the price of natural capital were to rise as it became more scarce. What keeps the price from rising? In most cases natural capital is unowned and consequently nonmarketed. Therefore it has no explicit price and is exploited as if its price was zero. Even where prices exist on natural capital, the market tends to be myopic and excessively discounts the costs of future scarcity, especially when under the influence of economists who teach that accumulating capital is a near-perfect substitute for depleting natural resources!

Natural capital productivity is increased by: (1) increasing the flow (net growth) of natural resources per unit of natural stock (limited by biological growth rates); (2) increasing product output per unit of resource input (limited by mass balance); and especially by (3) increasing the end-use efficiency with which the resulting product yields services to the final user (limited by technology). We have already argued that complementarity severely limits what we should expect from (2), and complex ecological interrelations and the law of conservation of matter–energy limits the increase from (1). Therefore the ecological economics focus should be mainly on (3).

The above factors limit productivity from the supply side. From the demand side, tastes may limit the economic productivity of natural capital in a way more stringent than the limit of biological productivity. For example, game ranching and fruit and nut gathering in a natural tropical forest may, in terms of biomass, be more productive than cattle ranching. But undeveloped tastes for game meat and tropical fruit may make this use less profitable than the biologically less productive use of cattle ranching. In this case a change in tastes can increase the biological productivity with which the land is used.

Since human-made capital is owned by the capitalist we can expect that it will be maintained with an interest to increasing its productivity. Labor power, which is a stock that yields the useful services of labor, can be treated in the same way as human-made capital. Labor power is human-made and owned by the laborer who has an interest in maintaining it and enhancing its productivity. But nonmarketed natural capital (the water cycle, the ozone layer, the atmosphere, etc.) is not subject to ownership, and no self-interested social class can be relied upon to protect it from overexploitation.

If the thesis argued above were accepted by development economists, what policy implications would follow? The role of economic development banks in the new era would be increasingly to make investments that replenish the stock and that increase the productivity of natural capital. In the past, development investments have largely aimed at increasing the stock and productivity of human-made capital. Instead of investing mainly in sawmills, fishing boats, and refineries, development should now focus on reforestation, restocking of fish populations, and renewable substitutes for dwindling reserves of petroleum. The latter should include investment in energy efficiency, since it is impossible to restock petroleum deposits. Since natural capacity to absorb wastes is also vital, resource investments that preserve that capacity (e.g., pollution reduction) also increase in priority. For marketed natural capital this will not represent a revolutionary change. For nonmarketed natural capital it will be more difficult, but even here economic development can focus on complementary public goods such as education, legal systems, public infrastructure, and population prudence. Investments in limiting the rate of growth of the human population are of the greatest importance in managing a world that has become relatively full. Like human-made capital, human-made labor power is also complementary with natural resources and its growth can increase demand for natural resources beyond the capacity of natural capital to supply sustainably.

The clearest policy implication of the full-world thesis is that the level of per capita resource use of the rich countries cannot be generalized to the poor, given the current world population. Present total resource use levels are already unsustainable, and multiplying them by a factor of 5 to 10 as envisaged in the Brundtland Report, albeit with considerable qualification, is ecologically impossible. As a policy of growth becomes less possible, the importance of redistribution and population prudence as measures to combat poverty increases correspondingly. In a full world both human numbers and per capita resource use must be constrained. Poor countries cannot cut per capita resource use; indeed they must increase it to reach a sufficiency, so their focus must be mainly on population control. Rich countries can cut both, and for those that have already reached demographic equilibrium the focus would be more on limiting per capita consumption to make resources available for transfer to help bring the poor up to sufficiency. Investments in the areas of population control and redistribution therefore increase in priority for development.

Investing in natural capital (nonmarketed) is essentially an infrastructure investment on a grand scale and in the most fundamental sense of infrastructure—that is, the biophysical infrastructure of the entire human niche, not just the within-niche public investments that support the productivity of the private investments. Rather, we are now talking about investments in biophysical infrastructure (“infra-infrastructure”) to maintain the productivity of all previous economic investments in human-made capital, be they public or private, by investing in rebuilding the remaining natural capital stocks that have come to be limiting. Since our ability actually to re-create natural capital is very limited, such investments will have to be indirect—that is, they must conserve the remaining natural capital and encourage its natural growth by reducing our level of current exploitation. Investments in waiting (e.g., fallow) have been respectable and accepted since Alfred Marshall in 1890. This includes investing in projects that relieve the pressure on these natural capital stocks by expanding cultivated natural capital (plantation forests to relieve pressure on natural forests), and by increasing end-use efficiency of products.

The difficulty with infrastructure investments is that their productivity shows up in the enhanced return on other investments, and is therefore difficult both to calculate and to collect for loan repayment. Also, in the present context these ecological infrastructure investments are defensive and restorative in nature—that is, they will protect existing rates of return from falling more rapidly than otherwise, rather than raising their rate of return to a higher level. This circumstance will dampen the political enthusiasm for such investments but will not alter the economic logic favoring them. Past high rates of return to human-made capital were possible only with unsustainable rates of use of natural resources and consequent (uncounted) liquidation of natural capital. We are now learning to deduct natural capital liquidation from our measure of national income[15]. The new era of sustainable development will not permit natural capital liquidation to count as an income, and will consequently require that we become accustomed to lower rates of return on human-made capital—rates on the order of magnitude of the biological growth rates of natural capital, since that will be the limiting factor.

Once investments in natural capital have resulted in equilibrium stocks that are maintained but not expanded (yielding a constant total resource flow), then all further increases in economic welfare would have to come from increases in pure efficiency resulting from improvements in technology and clarification of priorities. Certainly investments are made in increasing biological growth rates, and the advent of genetic engineering may add greatly to this thrust. However, experience to date (e.g., the green revolution) indicates that higher biological yield rates usually require the sacrifice of some other useful quality (disease resistance, flavor, strength of stalk). In any case, the law of conservation of matter–energy cannot be evaded by genetics: more food from a plant or animal implies either more inputs or less matter–energy going to the non-food structures and functions of the organism[16]. To carry the arguments for infrastructure investments into the area of biophysical/environmental infrastructure or natural capital replenishment will require new thinking by development economists. Since much natural capital is not only public but also globally public in nature, the United Nations seems to be the appropriate agency for a leadership role.

Consider some specific cases of biospheric infrastructure investments and the difficulties they present.

- A largely deforested country will need reforestation to keep the complementary human-made capital of sawmills (carpentry, cabinetry skills, etc.) from losing their value. Of course the deforested country could for a time resort to importing logs. To protect the human-made capital of dams from silting up the reservoirs behind them, the water catchment areas feeding the lakes must be reforested or original forests must be protected to prevent erosion and sedimentation. Agricultural investments depending on irrigation can become worthless without forested water catchment areas that recharge aquifers.

- At a global level enormous stocks of human-made capital and natural capital are threatened by depletion of the ozone layer, although the exact consequences are too uncertain to be predicted.

- The greenhouse effect is a threat to the value of all coastally located and climatically dependent capital (such as agriculture), be it human-made (port cities, wharves, beach resorts) or natural (estuarine breeding grounds for fish and shrimp). And if the natural capital of fish populations diminishes due to loss of breeding grounds, then the value of the human-made capital of fishing boats and canneries will also be diminished in value, as will the labor power (specialized human capital) devoted to fishing, canning, and so on.

We have begun to adjust national accounts for the liquidation of natural capital, but have not yet recognized that the value of complementary human-made capital must also be written down as the natural capital that it was designed to exploit disappears. Eventually the market will automatically lower the valuation of fishing boats as fish disappear, so perhaps no accounting adjustments are called for. But ex ante policy adjustments aimed at avoiding the ex post writing down of complementary human-made capital, whether by market or accountant, is certainly overdue.

Initial Policy Response to the Historical Turning Point

Although there is as yet no indication of the degree to which development economists would agree with the fundamental thesis argued here, three UN agencies (World Bank, UNEP, and UNDP) have nevertheless embarked on a project, however exploratory and modest, of biospheric infrastructure investment known as the Global Environmental Facility. The Facility provides concessional funding for programs investing in the preservation or enhancement of four classes of biospheric infrastructure or nonmarketed natural capital. These are: protection of the ozone layer, reduction of greenhouse gas emissions, protection of international water resources, and protection of biodiversity. If the thesis argued here is correct, then investments of this type should eventually become very important in development economics. It would seem that the “new era” thesis merits serious discussion, especially since it appears that our practical policy response to the reality of the new era has already outrun our theoretical understanding of it. We need a much deeper understanding of natural capital and the ecosystem services it provides. The current status of this understanding is discussed below.

Ecosystems, Biodiversity, and Ecological Services

An ecosystem consists of plants, animals, and microorganisms that live in biological communities and that interact with each other, with the physical and chemical environment, with adjacent [[ecosystem]s] and with the atmosphere. The structure and functioning of an ecosystem is sustained by synergistic feedbacks between organisms and their environment. For example, the physical environment puts constraints on the growth and development of biological subsystems that, in turn, modify their physical environment.

Solar energy is the driving force of ecosystems, enabling the cyclic use of materials and compounds required for system organization and maintenance. Ecosystems capture solar energy through photosynthesis by plants. This is necessary for the conversion, cycling, and transfer to other systems of materials and critical chemicals that affect growth and production, i.e., biogeochemical cycling. Energy flow and biogeochemical cycling set an upper limit on the quantity and number of organisms, and on the number of trophic levels that can exist in an ecosystem[17].

Holling[18] has described ecosystem behavior as the dynamic sequential interaction between four basic system functions: exploitation, conservation, release, and reorganization. The first two are similar to traditional ecological succession. Exploitation is represented by those ecosystem processes that are responsible for rapid colonization of disturbed [[ecosystem]s] during which organisms capture easily accessible resources. Conservation occurs when the slow resource accumulation builds and stores increasingly complex structures. Connectedness and stability increase during the slow sequence from exploitation to conservation and a “capital” of biomass is slowly accumulated. Release or creative destruction takes place when the conservation phase has built elaborate and tightly bound structures that have become “overconnected,” so that a rapid change is triggered. The system has become brittle. The stored capital is then suddenly released and the tight organization is lost. The abrupt destruction is created internally but caused by an external disturbance such as fire, disease, or grazing pressure. This process of change both destroys and releases opportunity for the fourth stage, reorganization, during which released materials are mobilized to become available for the next exploitative phase.

The stability and productivity of the system is determined by the slow exploitation and conservation sequence. Resilience, the system’s capacity to recover after disturbance or its capacity to absorb stress, is determined by the effectiveness of the last two system functions. The self-organizing ability of the system, or more particularly the resilience of that self-organization, determines its capacity to respond to the stresses and shocks imposed by predation or pollution from external sources.

Some natural disturbances, such as fire, wind, and herbivores, are an inherent part of the internal dynamics of [[ecosystem]s] and in many cases set the timing of successional cycles[19]. Natural perturbations are parts of ecosystem development and evolution and seem to be crucial for ecosystem resilience and integrity. If they are not allowed to enter the ecosystem, it will become even more brittle and thereby even larger perturbations will occur, with the risk of massive and widespread destruction. For example, small fires in a forest ecosystem release nutrients stored in the trees and support a spurt of new growth without destroying all the old growth. Subsystems in the forest are affected, but the forest remains. If small fires are blocked from a forest ecosystem, forest biomass will build up to high levels, and when the fire does come it will wipe out the whole forest. Such events may flip the system to a totally new state that will not generate the same level of ecological functions and services as before[20]. These sorts of flips may occur in many ecosystems. For example, savanna ecosystems[21], coral reef systems[22], and shallow lakes[23] all can exhibit this kind of behavior. The flip from one state to another is often induced by human activity; for example, cattle ranching in savanna systems can lead to completely different grass species assemblages; nutrient enrichment and physical disturbance around coral reefs can lead to replacement with algae-dominated systems; and nutrient additions can lead to eutrophication of lakes.

Natural ecosystems, including human-dominated systems, have been called “complex adaptive systems.” Because these systems are evolutionary rather than mechanistic, they exhibit a limited degree of predictability. Understanding the problems and constraints these evolutionary dynamics pose for [[ecosystem]s] is a key component in managing them sustainably[24].

Biodiversity and Ecosystems

Species diversity appears to have two major roles in the self-organization of large-scale [[ecosystem]s]. First, it provides the units through which energy and materials flow, giving the system its functional properties. There is some experimental evidence[25] that species diversity increases the productivity of ecosystems by utilizing more of the possible pathways for energy flow and nutrient cycling. Second, diversity provides the ecosystem with the resilience to respond to unpredictable surprises[26].

“Keystone process” species are those that control the system during the exploitation and conservation phases. The species that keep the system resilient in the sense of absorbing perturbation are those that are important in the release and reorganization phases. The latter group can be thought of as a form of ecosystem “insurance”[27]. The insurance aspect includes the reservoirs of genetic material necessary for the evolution of microbial, plant, animal, and human life. Genes preserve information about what works and what worked in the past. Genes thereby constrain the self-organization process to those options that have a higher probability of success. They are the record of successful self-organization[28]. Günther and Folke[29] distinguish between working and latent information in terms of the function of genes. Similarly, the organisms or groups of organisms that are controlling the ecosystem during the exploitation and conservation phases could be looked upon as working information; those with the ability to take over the system during the release and reorganization phases, that is, those who keep the system resilient, as latent information. Both are part of functional diversity.

Hence, it is the number of organisms involved in the structuring set of processes during the different stages of ecosystem development, and at different spatial and temporal scales, that determines functional diversity. This number is not necessarily the same as the number of all organisms in the system[30]. Therefore, it is not simply the diversity of species that is important; it is how that diversity is organized into a coherent whole system. The degree of organization of a system is contained in the network of interactions between the component parts[31], and it is this organization, along with system resilience and productivity (or vigor), which jointly determine the overall health of the system[32].

Ecosystems and Ecological Services

Ecological systems play a fundamental role in supporting life on earth at all hierarchical scales. They form the life-support system without which economic activity would not be possible. They are essential in global material cycles such as the carbon (Carbon cycle) and [[water cycle]s]. Ecosystems produce renewable resources and ecological services. For example, a fish in the sea is produced by several other “ecological sectors” in the food web of the sea. The fish is a part of the ecological system in which it is produced, and the interactions that produce and sustain the fish are inherently complex.

Ecological services are those ecosystem functions that are currently perceived to support and protect human activities or affect human well-being[33]. They include maintenance of the composition of the atmosphere, amelioration and stability of climate, flood controls and drinking water supply, waste assimilation, recycling of nutrients, generation of soils, pollination of crops, provision of food, maintenance of species and a vast genetic library, and also maintenance of the scenery of the landscape, recreational sites, aesthetic and amenity values[34]. Biodiversity at genetic, species, population, and ecosystem levels all contribute in maintaining these functions and services. Cairns and Pratt[35] argue that if a society was highly environmentally literate, it would probably accept the assertion that most, if not all, ecosystem functions are, in the long term, beneficial to society.

Ecosystem services are seldom reflected in resource prices or taken into account by existing institutions in industrial societies. Many current societies employ social norms and rules, which: (1) bank on future technological fixes and assume that it is possible to find technical substitutes for the loss of ecosystem goods and services; (2) use narrow indicators of welfare; and (3) employ worldviews that alienate people from their dependence on healthy ecosystems. But as the scale of human activity continues to increase, environmental damage begins to occur not only in local ecosystems, but regionally and globally as well. Humanity now faces a novel situation of jointly determined ecological and economic systems. This means that as economies grow relative to their life-supporting ecosystems, the dynamics of both become more tightly connected. In addition, the joint system dynamics can become increasingly discontinuous the closer the economic systems get to the carrying capacity of ecosystems[36].

The support capacity of ecosystems in producing renewable resources and ecological services has only recently begun to receive attention, despite the fact that this “factor of production” has always been a prerequisite for economic development. In the long run a healthy economy can only exist in symbiosis with a healthy ecology. The two are so interdependent that isolating them for academic purposes has led to distortions and poor management.

Defining and Predicting Sustainability in Ecological Terms

Defining sustainability is actually quite easy: “a sustainable system is one which survives or persists”[37].

Biologically, this means avoiding extinction and living to survive and reproduce. Economically, it means avoiding major disruptions and collapses, hedging against instabilities and discontinuities. Sustainability, at its base, always concerns temporality and, in particular, longevity.

The problem with the above definition is that, like “fitness” in evolutionary biology, determinations can only be made after the fact. An organism alive right now is fit to the extent that its progeny survive and contribute to the gene pool of future generations. The assessment of fitness today must wait until tomorrow. The assessment of sustainability must also wait until after the fact.

What often pass as definitions of sustainability are therefore usually predictions of actions taken today that one hopes will lead to sustainability. For example, keeping harvest rates of a resource system below rates of natural renewal should, one could argue, lead to a sustainable extraction system—but that is a prediction, not a definition. It is, in fact, the foundation of MSY-theory (maximum sustainable yield), for many years the basis for management of exploited wildlife and fisheries populations[38]. As learned in these fields, a system can only be known to be sustainable after there has been time to observe if the prediction holds true. Usually there is so much uncertainty in estimating natural rates of renewal, and observing and regulating harvest rates, that a simple prediction such as this, as Ludwig, Hilborn, and Walters[39] correctly observe, is always highly suspect, especially if it is erroneously thought of as a definition.

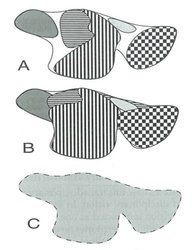

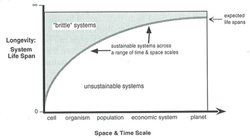

The second problem is that when one says a system has achieved sustainability, one does not mean an infinite life span, but rather a life span that is consistent with its time and space scale. Figure 3.2 indicates this relationship by plotting a hypothetical curve of system life expectancy on the y-axis versus time and space scale on the x-axis.

We expect a cell in an organism to have a relatively short life span, the organism to have a longer life span, the species to have an even longer life span, and the planet to have a longer life span. But no system (even the universe itself in the extreme case) is expected to have an infinite life span. A sustainable system in this context is thus one that attains its full expected life span.

Individual humans are sustainable in this context if they achieve their “normal” maximum life span. At the population level, average life expectancy is often used as an indicator of health and well-being of the population, but the population itself is expected to have a much longer life span than any individual, and would not be considered to be sustainable if it were to crash prematurely, even if all the individuals in the population were living out their full “sustainable” life spans.

Since [[ecosystem]s] experience succession as a result of changing climatic conditions and internal developments, they have a limited (albeit fairly long) life span. The key is differentiating between changes due to normal life span limits and changes that cut short the life span of the system. Things that cut short the life span of humans are obviously contributors to poor health. Cancer, AIDS, and a host of other ailments do just this. Human-induced eutrophication in aquatic ecosystems causes a radical change in the nature of the system (ending the life span of the more oligotrophic system while beginning the life span of a more eutrophic system). We would have to call this process “unsustainable” using the above definitions since the life span of the first system was cut “unnaturally” short. It may have gone eutrophic eventually, but the anthropogenic stress caused this transition to occur “too soon.”

More formally, this aspect of sustainability can be thought of in terms of the longevity of the system and its component parts:

- A system is sustainable if and only if it persists in nominal behavioral states as long as or longer than its expected natural longevity or existence time; and

- Neither component- nor system-level sustainability, as assessed by the longevity criterion, confers sustainability to the other level.

Within this context, one can begin to see the subtle balance between longevity and evolutionary adaptation across a range of scales that is necessary for overall sustainability. Evolution cannot occur unless there is limited longevity of the component parts so that new alternatives can be selected. And this longevity has to be increasing hierarchically with scale as shown schematically in Figure 3.2. Larger systems can attain longer life spans because their component parts have shorter life spans and can adapt to changing conditions. Systems with an improper balance of longevity across scales can become either “brittle” when their parts last too long and they cannot adapt fast enough[40] or “unsustainable” when their parts do not last long enough and the higher level system’s longevity is cut unnecessarily short.

Ecosystems as Sustainable Systems

Ecological systems are our best current models of sustainable systems. Better understanding of ecological systems and how they function and maintain themselves can thus yield insights into designing and managing sustainable economic systems. For example, in mature [[ecosystem]s] all waste and by-products are recycled and used somewhere in the system or are fully dissipated. This implies that a characteristic of sustainable economic systems should be a similar “closing the cycle” by finding productive uses and recycling currently discarded material, rather than simply storing it, diluting it, or changing its state, and allowing it to disrupt other existing ecosystems and economic systems that cannot effectively use it.

Ecosystems have had countless eons of trial and error to evolve these closed loops of recycling of organic matter, nutrients, and other materials. A general characteristic of closing the loops and building organized non-polluting natural systems is that the process can take a significant amount of time. The connections, or feedback mechanisms, in the system must evolve and there are characteristics of systems that enhance and retard evolutionary change. Humans have the special ability to perceive this process and potentially to enhance and accelerate it. The economic system should reinvent the decomposer function of ecological systems.

The first by-product, or pollutant, of the activity of one part of the system that had a disruptive effect on another part of the system was probably oxygen, an unintentional by-product of photosynthesis that was very disruptive to anaerobic respiration. There was so much of this “pollution” that the earth’s atmosphere eventually became saturated with it, and new species evolved that could use this by-product as a productive input in aerobic respiration. The current biosphere represents a balance between these processes that have evolved over millions of years to ensure that the formerly unintentional by-product is now an absolutely integral component process in the system.

Eutrophication and toxic stress are two current forms of by-products that result from the inability of the affected systems to evolve fast enough to convert the “pollution” into useful products and processes. Eutrophication is the introduction of high levels of nutrients into formerly lower nutrient systems. The species of primary producers (and the assemblages of animals that depend on them) that were adapted to the lower nutrient conditions are outcompeted by faster growing species adapted to the higher nutrient conditions. But the shift in nutrient regime is so sudden that only the primary producers are changed, and the result is a disorganized collection of species with much internal disruption (i.e., plankton blooms, fish kills), which can rightly be called pollution. The introduction of high levels of nutrients into a system not adapted to them causes pollution (called eutrophication in this case), whereas the introduction of the same nutrients into a system that is adapted to them (i.e., marshes and swamps) would be a positive input. We can minimize the effects of such by-products by finding the places in the ecosystem where they represent a positive input and placing them there. In many cases, what we think of as waste are resources in the wrong place.

Toxic chemicals represent a form of pollution because there are no existing natural systems that have ever experienced them and so there are no existing systems to which they represent a positive input. The places where toxic chemicals can most readily find a productive use are probably in other industrial processes, not in natural ecosystems. The solution in this case is to encourage the evolution of industrial processes that can use toxic wastes as productive inputs or to encourage alternative production processes that do not produce the wastes in the first place.

Substitutability vs. Complementarity of Natural, Human, and Manufactured Capital

The upshot of these considerations is that natural capital (natural resources) and human-made capital are complements rather than substitutes. The neoclassical assumption of near perfect substitutability between natural resources and human-made capital is a serious distortion of reality, the excuse of “analytical convenience” notwithstanding. To see how serious this is, just imagine that in fact human-made capital was indeed a perfect substitute for natural resources. Then it would also be the case that natural resources would be a perfect substitute for human-made capital. Yet if that were so, then we would have had no reason whatsoever to accumulate human-made capital since we were already endowed by nature with a perfect substitute! Historically, of course, we did accumulate human-made capital long before natural capital was depleted, precisely because we needed human-made capital to make effective use of the natural capital (complementarity!). It is amazing that the substitutability dogma should be held with such tenacity in the face of such an easy reductio ad absurdum. Add to that the fact that capital itself requires natural resources for its production—i.e., the substitute itself requires the very input being substituted for—and it is quite clear that human-made capital and natural resources are fundamentally complements, not substitutes. Substitutability of capital for resources is limited to reducing waste of materials in process, for example, collecting sawdust and using a press (capital) to make particleboard. And no amount of substitution of capital for resources can ever reduce the mass of material resource inputs below the mass of the outputs, given the law of conservation of matter–energy.

Substitutability of capital for resources in aggregate production functions reflects largely a change in the total product mix from resource-intensive to different capital-intensive products. It is an artifact of product aggregation, not factor substitution (i.e., along a given product isoquant). It is important to emphasize that it is this latter meaning of substitution that is under attack here—producing a given physical product with fewer natural resources and more capital. No one denies that it is possible to produce a different product or a different product mix with fewer resources. Indeed new products may be designed to provide the same or better service while using fewer resources, and sometimes less labor and less capital as well. This is technical improvement, not substitution of capital for resources. Light bulbs that give more lumens per watt represent technical progress, qualitative improvement in the state of the art, not the substitution of a quantity of capital for a quantity of natural resource in the production of a given quantity of a product.

It may be that economists are speaking loosely and metaphorically when they claim that capital is a near perfect substitute for natural resources. Perhaps they are counting as “capital” all improvements in knowledge, technology, managerial skill, and so on—in short anything that would increase the efficiency with which resources are used. If this is the usage, then “capital” and resources would by definition be substitutes in the same sense that more efficient use of a resource is a substitute for using more of the resource. But to define capital as efficiency would make a mockery of the neoclassical theory of production, where efficiency is a ratio of output to input, and capital is a quantity of input.

The productivity of human-made capital is more and more limited by the decreasing supply of complementary natural capital. Of course in the past when the scale of the human presence in the biosphere was low, human-made capital played the limiting role. The switch from human-made to natural capital as the limiting factor is thus a function of the increasing scale of the human presence.

Growth vs. Development

Improvement in human welfare can come about by pushing more matter–energy through the economy, or by squeezing more human want satisfaction out of each unit of matter–energy that passes through. These two processes are so different in their effect on the environment that we must stop conflating them. Better to refer to throughput increase as growth, and efficiency increase as development[41]. Growth is destructive of natural capital and beyond some point will cost us more than it is worth—that is, sacrificed natural capital will be worth more than the extra man-made capital whose production necessitated the sacrifice. At this point growth has become anti-economic, impoverishing rather than enriching. Development, or qualitative improvement, is not at the expense of natural capital. There are clear economic limits to growth, but not to development. This is not to assert that there are no limits to development, only that they are not so clear as the limits to growth, and consequently there is room for a wide range of opinion on how far we can go in increasing human welfare without increasing resource throughput. How far can development substitute for growth? This is the relevant question, not how far can human-made capital substitute for natural capital, the answer to which, as we have seen, is “hardly at all.”

Some people believe that there are truly enormous possibilities for development without growth. Energy efficiency, they argue, can be vastly increased[42]. Likewise for the efficiency of water use. Other materials are not so clear. Others[43] believe that the bond between growth and energy use is not so loose. This issue arises in the Brundtland Commission’s Report[44] where on the one hand there is a recognition that the scale of the human economy is already unsustainable in the sense that it requires the consumption of natural capital, and yet on the other hand there is a call for further economic expansion by a factor of 5 to 10 in order to improve the lot of the poor without having to appeal too much to the “politically impossible” alternatives of serious population control and redistribution of wealth. The big question is: how much of this called for expansion can come from development, and how much must come from growth? This question is not addressed by the Commission. But statements from the secretary of the WCED, Jim MacNeil[45] that “The link between growth and its impact on the environment has also been severed”, and “the maxim for sustainable development is not ‘limits to growth’; it is “the growth of limits,” indicate that WCED expects the lion’s share of that factor of 5 to 10 to come from development, not growth. They confusingly use the word “growth” to refer to both cases, saying that future growth must be qualitatively very different from past growth. When things are qualitatively different it is best to call them by different names, hence our distinction between growth and development. Our own view is that WCED is too optimistic—that a factor of 5 to 10 increase cannot come from development alone, and that if it comes mainly from growth it will be devastatingly unsustainable. Therefore the welfare of the poor, and indeed of the rich as well, depends much more on population control, consumption control, and redistribution than on the technical fix of a 5- to 10-fold increase in total factor productivity.

We acknowledge, however, that there is a vast uncertainty on this critical issue of the scope for economic development from increasing efficiency. We have therefore devised a policy that should be sustainable regardless of who is right in this debate. We save its full description for the final section. For now we mention only the basic logic: protect the pessimists against their worst fears and encourage the optimists to pursue their dreams by the same policy; namely, limit throughput. First some general principles of sustainable development.

More on Complementarity vs. Substitutability

The main issue is the relation between natural capital, which yields a flow of natural resources and services that enter the process of production, and the human-made capital that serves as an agent in the process for transforming the resource inflow into a product outflow. Is the flow of natural resources (and the stock of natural capital that yields that flow) substitutable by human-made capital? Clearly one resource can substitute for another—we can transform aluminum instead of copper into electric wire. We can also substitute labor for capital, or capital for labor, to a significant degree even though the characteristic of complementarity is also important. For example, we can have fewer carpenters and more power saws, or fewer power saws and more carpenters and still build the same house. In other words one resource can substitute for another, albeit imperfectly, because both play the same qualitative role in production: both are raw materials undergoing transformation into a product. Likewise capital and labor are substitutable to a significant degree because both play the role of agent of transformation of resource inputs into product outputs. However, when we come to substitution across the roles of transforming agent and material undergoing transformation (efficient cause and material cause), the possibilities of substitution become very limited and the characteristic of complementarity is dominant. For example, we cannot make the same house with half the lumber no matter how many extra power saws or carpenters we try to substitute. Of course we might substitute brick for lumber, but then we face the analogous limitation—we cannot substitute masons and trowels for bricks.

More on Natural Capital

Thinking of the natural environment as “natural capital” is in some ways unsatisfactory, but useful within limits. We may define capital broadly as a stock of something that yields a flow of useful goods or services. Traditionally capital was defined as produced means of production, which we call here human-made capital, as distinct from natural capital which, though not made by man, is nevertheless functionally a stock that yields a flow of useful goods and services. We can distinguish renewable from nonrenewable natural capital, and marketed from nonmarketed natural capital, giving four cross-categories. Pricing natural capital, especially nonmarketable natural capital, is so far an intractable problem, but one that need not be faced here. All that need be recognized for the argument at hand is that natural capital consists of physical stocks that are complementary to human-made capital. We have learned to use the concept of human capital (i.e., skills, education, etc.) which departs even more fundamentally from the standard definition of capital. Human capital cannot be bought and sold, although it can be rented. Although it can be accumulated it cannot be inherited without effort by bequest as can ordinary human-made capital, but must be re-learned anew by each generation. Natural capital, however, is more like traditional human-made capital in that it can be bequeathed. Overall the concept of natural capital is less a departure from the traditional definition of capital than is the commonly used notion of human capital.

There is a large subcategory of marketed natural capital that is intermediate between natural and human-made, which we might refer to as “cultivated natural capital.” This consists of such things as plantation forests, herds of livestock, agricultural crops, fish bred in ponds, and so on. Cultivated natural capital supplies the raw material input complementary to human-made capital, but does not provide the wide range of natural ecological services characteristic of natural capital proper (e.g., eucalyptus plantations supply timber to the sawmill, and may even reduce erosion, but do not provide a wildlife habitat or conserve biodiversity). Investment in the cultivated natural capital of a plantation forest, however, is useful not only for the lumber, but as a way of easing the pressure of lumber interests on the remaining true natural capital of natural forests.

Marketed natural capital can, subject to the important social corrections for common property and myopic discounting, be left to the market. Nonmarketed natural capital, both renewable and nonrenewable, will be the most troublesome category. Remaining natural forests should in many cases be treated as nonmarketed natural capital, and only replanted areas treated as marketed natural capital. In neoclassical terms, the external benefits of remaining natural forests might be considered “infinite” thus removing them from market competition with other (inferior) uses. Most neoclassical economists, however, have a strong aversion to any imputation of an “infinite” or prohibitive price to anything.

Sustainability and Maintaining Natural Capital

Solutions to the problems of sustainability will only be robust and effective if they are fair and equitable. Philosopher John Rawls[46] has argued that policies that represent an overlapping consensus of the interest groups involved in a problem will most likely be fair, effective, and resilient. The normal political process tends to accentuate conflict, and majority voting often sidetracks efforts to find overlapping consensus. The policies resulting from majority voting often are unfair to the minority and are not resilient since the minority spends all of its time fighting the decision and trying to build a new majority to overthrow the previous majority. In addition, interest groups important to global, long-run decisions (like future generations and other species) are given little if any representation in the process.

There is, however, a growing, global, overlapping consensus that attempts to acknowledge the interests of future generations and other species. The consensus is that the appropriate long-term social goal is sustainability[47]. Consensus on exactly what is meant by sustainability is still emerging[48], but we interpret this as healthy disagreement over the means, not the ends. The goal is a system that will survive indefinitely and in good shape, and one can only be sure one has achieved that goal in retrospect. In prospect, there is disagreement over which current policies will achieve the goal and, as discussed above, we need to be especially cognizant of the inherent uncertainty of our ability to predict the future. The “precautionary principle” is beginning to achieve a degree of consensus as the basic approach to uncertainty[49]. For this reason the focus should be on policies that are aimed at assuring sustainability over as wide a range of future conditions as possible.

For example, a sustainable system is one with “sustainable income,” defined in a Hicksian sense as the amount of consumption that can be sustained indefinitely without degrading capital stocks, including “natural capital” stocks[50]. Since “capital” is traditionally defined as produced (manufactured) means of production, the term “natural capital” needs explanation. It is based on a more functional definition of capital as “a stock that yields a flow of valuable goods or services into the future.” What is functionally important is the relation of a stock yielding a flow; whether the stock is manufactured or natural is in this view a distinction between kinds of capital and not a defining characteristic of capital itself. For example, a stock or population of trees or fish provides a flow or annual yield of new trees or fish (along with other services), a flow which can be sustainable year after year. The sustainable flow is “natural income,” the stock that yields the sustainable flow is “natural capital.” Natural capital may also provide services like recycling waste materials or water catchment and erosion control, which are also counted as natural income. Since the flow of services from ecosystems requires that they function essentially as whole systems, the structure and biodiversity of the ecosystem is a critical component in natural capital.

To achieve sustainability, we must therefore incorporate natural capital, and the ecosystem goods and services that it provides, into our economic and social accounting as well as our systems of social choice. In estimating these values, we must consider how much of our ecological life support systems we can afford to lose. To what extent can we substitute manufactured for natural capital, and how much of our natural capital is irreplaceable? For example, could we replace the radiation screening services of the ozone layer if it were destroyed?

Daly[51] has developed three basic criteria for the maintenance of natural capital and ecological sustainability:

- For renewable resources, the rate of harvest should not exceed the rate of regeneration (sustainable yield);

- The rates of waste generation from projects should not exceed the assimilative capacity of the environment (sustainable waste disposal); and

- For nonrenewable resources the depletion of the nonrenewable resources should require comparable development of renewable substitutes for that resource.

Population and Carrying Capacity

A primary question is: Are there limits to the carrying capacity of the earth system for human populations? Ecological economics gives an unequivocal yes. Where doubt sets in is on the precise number of people that can be supported, about the standard of living of the population, and about the way in which food production will reach the limit imposed by the carrying capacity. These issues must be the priority research topics for the next decades.

Various estimates of global carrying capacity of the earth for people have appeared in the literature ranging from 7.5 billion[52] to 12 billion[53], 40 billion[54], and 50 billion[55]. However, many authors are skeptical about the criteria—amount of food, or kilocalories—used as a basis for these estimates. “For humans, a physical definition of needs may be irrelevant. Human needs and aspirations are culturally determined: they can and do grow so as to encompass an increasing amount of ‘goods,’ well beyond what is necessary for mere survival”[56]. For a long and careful, if somewhat inconclusive, discussion of the population issue see Cohen[57].

Cultural evolution has a profound effect on human impacts on the environment. By changing the learned behavior of humans and incorporating tools and artifacts, it allows individual human resource requirements and their impacts on their resident [[ecosystem]s] to vary over several orders of magnitude. Thus it does not make sense to talk about the “carrying capacity” of humans in the same way as the “carrying capacity” of other species[58] since, in terms of their carrying capacity, humans are many subspecies. Each subspecies would have to be culturally defined to determine levels of resource use and carrying capacity. For example, the global carrying capacity for Homo americanus would be much lower than the carrying capacity for Homo indus, because each American consumes much more than each Indian does. And the speed of cultural adaptation makes thinking of species (which are inherently slow changing) misleading anyway. Homo americanus could change its resource consumption patterns drastically in only a few years, while Homo sapiens remains relatively unchanged. We think it best to follow the lead of Daly[59] in this and speak of the product of population and per capita resource use as the total impact of the human population. It is this total impact that the earth has a capacity to carry, and it is up to society to decide how to divide it between numbers of people and per capita resource use. This complicates population policy enormously, since one cannot simply state a maximum population, but rather must state a maximum number of impact units. How many impact units the earth can sustain and how to distribute these impact units over the population is a dicey problem indeed, but one that must be the focus of research in this area.

Many case studies indicate that “there is no linear relation between growing population and density, and such pressures towards land degradation and desertification”[60]. In fact, one study found that land degradation can occur under rising pressure of population on resources (PPR), under declining PPR, and without PPR[61]. Therefore, the scientific agenda must look toward more complex, systemic models where the effects of population pressures can be analyzed in their relationships with other factors. This would allow us to differentiate population as a “proximate” cause of environmental degradation from the concatenation of effects of population with other factors as the “ultimate” cause of such degradation.

Research can begin by exploring methods for more precisely estimating the total impact of population times per capita resource use. For example, the “Ehrlich identity” (Pollution/Area = People/Area x Economic Production/People x Pollution/Economic Production) can be operationalized as (CO2 Emissions/Km = Population/Km x GNP/Population x CO2 Emissions/GNP). Thus no single factor dominates the changing patterns of total impact across time. This points to the need for local studies of causal relations among specific combinations of populations, consumption, and production, noting that these local studies need to aim for a general theory that will account for the great variety of local experience.

Another research priority is to look at the effect adding a new person has on resources, according to consumption levels and the effect that efficiency has on rising levels of consumption. Decreasing energy consumption in developed countries could dramatically decrease CO2 emissions globally. It is only under a scenario of severe constraints on emissions in the developed countries that population (Population growth rate) growth in less developed ones plays a major global role in emissions growth. If energy efficiency could be improved in the latter as well as the former, then population increase would play a much smaller role.

Research priority should also look at situations where demand (either subsistence or commercial) becomes large relative to the maximum sustainable yield of the resource, where the regenerative capacity of the resource is relatively low, or where the incentives and restraints facing the exploiters of the resource are such as to induce them to value present gains much more highly than future gains.

Some authors single out a high rate of population growth as a root cause of environmental degradation and overload of the planet’s carrying capacity. Consequently, the policy instrument is obviously population control. Ehrlich and his colleagues maintain “There is no time to be lost in moving toward population shrinkage as rapidly as is humanly possible”[62]. But, as Ehrlich himself fully recognizes, the policy of focusing solely on population control is known to be insufficient. It has repeatedly been shown that it is not easily achieved in and of itself, and that in addition important social and economic transformations must accompany it, such as the reduction of poverty. Even in those cases where population growth has been relatively successfully controlled, as in China, the welfare of the people has not necessarily improved and the environment is not necessarily exposed to lower rates of hazard.

The opposite position is taken by those who see high rates of population growth as stimulating economic development through inducing technological and organizational changes[63] or as a phenomenon that can be solved through technological change[64].