Energy profile of Syria

Energy profiles of countries and regions  (February 20, 2013 update) Since the onset of protests in March 2011, Syria's energy sector has encountered a number of difficult challenges. Damage to energy infrastructure—including oil pipelines and electricity transmission networks—and the effects of Western-led sanctions have combined to hinder the exploration, development, production, and transport of the country's energy resources. While Syria is not a major player in the global energy system, the ongoing conflict will continue to have consequences in domestic and regional energy markets.

(February 20, 2013 update) Since the onset of protests in March 2011, Syria's energy sector has encountered a number of difficult challenges. Damage to energy infrastructure—including oil pipelines and electricity transmission networks—and the effects of Western-led sanctions have combined to hinder the exploration, development, production, and transport of the country's energy resources. While Syria is not a major player in the global energy system, the ongoing conflict will continue to have consequences in domestic and regional energy markets.

|

The Syrian energy sector continues to suffer from the combination of ongoing fighting between government and opposition forces and stiff Western-led sanctions. |

Syria faces major challenges in supplying heating oil and fuel oil to its citizens, and electricity service in some regions is sporadic as a result of fighting between government and opposition forces. Further, the exploration and development of the country's oil and natural gas fields is delayed indefinitely in most places. Even when the fighting subsides, it may take many months—or more—for the Syrian domestic energy system to return to pre-conflict operating status.

As of October 2012, the direct and indirect costs of war to the Syrian oil industry stood at approximately $2.9 billion, according to statements made by Syria's Minister of Petroleum and Mineral Resources. A large portion of this total reflects the loss of Syria's oil exports, which have been limited by escalating sanctions by the United States, European Union, and others. Additionally, domestic energy infrastructure—such as railway networks, oil pipelines, and refineries—is frequently the target of attacks, leaving many areas of the country without access to vital petroleum products. According to the Syrian government, damage to the country's energy infrastructure totaled approximately $220 million through the end of October 2012. Of that total, the electricity sector accounts for the majority of damage ($146 million), while damage to oil infrastructure amounted to more than $70 million.

Regionally, the continued violence threatens to derail Syria's ambitions of becoming an important energy transit country to its neighbors, the Mediterranean (Mediterranean Sea), and Europe. Syria's attempts to develop international oil, natural gas, and electricity networks will falter until there is a cessation of hostilities, and recent pullouts by international partners further reduce the probability of success. Damage to existing infrastructure already threatens the viability of such projects, and the sanctions on Syria's energy sector make progress unlikely in the short term.

While Syria was one of the larger energy producers in the Levant prior to March 2011, the ongoing hostilities—and sanctions—threaten to undermine its position. Damage to Syria's domestic energy infrastructure makes meeting internal demand all the more difficult in light of severe limitations on imports of petroleum products. Further, sanctions will limit activity by international energy companies, and uncertainty over the future of the Syrian energy sector will likely delay any decisions on investments not already prohibited under the current sanctions regime. Against this backdrop, Syria's energy sector is in a state of disarray, and the current conflict threatens to set Syria's energy sector back by years.

Source: Central Intelligence Agency, The World Factbook

Contents

Oil

|

Syrian oil production is down by over 50 percent since March 2011. - February 2013 |

Syria began issuing concessions to oil companies in the 1930s, but production did not begin in the country until the late 1960s, and even then at very low levels. Despite low production totals, Syria still earned money from its oil sector, primarily through transit fees on international pipelines. Even today, Syria's role in the international energy system is tied to its position as a potentially important transit country, a position that Syrian leaders hope to strengthen in the future. Nevertheless, oil exports have been a vital component of Syria's export economy, accounting for roughly 35 percent of the country's total export revenues in 2010, according to IHS reports.

The Oil & Gas Journal (OGJ) estimated Syria's proved reserves at 2.5 billion barrels as of January 1, 2013, a total larger than all of Syria's neighbors except for Iraq. Much of Syria's crude oil is heavy and sour, making the processing and refining of Syrian crudes difficult and expensive. Further, as a result of sanctions placed on Syria by the European Union in particular—which accounted for the vast majority of Syrian oil exports previously—there are limited markets available that can import and process the heavier crudes produced in Syria. As such, Syrian government revenues are severely limited by the loss of oil export capabilities, particularly the lost access to European markets, which in 2011 imported $3.6 billion worth of oil from Syria according to news reports.

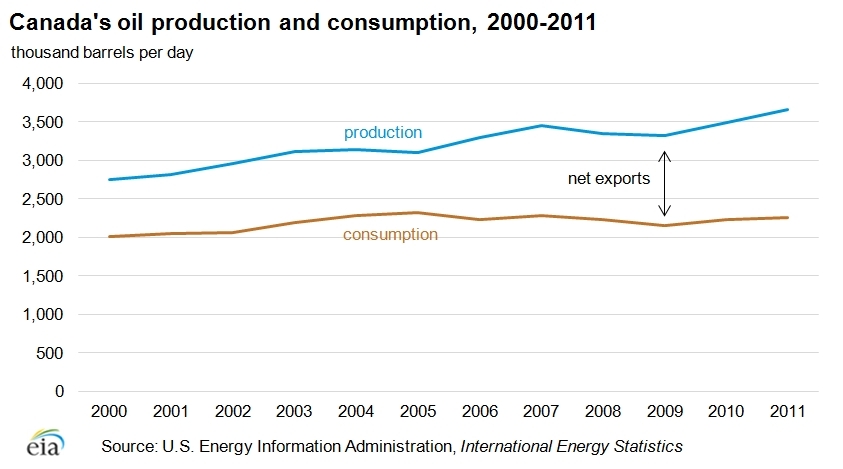

In 2011, Syrian total petroleum consumption was 258,000 barrels per day (bbl/d) while total production was 330,800 bbl/d, but the country has limited refining capacity and therefore must import refined products. Sanctions, and the resulting loss of oil export revenues, make importing such products difficult, although several countries continue to pursue energy deals with Syria, including Iraq, Iran, Russia, and Venezuela.

Sector organization

In 1964, Syria passed legislation that limited licenses for exploration and investment to the Syrian government, and the oil sector remains structured this way. The Ministry of Petroleum and Mineral Resources oversees the Syrian oil sector and is in charge of setting policy priorities and coordinating the efforts of the General Petroleum Company (GPC) and the General Organization for Refining and Distribution of Petroleum Products (GORDPP), both created in 2009.

The GPC oversees the strategies for exploration, development, and investment in Syria's oil and gas sector, and supervises the activities of its numerous affiliated companies, including the Syrian Petroleum Company (SPC) and the Syrian Gas Company (SGC). The SPC is Syria's largest state-owned oil company and has a number of production-sharing agreements (PSAs) in place throughout the oil sector. Most of the country's PSAs are evenly split between the SPC and its partners. These arrangements often ensure that the Syrian government retains a certain percentage of the oil produced in its fields as royalties, and contracts regularly last up to 25 years.

The SPC operates through several subsidiaries, with the most notable being the Al-Furat Petroleum Company (AFPC), which is a joint venture between the SPC, Royal Dutch Shell, the Chinese National Petroleum Company (CNPC), and India's Oil and Natural Gas Corporation (ONGC). Other SPC subsidiaries include the Deir Ez-zor Petroleum Company, the Syria-Sino Alkawkab Oil Company, the Hayan Petroleum Company, the Oudeh Petroleum Company, and the Dijla Petroleum Company. Other international oil companies with interests in Syria include Gulfsands, Sinopec, and Total, and several other smaller companies also have stakes in the Syrian oil sector.

The GORDPP manages the country's downstream portfolio for both oil and natural gas, and oversees the operations of the Banias Refinery Company and the Homs Refinery Company, among other duties. Other important state entities overseen by the GORDPP include the Syrian Company for Oil Transport (which operates the country's pipelines), Mahrukat (which deals with refined products), and Sytrol (which is the state marketer of petroleum products).

Exploration and production

|

Fighting between government and opposition forces makes oil exploration in Syria nearly impossible, and further bidding rounds are unlikely to occur until a resolution occurs. |

Exploration in Syria, already limited, is at a virtual standstill as a result of the ongoing conflict in the country. Bidding for offshore blocks—scheduled to be completed in 2011—is still delayed, and as long as conflict persists additional bidding rounds are unlikely to occur. While crude oil exploration and production in Syria began to fall with the onset of unrest in 2011, the country continues to do its best to maximize its output in the face of stiff sanctions and damage to the country's energy infrastructure. With the expansion of sanctions by the United States, European Union, and others, many of the international oil companies (IOCs) and national oil companies (NOCs) doing business in Syria ceased operations, further limiting Syria's exploration and production capabilities.

In September 2012, Syria was accused of illegally operating at the 22,000 bbl/d Hayan field after the SPC's international partner invoked force majeure when operations became untenable. These accusations help shed light on the difficult position Syria is in now that many of the IOCs previously involved in the country are adhering to the sanctions.

Average oil production from 2008–2010 was stable at approximately 400,000 bbl/d, but since the combined disruptions of military conflict and economic sanctions began the average dropped noticeably. The latest EIA data indicate that production in Syria was 153,000 bbl/d in October 2012, a nearly 60 percent decline from March 2011 when the conflict began. Syria's oil fields remain largely unaffected—in terms of damage from fighting and sabotage—but limited opportunities to export crude and other liquids, and limited domestic refining capacity, have resulted in shut-in production. EIA estimates total production shut-ins in Syria totaled 220,000 bbl/d as of November 2012.

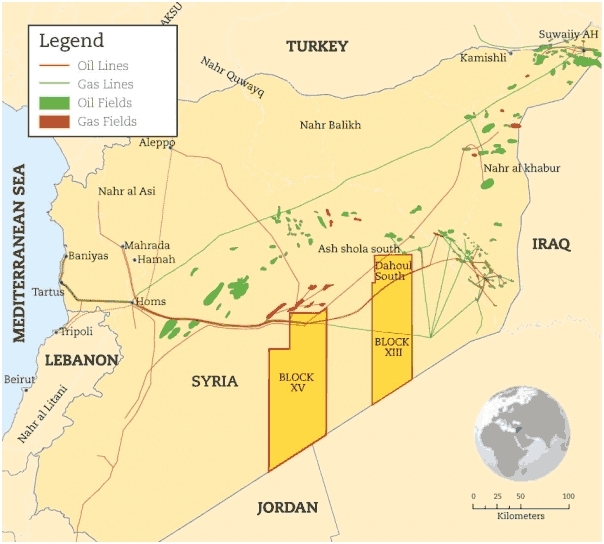

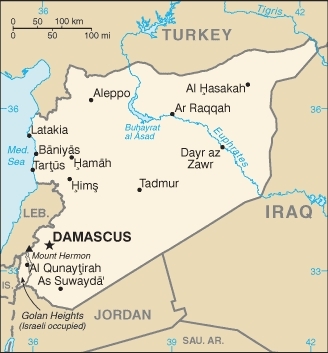

Most of Syria's existing oil fields are located in the east near the border with Iraq or in the center of the country east of the city of Homs. Reports indicate that special security units are deployed at many of the country's oil fields and facilities to protect them from sabotage. The additional security—and the understanding by both sides that the oil sector will be critical to Syria's economy moving forward—means that the center of the country's oil exploration and production operations are less likely to sustain damage from the ongoing violence, although attacks are not uncommon.

| Field name | Production ('000 bbl/d) | Source: IHS, EIA estimates, trade press | |

|---|---|---|---|

| Suwaidiyah | 104.4 | ||

| Karatchok | 21.8 | ||

| Gbeibe | 12.1 | ||

| Sheikh Said-Zurabeh-Babassi | 10.4 | ||

| Wadi Obeid | 5.5 | ||

| Ghouna | 4.8 | ||

| Rumailan | 4.2 | ||

| Jubaissah | 3.6 | ||

| Hamzah | 2.1 | ||

The past several years saw an increased emphasis on the use of enhanced oil recovery (EOR) techniques in Syria, with several companies promising increased investment in the country's mature oil fields. The AFPC utilizes water- and gas-injection systems to aid recovery in many of its fields, and—with little in the way of new discoveries expected—EOR techniques are likely to become increasingly important for ensuring stable output.

Syria also has oil shale resources, with estimates of reserves ranging as high as 50 billion tons as of late 2010 according to Syrian government sources. A bidding round for the country's shale resources was scheduled for November 2011, but had to be delayed because of the political situation in the country.

Refining

Syria has two state-owned refineries, one in Homs and the other in Banias. The combined capacity of the two refineries at the end of 2012 was just below 240,000 bbl/d according to the Oil & Gas Journal, a total capacity that meets only three-quarters of Syria's domestic demand for refined products. With damage to pipelines and other infrastructure around the refinery at Homs in particular, Syria's actual refining capacity may be lower. According to news reports citing official government statistics, the consumption of refined products decreased over the first eight months of 2012, with gasoline consumption alone down by more than 10 percent. The decline, however, is a product of both stifled demand and insufficient supply.

To help alleviate the shortfalls of petroleum products in the country, Syria is pursuing arrangements with Iran, Iraq, Russia, Venezuela, and other countries wherein Syrian crude is exchanged for refined products like heating oil and diesel fuel. Such arrangements should help in the short term, but increasing Syria's refining capacity remains a long-term goal of Syrian leadership.

Several proposed refineries are now on hold or canceled altogether, such as the proposed 100,000 bbl/d facility at Abu Khashab backed by the CNPC, which was canceled due to the political unrest in the country. Additionally, several other proposals are unlikely to move forward until the situation on the ground stabilizes. Nevertheless, an agreement between Syria, Venezuela, Iran, and Malaysia to build a refinery with 140,000 bbl/d capacity at Furqlus, near Homs, remains a possibility.

Imports and exports

Syria's exports of crude oil and petroleum products were severely restricted in 2012 as a result of sanctions.

In the 12 months prior to the onset of protests in March 2011, approximately 99 percent of Syria's crude exports went to Europe (including Turkey) according to trade data available to EIA. In 2012, only four cargoes were loaded, none of which went to European markets. Further exacerbating the effects of decreased European imports is the fact that Syria's heavy crudes require specific refining capabilities not found in all potential destination markets, thereby limiting the potential alternatives available for exports. Because the majority of Syria's oil exports previously went to European countries (which possess the ability to process Syrian grades), the current market for Syrian crude is extremely limited, but there are some countries still willing to take Syrian crude.

According to several news outlets, Syria and Russia agreed to swap 33,000 bbl/d of Syria's crude oil in exchange for gasoline and diesel fuel. This arrangement comes on the heels of shipments from Iran, Iraq, Malaysia, and Venezuela of much-needed petroleum products, although—unlike the barter deal with Russia—those deals were monetized.

The ongoing conflict diminishes Syria's production—and possibly refining—capacity, and heating oil (known in Syria as mazut) and diesel fuel are two of the products in short supply. Iraq agreed to send up to 720,000 tons of fuel oil to Syria as part of a one-year supply contract signed in June 2012, and Iran agreed in early 2012 to supply Syria with 900,000 tons per year of liquefied petroleum gas (LPG). Both of these arrangements—as well as the deal with Russia and others with Venezuela—help close the supply gap created by the sanctions, but even with lowered demand in Syria shortfalls are likely to persist.

Syria has three export terminals on the Mediterranean, all of which are operated by the Syrian Company for Oil Transport (SCOT) under the GORDPP. Syria exports two crude oil blends, Syrian Light and Syrian Heavy (also known as Souedieh) through Sytrol, the state-owned marketing company. Since the sanctions on Syria's oil sector came into full effect, total exports have fallen significantly, and they are not expected to rebound until there is a cessation of hostilities in the country.

Pipelines

Syria's domestic pipeline network is well-developed, although several sections have been damaged by fighting and sabotage since war broke out. One particular stretch of pipeline near the city of Homs (home of one of the country's two refineries) was damaged several times during 2012, interrupting oil flows and exacerbating the acute shortages of petroleum products in the country.

The SCOT manages the Syrian pipeline system, including its international connections with Iraq. Of the two pipelines between Syria and Iraq, only the Ain Zalah (Iraq)—Suweidiya (Syria) remains in operation. The Kirkuk (Iraq)-Banias (Syria) pipeline sustained damage in the U.S.-led invasion of Iraq in 2003, and despite agreements pledging to repair and restart the pipeline, progress is proving difficult.

Despite the challenges facing many energy projects in Syria, there are several plans underway to enhance Syria's role as an energy transit country. One particular project proposes to build two oil pipelines (and one for natural gas) that would send Iraqi crude to the Mediterranean coast in Syria, and from there to international markets. The first of the proposed pipelines would send heavier crudes from northern Iraq and have a capacity of 1.5 million bbl/d. The second pipeline would send lighter grades from southern Iraqi fields, and would follow the same route as the former Haditha-Banias pipeline; the second section is scheduled to have a 1.25 million bbl/d capacity. It is unlikely that this proposal will make significant progress until the situation in Syria improves. Thus far, pledges to become an important transit country in the eastern Mediterranean remain unfulfilled, and this is unlikely to change until there is a resolution to the conflict.

Natural gas

|

Syria has proven natural gas reserves of 8.5 trillion cubic feet. |

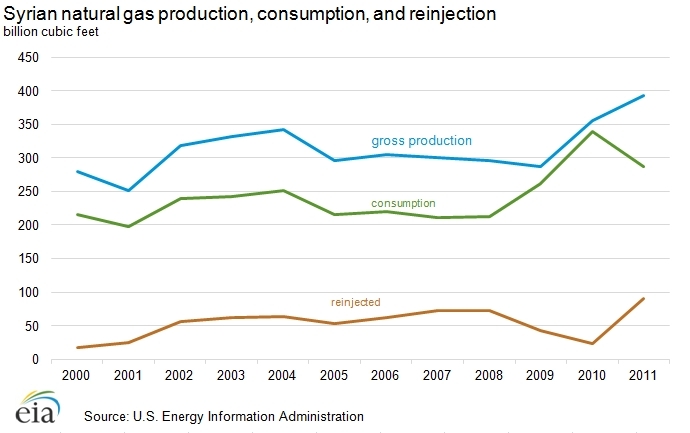

Natural gas consumption in Syria rose by 33 percent between the years 2000 and 2011, while gross production rose by slightly more than 40 percent. In 2008, Syria became a net importer of natural gas, but the country's current state of conflict—and the attendant sanctions—could impact the ability of Syria to receive volumes moving forward. Syria's plans to convert all existing thermal power generation facilities to natural gas-fired plants (many are currently using refined petroleum products) hinge on these volumes being available, but this goal appears out of reach at least in the short term.

The Oil & Gas Journal reported at the end of 2012 that Syria held proved reserves of 8.5 trillion cubic feet (Tcf) of natural gas. As with the country's oil fields, the majority of Syria's natural gas fields are found in the central and eastern parts of the country. Most of Syria's natural gas is used by commercial and residential customers and in power generation, but Syria also uses its natural gas in oil-recovery efforts, with an average of nearly 17 percent of daily gross production re-injected into the country's oil fields between 2000 and 2011. Syria reduced the venting and flaring of natural gas noticeably over the past decade, with an average of just 2.7 percent of its gross production being wasted in that way since 2000. By comparison, in the 1990's Syria vented and flared roughly 10 percent of the natural gas it produced.

Sector organization

Like the oil sector, Syria's natural gas sector falls under the jurisdiction of the Ministry of Petroleum and Mineral Resources. As such, many of the governing bodies are shared by the oil and natural gas sectors in Syria. The Syrian Gas Company (SGC)—which falls under the GPC—is the key entity in Syria's upstream natural gas operations, a position it inherited after being split off from the SPC in 2003. Syria's natural gas distribution network is managed by the SCOT. The majority of Syria's gas-processing plants are operated by state-owned firms—led by the SPC—but there are a handful that are operated by international companies.

| Operator | Facility | Estimated Capacity |

|---|---|---|

| SPC | Deir Ez-Zor | 441 MMcf/d |

| Palmyra | 264 MMcf/d | |

| Palmyra (South Middle Area Gas Project) | 247 MMcf/d | |

| Jbessa Plant | 105 MMcf/d | |

| Suweidiya/Hasakah | 23.2 MMcf/d | |

| AFPC | Omar Gas Plant | 230 MMcf/d |

| Suncor | Ebla | 88 MMcf/d |

| INA Naftaplin | Jihar | 141 MMcf/d |

| Stroytransgaz | Palmyra (North Middle Area Gas Project) | 106 MMcf/d |

| Source: IHS, EIA estimates | ||

Exploration and production

As with oil exploration, natural gas exploration hit a virtual standstill as the fighting intensified and sanctions began to take hold in 2011. Prior to the beginning of the conflict, Syria planned to expand its natural gas activities in an effort to help ease the demand on the country's petroleum supplies. The latest bidding round for Syria's offshore blocks (for oil and natural gas) began in March 2011, as Syria hoped to capitalize on the excitement of international investors after the gas discoveries in nearby Israel and Lebanon. After several delays, the blocks finally went to tender in December 2011. However, Syria has not announced the results as of January 2013.

In 2010, the last year under normal operating conditions, Syria produced 316 billion cubic feet (Bcf) of dry natural gas. In 2011, during which time the political and security environment changed considerably, that figure fell by 12 percent to 278 Bcf. While data for 2012 are currently unavailable, that figure will likely drop further as the combination of damaged infrastructure and reduced oil production (which uses substantial volumes of natural gas in recovery operations) combine to undermine domestic demand for natural gas.

More than half of Syria's natural gas production comes from non-associated fields, with those volumes being re-directed to oil fields and domestic demand centers through the country's domestic pipeline network. In 2011, 23 percent of Syrian natural gas production was re-injected into the country's oil fields to aid in recovery, a slight increase from the 2000-2011 average of nearly 17 percent.

Imports and exports

|

Several international pipeline projects are on hold, in part because of the uncertain security environment in Syria as of January 2013. |

Syria does not currently possess the ability to export liquefied natural gas (LNG), nor are current production levels sufficient to justify exporting natural gas volumes via pipeline. Syria imports a small amount of natural gas from Egypt to supplement its own domestic production, but volumes dropped by more than 60 percent between 2010 and 2011 (from 24.4 Bcf to 8.8 Bcf according to Cedigaz data). These imports began in 2008 and are carried by the Arab Gas Pipeline, which sends Egyptian gas into Syria (near Homs) and to Jordan. There are plans to expand the pipeline into Turkey, Lebanon, and eventually Europe, although progress has been slow. In addition to the planned build-out of the Arab Gas pipeline, Syria is pursuing several other potential projects that may make Syria a more important energy transit country in the region.

Proposed pipelines

In May 2011, a trilateral agreement between Iran, Iraq, and Syria was completed, arranging for Iranian natural gas volumes to be sent to Syria via Iraq. Some industry sources believe that the arrangement is an attempt by Iran to develop the ability to export natural gas to Europe (with this being a first step), but, with current European Union sanctions prohibiting the importation of Iranian natural gas, progress is expected to be slow in the short term. Nevertheless, all three countries remain interested in pursuing this project. If successful, the increased volumes from Iran could help close the supply gap that currently exists in Syria.

An agreement to build two oil pipelines from Iraq to Syria also includes plans to develop a natural gas pipeline. The natural gas pipeline will start in southern Iraq and link up with the important energy hub of Baiji in Iraq, and from there extensions to Baghdad and the Syrian border are expected to be built. Details on the natural gas portion of the proposal are limited.

Another proposed natural gas pipeline, originating in Azerbaijan, was expected to begin operations some time in 2012, but the conflict in Syria has pushed that target further into the future. Initially expected to provide over 90 million cubic feet per day (MMcf/d), delays in the infrastructure build-out have prevented delivery as of December 2012.

Electricity

|

Damage to Syria's electricity transmission network that resulted from fighting and the cessation of electricity imports from Turkey combine to leave the country's demand centers undersupplied. |

In 2010, Syria generated almost 44 billion kilowatthours of electricity, 94 percent of which came from conventional thermal power plants; hydroelectric power plants made up the remaining 6 percent. Syria's thermal power plants are fueled by refined petroleum products and natural gas. The lack of domestic refining capacity and the ongoing sanctions limit the availability of the oil-based fuels, leading to blackouts for much of the country. Syria plans to convert all thermal generation facilities to run on natural gas as soon as possible.

Prior to the current conflict, the Syrian government hoped to emphasize the importance of renewable energy and laid out plans to develop renewable energy sources in the country. The 11th Five-Year Plan for 2011-2015 made this goal clear, but progress will be slow until the political situation stabilizes. Similarly, Syrian nuclear energy aspirations are on hold for the foreseeable future.

Syria's domestic electricity grid has suffered extensive damage during the months since protests began in the spring of 2011. Estimates from the Syrian government indicate that the damage to the electricity sector cost the country $146 million through October 2012, with the bulk of the damage occurring to the country's distribution network. Both sides in the conflict appear committed to protecting as much of the electricity grid as possible, but vulnerabilities still exist.

Syria, along with Egypt, Iraq, Jordan, Libya, Lebanon, Palestine, and Turkey, is a member of the Eight Country Interconnection Project, but the recent developments in Syria's electricity sector leave the future of the project in doubt. In 2012, Syria reduced its imports of electricity from neighboring Egypt, Jordan, and Turkey, opting to pursue an arrangement with Iran instead. That agreement will connect 250 megawatts of transmission capacity from Iran to Syria, and came on the heels of the announcement that Syria had suspended purchasing electricity from Turkey.

In addition to the economic losses stemming from the fighting, Syria is becoming more isolated from its neighbors with whom it previously shared electricity infrastructure. In particular, Syria's relationship with Turkey is strained, as Syria responded to a transmission interruption by suspending all power transmission from Turkey. Industry estimates indicate that transmission capacity between the two countries is near 500 megawatts, but the actual supply is probably closer to 250 megawatts. Nonetheless, reports indicate that Turkish electricity accounted for roughly 20 percent of Syria's total supply in 2011. The loss of Turkish electricity is not inconsequential, particularly given the difficulties facing Syria's power plants in terms of damage sustained in the fighting and the limited access to oil-based feedstock.

In September 2012, the Minister of Electricity announced plans to boost generating capacity by an additional 1.5 gigawatts over the next several years, but like most projects in the country, the current lack of access to international capital makes such an undertaking difficult. To wit, Syrian officials announced that the schedule for the construction of 1 gigawatt in new generating capacity (from four new 250 megawatt power plants) would be delayed until the end of 2012, and as of January 2013 there has been no reported progress.

Notes

- Data presented in the text are the most recent available as of February 20, 2013.

- Data are EIA estimates unless otherwise noted.

Sources

- Agence France Presse

- Al-Furat Petroleum Co.

- APS Review Oil and Gas Market Trends

- The Arab Fund

- Arab Oil & Gas Journal

- BBC World Wide Monitoring

- Business Middle East

- The Center for Strategic and International Studies

- Daily News Egypt

- The Economist

- Energy Intelligence Group

- European Commission

- Financial Times

- Government of Syria, Ministry of Petroleum and Natural Resources

- Gulfsands Petroleum Co.

- IHS CERA

- IHS Global Insight

- International Energy Agency

- International Monetary Fund

- Middle East Economic Survey (MEES)

- NewsBase

- Oil & Gas Journal

- Oxford Business Group

- PFC Energy

- Reuters

- Syrian Arab News Agency (SANA)

- Syrian News Digest

- Syrian Petroleum Company (SPC)

- TendersInfo

- Transparency International

- Tri-Ocean Energy

- United Press International

- U.S. Energy Information Administration (EIA)

- The World Bank

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |