Environmental and ecological economics

Contents

Environmental Economics

Environmental economics, the orthodox approach to positing economic solutions to environmental problems, is taught in universities and practiced in government agencies and development banks, and virtually all of these solutions are based on the mathematical formalism of general equilibrium theory. This formalism obliges environmental economists to assume that production and consumption does not alter the material substances out of which goods and commodities are made. The creators of neoclassical economists arrived at this assumption after they substituted economic variables for the physical variables in the equations of a mid-nineteenth century theory in physics.

The resulting formalism obliged these economists to claim that there is symmetry between production and consumption in an immaterial energy field of utility in which lawful or law-like mechanisms govern and control decisions made by economic actors and determine the value (Value theory) of goods and commodities.

This explains why there is no basis in the mathematical formalism used by environmental economists for representing economic activities as physical processes embedded in and interactive with natural processes. The environment in this formalism has value only as environmental goods, services and amenities that can be bought, sold, traded, saved, or invested, like any other commodity, in a closed market system that must, if it is functioning properly, grow or expand.

When environmental economists calculate environmental costs, they assume that the relative price of each bundle of an environmental good, service, or amenity reveals the “real marginal values” of the consumer. In the mathematical theories used by these economists, a marginal value essentially represents how much a consumer is willing to pay a little bit more of something to acquire a little bit more of something else. Note what the writers of a standard textbook on environmental economics have to say about the dynamics of this process:

The power of a perfectly functioning market rests in its decentralized process of decision making and exchange; no omnipotent planner is needed to allocate resources. Rather, prices ration resources to those that value them the most and, in doing so, individuals are swept along by Adam Smith’s invisible hand to achieve what is best for society as a collective. Optimal private decisions based on mutually advantageous exchange lead to optimal social outcomes.

In environmental economics, one of the fundamental assumptions is that optimal private decisions “based on mutually advantageous exchange” in an amorphous field of utility lead to optimal social outcomes for the state of the environment. But according to these economists, this will not occur unless the following conditions apply—the market system in which economic actors make optimal private decisions must operate more or less perfectly, and the prices, or values, of environmental goods and services must be represented as a function of those decisions. But if these conditions are met, environmental economists assume that the lawful or law-like operation of the market system will resolve environmental problems when the “prices are right.”

Since the “right price” in neoclassical economic theory is a function of the dynamics allegedly revealed in the mathematical formalism, environmental economists assume that the results of computations based on this formalism will determine if a putative price is actually right. This explains why much of the work of the these economists attempts to represent environmental costs of economic activities in terms of prices that economic actors have paid, or are willing to pay, in order to realize some marginal benefits of environmental goods and services. This view of right prices also explains why the term “environmental externalities” has a rather peculiar meaning in the literature of mainstream economists.

Externalities are situations in which the production or consumption of one economic actor affects another who did not pay for the good produced or consumed, and externalities are viewed as either negative or positive. For example, environmental economists often cite pollution as an example of the former and preservation of biological diversity as an example of the latter. When these economists use the phrase “environmental externalities,” they are referring to environmental goods and services that are “external” to market systems in the sense that they are presumed to exist outside of the allegedly lawful or law-like dynamics of these systems.

From the perspective of environmental economists, markets fail if prices do not accurately communicate the desires and constraints of a society, and an environmental problem is a negative externality that represents such a failure. A market system is alleged to operate properly when a set of competitive markets generates a sufficient allocation of resources at a level of efficiency known as “Pareto optimality.” This term refers to a hypothetical idealized state or condition where it is impossible to reallocate resources to enhance the utility of one economic actor without reducing that of another. The assumption here is that if the natural laws of economics are allowed to maximize the private net benefits of consumers and producers with minimal restraint, a set of markets will emerge in which each economic actor will have access to a socially optimal allocation of resources.

The most traditional approach to internalizing a negative environmental externality is to impose a tax defined by Pigou in The Economics of Welfare (1932) which is presumably equal to the value of the marginal social damage associated with the externality. The aim of this tax, said Pigou, “is to ascertain how the free play of self-interest, acting under the existing legal system, tends to distribute the country’s resources in the way most favorable to the production of a large national dividend, and how it is feasible for State action to improve upon ‘natural’ tendencies.” There are, said Pigou, “natural” tendencies at work in market systems associated with the operation of the natural laws of economics and any tax imposed by the state should enhance these tendencies. He also claimed that the value of production will be maximized in the vast majority of economic situations if government refrains from interfering with these “natural” tendencies. Pigou also argued, however, that exogenous “human institutions” can interfere with the dynamics of closed market systems and, therefore, government must take some limited action “to control the play of economic forces in such ways as to promote the economic welfare, and through that, the total welfare, of their citizens as a whole.”

When environmental economists are asked to assess the potential impacts on market economies of environmental tax reforms, they typically factor a Pigouvian tax into the mathematical formalism of neoclassical economic theory. One problem with the optimal social outcomes which the calculations are intended to assess is that they are almost invariably premised on the assumption that the proposed environmental tax reforms must not impede the “natural” tendencies of market systems to grow and expand. Consequently, the calculated impacts of these reforms tend to emphasize economic losses associated with decreases in the consumption of environmental goods and services and to grandly minimize the environmental costs.

In dealing with pollution problems, environmental economists generally favor emissions charges or fees, and they often appeal to Pigou to make the case that this instrument is more efficient and effective than regulations imposed by the exogenous agency of government. They argue that these charges or fees will reduce the quantity or improve the quality of pollution by making polluters assume a portion of the costs for every unit of harmful pollution they release into the environment. The scheme is Pigouvian in the sense that the anticipated result is that the charges or fees will be equal to the marginal social damage associated with the externality. The expectation here is that firms will be induced to lower their emissions to the point where the incremental cost of pollution control equals the emissions charges they might otherwise pay. It is also presumed that if individual polluters use pollution control strategies that represent least cost solutions, the invisible hand will cause the aggregate costs of pollution control to be minimized.

Another traditional approach in environmental economics to getting the prices right by internalizing negative environmental externalities was originally proposed by economist Ronald Coase in a paper published in 1960. Coase objected to the use of any environmental tax or subsidy that would impose economic burdens not directly related to or a function of specific economic activities. He also argued that the value judgements implied in the use of taxes or subsidies were inconsistent with neoclassical assumptions about the character of economic reality and the lawful dynamics of market processes.

Coase claimed that the primary reason the mechanisms of market processes cannot resolve environmental problems is that many environmental resources are not owned and exist outside of the domain in which these mechanisms allegedly operate. He concluded, therefore, that the most effective way to internalize negative environmental externalities was to revise the legal system to allow for the assignment of ownership rights to environmental resources. If these resources were owned, argued Coase, the invisible hand would eliminate undesirable uses and adverse environmental impacts would disappear without the need for government intervention. In this situation, he said, there would be equivalence between paying someone for a good and charging someone for a bad in a state of general equilibrium where optimal social outcomes are necessarily realized.

Environmental economists often appeal to Coase to make the case that tradable pollution permits, like those used to implement the Kyoto accords, are a more effective market-based solution for environmental problems than Pigouvian taxes.

In these schemes, a predetermined level of emissions is established within a specific region and permits equal to the permissible total emissions are distributed among producers in the region. Polluters who keep their levels of emissions below that allowed in their permits can sell or lease their surplus permits to other producers or use them to offset emissions in other parts of their production system. Because the permits are limited and have, therefore, scarcity value, the environmental economists claim that this should provide sufficient incentives to create a market in which they are actively traded.

Beginning in the 1970s, the Environmental Protection Agency allowed states to use tradable permits to implement the provisions of the Clean Air Act, and they were used in the 1980s in the petroleum industry to accomplish the phase-down of leaded gasoline. This scheme was also employed to facilitate the worldwide reduction of emissions of ozone-depleting CFCs, to lower ambient ozone levels in the northeast United States, and to implement stricter air pollution controls in the Los Angeles area.

Experience has shown, however, that tradable permits are difficult to administer, costly to implement, and that the infrastructure required for actively trading them rarely emerges. There is also some research which suggests that tradable permits do not achieve more reductions in emissions than standard regulatory systems or stimulate more innovation in pollution control technology than restrictions on emissions imposed by governments.

There is, however, a more fundamental reason why emissions charges and tradable permits cannot be viewed as viable economic solutions to the environmental crisis. The assumption in the neoclassical economic paradigm that the economic activities of production or distribution systems exist in closed market systems effectively undermines the prospect that these market-based solutions can effectively deal with pollution problems in economic terms. This assumption obliges the environmental economists to represent the costs of pollution as a function of the economic activities which have value only in the mental space of economic actors operating within closed and isolated regional economies or national economies. The fundamental problem here is that economic activities are embedded in and interactive with the global environment and there is no such thing in this environment as discrete and isolated systems.

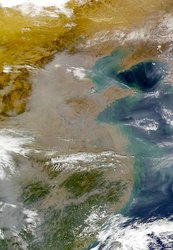

The fact that national economies are not closed or isolated systems should be obvious to anyone who has watched the weather channel. The precursors of acid rain produced in Great Britain (sulfur dioxide and nitrogen dioxide) travel on a prevailing western wind and are deposited in Scandinavia, and industrial facilities in northern Britain cause more pollution in Scandinavia than in southern England. Huge amounts of greenhouse gases and other pollutants produced in the United States cause environmental problems in Canada, and CFCs emitted from any region on the globe damage the ozone layer. Because the thinning of the ozone layer is non-uniform, some countries, such as Australia and New Zealand, suffer more damage from higher concentrations of UV radiation than countries that are located further from the poles.

It is, of course, theoretically possible to enlarge the zones, regions, or “bubbles” within which emissions schemes and tradable permits apply. And environmental economists did so in the failed U.S. proposal that would have allowed highly industrialized nations to meet the reductions in carbon dioxide emissions required in the Kyoto accords at less costs. This does not, however, obviate the fact, as that agreement nicely demonstrated, that such schemes tend, almost invariably, to expand market economies at the great expense of a sustainable global environment. The [[market-based solution]s] of the environmental economists may appear to result in “win-win” outcomes in the equations of neoclassical economics. But this is only because unscientific assumptions about economic reality implicit in this formalism preclude the prospect that any realistic assessment of the damage done to the global environment by economic activities can be included in the calculations.

The fundamental disjunction between constructions of parts (closed economic systems) and whole (global market system) in the neoclassical economic paradigm and the real or actual dynamics of part-whole relationships in the global environment is also apparent in attempts by environmental economists to assess long-term economic impacts of changes in this environment. For example, a well-known environmental economist notes in a study on the potential impact of global warming on the global economy that “climate change is likely to have different impacts on different sectors in different countries.” He then says the following about the U.S. economy:

In reality, most of the U.S. economy has little interaction with climate. For example, cardiovascular surgery and parallel computing are undertaken in carefully controlled environments and are unlikely to be directly affected by climate change. More generally, underground mining, most services, communications, and manufacturing are sectors likely to be largely unaffected by climate change—sectors that comprise about 85 percent of GNP.

In scientific terms, the assumption that various sectors of an economy can be isolated from the impacts of global warming because they have little or no “interaction” with climate makes no sense at all. In the climate models environmental scientists use to study global warming, increases in the 3 to 6 degree Centigrade range would have disastrous impacts on all natural environments, including those within the borders of the United States.

Other market-based instruments that environmental economists use to posit economic solutions to environmental problems, such as subsidies, incentive structures, performance bonds and deposit refund schemes, are also premised on unscientific assumptions about the allegedly lawful dynamics of market systems in neoclassical economic theory. For those interested in a more detailed discussion of the entire range of market-based solutions developed by the environmental economists, a good place to begin is Economics of the Environment, edited by Robert Stavins. This book contains a number of useful overview articles and a wealth of bibliographical material.

Environmental Policy and Cost-Benefit Analysis

Environmental economics often use cost-benefit analyses in the effort to internalize in market systems the costs of doing business in environmental terms. Developing methods to conduct these analyses became a growth industry after Ronald Reagan issued Executive Order 12291 in 1981. The Order required that cost-benefit analyses be performed for all environmental regulations in the United States with annual costs in excess of $100 million and stipulated that regulations could be implemented only if the benefits to society exceed the costs.

In theory, this concept seems fairly straightforward and very appealing. Why should we spend money dealing with an environmental problem if the costs exceed the benefits? But when translated into the methods for evaluation used by environmental economists, “benefits to society” means the optimal social outcomes that result from the alleged operation of the natural laws of economics within closed market systems. And the “costs” against which those benefits are measured refers to other alleged manifestations of these non-existent laws—the amounts that economic actors are willing to pay to protect or preserve environmental goods, services and amenities, or the amounts they are willing to accept for the exploitation or consumption of those goods, services or amenities.

One dilemma faced by environmental economists in doing cost-benefit analyses is that the only “real marginal values” they can confer on the environment are allegedly determined by the operation of the natural laws of economics within closed market systems. Given that the vast majority of the damage done to the global environment by economic activities cannot be valued in these terms, these economists have developed two methods for valuing “non-market” resources—indirect methods designed to estimate the “use-value” of these resources (hedonic pricing and the travel cost method), and direct methods designed to estimate both “use-value” and “non-use value” of the resources (contingent valuation methods).

In the hedonic pricing method, environmental economists try to estimate the market value of a commodity as a bundle of valuable characteristics and one or more of these characteristics may be environmental. For example, the value of a house may depend on number of rooms, the size of the lawn, proximity to shopping, air quality levels, and distance from toxic waste sites. A hedonic price for this house would be arrived at by estimating a hedonic price function and calculating prices for the environmental variables by creating a demand curve that allegedly allows all of the variables to be given an approximate monetary value. And the presumption is that the “real” marginal value of preserving air quality or eliminating toxic wastes can be reasonably inferred using this method.

The travel cost method is predicated on the assumption that the value a non-market resource, such as national parks and public forests, can be estimated based on the amount of money an economic actor would be willing to sacrifice to appreciate natural beauty. In this method, a statistical relationship between observed visits to non-market resources of natural beauty and the costs of visiting those resources is derived and used as a surrogate demand curve from which the consumer’s surplus per visit-day can be measured. While the travel cost method of evaluation may seem rather esoteric and quite strange, it has been widely used in cost-benefit analyses of proposals in the U.S. and Britain to create or preserve publicly owned recreational areas.

Contingent valuation methods have been used to assess the economic value of recreation, scenic beauty, air quality, water quality, species preservation, bequests to future generations and other non-market environmental resources. The methods are intended to assess the willingness-to-pay function of economic actors who would prefer to preserve natural environments (preservation or existence values), maintain the option of using natural resources (option values), and bequeath natural resources to future generations (bequest values). Most contingent valuation surveys seek to determine the maximal amount that individuals are willing to pay for an increase in the quality of an environmental resource and the minimal amount they are willing to accept as compensation to forgo this increase.

The word contingent is used to highlight the fact that the values disclosed by the respondents are contingent upon conditions in the artificial or simulated market described in the survey. A description of this market might include an estimate of the costs of reducing annual mortality risk by improving air quality or the costs of providing more protection for an endangered species. The questions take many forms, ranging from open-ended (“What is the maximum you would be willing to pay for….”) to specific yes-no responses (The government is considering a proposal X. Your per annum tax bill if this proposal passes would be Y. How would you vote?). The surveys also usually solicit information about the socioeconomic characteristics of the respondents, their environmental attitudes and/or recreational behavior, and other variables that pertain to the willingness-to-pay function.

However, there is no standard approach to the design of contingent valuation surveys and the level of environmental quality is typically predetermined by a third party, such as a government seeking to achieve a particular level of air quality. The resulting methodological problems and uncertainties have raised large questions about the efficacy of the results, and there is a lively debate among mainstream economists about whether the measures should be used at all. In spite of these problems, however, contingent evaluations are still routinely used by government agencies and the World Bank, and they have also been used in over 40 countries to determine values for a wide range of environmental goods and services.

The primary reason why mainstream economists have questioned the validity of contingent valuation studies has nothing to do, however, with flaws in designs, problems with statistically-based probability sampling, or lack of controls. According to most of these economists, the fundamental problem is that these studies are based on principles that are inconsistent with assumptions about the character of economic realty in neoclassical economics. Objections that appeal to these assumptions are often presumed to be self-evident, but uncovering what these economists are really saying requires some explanation.

In general equilibrium theory, an economic actor is represented as an atomized entity moving like a point particle in a field of utility in accordance with forces associated with the natural laws of economics and these forces allegedly govern or massively condition the decisions made by these actors. The hidden assumptions here are that the subjective reality of the actors is atomized, the forces associated with the natural laws act on this subjectivity from the outside, and the decisions are largely unaffected by ideas, impulses, emotions, and desires that would make the outcomes indeterminate. When, however, as the game theorists have discovered, the black box of human subjectivity is opened and economic decisions are examined based on individual criteria of rational decision-making, there is an infinite regress into the complexities of language and culture. Given that this clearly suggests that the natural laws of economics do not exist, mainstream economists typically argue that the natural laws of economics manifest only in actual decisions made in closed market systems. And this leads to the conclusion that the only data that can be used in the equations of general equilibrium theory are those that reflect these decisions.

However, a number of studies done by mainstream economists on the manner in which people make decisions in various economic contents have shown that there are often no discernible regularities in the process. For example, one study suggested that “for many purchases a decision process never exists, not even for first purchase,” and another on economic behavior in grocery stores found that shoppers construct a “choice heuristic on the spot about 25% of the time.” What these and other studies have revealed is something that most of intuitively know—people often make complex consumer choices based on irrational impulses which they rationalize after the fact by making up reasons why a purchase was needed or necessary.

For the sake of argument, let us assume that contingent valuation studies are capable of fully revealing maximal social outcomes of environmental policy decisions. Are we then to believe, as one such study showed, that reduction in chemical contaminants in drinking water was not important in economic terms because the value of a statistical life associated with a reduction in risk of death in thirty years was only $181,000? Is $26 a measure of the real marginal costs of pollution because this is the average price that a household is willing to pay annually for a 10 percent improvement of visibility in eastern U.S. cities? Is the value of whopping cranes the $22 per year average that one set of households was willing to pay to preserve this species and that of the bald eagle the $11 per year average that another set of households would spend to preserve this apparently less valuable species?

Ecological Economics

Ecological economists are not members of the community of mainstream economists and their work has been routinely dismissed or ignored by mainstream economists. The primary objective of the ecological economists is to enlarge the framework of the [[neoclassical] economic paradigm] to include scientifically valid measures of the environmental costs of economic activities. Scholarship in this discipline is replete with carefully developed and well documented reasons why the mathematical theories used by mainstream economists should include these costs and numerous demonstrations of how this could be accomplished. But the fact that there has been virtually no dialogue between ecological economists and mainstream economists clearly indicates that the former is saying something that the latter simply does not wish to entertain or understand.

Part of what mainstream economists clearly do not wish to confront is that there is no basis for assuming that the mathematical theories used in their profession are scientific. There is, however, a much more fundamental reason why neoclassical economists have been unwilling to engage in this dialogue. Because ecological economists are normally familiar with research done in environmental science, they know that assumptions about economic reality in neoclassical economics are anything but sacrosanct. However, the presumption that mainstream economists would be willing to revise these assumptions was unrealistic because they are foundational to the mathematical theories used by these economists. The large problem here is that any proposed economic solutions to environmental problems that require even a slight modification of these assumptions would threaten to undermine the efficacy of the mathematical theories. This is the case because the presumed efficacy of these theories is entirely dependent on the belief that the assumptions are valid.

Even a slight change in these assumptions would force mainstream economists to redefine initial conditions in the equations of neoclassical economics in ways that would require the introduction of new sets of complex variables. This would not only play havoc with the neat symmetry in these equations between consumption and production and yield results that describe very different outcomes. It would also effectively undermine the presumption that the economic process exists in a separate and distinct domain of reality in which decisions of economic actors are a function of lawful or law-like mechanisms that operate only within this domain.

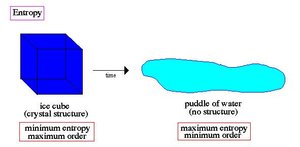

In an effort to incorporate scientifically valid measures of the environmental costs of economic activities into the neoclassical economic paradigm, many ecological economists have appealed to the first and second law of thermodynamics. The first law states that energy is conserved and cannot be created or destroyed, and the second that low-entropy matter-energy in a closed system is always transformed into high-entropy matter-energy. Entropy in physics is essentially a measure of disorder in a system—the higher the entropy, the greater the disorder.

From the perspective of thermodynamics, an economic system converts matter-energy from a state of low entropy to a state of high entropy and matter-energy exists in two forms—available or free and unavailable or bound. For example, the chemical energy in a piece of coal, which is low in entropy, is viewed as free, and theheat energy in waters of the oceans, which is high in entropy, is viewed as bound. Since the amount of bound matter-energy in a closed system must continually increase, the only way to lower entropy in such a system is to introduce matter-energy from the outside. But after this matter-energy is introduced into the system, the price paid for consuming what might initially appear to be a free lunch is an overall increase in the level of entropy.

Virtually every object with economic value has a highly ordered structure, and the matter-energy required to manufacture these objects inevitably increases the overall level of entropy in the ecosystem. For example, an automobile is vastly more ordered that a lump of iron ore, and the matter-energy required to transform raw materials into an automobile is enormous. Manufacturing processes also produce waste, pollution and greenhouse gases, and these byproducts massively contribute to the overall level of disorder in the ecosystem. Even recycled products require energy inputs that increase entropy levels and convert free energy to bound energy. As physicist Erwin Schrodinger put it, the life of all organisms, including our own, is necessarily an entropic process: “The device by which an organism maintains itself stationary at a fairly high level of orderliness (= a fairly low level of entropy) really exists in continually sucking orderliness from its environment.”

When the environmental movement in the United States emerged as a potent political force during the petroleum shortage in the 1970s, ecologist Howard Odum developed a systematic model based on energy flows to better understand the impact of human activity on the natural environment. He pointed out that wherever a flow of capital exists, there must be an energy flow in the opposite direction. Odum also noted that while a market system in neoclassical economics is represented as a closed loop with no inputs or outputs, low-entropy energy inputs always enter real or actual economic systems and become high-entropy energy outputs. He also argued that other essential energy flows, such as solar, water and wind, are misused because they are not represented in the flow of capital.

The work of economists Nicholas Georgescu-Roegen and Herman Daly (Daly, Herman E.) was also seminally important in the development of ecological economics. In The Entropy Law and the Economic Process (1971), Georgescu-Roegan demonstrated that the mathematical analysis of production in neoclassical economics is badly flawed because it fails to incorporate the laws of thermodynamics. In his view, an economy must be viewed in thermodynamic terms as a unidirectional flow in which inputs of low-entropy matter and energy are used to produce two kinds of outputs— goods and services and high entropy waste and degraded matter. Since neoclassical economic theory assigns value only to the first output and completely ignores the costs associated with the second, Georgescu-Roegen attempted to refashion this theory to include these costs.

“Man’s natural dowry,” wrote Georgescu-Roegen, “consists of two essentially distinct elements: 1) the stock of low-entropy on or within the globe; and 2) the flow of solar energy.” He also claimed that we have not used these resources well:

If we abstract from other causes that may knell the death bell of the human species, it is clear that natural resources represent the limitative factor as concerns the life span of that species. Man’s existence is now irrevocably tied to the use of exosomatic instruments and hence to the use of natural resources just as it is tied to the use of his lungs and of air in breathing, for example. We need no elaborated argument to see that the maximum of life quantity requires the minimal rate of natural resource depletion. By using these resources too quickly, man throws away that part of the solar energy that will still be reaching the earth after he has departed. And everything he has done during the last two hundred years or so puts him in the position of a fantastic spendthrift. There can be no doubt about it: any use of the natural resources for the satisfaction of non-vital human needs means a smaller quantity of life in the future.

The writings of Georgescu-Roegen are well known and appreciated by ecological economists, but there are no discussions of his work in standard textbooks on mainstream economics. The reason for this omission is that Georgescu-Roegen challenged three fundamental assumptions upon which the mathematical formalism of neoclassical economic theory is predicated: 1) market systems are closed; 2) non-market environmental resources must be viewed as existing outside of market systems and treated as externalities; and 3) there are no limits on the growth and expansion of market economies.

In Steady State Economics (1977), Herman Daly (Daly, Herman E.), who was a student of Georgescu-Roegen’s at Vanderbilt, criticized the failure of mainstream economics to account for the throughput of low-entropy natural resources.

He also argued that the preoccupation with money flows, or with movement of quantities of money over periods of time, serves to perpetuate the fiction that perpetual economic growth is possible and morally desirable. One solution to this problem, says Daly, is to use constraints associated with the second law of thermodynamics to formulate policies for long-term sustainability, such as taxes on energy and virgin resources. He claims that such policies would increase social awareness of ecological limits and promote the realization that “physical flows of production and consumption must be minimized subject to some desirable population and standard of living.”

In Daly’s view, the three basic goals of an economic system should be efficient allocation, equitable distribution, and sustainable scale. The first two goals are included in mainstream economics and specific public policies have been formulated to realize them. But scale is not included and, consequently, there are no policy instruments in mainstream economics that deal with scale. Daly defines scale as the total physical volume of low-entropy raw materials that move through the open subsystem of an economy and back into the finite and non-growing global environment as high-entropy wastes.

Since the scale of the global economy has grown dangerously large relative to the fixed size of the ecosystem, this economy is sustainable, says Daly, only if it does not erode the carrying capacity of the ecosystem. Consequently, he is critical of mainstream economists for assuming that environmental resources and sinks are infinite relative to the scale of the economy and that decisions about allocation merely move natural resources between alternative uses. The unfortunate result, says Daly, is that scale is not viewed as a constraint and economic policies encourage growth that cannot be sustained by the ecosystem.

The fundamental problem here is that there is no basis in neoclassical market price mechanisms, which are tied to the preferences of individual consumers, to account for scale. “Distribution and scale,” writes Daly, “involve relationships with the poor, the future, and other species that are fundamentally social in nature rather than individual.” Pretending that these social choices exist on the same plane as the choice between chewing gum and a candy bar seems, he continues, “to be dominant in economies today and is part of the retrograde reduction of all ethical choice to the level of personal tastes weighted by income.”

Given that Daly privileges market mechanisms, one might suppose that his views would be welcomed by mainstream economics. But this is not the case because his scientifically valid claim that economic systems are open to and interactive with the global environment challenged the assumption that market systems are closed. If mainstream economists admitted that these systems are open, they would be obliged to recognize that the allegedly lawful or law-like dynamics of these systems do not exist. In the absence of that assumption, there is no basis for believing in the existence of the dynamics and it would become clear that they exist only in the minds of those who believe in their existence.

The Tragedy of the Commons and GDP and GNP

Many ecological economists have also been concerned with the “tragedy of the commons,” a dilemma first described by American biologist Garrett Hardin in 1968.

A commons, said Hardin, is any area where property rights regimes do not apply and users have open access to its exploitation. He uses the example of a common grazing land where each cattle owner continues to enlarge his or her herd as long as doing so increases his income. Since each owner derives all the economic benefits from the sale of his cattle, and since the loss of grazing resources consumed by his or her cattle is borne by all the other owners, the tragedy is that all owners will increase the numbers in their herds to the point at which the grazing capacity of the land is utterly depleted or destroyed.

Economist H. S. Gordon came to very similar conclusion in an earlier study of fisheries. As long as fisherman can earn a profit, they continue to catch fish to the point at which over-fishing occurs. If a particular species of fish is valuable, which often correlates with scarcity, fisherman tend to develop more technologically efficient means of catching these fish and this often threatens this species withextinction. The problem here is that exploiters of common resources have little incentive to conserve them and a great deal of incentive to recklessly exploit them before others can do so, and this applies to the global commons of oceans, frozen poles, forests and the entire genetic reserve.

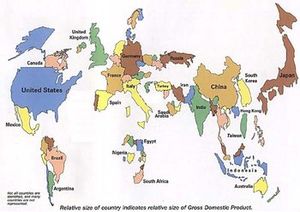

Ecological economists have tried to deal with this problem by proposing some substantive changes in the system of national accounts which mainstream economists use to evaluate the relative performance of national economies. The two standard measures are Gross Domestic Project (GDP) and Gross National Project (GNP), and both paint very distorted picture of the relationship between human systems and environmental systems. The principal reasons why this is the case are that these accounts do not reflect the costs of pollution and general environmental degradation and the costs associated with the deterioration of the environmental resource base.

The first comprehensive case for developing new accounting techniques was made in the World Bank report Environmental Accounting for Sustainable Development (1989). The authors of this report argued that a measure of sustainable income, which is not included in standard GDP measures, is badly needed. They noted that the GDP measures not only fail to distinguish between income derived from production and income derived from depleting natural assets, such as forests, soils, and mineral reserves. They also do not account for defensive expenditures, such as the costs of cleaning up oil spills or dealing with radioactive wastes.

Herman Daly (Daly, Herman E.) and John Cobb have developed an alternative to GNP, the “Index of Sustainable Economic Welfare,” that essentially divides national income accounts into sectors and imposes standards of sustainability, as well as equity, on these sectors. When Daly and Cobb used their Index to adjust GNP in the United States during the period 1945-1980, the surprising result was that net income has been virtually flat over this twenty-five year period. In another study of the U.S. economy from 1951 to 1990, a period during which per-capita GNP more than doubled, the economy according to this Index grew less than 20% and even declined slightly between 1980 and 1990. If these results are reasonably accurate, the conclusion is rather devastating—all apparent economic growth in the U.S. economy from 1951 to 1990 is a delusion that resulted from a failure to account for losses innatural capital.

Robert Repetto and his associates at the World Resources Institute have done a number of natural resource accounting studies on developing nations such as Indonesia, the Philippines, and Costa Rica.

These studies show that growth trends in GNP massively distort the health of economies in these developing nations because they do not account for such factors as petroleum depletion, forest loss (Deforestation), and soil erosion. When net investment was adjusted to account for these factors, the results showed that it was negative during a period when gross investment by standard GDP measures was very high and rising. When ecological economist Kirk Hamilton factored in resource depletion and environmental damage to calculate net savings in national economies, he arrived at the disturbing conclusion that these savings in most of the developing world have been negative since the mid-1970s.

Mark Sagoff argues that neoclassical market valuation is not capable of realistically assessing the environmental costs of economic activities. He points out that market value in mainstream economics is based on a vague something that is not subject to direct observation or measurement—individual utility or individual happiness and well-being. He then argues that even if individuals could be enticed into placing a marginal money valuation on an environmental “amenity,” they might be happier if they paid this amount in exchange for the opportunity to destroy the amenity. To lend weight to this argument, Sagoff cites the results of a study in Wyoming in which participants refused to recognize that the environment had any monetary value.

Ecological economist Bruce Hannon has taken a different approach. Rather than revise standard GNP measures, he proposes that we develop a contrasting measure of the health of the ecosystem—the Gross Ecosystem Product or GEP. He argues that the GEP would demonstrate that increased economic output has some very destructive environmental impacts. If the proposed GEP existed, and if economic planners were committed to making GEP and GNP more compatible, this could, says Hannon, result in more efficient production techniques and promote the recognition that there are limits to economic growth.

All of these suggestions for revising the system of national accounts used by mainstream economists have been rather systematically dismissed or ignored by these economists. The problem is not merely that there is no viable basis in the [[neoclassical] economic paradigm] to establish market prices for environmental resources which are commensurate with their real or actual value in ecological terms. It is also that any successful attempt to value the resources in these terms would require the introduction of a new set of variables that would falsify the assumption that [[market]s] are closed and tend toward a state of equilibrium.

The ecological economists have been successful in convincing some leaders in other nations that GNP is not necessarily the best indicator of human satisfaction and that accounting for the depreciation of national capital is a necessary part of the economic process. Norway has developed a system for calculating balances for mineral and living resources, France is using a system of accounts that attempts to track the status of all resources influenced by human activity, and the Netherlands has a system that includes environmental damage and the costs for repairing this damage. The governments of these nations use this information to assess environmental impacts of economic activities and to make policy decisions. However, these studies are rarely taken seriously by their own mainstream economists and they are routinely ignored by the mainstream economists who assess the relative “health” of their national economies.

This brief overview does not even begin to represent the range and complexity of the scholarship of the ecological economists. However, the discipline of ecological economics has become increasingly more fragmented in a variety of different, often contradictory, approaches, and there is no single economic paradigm that encompasses these approaches. On one side there are those who take the more traditional approach and argue that ecological criteria for sustainability should serve as the basis for making policy recommendations. On the other, there are those who are attempting to redefine the discipline as a science of social change that is committed to developing institutional frameworks that feature sustainable production and consumption patterns. This inability to evolve a set of assumptions that could serve as the basis for a commonly shared economic paradigm also explains why many ecological ecologists have migrated toward solutions derived from more humanistic disciplines in the social sciences, such as public policy, psychology and sociology.

The Science of Economics?

A fair number of mainstream economists have argued that assumptions about the character of economic reality in the [[neoclassical] economic paradigm] are fundamentally flawed. It is also significant that those who have made the most convincing case that the mathematical theories used by neoclassical economists cannot be viewed as scientific have consistently been trained economists. For example, Alfred Eichner in Why Economics Is Not Yet a Science offers the following commentary on the discipline of economics as a social system:

The refusal to abandon the myth of the market as a self-regulating system is not the result of a conspiracy on the part of the “establishment” in economics. It is not even a choice that any individual economist is necessarily aware of making. Rather it is the way economics operates as a social system—including the way new members of the establishment are selected—retaining its place within the larger society by perpetuating a set of ideas which have been found useful by that society, however dysfunctional the same set of ideas may be from a scientific understanding of how the economic system works. In other words, economics is unwilling to adhere to the epistemological principles which distinguish scientific from other types of intellectual activity because this might jeopardize the position of economists within the larger society as the defender of the dominant faith. This situation in which economists find themselves is therefore not unlike that of many natural scientists who, when faced with mounting evidence in support of first, the Copernican theory of the universe and then, later, the Darwinian theory of evolution, had to decide whether undermining the revelatory basis of Judeo-Christian ethics was not too great a price to pay for being able to reveal the truth.

Disclosing the “revelatory basis” of neoclassical economic theory is not terribly difficult. The French moral philosophers who first posited the existence of the natural laws of economics presumed that these laws, like the laws of Newtonian physics, were created by the Judeo-Christian God. The creators of classical economists appealed to this conception of natural law to legitimate the real or actual existence of the invisible hand, and they did so within the context of a mechanistic Newtonian worldview that did not need or require the presence of the willful and mindful agency of God. They concluded, therefore, that both the laws of Newtonian physics and the natural laws of economics originated in the mind of a Deistic God who withdrew from the universe following the first moment of creation.

The presence of these metaphysically-based assumptions about the natural laws of economics was disguised by the creators of neoclassical economics under a maze of mathematical formalism borrowed from a mid-nineteenth century physical theory. This disguise become more convincing after these economist managed to successfully promulgate the fiction that they had transformed economics into a rigorously scientific discipline with the use of higher mathematics. The totally unwarranted assumption that mainstream economics is a scientific discipline was massively reinforced by subsequent generations of economists who refined and extended general equilibrium theory with the use of increasingly more sophisticated mathematical devices and techniques. All of which has recently resulted, as Nobel prize-winning economist Robert Solow describes it, in a very strange situation:

My impression is that the best and the brightest in the profession proceed as if economics is the physics of society. There is a single universal model of the world. It only needs to be applied. You could drop a modern economist from a time machine…at any time in any place, along with his or her personal computer; he or she could set up business without even bothering to ask what time and which place. In a little while, the up-to-date economist will have maximized a familiar looking present-value integral, make a few familiar log-linear approximations, and run the obligatory regression. The familiar coefficients will be poorly determined, but about one-twentieth of them will be significant at the 5 per cent level, and the other nineteen did not have to be published. With a little judicious selection here and there, it will turn out that the data are just barely consistent with your thesis advisor’s hypothesis that money is neutral (or non-neutral, take your choice) everywhere and always, model an information asymmetry, any old asymmetry, don’t worry, you’ll think of one.

See Also

Further Reading

- Bettman. J. R. and M. A. Zins, “Constructive Processes in Consumer Choice,” Journal of Consumer Research 4 (September 1977): 75-78.

- Bowker, James and John R. Stoll, “Use of Dichotomous Choice Nonmarket Methods to Value the Whopping Crane Resource,” American Journal of Agricultural Economy 23, no. 5 (May 1987): 372-381.

- Boyle, Kevin J. and Richard C. Bishop, “Valuing Wildlife in Benefit-Cost Analyses: A Case Study Involving Endangered Species,” Water Resources Research 23, no. 5 (May 1987): 943-950.

- Carson, Richard T., et al, A Bibliography of Contingent Valuation Studies and Papers (La Jolla, Calif.: Natural Resource Damage Assessment, 1994).

- Coase, R. H., “The Problem of Law and Economics,” Journal of Law and Economics (October, 1960): 1-44.

- Cruz, Maria Concepcion et. al., Population Growth, Poverty and Environmental Stress: Frontier Migration in the Philippines and Costa Rica (Washington, D.C.: World Resources Institute, 1992).

- Cruz, Wilfrido and Robert Repetto, The Environmental Effects of Stabilization and Structural Adjustment Programs: The Philippines Case (Washington, D.C.: World Resources Institute, 1992).

- Daly, Herman E., “Allocation, Distribution, and Scale: Toward an Economics That Is Efficient, Just, and Sustainable,” Ecological Economics 6 (December 1992): 186.

- Daly, Herman E., “Allocation, Distribution, and Scale,” pp. 190-191.

- Daly, Herman E. and John B. Cobb Jr., “Appendix: The Index of Sustainable Development,” in For the Common Good: Redirecting the Economy toward Community, the Environment and a Sustainable Future (Boston: Beacon Press, 1989), pp. 443-507.

- Daly, Herman E. and Kenneth N. Townsend, eds. Valuing the Earth: Economics, Ecology, Ethics, (Cambridge, Mass.: MIT Press, 1993), p. 21.

- Eichner, Alfred S., ed., Why Economics Is Not Yet A Science (New York: M. E. Sharpe, 1983), p. 238.

- Fletcher, J. W., W. Adamowicz, and T. Graham-Tomasi, “The Travel Cost Model of Recreation Demand,” Leisure Studies 12 (1990): 119-147.

- Freeman III, A. M., “The Measurement of Environmental Resource and Values: Theory and Methods,” Resources for the Future (Washington, D.C.: U. S. Government Printing Office, 1993).

- Georgescu-Roegen, Nicolas, The Entropy Law and the Economic Process (Cambridge, Mass.: Harvard University Press, 1971), pp. 20-21.

- Gordon, H. S., “The Economic Theory of a Common-Property Resource: The Fishery,” Journal of Political Economy 62 (1954): 124-142.

- Hamilton, Kirk, “Monitoring Environmental Progress” and “Green Adjustments to GDP,” World Bank Environment Discussion Papers, 1994.

- Hanley, Nick , Jason E. Shogren, and Ben White, Environmental Economics in Theory and Practice (New York: Oxford University Press, 1997), p. 358.

- Hanneman, W. Michael, “Valuing the Environment through Contingent Value,” Journal of Economic Perspectives 8, no. 4 (Fall, 1994): 19.

- Hanneman, J. A., “Valuing the Environment,” pp. 19-43.

- Hannon, Bruce, “Measures of Economic and Ecological Health,” in Robert Costanza, Brian Norton, and Benjamin Haskell, eds., Ecosystem Health: New Goals for Environmental Management (Washington, D.C.: Island Press, 1992).

- Hardin, Garrett, “The Tragedy of the Commons,” Science 162 (13 December 1968): 1243-1248.

- Hausman, J. A., ed., Contingent Valuation: A Critical Assessment (New York: North-Holland, 1993).

- Hinterberger, F., “Another Plea for Pluralism in Ecological Economics,” ESEE Newsletter (November 1997): 3-7.

- Keohane, Nathaniel O., Richard L. Revesz and Robert N. Stavins, “The Choice of Regulatory Instruments in Environmental Policy,” in Robert N. Stavins, ed., Economics of the Environment, 4th edition (New York: Norton, 2000), p. 563.

- Keohane, Revesz, and Stavins, “The Choice of Regulatory Instruments,” p. 563.

- Mitchell. Robert C. and Richard T. Carson, “Valuing Drinking Water Risk Reduction Using the Contingent Valuation Methods: A Methodological Study of Risks from THM and Giardia,” paper prepared for Resources for the Future, Washington, D.C., 1986.

- Norhaus, William D., “Reflections on the Economics of Climate Change, Journal of Economic Perspectives 7, no. 4 (Fall, 1993): 14.

- Office of Technology Assessment, Technical Assessment Board of the 103rd Congress, Environmental Policy Tools: A User’s Guide (Washington, D.C.: U.S. Government Printing Office, 1995).

- Olschavsky. Richard W. and Donald H. Granbois, “Consumer Decision Making—Fact or Fiction?” Journal of Consumer Research 6 (September 1977): 93-100.

- Pigou, A. C., The Economics of Welfare, 4th edition (London: Macmillan, 1932), p. 183.

- Pigou, A.C., The Economics of Welfare, p. xii.

- Portney, Paul J., “The Contingency Valuation Debate: Why Economists Should Care, Journal of Economic Perspectives 8, no. 4 (Fall, 1994): 3.

- Renner, Andreas, “Some Methodological Reflections: A Plea for a Constitutional Ecological Economics,” in Jorg Kohn et. al., eds, Sustainability in Question: The Search for a Conceptual Framework (Northampton, Mass.: Edward Elgar, 1999), p. 320.

- Repetto, Robert et al., Wasting Assets: Natural Resources in the National Income Accounts (Washington, D.C.: World Resources Institute, 1989).

- Sagoff, Mark, “Some Problems with Environmental Economics,” Environmental Ethics 10 (Spring 1988): 55.

- Sagoff, Mark, “Some Problems with Environmental Economics, Environmental Ethics 3 (Spring 1988): 55-74.

- Schrodinger, Erwin, What is Life? (London: Cambridge University Press, 1967), p. 79.

- Solow, Robert M., “Economic History and Economics,” American Economic Review 75, no. 2 (May, 1985): 330.

- Stavins, Robert N., ed., Economics of the Environment, 4th edition (New York: Norton, 2000).

- Tolley, George et al., “Establishing and Valuing the Effects of Improved Visibility in Eastern United States,” paper prepared for the Environmental Protection Agency, Washington, D.C., 1986.