Net Energy Analysis (historical)

Originally Published As:

Title: Net Energy Analysis: Handbook for Combining Process and Input-Output Analysis

Author: Clark W. Bullard, Peter S. Penner, and David A. Pilati

Source: Resources and Energy 1 (1978) 267 313. Norlh-Holland Publishing Company.

Year published: 1978

Methods are presented for calculating the energy required, directly and indirectly, to produce all types of goods and services. Procedures for combining process analysis with input-output analysis are described. This enables the analyst to focus data acquisition effects cost-effectively, and to achieve down to some minimum degree a specified accuracy in the results. The report presents sample calculations and provides the tables and charts needed to assess total energy requirements of any technology, including those for producing or conserving energy.

Contents

- 1 IntroductionWhen we consume anything, we consume energy (Net Energy Analysis (historical)) . It takes energy to manufacture, deliver and sell all types of goods and services. It is possible to add up the energy required at each step of the production process to determine the total ‘energy cost’ of particular goods and services.

- 2 Methodology

- 3 Discussion

- 4 Appendix: Tables for computing indirect energy requirements Table A-I Table A-II: Margins on Direct Energy Sold to Final Demand (Dollars/Million Btu) Table A-III Part One Table A-III Part Two Table A-III Part Three Table A-III Part Four Table A-III Part Five Table A-III Part Six Table A-III Part Seven Table A-III Part Eight Table A-III Part Nine Table A-III Part Ten Table A-III Part Eleven Table A-IV Table A-V Part One Table A-V Part Two Table A-V Part Three Table A-V Part Four Table A-V Part Five Table A-V Part Six Table A-V Part Seven Table A-V Part Eight Table A-V Part Nine Table A-V Part Ten Table A-VI Part One Table A-VI Part Two Table A-VI Part Three (Net Energy Analysis (historical))

- 5 Notes 19. ^Sectors listed are those producing major inputs to construction and operation of facilities for energy production, processing and transportation.39. ^Perry, A.M., 1977, Guidelines for net energy analysis (Oak Ridge Associated Universities, Institute for Energy Analysis, Oak Ridge, TN). (Net Energy Analysis (historical)) Glossary

IntroductionWhen we consume anything, we consume energy (Net Energy Analysis (historical)) . It takes energy to manufacture, deliver and sell all types of goods and services. It is possible to add up the energy required at each step of the production process to determine the total ‘energy cost’ of particular goods and services.

The concept also applies to facilities that produce or conserve energy. It takes energy to construct and operate oil wells and pipelines, and this should be compared to the energy output. Similarly, it takes energy to manufacture insulation for homes and additional capital equipment for industry; these energy costs can also be compared to the energy savings.

Consumers demand energy in two ways; directly and indirectly. Energy is consumed directly in the form of gasoline, electricity, natural gas, or fuel oil. It is consumed indirectly as energy used elsewhere in the economy to produce the other goods and services purchased by consumers. Indirect energy is by no means negligible; the average consumer demands more energy indirectly than directly[1].

To clarify the concept of energy cost, consider aluminum as an example. A certain amount of energy is consumed directly in the ore reduction process. But energy is also required to mine the bauxite and transport it to the smelter. Additional energy is needed to manufacture the mining and transportation equipment, and to make the inputs to these industries. All these energies have to be summed to determine the total energy cost of aluminum.

The purchase of this report is to provide a practical guide for calculating the energy cost of any item. Two methods are described. One is tedious and involves adding all the energy inputs individually and is subject to error because some inputs are inevitably neglected. The other is a simpler one-step operation that has inaccuracies due to the level of aggregation at which goods and services are defined. We describe both methods, and then show how to combine them to minimize the effort required to obtain a predetermined degree of accuracy in the result. Appendix A gives most of the data needed for any application.

The range of possible applications is quite broad. Energy analyses have been used to determine the overall energy efficiencies of systems as varied as beverage containers[2] and nuclear power plants[3]. Published results of energy analyses (particularly net energy analyses) vary for a host of reasons, due to differences in computational techniques, system boundaries, types of fuels and energy, etc.[4][5]. This report is limited to treating the computational issues involved in such analyses. The methods and results presented are consistent with a forthcoming set of ERDA guidelines for net energy analysis[6][7].

Definitions and conventions

The data and methodologies described in this report permit calculation of five types of energy ‘embodied’ in a particular goods or service. One calculation determines the coal required, directly and indirectly, to produce a unit of aluminum. Parallel calculations yield the total crude oil and gas, refined oil, electricity, and natural gas requirements. All these inputs are useful for certain purposes, but they are not directly additive to obtain a 'total energy requirement’. For example, due to the direct plus indirect nature of the calculations, there would be some double counting of electricity and the coal used to produce electricity.

To obtain a total energy figure, we adopt the convention employed historically by the U.S. Bureau of Mines to combine U.S. fuel and electricity consumption. This convention views coal, crude oil and crude gas as primary fossil energy resources, and expresses physical quantities (tons, barrels, cubic feet) in terms of their total enthalpy[8]. Similarly, hydro and nuclear electricity are viewed as primary energy resources, whose enthalpies are evaluated in terms of their fossil fuel equivalents using the prevailing heat rate for fossil electric power plants. These enthalpies are then added to define a total primary requirement, and double-counting is avoided.

Similarly, we define a total primary energy intensity as the energy required directly and indirectly to produce a unit of goods or services for final consumption. It is calculated by adding the (direct plus indirect) coal intensity, crude oil and gas intensity, and the fossil fuel equivalent of the hydro and nuclear electric intensity. It is useful to compare the total energy intensities of goods and services for broad-based analyses of conservation options, such as substituting fiberglass for steel in a manufacturing process. In specific instances where options for fuel substitution are limited (e.g., aluminum production), it is more useful to retain the individual fuel intensity detail. In particular, net energy analyses often require that the distinction between fuels be maintained, because the object of the analysis is often a facility (e.g., a power plant) for converting one form of energy to another. ‘Viewing ail energy as equal’ obscures the economic purpose of the facility[9][10].

Methodology

General

The energy cost of any economic activity can be measured by either of two general methods: Process analysis or input-output (I-O) analysis. As will be shown, both theoretically require the same data and would yield the same result if a fully disaggregated data base were available. In the real world, each technique is most useful for a particular type of problem. Aggregated, nationwide problems are well suited to I-O analysis because the data base for this analysis is a 368 sector model of the entire U.S. economy. Process analysis is more suited to specific processes, products, or manufacturing chains for which physical flows of goods and services are easy to trace.

Process analysis

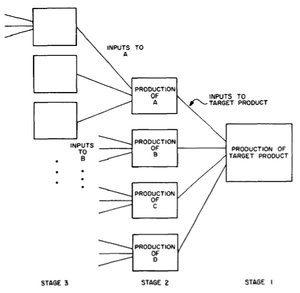

Process analysis begins by identifying one particular product as the object of study. This target product may be either a good or a service. One then examines the process which makes the product and asks: "What goods and services were required directly by this plant to produce the target product?" When the list of such inputs is obtained, it will include some fuels (direct energy) and some non-energy goods and services from other industries. The direct energy use is tallied while each non-energy input is further examined to determine the energy and non-energy inputs required for its production. This process continues, tracing back from the target product through each stage of the production process (Figure 1). Each successive step in the analysis typically identifies smaller and smaller energy inputs, and all these energy inputs are summed to obtain the total energy intensity of the target product. The first energy input is called the direct energy requirement, the remainder is called the indirect energy requirement. It is often the case that certain items appear as both inputs and outputs several places in the production tree, reflecting feedback loops of economic activity.

In stage 2 and beyond, the indirect energy inputs are identified and summed. Note that indirect energy inputs include the energy consumed in energy producing industries.

In Figure 1, there are four inputs to the production of the target product. Suppose input A is energy and B, C, and D are non-energy goods and services. The direct energy requirement is simply input A. Indirect energy inputs to the target product are the sum of energy inputs to all the production processes in stages 2, 3, and beyond.

In practice, a large number of terms is never computed, and the analysis is terminated at a point where the input is believed to add a negligible amount to total energy use. At the second stage only the most significant inputs are considered, and of those, only a subset is further broken down into its components. Unfortunately, diminishing contributions from each stage provide no guarantee that the truncated infinite number of terms actually sum to a negligible quantity.

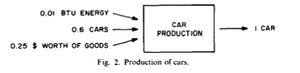

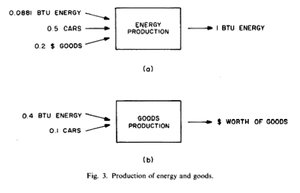

Performing a process analysis requires extensive data on the production of the target product and similar (but usually less detailed) data on any secondary, tertiary, and other inputs not truncated. For aggregated production sectors, data are obtained from government statistics on economic activity. For individual production processes, information must often be collated directly from manufacturers, trade associations. and consultants. If all flows can be measured in physical units, there is usually no reason to introduce dollar values in the analysis. so the resulting energy intensity is expressed in physical terms (energyjunit of target product). As an example we shall calculate the energy intensity of cars in a simple 3-sector economy[11]. This hypothetical economy consists only of energy, measured in British Thermal Units (Btu), cars and another aggregate industry composed of all other goods and services. We shall simply label this aggregate industry ‘goods’ and presume its output is measured in dollars due to the heterogeneity of its output. Assume that census data for all three sectors in this hypothetical economic system identify the inputs for each industry’s production process. A typical production facility in the car industry uses 0.6 car, 0.01 Btu energy and $0.25 worth of goods to produce one car, (In this entire example, the numbers are chosen arbitrarily.) The final stage of production is shown in Figure 2.

Similarly, typical energy and goods production facilities use inputs as shown in Figures 3a and 3b. Energy extracted from the earth does not appear in Figure 3a, only purchased energy inputs are shown.

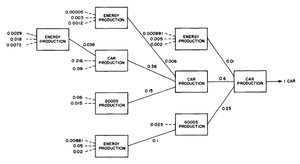

We now have most of the data necessary to calculate the energy intensity of cars using process analysis. The production ‘tree’ is shown in Figure 4, where dashed lines denote inputs that are ignored, and represent the truncation points for the analysis. Values for input flows exactly match Figures 2 and 3 in the first production stage where the output is one unit. Outputs at all other stages are less than one unit and their inputs are scaled accordingly. For example, in the second stage, 0.6 cars are produced, so scaling the inputs in Figure 2 gives (0.6)(0.01) Btu, (0.6)(0.6) cars, and (0.6)(0.25) $ goods.

In Figure 4, the direct[12] energy input to car production is 0.010 Btu/car. There are an infinite number of indirect inputs, all but three of which are neglected. They sum to 0.006 + 0.100 + 0.036 = 0.142 Btu/car. Thus process analysis yields a total (direct plus indirect) energy intensity of 0.152 Btu/car. The truncation error is unknown.

In this simple 3-sector example it is clear that we have sufficient data to carry the process analysis on for an indefinite number of steps. In a real problem, however, a process is truncated to reduce the data acquisition effort. For example, in an economic system with hundreds of sectors, a process analyst may follow only the largest branches on the tree to limit data acquisition efforts to those sectors most important to the particular target product.

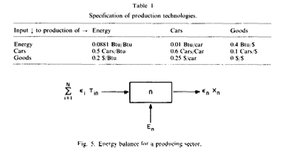

In Table I, the inputs shown in Figures 2 and 3 are arranged in matrix form, normalized to one unit of output. This matrix is one way to represent the technologies for all goods and services in our hypothetical economy. Note that it shows only interindustry flows, not resource flows from Earth to producing industries.

Entries on the diagonal show the amount of self-input required to produce 1 unit of output. For example, each Btu of energy output requires 0.0881 Btu of energy input. This representation of the data, as we shall see below, is useful for input-output analysis.

Input-output analysis

Input-output analysis is a modeling technique used extensively in economic research since its introduction by Leontief (1941)[13]. It has been adapted to analyze energy and labor intensities[14]. The structure of the model, a large linear network, remains the same for any variable. Initially the economy must be disaggregated into N major sectors. each producing a unique good or service and each characterized by a node in the network equations. Examples of these sectors might be primary metals, retail trade or petroleum products. Figure 5 shows the energy flows entering and leaving each sector. Energy ‘embodied’ in outputs from other sectors enters at the left and can be expressed as Ei, Tin energy intensity of product i times the input of sector i to sector n. Energy embodied in the sector’s output is shown exiting at the right and is expressed as the product of the energy per unit of sector n output (epsilon;n) and its output (Xn). If in fig. 5, sector n denotes the energy sector, a non-zero amount En is extracted from the earth. The energy balance equation becomes

<math>sum_{i=1}^N varepsilon_i T_{in}+E_n=varepsilon_n X_n</math>

or, in matrix notation we have

<math>varepsilon T + E = varepsilon hat{X}</math>

The above set of N equations can be solved for the N unknowns, ?. X is the diagonal matrix whose elements represent the total output from each sector.

For a typical product, n, the production technology is represented by a vector An where a typical element Ain, represents the amount of product i needed directly to produce a unit of product n. The N x N matrix A then provides a linear representation of the technology of producing all goods and services. From this definition of A we have

<math> T = A hat{X}</math>

and equation (2) becomes

<math>varepsilon = e (I-A)^{-1}</math>

where e is a unit vector which identifies the energy sector row of (I -A)-1 as the energy intensities[15]. For a multi-fuel economy, this analysis can be repeated for each type of energy (coal, oil, etc.) and the total primary energy intensities can be calculated[16].

Though I-O is a simple and elegant technique, it would hardly be useful without large amounts of data. The U.S. Department of Commerce has reported economy-wide data separated into 368 sectors of economic activity for 1963 and 1967. From these data, the A (technological coefficients) and 2 (total output) matrices are determined. Physical data for the E (energy) vector are available from a variety of sources and are equal to the output, Xn of the primary energy-producing sectors. Thus, equation (4) can be solved for an ? (energy intensity) vector containing 368 values for the entire economy in the year studied.

This pure I-O approach implicitly assumes that the target product is typical of a certain sector’s output. (The same assumption was made for ‘cars’ in the process-analysis example.) Treatment of atypical products is discussed in section 2.3.2.

A simple I-O example

Now we consider a practical application of input-output analysis. It makes use of a 357-sector description of the U.S. economic system in 1967. It includes detailed information on consumption of five forms of energy by each sector, and is based on data from the U.S. Bureau of Mines and the U.S. Department of Commerce Bureau of Economic Analysis (BEA).

In this example we shall calculate the energy cost of a typical large computer. We assume that the price (to the ultimate consumer) was $1,000,000 in 1970. The first step is to determine which of the 357 BEA economic sectors produces computing machines. Reference to the table of the Industry Classification in the 1967 Input-Output study shows that the correct sector is 51.01, ‘computing and related machines’. The table also lists the SIC (Standard Industrial Classification) industries included in BEA sector 51.01. Thus for a more detailed description of 51.01, one could check either the results of the Office of Statistical Standards (1967) or those of the U.S. Department of Commerce (1970) to insure that the correct sector is used.

Having identified the appropriate sector, the corresponding energy intensity can be obtained from Table A-4, and it is multiplied by the quantity of computers to obtain the total energy cost. The total primary energy intensity given in the table is 47,116 Btu per 1967 dollar’s worth of computers. The Department of Commerce data used to construct the I-O tables in 1967 measured that sector’s output in dollars because of the aggregation within the computer industry; that is why the energy intensity is given in those terms. This is true for all non-energy sectors in the U.S. input-output tables; only the five energy sector outputs are expressed in physical units (Btu).

However, due to inflation between 1967 and 1970, there is a difference between one million 1967 dollars’ worth of computers and one million 1970 dollars’ worth, even though we’re talking about exactly the same machine. If we convert the $1 million price tag in 1970 to 1967 prices, we can remove the effects of inflation, and the ‘1967 dollars’ unit of measurement becomes a surrogate for a physical unit of measurement[17]. Using price indices (deflators) from Table A-1 we calculate the quantity of computers in units of 1967 dollars:

Value of a million dollar (1970) computer in 1967 dollars

<math>= $10^6 frac{(1967 price index for 51.01)}{(1970 price index for 51.01)} - (10^6) frac{1.0}{1.015}</math>

<math>=(10^6) 0.99=$990.000 (1967)</math>

This figure is multiplied by the total primary energy intensity (E) for sector 51.01, found in Table A-4,

Energy cost of computer

=$990,000 (1967) x 47,116 Btu/$1967

=46.64 billion Btu

This example demonstrates how energy costs can be found quite simply using I-O. However, anyone employing this method should have a good understanding of the limitations and uncertainties inherent in it.

Uncertainty associated with I-O analysis

One source of uncertainty which has been mentioned already is the change in price levels over time. Due to inflation, price levels change while physical quantities (and energy cost) may not. Price level changes can be approximately corrected using deflators as above, though deflators are sometimes inaccurate and may not strictly conform to BEA sector definitions. Measuring quantities in terms of constant (1967) dollars is a surrogate for using physical units. For some products the correspondence between physical units and 1967 dollars is known. The average 1967 price data in Table A-5 can be used to express many energy intensities directly in terms of Btu per physical unit.

Another source of uncertainty is change in the structure of the economy, the technology of producing goods and services, as represented by the matrix A. Energy intensities are a function of A alone, and as technological change occurs over time, the uncertainty in ? will increase. Recent studies have identified the parameters in A which are most important for energy analysis and work is now underway to update them to reflect the latest technological advances[18].

Some of the uncertainty in ? is due to sector aggregation. Ideally, each product would be a unique output of a BEA sector, and therefore would have a unique energy coefficient. Because millions of different goods and services are produced by the U.S. economy, it would be infeasible to collect data on N2 technological coefficients at that level of detail. In practice, many similar products or services with a range of energy costs are grouped in a single sector. The question one wants to ask prior to calculation is: How much of BEA sector X is devoted to making the target product X1? To answer this question, it is possible to go back to the original Department of Commerce data base and examine the composition of each sector. We have done this and list in Table A-5 some common BEA sectors and their major products[19]. To the extent that the target product is typical of the sector’s output, the sector energy intensity is a relatively accurate measure of its energy cost. This table provides a basis for estimating the certainty in an energy intensity, as applied to a particular product. If the target product were a very minor output of a large or diverse sector, there is little the user can do to correct the error using input-output analysis. There is a way to eliminate this problem, and it will be discussed in section 2.4.

|

Table 2. Energy Cost of a Computer | |||||

| Sector | % of purchase price (Table A-3) |

Allocated share of total cost ($1970) |

Deflator ($1967/$1970) (Table A-1) |

Energy intensity Btu/$1967 (Table A-4) | Primary energy cost (109 Btu) |

| 65.01-65.06 | 0 | - | - | - | - |

| 69.01 | 5 | $50,000 | 0.91 | 39.636 | 1.8 |

| 69.02 | 1 | $10,000 | 0.84 | 39.372 | 0.3 |

| 51.01 | 94 | $940,000 | 0.99 | 47.116 | 43.8 |

| Total | $1,000,000 | 45.9 | |||

A number of economic and accounting conventions also cause problems. Since data are collected from firms rather than consumers, they are based on the firm’s value of the product, or producer’s price. However, consumers pay not only this price but also the wholesale and retail margins, transportation costs, insurance, etc., required to market the product. In the previous example of the energy cost of the computer, these margins were ignored. Taking them into account, the calculation proceeds as follows:

The total price (to the purchaser) of the computer is $1,000,000 in 1970. Of this, the margins can be obtained from Tables A-2 and A-3, and a more accurate energy cost can be determined as set forth in Table 2. This result compares to 46.64 x 109 Btu in the previous example where the margins were not explicitly accounted for. The favorable comparison is fortuitous in this example because the energy intensity of computers happens to be approximately equal to that of trade. For a more energy-intensive commodity (e.g., steel), the impact of including margins explicitly could be quite significant.

Another economic convention is that purchases of capital goods are counted as net outputs of the economic system, rather than as inputs to production processes. This means that ordinary I-O energy intensities[20] do not include the energy required to build the factories or machines used by each sector. A correction[21] has been performed using capital requirements data from Fisher and Chilton (1971)[22], so the energy intensities presented in Table A-4 include the energy required to make capital equipment.

Finally, there is uncertainty in the results due to errors in collecting and processing the basic data on the technology of producing goods and services. These errors include those due to, more specifically, incomplete census coverage, reporting errors due to misunderstanding, false reports, sampling errors inherent in surveys of firms, transcription or key punching errors, the possibility that forms are lost, classification errors, and the problems of separating companies from establishments in processing returns from surveys or census. Considerable effort has been expended in trying to estimate these stochastic errors, and their effect on the resulting energy intensities. Our investigation considered all the sources of error listed directly above including incomplete reporting. Briefly, results indicate that the energy intensities are approximately normally distributed with more than a 99% likelihood that the actual value falls within the error bounds shown in Table A-4[23]. It is assumed that these values, computed at the aggregated 90-sector level, can be applied directly to the 357-sector intensities. However, these figures do not include uncertainty due to changes in the technology of producing goods and services since 1967. Where significant process changes have been made, the error bounds should be increased.

Table 3 summarizes the error treatment in energy input-output analysis and points to two errors that are unresolvable using this technique.

The last two items in Table 3 result from the fact that the U.S. input-output tables are aggregated to such a level that it is not possible to express each sector’s output in terms of a single physical unit, and the data are collected on establishments not directly on processes. Methods for eliminating these problems are discussed by Herendeen and Bullard (1974)[24].

|

Table 3. Limitations of input-output analysis | |

| Problem | Treatment |

| 1. Price level changes |

Use Tables A-2 and A-6 |

| 2. Technology changes (since base year) |

Updated energy intensities not yet available |

| 3. Aggregation: Typical and atypical products | Use Table A-6 |

| 4. Producer's versus purchaser's prices |

Use Tables A-3 and A-4 |

| 5. Including energy cost of capital |

Use Table A-5 |

| 6. Uncertainty in base year data |

Use Table A-7 |

| 7. Physical flows assumed proportional to dollar values |

Use a more disaggregated model |

| 8. Errors due to secondary products and linearity assumptions |

None |

Combining process and input-output analyses

As shown above, the energy cost of any good and service can be determined by either process analysis or input-output analysis. In theory, both methods require identical input data and provide identical results.

For most applications, however, the complete set of input-output data (the N x N matrix A) are not available at the necessary level of detail. It exists only at a more aggregated level of about 368-sectors for the United States economic system, and is much smaller for most other nations.

Because of this lack of data, input-output results give only the average energy intensity of a sector’s output. Accuracy is limited by the level of aggregation: the energy intensity of aluminum castings would apply to both pressure cookers and aluminum tools because both are included in sector 38.11. Process analysis does provide a framework for determining the energy intensity of atypical products within a sector. The chain of inputs can be traced back to the point where all inputs are sufficiently ‘typical’ or until the inputs are so small that the aggregation error is tolerable.

The errors associated with truncating a process analysis can be minimized using the results of input-output analysis. The truncation error is replaced by a smaller aggregation error associated with energy-costing the higher indirect order inputs. The combination of these techniques is called ‘hybrid analysis’ and the procedures are described below.

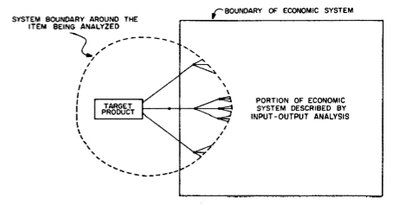

Theoretically, each step in a process analysis may be viewed as an expansion of the system boundary (around the item being analyzed) into the economic system, tabulating direct energy inputs at each step (see Figure 6). The results of input-output analysis may be used to estimate the energy embodied in flows crossing the system boundary at any level, by associating each good or service with one of the 368 sectors of the I-O model. These I-O results are indifferent to the location of the system boundary. Regardless of the number of process analysis steps taken, the boundary looks the same from the I-O side. Thus in theory, it does not matter at which stage of the process analysis you correct for the truncation error. In practice, by carefully choosing the number of stages, hybrid analysis can reduce the error in both techniques and produce the most accurate result possible. The truncation error is eliminated from the process analysis and the aggregation error is minimized in the I-O analysis.

Procedure

To perform a hybrid analysis, begin by doing the first one or two steps in a process analysis. Select the target product and carefully determine the energy and materials required for its production. Some of the input materials may be typical products of I-O sectors; I-O can be used to determine their total energy costs with only a single additional calculation. Thus the only input materials requiring further process analysis are atypical products not easily classified in an l-O sector. The technology for producing these items must be examined to identify their inputs which must in turn be energy-costed with either I-O or further process analysis, depending on whether they are typical or not. Hybrid analysis is best suited for large atypical problems such as determining the energy cost of a power plant, since there is no I-O sector corresponding to power plant construction.

Example

We will now calculate the energy cost of a large prototype coal-fired power plant[25]. Assume that information on this plant is available from either a line-item plant budget or an expert consultant on the project. Our objective is to calculate this energy cost in the easiest manner within an uncertainty of ±10%. A sequence of approximations will be used, starting with the simplest assumptions. The sequence can be terminated as soon as the error tolerance is less than 10%.

As a first approximation, we could multiply the dollar cost of the power plant ($88 million[26] at 1970 prices, ±15%) by the average intensity for all goods and services in 1970 (68,690 Btu/$)[27]. This coefficient is simply the ratio of total U.S. energy use to gross national product in 1970. When used to approximate the energy intensity of a particular item such as a power plant, this coefficient has an extremely large uncertainty (say a factor of two: + 100%, - 50%. The total energy cost and error terms are given by the formula

(a±?)(?±??) = a?±a??±??a±???a

where a is the budget figure and ? the energy intensity, and ?a and ?? represent the uncertainties. Values for ?a and ?? are obtained by simply multiplying a and ? by their respective percentage errors. This first approximation yields an energy cost of 6.04 x 1012 Btu, while the first-order errors are clearly far outside the desired tolerance interval,

+(??a) + (a??) = +6.9 x 1012 Btu (+114%),

-(??a) - (a??) = -3.9 x 1012 Btu (-65%).

For some applications, however, errors such as these may be acceptable, and the analysis could terminate here.

The second approximation begins by identifying the major single expenses in the budget. Assume that an expert consultant provided a list of such purchases shown in Column I of Table 4. Care must be taken to identify each expense with its appropriate BEA sector, as defined by the U.S. Department of Commerce (1974)[28].

The energy cost calculation for these purchases, including removal of transportation and trade margins and price deflation, is shown in Columns II thru VII of Table 4. Energy used directly (on-site for construction) should be included in every energy cost calculation, because it may be significant even if it is not a large dollar expense. The energy embodied in the remaining (miscellaneous) inputs to the plant is estimated using the energy/GNP ratio as an average energy intensity as was done in the first approximation.

Column VIII contains the error due to budget uncertainty (??a), which is assumed in this example to be 15% for all items. Column IX reflects the uncertainty in the energy intensity (a??). The magnitude of the uncertainty in ? is based on Table A-6[29]. An examination of Table A-6 can indicate whether an input is typical of a particular sector’s output. Assume that, based on careful classification and data from the consultant, all inputs except construction machinery (45.00), are believed to be typical sector outputs. Typical inputs can use the figure from table A-6 for their ?? terms. To account for the atypical construction machinery, an additional 20% is added to the construction machinery uncertainty from Table A-6.

|

Table 4. Second-approximation energy cost Inputs(I)1970 price($103)(II)BEA sector (III)$1970 to $1967 deflator (IV)1967 price ($103) (V)Price less margins[30]($103 1967)(VI)Energy Intensity (Btu/$) (VII)Energy (109 Btu) (VIII)Budget uncertainty (??a)(109 Btu) (IX)Energy intensity uncertainty[31] (a??)(109 Btu) Structural steel$25,00040.000.9022,50018,950105,582200130660Turbines10,00043.000.878,6007,99581,1146489719Construction machinery2,50045.00 0.862,1501,95782,5341622439Transformers3000 5.77 x 1011 Btu 53.00 31.01 0.92-- 2,765-- 2,516-- 65,401 1.219 Btu/Btu 165703 25105 521 Energy7.20 x 106 Btu9.69 x 108 Btu 68.0168.02 ---- ---- ---- 4.0641.126 Btu/Btu <11 ---- ---- Miscellaneous$42,4010.8737,594 42,19273,3823096464+3096-1548 Total73, 60973,6096776+3583 (+53%)-2052 (-30%) The result of calculating the second approximation is a total energy cost of 6.78 x l012 Btu with error bounds of + 53%, - 30%[32] This is an improvement but it still does not fall within our desired ±10% limits. In the next approximation fewer inputs are classified as miscellaneous in order to further reduce the error. Assume that we instructed the consultant to write down every significant budgeted expense classified in BEA sectors 36.00, 38.00, 40.00, 42.00, 43.00, 45.00, 46.00, 49.00, 53.00, 62.00, and 75.00. These sectors were chosen because they contain most of the materials commonly used for power plant construction; the amounts appear in Column I of Table 5. As in Table 4, computing the energy (Net Energy Analysis (historical)) cost of these purchases is straightforward and the remaining expenses are costed with the average energy/GNP ratio as before. The error analysis proceeds as in the previous step, and this time the error is + 15, - 13%, for an energy cost of 7.19 x 1012 Btu. This still does not meet our accuracy requirements so the analysis must proceed another step. From Table 5 it appears that two of the largest errors are due to budget uncertainties for sectors 43.00 and 40.00. Assume that we have no way of improving the 15% accuracy of the expenses in sector 43.00, but note that the budget figure in sector 40.00 has an unusually large (±30%) error. Assume that, with a small effort, the consultant could improve the error term on structural steel expenses to ±15%. This reduces the ??a error in that sector and reduces the error bound for the entire power plant to + 8, - 7%. This is within our error specification and the analysis can now be terminated. To give an idea of how much effort was saved by these approximations, a complete computation from a line-item budget for the plant is shown in Table 6. Column I lists all inputs deflated to 1967 dollars with margins already computed and assigned to the appropriate margin sectors. This is why, for example, sector 65.01 (rail transport) shows an expense of $883,154 even though the plant budget may not actually show any money allocated to direct purchases of rail transport. This complete I-O analysis eliminated the large errors due to use of the average energy/GNP ratio as an energy intensity. It can be seen that accuracy has been slightly improved by this method; total energy cost is 7.36 x 1012 Btu ±7%.

| ||||||||||||||||||||