Energy profile of Iran

Energy profiles of countries and regions

Iran, a member of the Organization of the Petroleum Exporting Countries (OPEC), ranks among the world's top four holders of both proven oil and natural gas reserves. In 2012, Iran saw unprecedented drops in its oil exports as sanctions by the United States (U.S.) and European Union (EU) were tightened, targeting Iranian oil export revenues. Preliminary data show that Iran ranked fifth in terms of crude oil and condensate exports, which was in contrast to its third position only two years ago. Given the sanctions and resulting drop in production, export volumes likely will continue to be hampered.

|

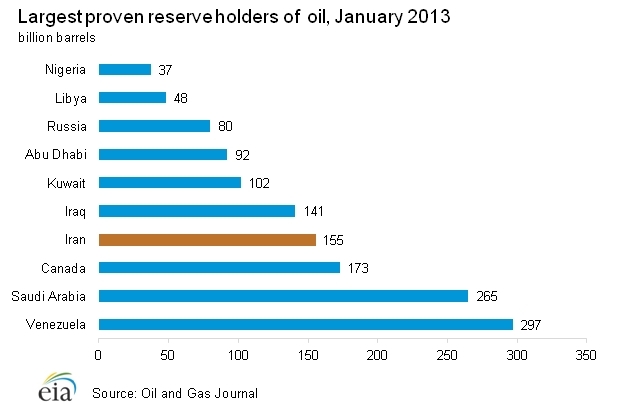

Iran holds the world's fourth-largest proven oil reserves and the world's second-largest natural gas reserves. International sanctions are redefining the Iranian energy sector, and the lack of foreign investment and technology is affecting the sector profoundly. |

Iran has the world's second largest natural gas reserves, but the sector is underdeveloped and used mostly to meet domestic demand. In contrast to the decreasing oil production, natural gas development has been slowly expanding. Nonetheless, natural gas production has been lower than expected as a result of a lack of foreign investment and technology.

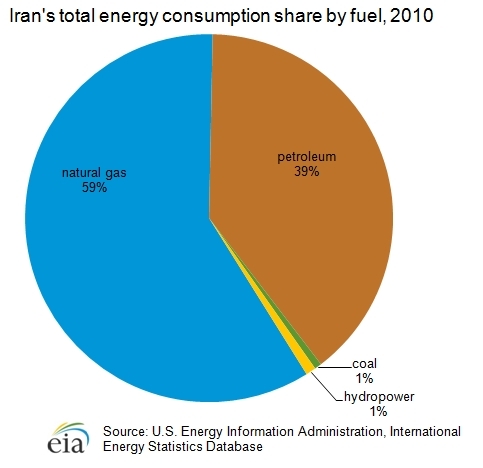

Natural gas accounted for about 59 percent of Iran's total domestic energy consumption in 2010, with oil consumption at 39 percent of total energy use. Iran had marginal contributions from coal and hydropower.

International sanctions enacted in 2011 and 2012 have stymied progress across Iran's energy sector, especially affecting upstream investment in both oil and natural gas projects. The United States and the European Union, in particular, have enacted measures that have affected the Iranian energy sector more profoundly than any previously enacted sanctions. These sanctions have prompted a number of cancellations of upstream projects and have resulted in declining oil production capacity. Sanctions have also impeded the import of refined products, effectively reshaping the midstream sector and forcing Iran to become self-sufficient.

The Strait of Hormuz, on the southeastern coast of Iran, is an important route for oil exports from Iran and other Persian Gulf countries. At its narrowest point, the Strait of Hormuz is 21 miles wide, yet an estimated 17 million barrels per day (bbl/d) flowed through it in 2011 (35 percent of all seaborne traded oil and 20 percent of oil traded world-wide). In addition to oil, liquefied natural gas (LNG) volumes also flow through the Strait. Qatar exports about 2 trillion cubic feet (Tcf) per year of LNG through the Strait, accounting for almost 20 percent of global LNG trade. Furthermore, Kuwait imports LNG volumes that travel northward through the Strait of Hormuz. These LNG flows totaled about 100 billion cubic feet in 2010.

Source: U.S. Energy Information Administration

Representation of international boundaries and names is not necessarily authoritative

Contents

Oil

|

More than half of Iran's oil reserves are confined to five giant fields, the largest of which is the Marun field. |

According to Oil & Gas Journal, as of January 2013, Iran has an estimated 154 billion barrels of proven oil reserves, nine percent of the world's total reserves and over 12 percent of OPEC reserves.

Over 50 percent of Iran's onshore oil reserves are confined to five giant fields, the largest of which are the Marun field (22 billion barrels), Ahwaz (18 billion barrels), and Aghajari (17 billion barrels). Of those onshore reserves, more than 80 percent are located in the southwestern Khuzestan Basin near the Iraqi border. Iran's crude oil is generally medium in sulfur content and in the 28° to 35° API gravity range. According to FACTS Global Energy (FGE), Iran also possesses reserves in the Caspian Sea totaling approximately 100 million barrels. Iran faces continued depletion of its production capacity, as its fields have relatively high natural decline rates (8-13 percent), coupled with an already low recovery rate of around 20-30 percent. Sanctions and prohibitive contractual terms have impeded the necessary investment to halt this decline. Moreover, sanctions enacted in late 2011 and throughout 2012 have accelerated Iran's production capacity declines.

Sector organization

The energy sector is overseen by the Supreme Energy Council, which was established in July 2001 and is chaired by the president of Iran. The council is comprised of the Ministers of Petroleum, Economy, Trade, Agriculture, and Mines and Industry, among others. The state-owned National Iranian Oil Company (NIOC), under the supervision of the Ministry of Petroleum, is responsible for all upstream oil projects, encompassing both production and export infrastructure. The National Iranian South Oil Company (NISOC), a subsidiary of NIOC, accounts for 80 percent of oil production covering the provinces of Khuzestan, Bushehr, Fars, and Kohkiluyeh and Boyer Ahmad. Nominally, NIOC also controls the refining and domestic distribution networks, by way of its subsidiary, the National Iranian Oil Refining and Distribution Company (NIORDC), although functionally, there is a separation between the upstream and downstream sectors.

| NIOC subsidiary | Main objectives | Source: U.S. Energy Information Administration, FACTS Global Energy, Arab Oil and Gas Directory, National Iranian Oil Company. | |

|---|---|---|---|

| Iranian Central Oil Fields Company (ICOFC) | Iranian Central Oil Fields Company, established in 1999, is the largest gas producer in Iran and mainly controls production in the south and central areas of the country. It produces gas and oil through 68 reservoirs including 43 gas fields and 25 oil fields. It produces non-associated natural gas from Aghar, Dalan, Homa, Kangan, Khangiran, Nar, Qeshm, Sarajeh, Sarkhon, Shanol, Tabnak, Tange Bijar, and Varavi. | ||

| Iranian Drilling Services Company (IDSC) | IDSC was established in early 2004 and provides wellhead and well work services. | ||

| Iranian Fuel Conservation Company (IFCO) | IFCO was established in 2000 with the objective of optimizing energy consumption, protecting the environment, and increasing energy efficiency. | ||

| Iranian Offshore Oil Company (IOOC) | IOOC controls all upstream activities in offshore fields, including Salman, Sirri, Doroud, and Balal. The subsidiary was founded with the goal of optimizing offshore production, safeguarding oil and gas reservoirs in the Persian Gulf, and preventing oil and gas migration. | ||

| Iranian Oil Terminals Company (IOTC) | Accepts deliveries and stores crude oil, petroleum products, and condensates for exports. | ||

| Manufacturing Support and Procurement Kala Naft Company (Kala Naft) | Manufactures equipment for the oil, gas, and petrochemical sectors since 1983 and is tasked with distributing needed equipment among producers and operational centers. | ||

| Khazar Exploration and Production Company (KEPCO) | Established as an exploration and production company in the Caspian Sea region and has recently undertaken drilling at the Sardare Jangal discovery. | ||

| Karoon Oil and Gas Production Company (KOGPC) | Operating in Khouzestan, the company operates 538 wells and delivers natural gas to NIGC. | ||

| North Drilling Company (NDC) | Established in 1999 to develop internal expertise needed for complex oil and gas drilling. | ||

| Naftiran Intertrade Company (NICO) Sarl | Established in 2003 and its activities include investment and financing of Iranian oil, gas, and petrochemical trade. | ||

| National Iranian Drilling Company (NIDC) | Conducts most of the onshore and offshore drilling in Iran and handles related technical services and well control operations. | ||

| National Iranian Oil Refining and Distribution Company (NIORDC) | Engaged in exports of petroleum products, mainly fuel oil, and is in charge of eleven subsidiaries that control the refining sector, pipelines, telecommunications, and oil products distribution. | ||

| National Iranian South Oil Company (NISOC) | Controls oil and gas upstream activities in the south and southwest of the country. It produces approximately 80 percent of all crude oil produced in Iran. | ||

| National Iranian Tanker Company (NITC) | Delivers crude oil and petroleum products and its fleet consists of 43 crude tankers, three oil product tankers, and one liquid gas vessel. | ||

| Petroleum Engineering and Development Company (PEDEC) | Responsible for carrying out all engineering and development projects conducted by NIOC, including designing, engineering, construction, and implementation operations. | ||

| Pars Oil and Gas Company (POGC) | Established in 1998, its objective is the development of the South and North Pars gas fields, as well as the Golshan and Ferdowski fields. | ||

| Pars Special Economic Energy Zone (PSEEZ) | Established in 1998 and promotes use of South Pars oil and gas resources. | ||

The Iranian constitution prohibits foreign or private ownership of natural resources, and all production-sharing agreements are prohibited under Iranian law. The government permits buyback contracts that allow international oil companies (IOCs) to enter into exploration and development contracts through an Iranian affiliate. The contractor receives a remuneration fee, usually an entitlement to oil or gas from the developed operation, leaving the contractor to provide the necessary capital up front. Once development of a certain field is complete, however, operatorship reverts back to NIOC or the relevant subsidiary. The payback of the capital cost is deducted from oil and gas sales revenues. According to FACTS Global Energy, the rate of return on buyback contracts varies between 12 and 17 percent with a payback period of about five to seven years.

Iran's fifth five-year development plan covering 2010-2015 calls for an increase in crude oil production capacity to 5 million bbl/d in 2015. In addition, it identifies a need for $35 billion per year in upstream investment in both the oil and natural gas sector and anticipates that the majority of the funds would come from foreign investors under buyback contracts. However, given that the previous five-year (2005-2010) plan saw total upstream investment of only about $10 billion, the latest plan likely will be difficult to implement, even without western sanctions.

Exploration and production

|

Iran's crude oil production fell dramatically in 2012, and, although it remained the second-largest OPEC producer on average during the year, it exceeded Iraq's production only narrowly. In August 2012, its crude oil production fell below Iraq's for the first time since 1989. |

A series of sanctions targeting the oil sector have resulted in cancellations of new projects by a number of foreign companies, while also affecting existing projects. Following the implementation of sanctions in late-2011 and mid-2012, Iranian production dropped dramatically. Although Iran had been subject to four earlier rounds of United Nations sanctions, the much tougher measures passed by the United States and the European Union have severely hampered Iran's ability to export its oil, which directly affected its ability to produce petroleum and petroleum products.

The U.S. and EU measures targeted its petroleum exports and imports, prohibited large-scale investment in the country's oil and gas sector, and cut off Iran's access to European and U.S. sources of financial transactions. Further sanctions were implemented against institutions targeting the Central Bank of Iran, while the EU imposed an embargo on Iranian oil and banned European Protection and Indemnity Clubs (P&I Clubs) from providing Iranian oil carriers with insurance and reinsurance. The implementation of insurance-related sanctions was a particularly effective sanction in stymieing Iranian exports, which affected not only European importers, but also Iran's Asian customers who were forced to temporarily halt imports.

In 2012, Iran produced approximately 3.5 million barrels per day (bbl/d) of total liquids, of which roughly 3.0 million bbl/d was crude oil. The total production level in 2012 was about 17 percent lower than the production level of 4.2 million bbl/d in 2011, most of the drop is attributable to the imposition of sanctions. Condensate production totaled approximately 650 thousand bbl/d in 2011, according to Arab Oil and Gas Directory, of which 440 thousand bbl/d was marketed and 210 thousand bbl/d was mixed in with the crude oil.

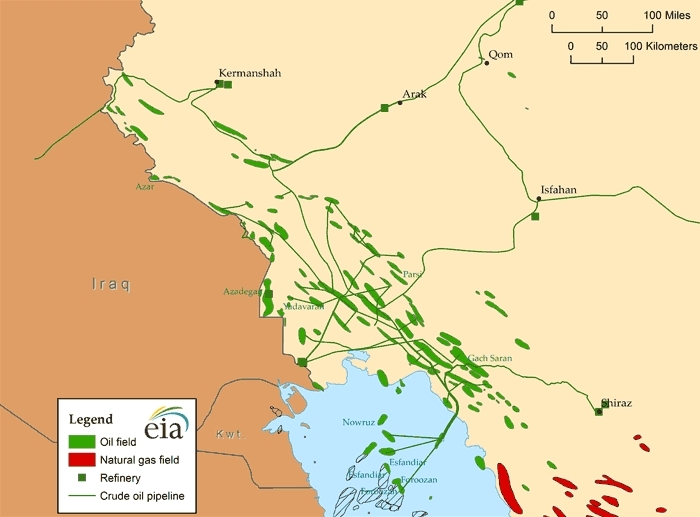

Iran has 34 producing fields (22 onshore and 12 offshore), with onshore fields comprising more than 71 percent of total reserves. Currently, Iran's largest producing field is the onshore Ahwaz-Asmari field, followed by the Marun and Gachsaran fields, all of which are located in Khuzestan province.

Iran Heavy crude stream accounts for most of the country's oil production, at approximately 45 percent, according to FGE. The stream is mainly sourced from a few onshore fields in southern Iran, some of which are multilayered and also feed the Iran Light stream. Gachsaran and Marun are two of the largest fields that contribute to Iran Heavy. Other fields include Rag-e-Safid, Ahwaz, Bangestan, Mansouri,and Bibi Hakimeh.

Iran Light crude stream is the other key grade and is sourced from several onshore fields in the Khuzestan region. However, two-thirds of this grade comes from three fields: Ahwaz-Asmari, Karani, and Agha Jari. Many of the fields that produce Iran Light have been producing for decades and are declining rapidly. NIOC has been working on offsetting these declines through the use of enhanced oil recovery (EOR) techniques, mainly using associated gas. However, this effort was severely hampered as a result of a shortage of natural gas available for reinjection.

Since the 1970s, Iran's oil production has varied greatly. Iran averaged production of over 5.5 million bbl/d of oil in 1976 and 1977, with production topping 6 million bbl/d for much of the period. Since the 1979 revolution, however, a combination of war, limited investment, sanctions, and a high rate of natural decline in Iran's mature oil fields has prevented a return to such production levels.

Iran's reserves are not confined to the southwest and offshore Persian Gulf, creating potential for further discoveries. Iran has oil reserves under the Caspian Sea, but exploration and development of these reserves have been at a standstill due to territorial disputes with neighboring Azerbaijan and Turkmenistan. Iran also shares a number of both onshore and offshore fields with neighboring countries, including Iraq, Qatar, Kuwait, and Saudi Arabia.

Upstream projects

New developments

Although there were a number of new exploration and development blocks announced over the last several years, which could provide Iran with an increase in its crude oil production capacity, sanctions have negatively affected the Iranian oil industry. In the last year in particular, Iran has seen a significant erosion of production capacity that is at least in part attributable to the sanctions.

Virtually all western companies have halted their activities in Iran, although there are a number of Chinese and Russian companies that are still participating. The sanctions and lack of international involvement has particularly affected the upstream projects negatively, as the lack of expertise, technology, and investment has resulted in delays and, in some cases, cancellations of projects. Nonetheless, development of a few projects continues, albeit at a slower pace than planned.

The Azadegan field was Iran's biggest oil find in 30 years when announced in 1999. It contains 26 billion barrels of proven crude oil reserves, but its geologic complexity makes extraction difficult. The field is separated into two portions: North and South Azadegan. China National Petroleum Corporation (CNPC) is developing North Azadegan in a two-phase development, with ultimate total production estimated at 150 thousand bbl/d (75 thousand bbl/d for each phase). Latest estimates by FGE indicate that the first phase will be onstream by 2016.

In 2004, a consortium of NIOC (25 percent) and Japan's INPEX (75 percent) signed an agreement to develop the southern portion of the Azadegan field. However, as a result of sanctions, INPEX has halted its activities in South Azadegan. According to FGE, production from South Azadegan averaged 50 thousand bbl/d in 2012, although peak production is expected to reach around 260 thousand bbl/d in two phases. Considering the delays the project has already experienced, it is not likely that the field will be fully developed before 2020.

Yadavaran is the other promising upstream oil development project, with 3.2 billion barrels of recoverable reserves. China Petroleum & Chemical Corporation (Sinopec) signed a buyback contract at the end of 2007 to develop Yadavaran in two phases. The first phase of production is expected to plateau at 85 thousand bbl/d, while the second phase will boost production to 185 thousand bbl/d. NIOC originally planned to have Yadavaran's first phase completed by 2012. However, new estimates indicate that this will occur most likely in 2016.

There are a number of other upstream projects that are in various stages of development. However, development of all these projects may be adversely affected by the international sanctions. Thus far, at least four of these projects saw initial operators cease activities because of sanctions, including the geologically challenging Azar field. Although drilling operations began in October 2012, production is unlikely to come onstream in this decade.

Existing production

Ahwaz is the largest producing field in Iran and is composed of three zones: Asmari, Bangestan, and Mansouri. The combined production capacity of these three formations is 750 thousand bbl/d, according to Arab Oil and Gas Directory. Asmari is the largest of the three formations and produces 530 thousand bbl/d. Ahwaz is located onshore in the Khuzestan province. The second-largest producing field in Iran is Marun, with a production capacity of 500 thousand bbl/d.

Iran's largest offshore field is Abuzar field, with a production capacity of 175 thousand bbl/d. NIOC plans to undertake an expansion of the field, which would bring its total capacity to 220 thousand bbl/d.

| Project | Proven reserves (billion barrels) |

Operator/ Developer |

Status | Source: FGE, NIOC, Bloomberg, Fars News | |||

|---|---|---|---|---|---|---|---|

| North Azadegan and South Azadegan | 26.0 | CNPC (Phase I), NIOC (Phase II) | Phase I underway expected to be completed by 2016, Phase II expected to be completed by 2020 | ||||

| Azar | 2.5 | Persian Oil And Gas Company, NIDC, and Global Petro Tech Company | Drilling operations began in October 2012 | ||||

| Band-e-Karkheh | 2.0 | PEDEC | Initial drilling underway in 2013 | ||||

| Bushgan,Kuh-e-Kaki, Kuh-e-Mond | 2.5 | NIOC, PEDEC, Kish International Petroleum Company | Drilling planned to begin by 2016 | ||||

| Changouleh | 3.4 | PEDEC, Dana Oil and Gas Company | Agreement between the companies signed in early 2012 | ||||

| Jofeir | 2.1 | PEDCO, PEDEC | Drilling expected to begin in 2013, with field production commencing by 2018 | ||||

| Sousangerd | 8.8 | Iranian Revolutionary Guard Corps (IRGC) subsidiaries | Contract has not yet been awarded | ||||

| South Pars (oil layer) | 7.5 | PEDCO | Installation of a floating production, storage, and offloading unit needs to occur before production can commence | ||||

| Yadavaran | 3.2 | Sinopec | Development of Phase I underway, completion expected by 2016 | ||||

Exports

|

Once the third-largest exporter of crude oil, Iran has seen its exports drop to 1.5 million bbl/d in 2012 as the United States and the European Union tightened sanctions that target the country's oil exports. Despite the precipitous decline in exports, it remained among the top ten exporters in 2012. |

In 2012, Iran exported approximately 1.5 million bbl/d of crude oil and condensate, according to the International Energy Agency (IEA). Iranian Heavy crude oil is Iran's largest crude export, followed by Iranian Light. In 2012, Iran's net oil export revenues amounted to approximately $69 billion, significantly lower than the $95 billion total generated in 2011. Oil exports make up 80 percent of Iran's total export earnings and 50-60 percent of government revenue, according to the Economist Intelligence Unit.

Iranian oil exports saw dramatic declines in 2012 compared with the previous year, as tightening of sanctions by the United States and the European Union brought Iranian oil exports to a near standstill in the summer of 2012. This was particularly the result of the EU ban on all Iranian petroleum imports as well as the imposition of insurance and reinsurance bans by European P&I Clubs effective on July 1, 2012. European insurers underwrite the majority of insurance policies for the global tanker fleet, covering about 95 percent of tankers. The insurance ban particularly affected Iranian oil exports as lack of adequate insurance impeded the sales of Iranian crude to all of its customers, including those in Asia. Iranian exports dropped to less than 1.0 million bbl/d in July as Japanese, Chinese, Korean, and Indian buyers scrambled to find insurance alternatives.

By August and September 2012, Iranian exports recovered somewhat as Japan, South Korea, and India began to issue sovereign guarantees for vessels carrying Iranian crude oil and condensate. China and India began to accept Iranian Kish P&I Club guarantee on the vessels that shipped oil to its refineries.

Nonetheless, Iranian exports failed to reach levels recorded in the first half of 2012. Adding to the insurance difficulties was continued pressure imposed by the U.S. sanctions on Iranian oil customers to decrease their purchases.

| Jan-12 | Feb-12 | Mar-12 | Apr-12 | May-12 | Jun-12 | Jul-12 | Aug-12 | Sep-12 | Oct-12 | Nov-12 | Dec-12 | 2012 average |

Note: IEA member countries are Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Republic of Korea, Luxembourg, The Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Spain, Sweden, Switzerland, Turkey, United Kingdom, and the United States. | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Japan and Korea | 0.57 | 0.51 | 0.43 | 0.44 | 0.26 | 0.38 | 0.13 | 0.10 | 0.25 | 0.34 | 0.38 | 0.39 | 0.35 | ||||||||||||||

| China and India | 0.96 | 0.70 | 0.66 | 0.66 | 0.77 | 0.98 | 0.66 | 0.56 | 0.68 | 0.82 | 0.65 | 0.87 | 0.75 | ||||||||||||||

| Other non-IEA | 0.12 | 0.26 | 0.32 | 0.15 | 0.09 | 0.07 | 0.09 | 0.13 | 0.03 | 0.00 | 0.33 | 0.09 | 0.14 | ||||||||||||||

| Greece, Italy, Spain, and Turkey | 0.63 | 0.42 | 0.54 | 0.40 | 0.29 | 0.39 | 0.05 | 0.22 | 0.11 | 0.07 | 0.11 | 0.10 | 0.28 | ||||||||||||||

| Other Europe | 0.06 | 0.04 | 0.02 | 0.00 | 0.02 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | ||||||||||||||

| Total Exports | 2.35 | 1.92 | 1.96 | 1.65 | 1.42 | 1.82 | 0.93 | 1.01 | 1.07 | 1.24 | 1.47 | 1.46 | 1.53 | ||||||||||||||

| 2011 average | 2012 average |

Note: IEA member countries are Australia, Austria, Belguim, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Republic of Korea, Luxembourg, The Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Spain, Sweden, Switzerland, Turkey, United Kingdom, and the United States. | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Japan and Korea | 0.55 | 0.32 | ||||||||||||||

| China and India | 0.88 | 0.76 | ||||||||||||||

| Other non-IEA | 0.31 | 0.13 | ||||||||||||||

| Greece, Italy, Spain, and Turkey | 0.63 | 0.22 | ||||||||||||||

| Other Europe | 0.14 | 0.02 | ||||||||||||||

| Total Exports | 2.51 | 1.53 | ||||||||||||||

Estimates through the end of 2012 show that Iranian oil exports saw a 1-million-bbl/d decrease compared with the previous year. Every customer of Iranian crude oil and condensate decreased its imports of Iranian oil, mainly in response to U.S. and EU sanctions.

However, sanctions were not the only driver of export decreases. For example, commercial interests drove the decrease in China's imports, which was engaged in a contractual dispute in the first quarter of 2012. China is Iran's largest trading partner and biggest oil importer, according to the World Bank. Chinese refiners significantly decreased their purchases of Iranian crude and condensate as a result of a dispute over the terms of annual purchase contracts. Although eventually Unipec (the trading arm of China's largest refiner Sinopec Corporation) signed a supply contract with NIOC for volumes comparable to those imported in 2011, the contract did not allow NIOC to make up for the oil sales that did not get delivered to China in the first quarter of that year.

In addition to crude oil and condensate, Iran also exports liquefied petroleum gas (LPG), naphtha, fuel oil, kerosene, and gasoline. According to FGE, Iran's exports of petroleum products totaled approximately 320,000 bbl/d in 2011. Iran's LPG is generally destined for Asian markets, in particular Japan, South Korea, and Indonesia, while fuel oil also went eastward, including Singapore. The relatively small volumes of gasoline are exported to Afghanistan and Iraq, which FGE estimates at 3,000 bbl/d in 2011.

Iran also has had swap agreements in place since 1997 with Azerbaijan, Kazakhstan, and Turkmenistan. Under these agreements, Iran receives crude oil at its Caspian Sea port of Neka, which is processed in the Tehran and Tabriz refineries. In return, Iran exports the same amount of crude oil through its Persian Gulf ports. Volumes traded under these swap agreements averaged close to 100 thousand bbl/d in 2009 and 2010, but they have declined since then to below 40 thousand bbl/d, mainly as a result of disagreements over contractual terms.

Export terminals

Three export terminals, Kharg Island, Lavan, and Sirri, handle virtually all of Iran's petroleum liftings, with a total export capacity of approximately 6 million bbl/d. Kharg Island is the largest and most important export terminal in Iran, and it handles the majority of Iran's exports. According to Energy Intelligence, six of the main terminal's ten jetties are operational and can handle ships between 90,000 and 275,000 deadweight tons. In addition, three of the four berths on the Sea Island part of the terminal can accommodate tankers up to 500,000 deadweight tons. Kharg Island relies on storage to ensure even operations, and its current storage capacity totals 20.2 million barrels of oil. Recent Ministry of Energy announcements have indicated that additional crude oil storage is under construction at the terminal, which will add up to 8 million barrels of additional capacity.

Lavan Island mostly handles exports of Lavan Blend, Iran's highest-quality export grade and has one of Iran's smallest streams at only about 100,000 bbl/d of production. Lavan has a two-berth jetty, which can accommodate vessels of between 25,000 and 225,000 deadweight tons. In addition, Lavan's storage capacity totals 5.5 million barrels.

Sirri Island serves as a loading port for the Sirri stream that is produced in the offshore fields by the same name. Sirri terminal includes an oil loading jetty and a loading platform is equipped with at least three mooring buoys at each end. The jetty can handle ships of between 80,000 and 330,000 deadweight tons. Its storage capacity is 4.5 million barrels.

Other export terminals include Bandar Mahshahr and Abadan (also known as Bandar Imam Khomeini), both of which are near the Abadan refinery and are used as loading terminals for refined product. Bandar Abbas, located near the northern end of the Strait of Hormuz, is Iran's main fuel oil export terminal.

Neka is the Caspian Sea port, which receives crude oil imports from the region's producers that are delivered under swap agreements. The port was built in 2003 and has a storage capacity is 1 million barrels, according to FGE.

Consumption and downstream

|

Over the past few years, Iran has expanded its domestic refining capacity to meet growing domestic demand, particularly for gasoline |

Iran is the second-largest oil-consuming country in the Middle East, second only to Saudi Arabia. Iranian domestic oil consumption is mainly diesel and gasoline. Total oil consumption was approximately 1.7 million bbl/d in 2011, about 1.5 percent lower than the year before.

In the past, Iran had very limited domestic oil refining capacity and was heavily dependent on imports of refined products, especially gasoline, to meet domestic demand. In response to international sanctions and the resulting difficulty in purchasing refined products, Iran expanded its domestic refining capacity. As of January 2013, its total refining capacity was nearly 1.5 million bbl/d, with all nine of its refineries operated by the National Iranian Oil Refining and Distribution Company (NIORDC), a NIOC subsidiary.

Iran plans to increase refining capacity to become self-sufficient in gasoline production. Over the last several years, Iran's gasoline import dependence has decreased significantly as a result of increased domestic refining capacity and lower demand. According to FGE, Iran's gasoline imports will cease sometime in 2013 as some upgrades to refineries take place. Furthermore, following the installation of crackers, fuel oil upgrading facilities, and upgrades to existing refineries post-2015, fuel oil exports are expected to decline.

Abadan is Iran's oldest refinery and is the biggest in the country. It has been operating since 1913, although it was destroyed during the Iran-Iraq war. It was rebuilt and since then has undergone a number of expansions and modernizations. In 2011, a new gasoline unit was added, but it was destroyed in an explosion during the commissioning ceremony. Subsequently, this unit had to be rebuilt and it began operating in February 2013.

Isfahan, Iran's second largest refinery, has been in operation since 1980 and has been upgraded at least three times since it first began operating. Currently, additional capacity is being added to boost the refinery's gasoline output.

Rationing and subsidies

Iran's energy prices are heavily subsidized, particularly for gasoline. At the end of 2010, the government decreased the subsidies on energy prices to discourage waste. Over the next couple of years, the government plans to further reduce subsidies so that Iranian consumers would pay prices that more closely reflect the market value of energy. Removal of subsidies includes both petroleum and natural gas.

| Refinery | Crude distillation capacity (million bbl/d) |

Source: Oil and Gas Journal, January 2013 | |

|---|---|---|---|

| Abadan | 0.35 | ||

| Arak | 0.17 | ||

| Bandar Abbas | 0.23 | ||

| Isfahan | 0.28 | ||

| Kermanshah | 0.03 | ||

| Lavan Island | 0.03 | ||

| Shiraz | 0.04 | ||

| Tabriz | 0.10 | ||

| Tehran | 0.22 | ||

| Total | 1.45 | ||

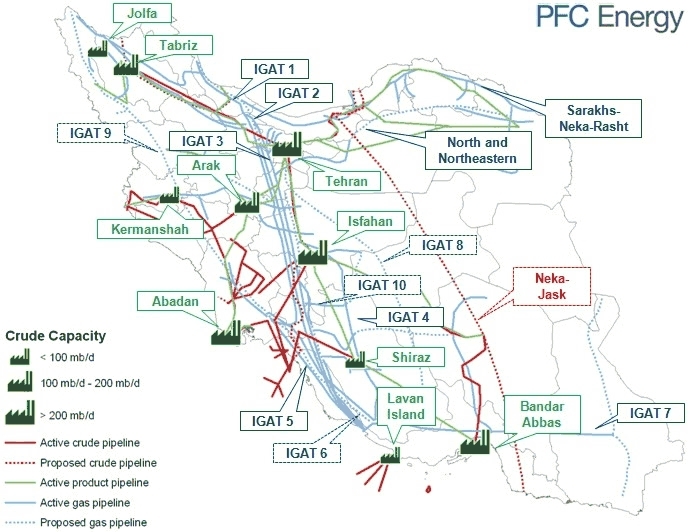

Pipelines

Iran has an expansive domestic oil pipeline network including 12 pipelines that are between 63 and 630 miles long. Iran has developed import capacity at the Caspian port Neka to handle increased product shipments from Russia and Azerbaijan, and to enable crude swaps with Turkmenistan and Kazakhstan. In the case of crude swaps, the oil from the Caspian is consumed domestically in Iran, and an equivalent amount of oil is produced for export through the Persian Gulf with NICO for a swap fee.

Iran's longest pipeline connects the Bandar Abbas refinery with the Isfahan refinery and oil-products receiving terminal. Its capacity was expanded in 2008 and the pipeline is capable of transporting more than 300 thousand bbl/d. Iran's second longest pipeline connects the Ahwaz oil fields with the Tehran refinery on its terminus points, although the Arak refinery is also connected to the pipeline. It can transport more than 300 thousand bbl/d.

According to FGE, Khatam Al-Anbia Construction Headquarters (KACH), the construction company controlled by Iran's Islamic Revolutionary Guard Corps (IRGC), was awarded a new contract by NIOC worth $1.3 billion to build two oil pipelines. The new oil pipelines will total 684 miles and will deliver crude oil from the Khuzestan Province to the Tehran oil refinery. In addition, KACH is constructing three pipelines that will deliver crude oil and petroleum products. These are the Nayeen-Kashan, Rafsanjan-Mashhad, and Bandar Abbas-Rafsanjan pipelines.

Natural gas

|

Iran holds the world's second-largest reserves of natural gas, but the vast majority of these reserves are undeveloped. |

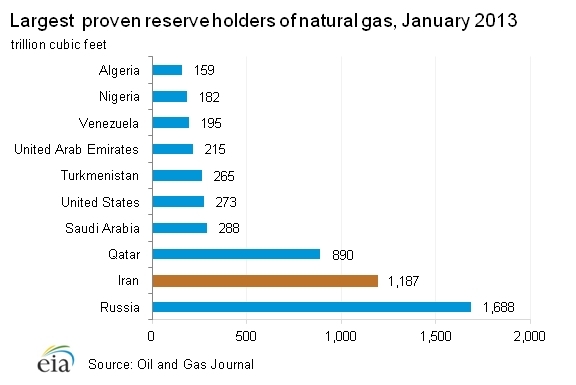

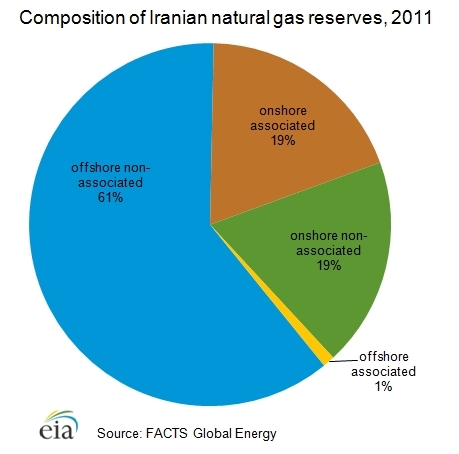

According to Oil & Gas Journal, as of January 2013, Iran's estimated proved natural gas reserves stood at 1,187 trillion cubic feet (Tcf), second only to Russia. Eighty percent of Iranian natural gas reserves are located in non-associated fields, and most of these reserves have not been developed. Major natural gas fields include: South Pars, North Pars, Kish, and Kangan. In 2011, Iran produced an estimated 5.4 Tcf of dry natural gas and consumed an estimated 5.4 Tcf.

Iran's natural gas reserves are located predominantly offshore, although significant associated natural gas production originates from the country's onshore oil fields. The giant South Pars gas field, only a portion of which is in Iranian territory, comprises over 27 percent of Iran's total proved natural gas reserves and is Iran's largest natural gas field. South Pars' proved natural gas reserves are estimated at 325 Tcf, according to FGE, with 3-4 billion barrels of condensate in place, as reported by Arab Oil and Gas Directory.

Kish is Iran's second-largest field, with an estimated 70 Tcf of reserves in place. Other large natural gas fields include North Pars, Tabnak, Forouz, Kangan, and Ferdowsi.

Sector organization

The National Iranian Gas Company (NIGC) is responsible for natural gas infrastructure, transportation, and distribution. The National Iranian Gas Exports Company (NIGEC) was created in 2003 to manage and supervise all gas pipeline and LNG projects. NIGEC was under the control of NIOC until May 2010, when the Petroleum Ministry transferred it to NIGC in an attempt to broaden responsibility for new natural gas projects.

As a result of the poor investment climate and international political pressure, some international oil companies, including Repsol, Shell, and Total, have divested from Iran's natural gas sector. In response, Iran has looked toward eastern firms, such as state-owned Indian Oil Corp., China's Sinopec, and Russia's Gazprom, to take a greater role in Iranian natural gas upstream development. Activity from these sources has also been on the decline because of imposition of sanctions on technology and financial transactions.

Under Iran's buy-back scheme, foreign firms hand over operations of fields to the National Iranian Oil Company (NIOC), and after development they receive payment from natural gas production to cover their investment. National Iranian South Oil Company (NISOC), a subsidiary of NIOC, is responsible for much of the southern natural gas production.

Exploration and production

|

Iran is the third-largest natural gas producer in the world due in part to the development of the giant South Pars field. Despite repeated delays in field development and the effects of sanctions, Iran's natural gas production is expected to increase in the coming years. |

Iran's natural gas resources are abundant, and although exploration for new resources is not a priority for the Iranian government, a number of new finds have been announced recently. In 2011, four sizeable new discoveries were announced: Kayyam, Farouz B, Madar, and Sardare Jangal fields.

The discovery of the Khayyam field, located south of the city of Assaluyeh, was announced in January 2011. According to FGE and Arab Oil and Gas Directory, the field contains 9.1 Tcf of natural gas in place, of which at least 7 Tcf is recoverable, along with approximately 220 million barrels of condensate reserves. Madar, a second discovery close to Assaluyeh, is thought to hold about 17.5 Tcf of natural gas and 653 million barrels of recoverable condensate reserves.

The Forouz B field was discovered in the Persian Gulf, close to Lavan Island, and holds estimated natural gas reserves of 29 Tcf. This field could provide feedstock for a petrochemical complex that is planned to be built on Lavan Island.

Finally, in December 2011, Khazar Oil Company discovered the giant Sardare Jangal field approximately 150 miles offshore in the Caspian Sea. Based on initial assessments, the field's estimated reserves total 50 Tcf of natural gas. Given the field's position in the Caspian Sea, it is possible that Iran shares the field with Azerbaijan; however, lack of a border delineation agreement among littoral states could complicate the development of this field.

Over the last two decades, Iran's dry natural gas production has rapidly increased, rising from 0.9 trillion cubic feet (Tcf) in 1991 to 5.4 Tcf in 2011, and accounts for around 5 percent of the world's natural gas production. Domestic consumption, also estimated at 5.4 Tcf in 2011, has kept pace.

Gross natural gas production totaled 7.9 Tcf in 2011, increasing nearly 2 percent compared with the year prior. Nearly three quarters of total production originated in non-associated gas fields, with the remainder of gross natural gas being produced associated with oil.

The South Pars field accounts for about 35 percent of Iran's total natural gas production, with sizeable production coming also from the Kangan and Tabnak fields. In addition, Gonbadli began producing in June 2011 and contributed about 25 thousand cubic feet (Mcf) during the remainder of the year.

Associated natural gas production originates mainly from the Khuzestan, Ilam, and Kermanshah provinces, and offshore oil fields. According to FGE, about 30 percent of Iran's total associated natural gas production was flared.

In 2011, more than 67 percent of the gross natural gas was delivered to market as dry gas, with 16 percent (1.2 Tcf) reinjected to enhance oil recovery. Approximately 0.6 Tcf of total natural gas produced was flared, with shrinkage, loss, and flaring representing 17 percent of the total.

Much like in the oil sector, the natural gas sector has been hampered by international sanctions. Although sanctions targeting the Iranian natural gas exports were only recently enacted by the EU, lack of foreign investment and sufficient financing has resulted in slow growth in Iran's natural gas production. According to some analysts, Iran should have become one of world's leading natural gas producers and exporters given its large resource base. Development of its fields has been hampered by a combination of financing, technical, and contractual issues.

Nonetheless, Iran's natural gas production has grown and likely will continue to increase in coming years. FGE estimates that Iran's gross natural gas production will increase to 10.9 Tcf in 2020, but that growth will depend on the pace of development of the South Pars field.

South Pars

|

Development of the offshore South Pars field is of vital importance to Iran, both politically and economically. Natural gas production from South Pars is critical to meet increasing domestic consumption and to meet Iran's current and future export obligations. |

The most significant energy development project in Iran, the South Pars field, produces about 35 percent of total natural gas in Iran. Discovered in 1990 and located 62 miles offshore in the Persian Gulf, South Pars has a 24-phase development scheme spanning 20 years at a cost of approximately $60 billion, which excludes downstream facilities.

The entire project is managed by Pars Oil & Gas Company (POGC), a subsidiary of National Iranian Oil Company. Each of the 24 phases has a combination of natural gas with condensate and/or natural gas liquids production. Phases 1-10, which are either producing or are under development, are allocated for the domestic market for consumption and reinjection.

Production from the remaining phases will be exported via pipelines and as liquefied natural gas (LNG) and/or used for gas-to-liquids (GTL) projects.

Contracts for the first ten phases were awarded prior to 2002; half of these came online between 2002 and 2005. Phases 5-10, which were managed by PetroPars, experienced repeated delays, with phases 6-8 expected to come online in mid-2013.

| Phase | Natural gas capacity (Bcf/d) |

Condensate capacity (bbl/d) |

Participating companies |

Start-up | Note: CNPC: China National Petroleum Corporation; PDVSA: Petroleos de Venezuela S.A.; IDRO: Industrial Development and Renovation Organization of Iran; ISOICO: Iran Shipbuilding and Offshore Industries Complex Company; OIEC: Oil Industries Engineering Construction Company; IOEC: Iranian Offshore Engineering and Construction Company. Source: Arab Oil and Gas Directory, FACTS Global Energy, and U.S. Energy Information Administration | ||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 40,000 | PetroPars,Petronas | 2004 | |||||

| 2 | 2 | 80,000 | Total, Petronas, Gazprom | 2002 | |||||

| 3 | |||||||||

| 4 | 2 | 80,000 | Agip, PetroPars, NaftIran | 2004 | |||||

| 5 | |||||||||

| 6 | 3.9 | 156,000 | Statoil, PetroPars | 2009 | |||||

| 7 | |||||||||

| 8 | |||||||||

| 9 | 2 | 80,000 | PetroPars | 2011 | |||||

| 10 | |||||||||

| 11 | 2 | 80,000 | CNPC | 2016 | |||||

| 12 | 3 | 110,000 | POGC, NIOC, PDVSA | 2014 | |||||

| 13 | 2 | 77,000 | Mapna, Sadra,Pedro Pidar | 2017 | |||||

| 14 | 2 | 77,000 | IDRO, IEOCC, NIDC | 2017 | |||||

| 15 | 2 | 80,000 | POGC,ISOICO | 2015 | |||||

| 16 | |||||||||

| 17 | 2 | 80,000 | PetroPars, OIEC, IOEC | 2016 | |||||

| 18 | |||||||||

| 19 | 2 | 77,000 | PetroPars, IOEC | 2018 | |||||

| 20 | 2 | 75,000 | OIEC | 2017 | |||||

| 21 | |||||||||

| 22 | 2 | 77,000 | Petro Sina Arian, Sadra | 2016 | |||||

| 23 | |||||||||

| 24 | |||||||||

Other field developments

Kish, which was originally thought to hold approximately 50 Tcf of natural gas reserves, was reassessed in mid-2011 at 70 Tcf. According to FGE, Kish may be one of Iran's more lucrative natural gas prospects because of its reserves and location. PEDEC put in place a six-phase plan to develop Kish, which could produce more than 4 Bcf per day of natural gas.

Because of repeated contractual disagreements among companies involved in the development of this field, as well as the infrastructure required (which includes the construction of a natural gas processing plant, gas pipelines, and a new power plant), the first phase of this field is unlikely to come online before 2020.

In addition to Kish, there are other promising gas fields that could further boost Iran's production. The North Pars field, adjacent to South Pars, has approximately 50 Tcf of reserves of sour gas. China National Offshore Oil Corporation (CNOOC) signed an agreement with NIOC to develop North Pars, however, CNOOC recently halted its activities as a result of U.S. sanctions. According to FGE, this project is not likely to come online before 2020.

West Assaluyeh is adjacent to the Kangan field and contains up to 6 Tcf of natural gas reserves. Development of this field requires building a natural gas gathering system, construction of a gas treatment plant, and construction of a pipeline that would transport the natural gas into the IGAT-2 trunkline.

The Lavan gas field's estimated reserves are approximately 9.5 Tcf, with 62 million barrels of condensate. The first phase of the project, expected to be completed by 2015, will produce 750 million cubic feet per day (MMcf/d) of natural gas and 11 thousand bbl/d of condensate.

Forouz B's reserves are estimated at 25 Tcf; production from this field is expected to be used for electricity generation for exporting to Iraq, Turkey, Pakistan, and Oman. The first gas from Forouz B is expected in 2017.

The Golshan and Ferdowsi fields hold 39 Tcf and 11 Tcf of natural gas reserves, respectively. Contracts for the development of these fields were awarded but subsequently cancelled; there are currently no development plans. NIOC plans to award these fields to Iranian firms sometime during 2013.

Consumption

In 2012, Iran consumed an estimated 5.4 Tcf of dry natural gas, an increase of 6 percent compared with the year prior. While Iran's domestic natural gas consumption has been growing in the residential sector, domestically-produced natural gas is also central to Iran's plans to increase crude oil production through EOR techniques. In 2011, Iran reinjected more than 1 Tcf of natural gas in its oil fields to help boost oil production. It is expected that natural gas reinjection will increase in the coming years. Some estimates indicate that NIOC will require 8 Bcf/d of natural gas for reinjection into its oil fields in the next decade.

Overall, Iran's natural gas consumption is expected to grow around 7 percent annually for the next decade. The potential for shortfalls in natural gas supply will also increase as domestic natural gas projects face delays.

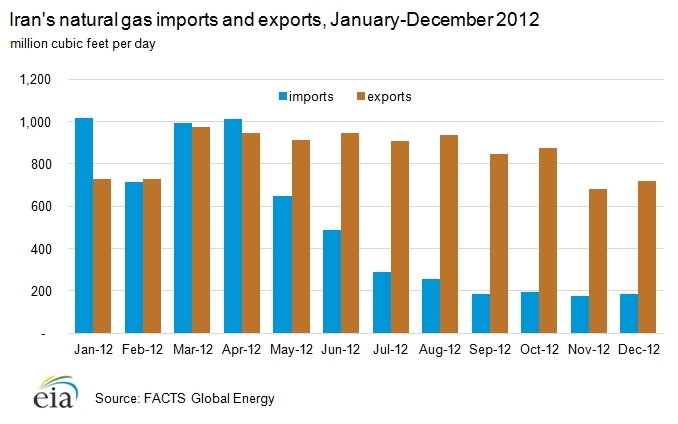

Imports and exports

In 2009, Iran's imports and exports of natural gas were roughly balanced. Iran is particularly dependent on imports during winter months, when residential space-heating demand peaks during colder weather . In 2011, Iran's imports of natural gas grew to 1,024 MMcf/d, while its exports totaled 875 MMcf/d. Preliminary data for 2012 show that, on average, Iran exported more natural gas (850 MMcf/d) than it imported (513 MMcf/d).

Iran exports natural gas to Turkey, Armenia, and Azerbaijan, and receives pipeline imports from Turkmenistan and Azerbaijan. Since 2000, Iran's annual natural gas imports have exceeded its exports in all but two years (2010 and 2012). In 2011 and 2012, Iran accounted for less than 1 percent of global dry natural gas imports and exports.

In a recent report titled Natural Gas Exports from Iran, EIA estimated that the average revenues from Iran's natural gas exports during the period July 2011-June 2012 were approximately $10.5 million per day, or about 5 percent of the estimated $231 million per day in revenues from crude oil and condensates exports over the same period. In 2010, natural gas exports accounted for less than 4 percent of Iran's total export earnings, while crude oil and condensates accounted for over 78 percent.

Turkmenistan

Although Iran accounts for less than 1 percent of global natural gas trade, it is a significant market for exports from Turkmenistan, receiving just under 30 percent of all Turkmen natural gas exports in 2011, according to Cedigaz. Since its completion in late 2010, the Dauletabad-Hasheminejad pipeline—which delivers gas from Turkmenistan to Iran—boosted Iran's import capacity from 0.8 Bcf/d to nearly 1.5 Bcf/d of Turkmen gas.

During 2012, Iran's imports from Azerbaijan and Turkmenistan averaged approximately 800 MMcf/d. Imports of Turkmen natural gas are essential to Iran's ability to meet both seasonal peak demand and industrial demand in northern Iran. Turkmen export volumes to Iran exceed Iranian export volumes to Turkey, and analysis suggests that Iran has flexibility to substitute some of the volumes intended for export for those it currently receives from Turkmenistan. Iran could redistribute natural gas volumes intended for export to its domestic consumers, thereby reducing the need for imports.

Turkey

Turkey's imports of Iranian natural gas via the Tabriz-Dogubayazit pipeline averaged nearly 670 MMcf/d during 2012, according to FACTS Global Energy's Iran Oil and Gas Monthly Reports. Of those imports, the vast majority are incorporated into the Turkish central pipeline network and further distributed as necessary. Cedigaz data indicate that Turkey receives approximately 20 percent of its natural gas imports from Iran, making Iran Turkey's second largest source of natural gas imports after Russia, which had a 57 percent share of Turkey's natural gas imports in 2011.

Armenia and Azerbaijan

Armenia used the majority of the approximately 44 MMcf/d of Iranian natural gas it imported to produce electricity at the Hrazden power plant. In return, excess base-load electricity generated from the Armenian Nuclear Power Plant (ANPP) is exported to Iran. Armenia supplies 3 kilowatthours of electricity for every cubic meter of natural gas it receives from Iran. Initially, Armenia was to receive 106 MMcf of natural gas per day from Iran, with volumes slated to increase to 220 MMcf per day by 2019 as part of the ongoing 20-year contract agreed to in May 2004. However, reported volumes have thus far failed to reach these targets. According to Cedigaz, Armenia receives 23 percent of its natural gas imports from Iran.

Iran's exports to the isolated Azerbaijani exclave of Nakhchivan via the Salmas-Nakhchivan pipeline averaged just over 56 MMcf/d in 2012. In exchange, Azerbaijan exports natural gas to Iran's northern provinces via the Astara-Kazi-Magomed pipeline. Nakhchivan's only supply source of natural gas is Iran.

| Imports | Exports | Source: FACTS Global Energy, Iran Oil and Gas Monthly Reports | |||

|---|---|---|---|---|---|

| Armenia | -- | 44 | |||

| Azerbaijan | 35 | 56 | |||

| Turkey | -- | 670 | |||

| Turkmenistan | 770 | -- | |||

| Total | 805 | 770 | |||

Liquefied natural gas (LNG)

Although Iran's LNG aspirations to build a liquefaction facility date back to the 1970s, the country has yet to build one. Despite ambitious plans, Iran has had to cancel or delay LNG projects because of U.S. and EU sanctions, which made it impossible to obtain financing and purchase necessary technology. Given the political constraints, Iran's LNG projects are years away.

Pipelines

Domestic pipelines

Iran has an extensive natural gas pipeline system that includes trunklines, import/export pipelines, and gathering and distribution lines. The backbone of the domestic pipeline system is the Iranian Gas Trunkline (IGAT) pipeline series, which transports natural gas from processing plants to end-use consumers. Development of IGAT pipelines, fed by South Pars development phases, is important to Iran's natural gas transport. IGAT-8 will run nearly 650 miles to Iran's northern consumption centers, including Tehran. IGAT-9 and IGAT-10 are still in the planning and construction phase and are not likely to become operational before 2017.

Planned pipelines

There are a number of new export proposals, including the Iran-United Arab Emirates (UAE) contract (Iran-Pakistan Pipeline), as well as proposed projects such as the Iran-Oman cooperation project and the Iran-Iraq-Syria project.

The Iran-UAE gas contract outlined an agreement to transport natural gas from the Salman field to Sharjah. Contract negotiations never concluded because of a pricing and volume dispute, and the contract has been referred to international arbitration. In the meantime, the pipeline required to transport natural gas between Iran and UAE was completed in July 2011; however, it only can be used to transport gas domestically.

While the Iran-Pakistan Pipeline has experienced considerable financing difficulties, both countries seem committed to complete the project. In 2012, Pakistan completed tenders for engineering, procurement, construction, and commissioning, and Iran agreed to supply Pakistan with $500 million to finance the line on the Pakistani side. The pipeline will be able to transport 1 Bcf/d of natural gas. The agreement covers 750 MMcf/d of natural gas for 25 years.

The planned Iran-Iraq-Syria pipeline would connect Iran's natural gas fields with Iraq's power plants in and around Baghdad. This pipeline would be an extension of the IGAT-6 pipeline, which would eventually deliver natural gas to Syria. The pipeline's planned capacity is 880 MMcf/d and would require more than 100 miles of newly constructed pipeline in Iraq. Given the economics and political situation associated with these three countries, it is unlikely that this pipeline will be constructed in the near future.

Electricity

|

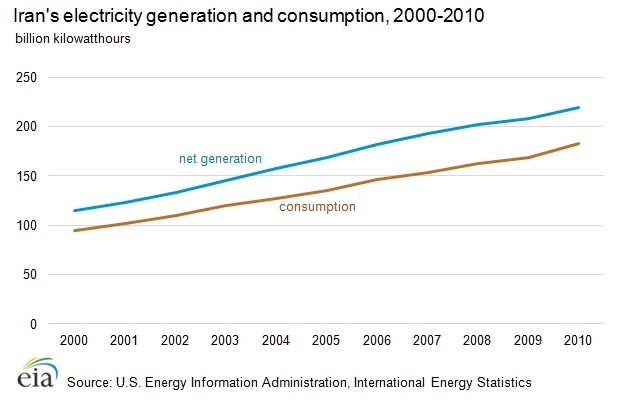

While Iran is a net exporter of electricity, increasing domestic demand has created supply shortfalls during times of peak energy demand. |

In 2011, Iran generated approximately 220 billion kilowatthours (Bkwh) of electricity. This power was generated from a network capacity of 64 gigawatts (GW), which is strained during times of peak demand. Approximately 95 percent of total electricity supply during the year was generated by conventional thermal electric power. The remaining portion was from hydroelectric and other renewable sources, with marginal generation from a nuclear power plant that came online in the third quarter of 2011 and operated below maximum capacity for most of the next 12 months.

Iran's first nuclear power plant at Bushehr came online after many years of delay, launching operations of the plant's first unit. Construction at this power plant originally began in the mid-1970s, but was repeatedly delayed by the Iranian Revolution, the Iran-Iraq war, and more recently by problems associated with the Russian consortium that was awarded the construction contract. The first unit of the power plant reached its full capacity in August 2012 at 1,000 megawatts (MW). Two additional units are planned at Bushehr, each with a planned capacity of 1,000 MW.

Iran's government plans to construct additional nuclear power plants, the next of which is likely to be a station near Darkhovin with a generation capacity of 360 megawatts, although initial plans included capacity of more than 1,000 MW. However, sanctions imposed on Iran's controversial nuclear program may prevent the development of not only this nuclear power plant, but also adversely affect thermal and hydroelectric projects due to a lack of financing and necessary technology.

In addition to nuclear power plants, the Iranian government is focused on expanding power generation from thermal sources, with a number of new projects being developed as independent power projects, including a station near Assaluyeh (natural gas-fired), one in the East Azerbaijan province (gas-fired combined-cycle), and another at Parehsar on the Caspian Sea coast.

Increasing its generation capacity will help ensure that Iran can meet its increasing domestic demand and continue to export electric power to neighboring countries. Preliminary data show that as of 2011, Iran was a net exporter of electric power to Armenia, Pakistan, Turkey, Iraq, and Afghanistan. Azerbaijan and Armenia supply electricity to Iran under a swap agreement.

Notes

- Data presented in the text are the most recent available as of March 28, 2013.

- Data are EIA estimates unless otherwise noted.

Sources

- Arab Oil and Gas Directory

- British Broadcasting Corporation

- Bloomberg

- Business Monitor International

- Economist Intelligence Unit Ltd.

- Eurasia Group

- FACTS Global Energy, Inc.

- Financial Times

- Global Insight

- IHS Inc.

- Middle East Economic Survey

- Oil and Gas Journal

- Organization of the Petroleum Exporting Countries

- Petroleum Economist

- PFC Energy, Inc.

- Reuters

- Trend News Agency

- Upstream

- U.S. Energy Information Administration

| Disclaimer: This article contains information that was originally published by the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth have edited its content amd added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |