Voluntary carbon markets in the USA

The Kyoto Protocol (1997) is approaching its expiration date, with the USA signing it in 1998; the USA has not yet ratified the agreement, and throughout the Obama administration has yet to implement any nationwide legislation to effectively control greenhouse gas (GHG) emissions. The European Union, on the other hand, signed the Kyoto Protocol in 1998, ratified it in 2002 and since 2005 has entered it into force. In response to the EU’s ratification of Kyoto, the European Commission (EC) passed Directive 2003/87/EC in October 2003, establishing the European Union Emissions Trading Scheme (EU ETS), which began operation in January 2005 and is now the largest international GHG emissions trading scheme in place. Despite some minor setbacks, including volatile carbon prices peaking at around 30 euros in the first stages of the market and then crashing to under four euros in early 2007, the EU has demonstrated that a GHG trading scheme can improve industrial efficiencies, spur economic growth and reduce the amount of GHG emissions companies emit. Thus, why has the United States been reluctant to establish a mandatory emissions trading scheme?

CO2 emissions (Emissions factors) account for more than 80% of total emissions in the USA. The United States in 2005 emitted 5957 million metric tons (MMT) of carbon dioxide compared with the EU, which emitted 4675 MMT of CO2. USA CO2 emissions from energy related activities is expected to increase by 1.1 percent annually through 2030, while non-OECD countries are expected to increase their CO2 emissions by 2.6 percent per year through 2030. If we rely on EIA’s prediction, then by 2030 the USA will still be the second largest emitter of CO2 at 7950 MMT and China will be number one at 11,240 MMT of CO2. (See Table 1).

|

Table 1: 2003 Top-Ranked Carbon Dioxide Emissions by Nation, US States and US Regional Partners | |

| United States | 5,779 |

| China | 4,497 |

| EU | 4,003 |

| Russian Federation | 1,581 |

| Japan | 1,258 |

| India | 1,148 |

| Germany | 865 |

| Midwest Accord States | 797 |

| WCI States | 764 |

| Texas | 719 |

| RGGI States | 606 |

| UK | 553 |

| Canada | 544 |

| South Korea | 489 |

| Italy | 468 |

| Mexico | 400 |

| California | 395 |

| France | 394 |

|

Source: From CRS report using data from World Resources Institute | |

Ironically, the US was a strong promoter of the trading scheme under the Kyoto Protocol, yet lack of US participation has stagnated climate change initiatives and consequently American businesses are now realizing that they are at a disadvantage to their European counterparts who are already familiar with trading schemes. Fortunately, there is a growing interest in the US among various actors who are taking matters into their own hands. Actors can include state governments, online retailers, businesses/corporations of all shapes and sizes, non-profit organizations, developers, credit aggregators, and individuals. As a result, voluntary markets, regional initiatives and consumer participation are rapidly evolving and demonstrating that the US with or with out nation-wide legislation can still play a role in reducing global greenhouse emissions.

Contents

Voluntary Markets

Voluntary CO2 markets are a rapidly growing business, with the USA grew to dominate the market During the George W.Bush administration. According to a comprehensive report on the state of voluntary carbon markets in 2007 by Ecosystem Market Place and New Carbon Finance 50% of carbon credit suppliers were US based firms, 68% of customers were from the USA and 43% of offsets that were sold in voluntary markets were based in the US.

Interestingly, the report also revealed that companies, which are the largest buyers of carbon credits, are motivated by corporate social responsibility (CSR) and not by the likelihood of future regulations. As conscientious consumers are increasingly demanding greener products and services, businesses are using voluntary markets as a means to reduce the amount of CO2 from operational activities as well as from their products and services.

The Chicago Climate Exchange (CCX) was launched in 2003 as “North America’s only active voluntary, legally binding integrated trading system to reduce emissions of all six major GHGs, with offset projects worldwide”. CCX is becoming increasingly popular because it is filling a market niche by providing businesses with a legitimate way of exchanging carbon credits. According to Ecosystem Marketplace and New Carbon Finance, CCX reported more trading in the first half of 2007 than in the entire year of 2006. In December 2007 a total of 2 MMTCO2e were traded and the total program-to-date volume exceeded 36 MMTCO2e. The average closing price per metric ton in December 2007 was $2.00. On February 29, 2008, the closing price for all CFI vintages was $4.50.

The CCX has two phases: During phase I, members are required to reduce emission by 1% per year from 2003 through 2006, with a total 4% reduction from baseline levels; Phase II requires a 6% reduction below baseline levels by 2010. A baseline level is calculated for each member by taking the average emissions from 1998 through 2001, however, if a member joins during Phase II, than the baseline level may be just from the year 2000.

CCX members voluntarily agree to legally binding reductions and can trade six different GHGs[1], which are converted to CO2 equivalents (CO2e) based on their global warming potential (GWP) in relation to the GWP of CO2, which is 1. The Carbon Financial Instrument (CFI) is the unit of trade where by one CFI equals 100 tCO2e and all CFI contracts are electronically filed and managed in the CCX Registry. CCX also issues CFIs for eligible offset projects (see Table 2).

|

Table 2: Offset Projects | |

| Under CCX | Under RGGI |

|

|

While CCX is a voluntary market, it is still closely linked to regulated markets, mainly the EU ETS where by European Union Allowances (EUAs) are widely traded on the CCX. The success of CCX coupled with increasing demand from firms to offset their emissions in a quantifiable and verifiable way has led CCX to expand its operations with the creation of the European Climate Exchange (ECX) in 2005 and the New York Climate Exchange and the Northeast Climate Exchange in 2006, which will enhance the regional initiatives of these states.

Aside from the CCX, all other voluntary markets can be grouped as voluntary Over the Counter (OTC) markets. OTC markets do not operate under a cap-and-trade system; instead carbon reductions are derived from projects such as reforestation, agroforestry, methane capture from [[landfill]s or renewable energy projects. This type of market is more popularly known as carbon offsetting. Offset markets result in verified emissions reductions (VERs) or renewable energy credits (RECs) where as CDM projects generate certified emissions reductions (CERs) which means that VERs are simply verified by a third party but can not be certified because it is not formally regulated and recorded on a registry. This is a rising issue with carbon offsets as customers tend to be wary of such purchases which has a huge capacity to hinder the development of offsets.

Offset retailers are increasingly providing opportunities for the individual to participate. While this is not unique to the US, it is worth mentioning as the US is a major offset retailer. [[size="2" face="Arial">]]] is just one example of a US online based company that sells carbon offsets (see Table 3). TerraPass provides an array of offset options for concerned citizens who want to reduce their carbon footprint. These online retailers usually encourage the user to calculate their carbon footprint from a certain activity, such as driving or flying or even from the type of home, then after calculating their footprint the customer can by a carbon-offset certificate that essentially funds a variety of projects, theoretically allowing the consumer to become carbon neutral.

|

Table 3: US Offset Providers and Prices for Individuals[2] | |||

| Provider | US$/MMT CO2 | Project Types | Verification |

| AtmosClear Climate Club | $3.96-$25.00 | Environmental Resources Trust | |

| Carbonfund.org | $4.30-$5.50 | Renewablea, Efficiency, Reforestation | Environmental Resources Trust, Climate Community and Biodiversity Standards, Chicago Climate Exchange, UNFCCC JI |

| E-BlueHorizons | $5.00 | Renewablea, Reforestation | Chicago Climate Exchange, Environmental Resources Trust |

| Eco2Pass | $5.62-$6.25 | Projects from CCX | Chicago Climate Exchange |

| DriveNeutral.org | $6.93 and up | Efficiency | Chicago Climate Exchange |

| Terrapass | $10.91 | Renewables, Efficiency | Chicago Climate Exchange, Center for Resource Solutions |

| Standard Carbon | $15.00 | Methane, Efficiency, Renewables, Carbon Sequestration | Chicago Climate Exchange |

| Source: Ecobusinesslinks.com Carbon Offset Survey. Prices mainly vary because project size and type | |||

Two main benefits can be associated with individual participation in offset markets: 1) Increasing awareness of climate change is driving individual action, thus purchasing offsets allows individuals to directly participate in reducing CO2 emissions while, 2) the promoting of offsets fosters an increase in awareness of the issues at hand.

Action by States

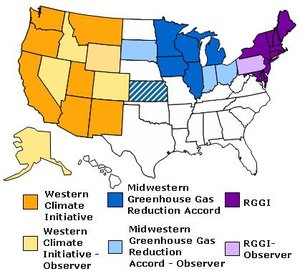

Because states have unique economies, political structures and access to natural resources, climate change action plans can vary quite substantially from softer strategies like improving energy efficiency to harder measures that use economic instruments or command and control approaches. States are addressing climate change for a variety of reasons: anticipation of direct impacts such as sea level rise or declining agricultural production, a more secure energy future, and/or economic opportunities. (See Appendix II for a list of states with GHG emissions Targets, Appendix IV for map of regional initiative participants).

Regional Initiatives by States. (Source: Pew Center on Global Climate Change)

Regional Initiatives by States. (Source: Pew Center on Global Climate Change) Regional GHG Initiative

In 2003, New York Governor George Pataki invited 11 governors from the North East and Mid Atlantic states to discuss the possibility of a Regional GHG Initiative or RGGI. Since then, ten states have joined RGGI: Connecticut, Delaware, Maine, New Hampshire, New Jersey, New York, Vermont, Maryland, Massachusetts and Rhode Island, making it the first mandatory CO2 cap-and-trade program in the US.

RGGI is a sector specific approach that will reduce CO2 emissions from electricity utilities with a generating capacity of 25 MW or greater, but this will most likely extend to other sources of GHG emissions depending on the success of the initial program.

In 2006, participating states issued a model rule describing the proposed program as it is outlined in the Memorandum of Understanding (MOU), which was signed by all participants, some of which were already in the process of implementing state-wide programs such as Massachusetts and New Hampshire. RGGI’s cap-and-trade approach will allow flexibility among states depending on each one’s ability to reduce emissions in the most cost effective way. Each state is responsible for establishing and enforcing its own emissions reduction regulations or laws, but it must be based on the model rule.

Allowances will be allocated for "consumer benefit or strategic energy purpose” which means that power plants will have to purchase allowances instead of receiving them at no charge. There are concerns that utilities may pass along this additional cost to consumers, causing an increase in electricity bills; however, this could be resolved by using the revenues from purchased allowances to subsidize the most impacted industries or to assist low-income families.

The first compliance period will begin on January 1, 2009 when RGGI participants will attempt to stabilize CO2 emissions during the first six years of implementation (2009-2014) at a cap of 188 million short tons or roughly 170 MMT[3]. Then, reductions will take place from 2015 onwards with an annual decrease of CO2 emissions by 2.5% with the overall goal of achieving a 10% reduction of the initial CO2 budget by 2018.

To ensure that states are meeting their obligations RGGI will require strict monitoring and reporting requirements. Furthermore, participants are developing the Eastern Climate Registry, which will be used to keep track of all emissions reductions.

In addition to the cap-and-trade mechanisms, RGGI also includes a provision for CO2 offset projects allowing states offset 3.3% of a source’s total compliance obligation. Additionally, RGGI acknowledges that certain events in the market may result in higher than expected allowance prices (Stage one is set at $7 and stage two is set at $10). If the average price of a CO2 allowance exceeds the set price in either stage than states can increase the amount that CO2 offset allowances contribute to their overall obligation from 3.3% to 5% in stage one and to 10% in stage two. CO2 offset projects are limited to five specific project areas as a means to certify that the emissions reductions are verifiable, enforceable, and permanent. (See Appendix III for list of approved offset projects).

Interestingly, unlike EU ETS, offset projects are restricted to national borders. If a project is located in a non-participatory state, a MOU must be signed between the cooperating regulatory agency of that state and the RGGI signatory state. All projects must prove that they meet the criteria by submitting a monitoring and verification report indicating the exact amount of reduced GHG emissions before they are awarded the offset allowance and all projects must be verified independently.

California Assembly Bill 32

California is undoubtedly one of the most aggressive states with regards to greenhouse gas emissions. California is one of three states that has implemented mandatory GHG emissions targets. Governor Schwarzenegger signed the California Global Warming Solutions Act of 2006 (Assembly Bill 32) in September 2006 to limit statewide GHG emissions equal to California’s 1990 levels, which is estimated at 427 million MTCO2e, by 2020 resulting in an overall 25 percent reduction. Mandatory reporting will begin in January 2008 and mandatory caps will come into effect in 2012.

The bill requries the California Air Resources Board (CARB) to ensure that GHG emissions reudctions are achieved using the most feasible and cost-effective technologies. This will be an economy-wide system that will utilize a cap-and-trade program and command and control tools depending on the sector where by CARB will ultimately determine which sources will be included in the state-wide targets. Some sectors like the electricity and industrial sectors are more suitable for trading schemes where as transportation sector will be more effectively dealt with using a command and control approach.

CARB will develop and adopt regulations for the reporting and verification of GHG reductions, develop appropriate tools to will facilitate rigorous record keeping and devise measures to periodically update emission-reporting requirements as necessary. Reductions will be registered on the California Climate Action Registry.

Western Climate Initiative

The Western Climate Initiative (WCI) is a more recent regional collaboration (February 2007) among Arizona, California, New Mexico, Oregon, Washington, and Utah (Manitoba and British Columbia are also participants). WCI is an economy-wide program with a target to reduce GHG emissions 15% below 2005 lelves by 2020 using a cap-and-trade program that will begin August 2008.

California, as previously discussed is already working intently on its own climate initiatives, however the state is still coordinating with this regional initiative to facilitate coordination with other Western states and to address the issue of emissions leakage, whereby a company or an industry moves to another region with more lenient laws on emissions. WCI will participate in [[size="2" face="Arial">http://www.theclimateregistry.org/ size="2" face="Arial">The Climate Registry]] to keep track of all emissions reductions and partners will be required to keep other partners updated on their progress and their GHG inventories every two years.

The sectors that appear feasible to include under the cap-and-trade program include:

- Electric sector, as defined by the Electricity Subcommittee;

- Large stationary combustion sources;

- Liquid transportation fuels;

- Residential and commercial natural gas combustion;

- Residential and commercial stationary combustion of fuel oil and other liquid fuels;

- Industrial process and waste management emissions; and

- Fossil carbon content of fuels.

As off January 2008, the WCI Offsets Subcommittee is still considering whether to include offsets as a part of the WCI cap-and-trade system (For a complete list of the advantages and disadvantages prepared by the Subcommittee on offsets see Appendix V.).

Midwest Initiative

The most recent of regional initiatives is the Midwestern Regional GHG Reduction Accord. On November 15, 2007, six Midwestern states (Illinois, Iowa, Kansas, Michigan, Minnesota and Wisconsin) signed a pact to develop a regional market for GHGs in response to the federal government’s failing to meet the challenge of devising a national response to climate change. The Accord states that governments have an obligation to reduce emissions in a reliable, cost-effective way while maintaining competitiveness among Midwest energy suppliers.

Participants will develop a cap-and-trade program and model rule by November 2008, however, all have agreed that the scheme will enter into force by May 2010 with the goal of reducing the region’s CO2 and other GHGs 60 to 80 percent below 1990 levels by 2050.

National Legislation?

It seems inevitable that with in the coming years there will be nation-wide legislation in the USA. Thus, how will these existing initiatives play a role in the formation of such legislation? While there is a common objective among these states to reduce GHG emissions, these various initiatives are fragmented, creating a “patchwork” of regulations. Main inconsistencies include different baseline years, reduction amounts, sector specific versus economy wide standards, and the use of multiple registries and independent verifiers. Also, the newer initiatives have not set prices for CO2, but we should expect to see some inconsistencies with prices as well. Perhaps nationwide legislation will dissolve these inconsistencies, creating a more uniform system.

Conclusion

Whether voluntary or regulated, one of the biggest issues with creating a market for CO2 is setting the correct price for a metric ton of carbon. As what happened in EU ETS, the price can fluctuate drastically. Setting the right cap on CO2 emissions is crucial if a market approach is going to work; however, the EU the market should not be overly criticized, as the significant drop in carbon permits can be attributed to the trial-and-errors of trying to establish a new trading system—each industry behaves differently. Even though the EU is ahead of the game and can provide valuable insight as to how carbon markets should function, every country is different and consequently a new trading scheme will most likely face the same pitfalls until the market can work itself out and the proper constraints can be put in place.

Another downside associated with voluntary markets is the range of processes and standards in the abscence of universally applied regulations and rules. For example, you can have 20 different firms that are voluntarily trading CO2 permits, but each of these firms may have a completely set of policies regarding these transactions. A deficiency of universally accepted guidelines and regulations coupled with insufficient transparency among corporations has induced doubt about the credibility of emission reductions. Furthermore, the lack of a commonly used registry increases the possibility that CO2 reductions are double counted, which diminishes the legitimacy of how much GHG emission are actually abated.

The USA is only in the infancy of developing CO2 markets, so that it is hard to determine the effects the cap-and-trade instrument will have on the country’s ability to competiviely and effectively reduce GHG emissions. Aside from the criticisms that voluntary markets face, when you have an increasingly globalized world fixated on capitalism, a direct command and control approach is not going to get industries, individuals and businesses to react the right way. A market approach may not be the most ideal, but it is the most compatible with our capital-oriented system.

I personally do not believe that trading emissions is addressing the real issue at hand; instead it is simply providing a way for individuals and companies to pay to ease their conscience so that they can continue to go on as usual by buying their way to carbon-neutral-ness instead of making serious lifestyle changes. However, this seems the path the world is going, so with time for the markets to mature and gain experience coupled with the possibility of universally adopted standards, registries, and regulations as well as stricter guidelines for verification/certification, the US has an enormous potential to benefit internally from market instruments while simultaneously allowing the benefits of GHG abatement to spill over to the rest of the world.

Notes (Voluntary carbon markets in the USA)

References

- California Air Resources Board (CARB). 2006. Assembly Bill No. 32, Nunez. California Global Warming Solutions Act of 2006.

- California Air Resources Board (CARB). 2007. Staff Report: California 1990 Greenhouse Gas Emissions Level and 2020 Emissions Limit. November 16, 2007.

- Chang, S. 2007. Carbon commerce: Emissions trading has a turbulent takeoff in Europe. Institute of Electrical and Electronics Engineers (IEEE) Spectrum Online Magazine.

- Chicago Climate Exchange (CCX). 2007a. About Chicago Climate Exchange. On 15 Feb 2008.

- _____. 2007b. CCX Market Report December 2007. 4 (12) 15 Feb 2008.

- Energy Information Association. 2007a. Emissions of Green House Gases Report. On 14 Feb 2008.

- _____. 2007b. International Carbon Dioxide Emissions from the Consumption of Energy and Carbon Intensity Tables: Total Emissions from the Consumption of Energy. On 14 Feb 2008.

- European Commission (EC). Emission Trading Scheme (EU ETS). On 14 Feb 2008.

- Ford, Andrew. 2008. Simulation scenarios for rapid reduction in carbon dioxide emissions in the western electricity system. Energy Policy 36: 443-455.

- Hamilton, K, Bayon, R., Turner, G., and Higgins., D. 2007. State of the voluntary carbon markets 2007: Picking up Steam. Ecosystem Marketplace and New Carbon Finance. On 20 Feb 2008.

- Harris, E. 2006. Working paper on the voluntary carbon market: Current & future market status, and implications for development benefits. International Institute for Environment and Development (IIED) and NEF round-table discussion: Can voluntary carbon offsets assist development 26 October 2006.

- Kahn, D. 2007. Six Midwestern states, Manitoba sign cap-trade pact. Environment & Energy News. On 19 Feb 2008.

- Midwestern Governors Association (MGA). 2007. Midwestern Greenhouse Gas Reduction Accord. Midwestern Energy, Security, and Climate Stewardship Summit. 23 Feb 2008.

- Ramseur, J. 2007a. Climate change: Action by states to address greenhouse gas emissions. CRS Report for Congress (RL33812). November 23, 2007.

- Ramseur, J. 2007b. Greenhouse gas reductions: California action and the Regional Greenhouse Gas Initiative. CRS Report for Congress (RL33962). August 31, 2007.

- Regional GHG Initiative (RGGI). 2005. Memorandum of Understanding. Regional GHG Initiative. On 18 Feb 2008.

- ______. 2007a. About RGGI. On 14 Feb 2008.

- _____. 2007b. Overview of RGGI CO2 Budget Trading Program (Voluntary carbon markets in the USA) . On 14 Feb 2008.

- Rousse, O. 2008. Environmental and economic benefits resulting from citizens’ participation in CO2 emissions trading: An efficient alternative solution to the voluntary compensation of CO2 emissions. Energy Policy 36: 388-397.

- Sullivan, Colin. 2008. California carbon-trading market begins to emerge. Environment & Energy News. On 20 Feb 2008.

- UNFCCC. 2007. Kyoto Protocol: Status of Ratification. On 14 Feb 2008.

- Western Climate Initiative (WCI). 2008. The Western Climate Initiative. On 19 Feb 2008.

Citation

Roman, A. (2012). Voluntary carbon markets in the USA. Retrieved from http://editors.eol.org/eoearth/wiki/Voluntary_carbon_markets_in_the_USA- ↑ carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6)

- ↑ Prices mainly vary because project size and type.

- ↑ 188 million short tons is 4% above the average emission levels observed between 2000 and 2002 (Ramseur 2007b).