Energy profile of Qatar

| Topics: |

Energy profiles of countries and regions

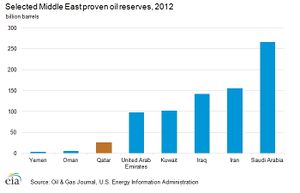

Qatar holds the world's third largest natural gas reserves and is the single largest supplier of liquefied natural gas. Qatar is also a member of OPEC and is a significant net exporter of oil.

Qatar's proven reserves of oil were the 13th largest in the world at the end of 2012 and the country remains an important supplier of oil to world oil markets.

Qatar is a member of the Organization of the Petroleum Exporting Countries (OPEC) and is a significant oil producer. The Qatari government has devoted more resources recently to the development of natural gas, particularly for export as liquefied natural gas (LNG). Although only producing LNG since 1997, Qatar is now the world's largest supplier of LNG. Qatar is also a member of the Gas Exporting Countries Forum (GECF), an organization formed in 2001 to promote the interest of the world's major natural gas producers.

According to the Qatar Statistics Authority, the oil and gas sector accounted for 58 percent of Qatar's 2011 gross domestic product (GDP). Qatar's growing production of hydrocarbons paired with an increase in prices contributed to a 36 percent increase in GDP in 2011 compared to the previous year. In addition, Qatar relies entirely on oil and natural gas for its primary energy consumption. Although the transportation sector continues to contribute significantly to growth in oil demand, all electricity capacity in Qatar is gas-fired.

Contents

Oil

Sector organization

State-owned Qatar Petroleum (QP) controls all aspects of Qatar's upstream and downstream oil sector. While QP owns and operates the onshore Dukhan field and the offshore Maydan Mahzam and Bul Hanine fields, the remaining offshore fields are operated by international oil companies via production sharing agreements (PSAs). In an effort to increase production and reserves and mitigate gas-related capital expenditures, QP has offered more favorable terms for PSAs in recent years.

Production

In 2011, Qatar was the third smallest crude oil producer in OPEC, with its production exceeding only that of Ecuador and Libya. Qatar produced approximately 1.6 million barrels per day (bbl/d) of total liquids of which 850,000 bbl/d was crude oil. Just over half of the country's crude oil production comes from Dukhan and Al-Shaheen fields, with production of 270,000 bbl/d and 300,000 bbl/d, respectively.

Though Qatar's petroleum production has grown steadily since the 1990s, Qatar's fields are maturing, and output at Dukhan — formerly the largest producing field — is in decline. To offset anticipated declines, EOR techniques have been utilized for several fields including Al-Shaheen, Dukhan, Bul Hanine, and Maydan Marjam. Danish company Maersk's offshore field Al-Shaheen is an important source for future production growth. Although the field averaged just under 300,000 bbl/d of production in 2009, Maersk completed an expansion project in 2010 that increased its production capacity to 525,000 bbl/d. In aggregate, Qatar hopes to increase its total production capacity to 1.2 million bbl/d from current capacity of 950,000 bbl/d through the development of existing fields.

Consumption

In 2011, Qatar consumed approximately 183,000 bbl/d of petroleum. Although still relatively small compared to total production levels, consumption has more than tripled since 2000. FACTS Global Energy forecasts Qatar's oil product consumption to grow by an average annual rate of about five percent between 2010 and 2015. Qatar's increased petroleum consumption rate is due to its rapidly growing economy, particularly the associated growth of transportation sector demand.

Pipelines

National Oil Distribution Company, a subsidiary of QP, operates Qatar's oil pipeline network, which delivers supplies from oil fields to Qatar's export terminals and refineries. QP's offshore pipeline network brings crude oil from offshore oil fields to Halul Island where oil can be processed for export. Onshore, most oil is sent to the Mesaieed export terminal for refining or export.

Exports

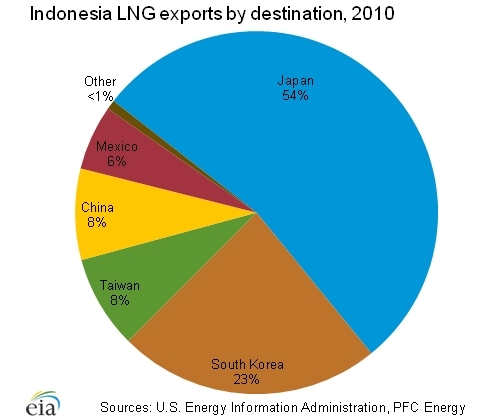

Qatar has three primary export terminals: Mesaieed, Halul Island, and Ras Laffan. Ras Laffan is used primarily for the export of liquefied natural gas (see Natural Gas section). The vast majority of Qatar's oil exports are sent to Asian economies. Japan is the single largest importer, although South Korea is also an important export market.

Refining

According to Oil and Gas Journal, as of January 1, 2013, Qatar has 338,700 bbl/d of refining capacity. There are currently two refineries in Qatar, located in the major port cities of Umm Said and Ras Laffan. The 138,700 bbl/d Ras Laffan condensate refinery began operations in late September 2009. Operated by Qatargas (a QP subsidiary; see Natural Gas section for more information), the Laffan refinery is controlled by a consortium of investors: QP (51 percent), ExxonMobil (10 percent), and Total (10 percent), and Japanese companies Idemitsu (10 percent), Cosmo (10 percent) Mitsui (4.5 percent) and Marubeni (4.5 percent). The refinery will have the capacity to produce about 60,000 bbl/d of naphtha, 50,000 bbl/d of jet fuel, 25,000 bbl/d of gasoil, and 10,000 bbl/d of liquefied petroleum gases (LPG). Plans call for a doubling of Ras Laffan's refining capacity by 2015, primarily to refine a greater portion of the North Field's rapidly growing production of condensate. Although QP was considering an additional 250,000 bbl/d refinery to process the heavier Al-Shaheen crude, the project was put on hold.

Natural gas

Qatar has the largest non-associated natural gas field in the world and is the world's largest liquefied natural gas exporter.

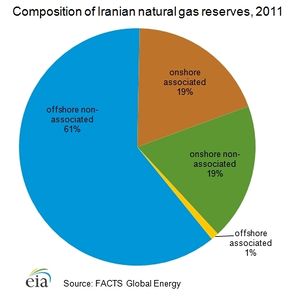

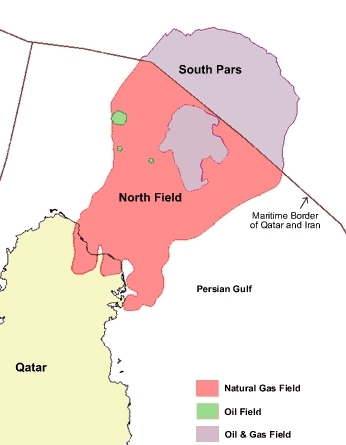

According to Oil & Gas Journal, Qatar's proven natural gas reserves stood at approximately 890 trillion cubic feet (Tcf) as of January 1, 2013. Qatar holds 13 percent of total world natural gas reserves which is the third-largest total in the world behind Russia and Iran. The majority of Qatar's natural gas is located in the immense offshore North Field, which spans an area roughly equivalent to Qatar itself. The North Field is actually a part of the world's largest non-associated natural gas field that sits in both Qatar's and Iran's maritime territories, and is the main source of Qatari natural gas production. Iran's South Pars field holds an additional 450 Tcf of recoverable natural gas reserves. Qatar produces condensate and natural gas liquids (NGL) alongside its natural gas production. In 2011, EIA estimates that condensate and NGL production has exceeded one million bbl/d, surpassing crude oil production. Analysts estimate that condensate production alone will overtake crude by 2015.

Sector organization

To an even greater extent than in the oil sector, Qatar Petroleum (QP) plays a dominant role in Qatar's natural gas sector, leading upstream and downstream projects. Qatar's focus on natural gas development tends to be integrated large-scale projects linked to LNG exports or downstream industries that use natural gas as a feedstock. Therefore, foreign company involvement has favored international oil companies with the technology and expertise in integrated mega-projects, including ExxonMobil, Shell, and Total. However, QP has maintained a majority share in most of its gas projects—in particular, the dominant companies in Qatar's LNG sector: Qatargas Operating Company Limited (Qatargas) and Ras Laffan Company Limited (RasGas). The LNG companies handle all upstream to downstream natural gas transportation themselves, while the Qatar Gas Transport Company (known as "Nakilat", which means "carriers" in Arabic) is responsible for shipping Qatari LNG.

Production and consumption

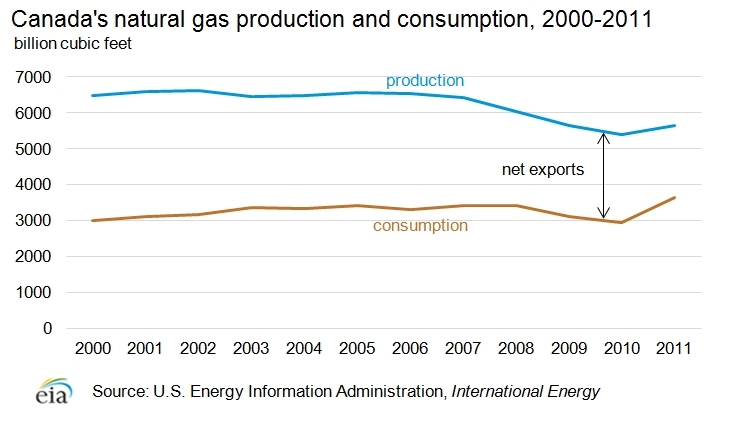

Qatar continues to expand natural gas production for the expressed purpose of exporting. In 2011, EIA estimates that Qatar produced nearly 5,200 billion cubic feet (Bcf) of natural gas, more than three times the amount it produced in 2000. EIA estimates Qatar's natural gas consumption in 2011 was approximately 690 Bcf, leaving the remainder for exports destined primarily for Asia. Although the increase in natural gas production fuels the growing natural gas requirements of domestic industry and its gas-to-liquids (GTL) projects, the bulk of this increase is going towards LNG exports.

North Field

The North Field is key to Qatar's natural gas development and production plans, as the site of nearly all of the country's natural gas reserves. In 2005, Qatari government officials placed a moratorium on additional natural gas development projects at the North Field to allow time to study field development optimization. During the moratorium, ongoing exploration on both sides of the maritime boundary is causing pressure drops in various wells leading to liquid formation that results in slowed or blocked flows.

The moratorium did not affect exploration and production projects already approved or underway, allowing Qatar to continue its growth in natural gas production. Although the moratorium was scheduled to be lifted in 2014, the Energy Ministry indicated in late 2010 that it does not plan to lift the moratorium at that time. The Barzan gas project, which will produce an additional 600 Bcf per year, was the last North Field project to be approved prior to the moratorium. The project will be a 90-10 joint venture between QP and ExxonMobil, and is expected to come online between 2014 and 2015.

Adapted from IHS Energy

Exports

In 2011, Qatar exported over 4,200 Bcf of natural gas, of which over 80 percent was LNG primarily to Asia and Europe. The United States received 90 Bcf of Qatar's LNG, which represented 26 percent of total U.S. imports of LNG in 2011. The remaining exports (680 Bcf) of natural gas were transferred through the Dolphin pipeline to the United Arab Emirates (UAE) and Oman.

Liquefied natural gas

Qatar is the world's leading LNG exporter.

Qatar is the world's leading LNG exporter. In 2011, Qatar exported nearly 3,600 Bcf of LNG. The United Kingdom, Japan, India, and South Korea were the primary destinations for Qatar's LNG exports. Asia was the principal import hub, accounting for 48 percent of Qatar's LNG in 2011. European markets, including Belgium, the United Kingdom, and Spain were also significant buyers of Qatari LNG, accounting for an additional 42 percent.

Although Qatar only began exporting LNG in 1997, heavy government emphasis on this sector — both in terms of generating investments and attracting foreign investors — contributed to the rapid development of Qatar's LNG capacity. Qatar's LNG sector is dominated by Qatargas Operating Company Limited (Qatargas), which operates four major LNG ventures (Qatargas I-IV), and Ras Laffan Company Limited (RasGas), which operates three major LNG ventures (RasGas I-III). RasGas is 70 percent owned by QP and 30 percent-owned by ExxonMobil, while the Qatargas consortium includes QP, Total, ExxonMobil, Mitsui, Marubeni, ConocoPhillips, and Shell. Each venture has an individual ownership structure, although QP owns at least 65 percent of all the above ventures.

RasGas and Qatargas have 14 LNG trains currently online, with a total LNG liquefaction capacity of 3,750 billion cubic feet per year (Bcf/y) (77 million tonnes per year (MMt/y)) achieved in December 2010. Five of these trains were added in 2009 and 2010. RasGas III, Train 7, with a liquefaction capacity of 380 Bcf/y (7.8 MMt/y) of LNG began operations in February of 2010. Qatargas III, Train 6, came online in November of 2010 with the same liquefaction capacity. The 14th train, Qatargas IV Train 7, with the same capacity of 380 Bcf/y (7.8 MMt/y) came online in January 2011 and shipped its first cargo in February of this year. The 7.8 MMt/y train is considered a mega-train and currently has the largest operating capacity in the world.

Qatari government officials have noted that they do not anticipate building any more LNG facilities in the near-term future and that any additional capacity increases will be the result of improvements in the existing facilities. Although the most recent train additions were originally designed with U.S. markets as the primary target, the global recession and low U.S. natural gas prices due to the shale gas boom have caused Qatar to pursue contract options with other countries — particularly China and India.

Dolphin Project

Qatar is the supplier for the Dolphin Project, which connects the natural gas networks of Qatar, the UAE, and Oman with the first cross-border natural gas pipeline in the Gulf Arab region. The pipeline currently exports about 2 billion cubic feet per day (Bcf/d) from Qatar, although it has a design capacity of 3.2 Bcf/d. Dolphin Energy has been trying to secure additional Qatari gas to meet the rapidly growing demand for natural gas in the UAE. However, increased supplies from Qatar are uncertain. Additional international pipelines to Kuwait and Bahrain via Saudi Arabia and to Pakistan were proposed but face indefinite delays because of political and financial issues.

Gas-to-liquids

Qatar's Oryx GTL project is in operation and the Pearl GTL project is expected to begin operations in 2011.

Gas-to-liquids (GTL) technology uses a refining process to turn natural gas into liquid fuels such as low-sulfur diesel and naphtha, among other products. Qatar is one of only three countries — with South Africa and Malaysia being the others — to have operational GTL facilities. Qatar's Oryx GTL plant (QP 51 percent, Sasol-Chevron GTL 49 percent) came online in 2007, but due to initial problems, was not fully operational until early 2009. At full capacity, the Oryx project uses about 330 MMcf/d of natural gas feedstock from the Al Khaleej field to produce 30,000 bbl/d of GTL.

The Pearl GTL project (QP 51 percent, Shell 49 percent) is expected to use 1.6 Bcf/d of natural gas feedstock to produce 140,000 bbl/d of GTL products as well as 120,000 bbl/d of associated condensate and LPG. Shell announced that the plant's initial phase commenced early in 2011 and the first shipments of gasoil were sent out in June. After initiating the second phase of development, Pearl GTL achieved full capacity in October 2012. In addition to being the largest GTL plant in the world, the Pearl project is also the first integrated GTL operation, meaning it will have upstream natural gas production integrated with the onshore conversion plant.

Notes

- Data presented in the text are the most recent available as of January 30, 2013.

- Data are EIA estimates unless otherwise noted.

Sources

- Bloomberg Businessweek

- Cedigaz

- Central Intelligence Agency

- Dow Jones News Wire service

- Energy Compass

- Energy Information Administration

- FACTS Global Energy

- International Oil Daily

- IHS Global Insight

- Middle East Economic Survey

- Oil & Gas Journal

- Petroleum Economist

- Platt's International Gas Report

- Platt's Oilgram

- Petroleum Intelligence Weekly

- Qatargas

- Qatar National Petroleum

- Qatar Petroleum

- Qatar Statistics Authority

- RasGas

- Shell

- Wall Street Journal

- World Gas Intelligence

Further Reading

- CIA, 2007. "Country Profile: Qatar." The World Factbook. Central Intelligence Agency.

- Dolphin Energy

- EIA, 2007. Country Profile: Qatar. Energy Information Administration.

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |