Energy profile of Mexico

Energy profiles of countries and regions

Mexico is one of the ten largest oil producers in the world, the third-largest in the Western Hemisphere, and an important partner in the U.S. energy trade. However, the amount of oil produced in Mexico has steadily decreased since 2004 due to natural production declines from Cantarell and other large offshore fields, though the rate of their decline has abated in recent months (October 17, 2012). The onus on arresting or reversing production declines falls squarely on the shoulders of Petróleos Mexicanos (PEMEX), the state-owned oil company, due to constitutional limits on foreign involvement in the exploration, production, and ownership of the nation's hydrocarbon resources. Nonetheless, recently enacted and potential reforms could liberalize the sector and promote greater foreign investment.

|

Mexico is a major non-OPEC oil producer and among the largest sources of U.S. oil imports. |

Oil is a crucial component of Mexico's economy. The oil sector generated 16 percent of the country's export earnings in 2011, according to Mexico's central bank, a proportion that has declined over time. More significantly, earnings from the oil industry (including taxes and direct payments from PEMEX) accounted for 34 percent of total government revenues in 2011. Declines in oil production have a direct impact upon the country's economic output and the government's fiscal health, particularly as refined product consumption and import needs grow.

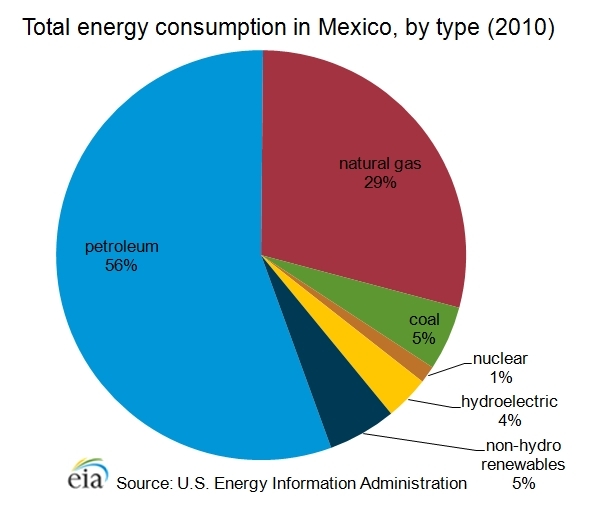

Mexico's total energy consumption in 2010 consisted mostly of oil (56 percent), followed by natural gas (29 percent). Natural gas, is increasingly replacing oil as a feedstock in power generation. However, Mexico is a net importer of natural gas, so higher levels of natural gas consumption will likely depend upon more imports from either the United States or via liquefied natural gas (LNG) from other countries. All other fuel types contribute relatively small amounts to Mexico's overall energy mix. Most of Mexico's non-hydro renewables consumption is attributable to traditional biomass, the use of which is important in rural areas albeit difficult to quantify accurately, but the country also has noteworthy geothermal (Geothermal) and wind energy sectors.

Oil

|

Mexico's oil production has declined in recent years, as has its position as a net oil exporter to the United States. |

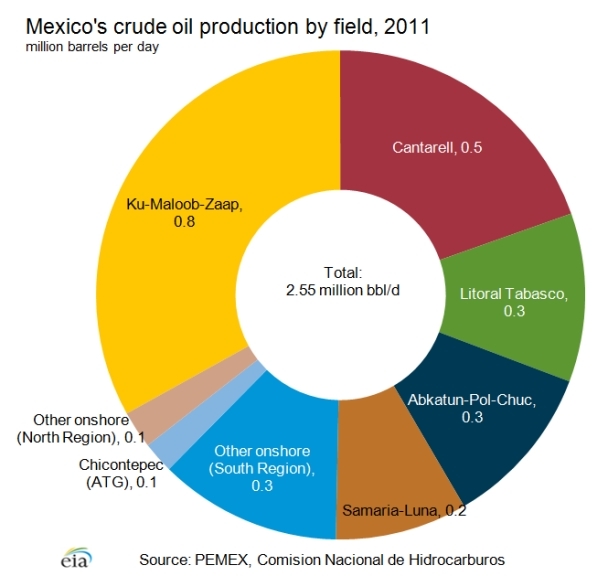

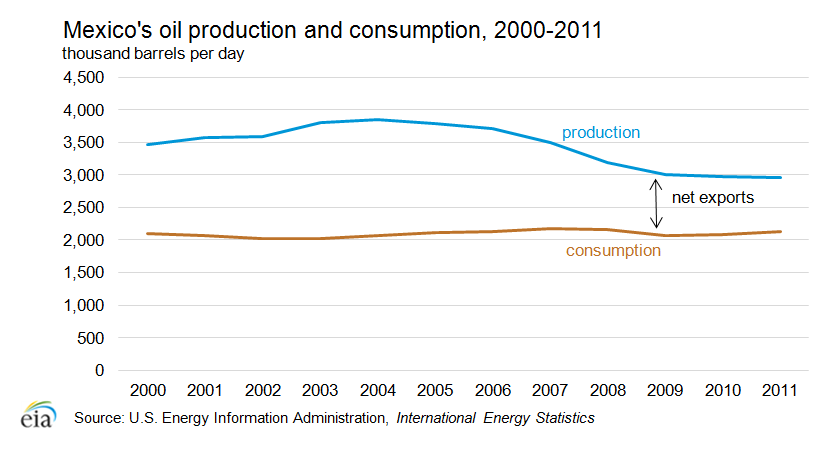

Mexico produced an average of 2.96 million barrels per day (bbl/d) of total oil liquids during 2011. Crude oil accounted for 2.55 million bbl/d, or 86 percent of total output, with the remainder attributable to lease condensate, natural gas liquids, and refinery processing gain. Mexico's oil production has been relatively stagnant since 2009, and the minor decreases that have occurred mark an improvement from the more drastic declines that commenced around the middle of the last decade. Mexico is a large but declining net crude exporter, and is a net importer of refined petroleum products. Its most important trading partner is the United States, which is the destination for most of its crude oil exports and the source of most of its refined product imports.

Graph showing Mexico's oil production and consumption for 2000-2011

Graph showing Mexico's oil production and consumption for 2000-2011

Reserves

According to the Oil & Gas Journal (OGJ), Mexico had 10.2 billion barrels of proven oil reserves as of the end of 2011. Most reserves consist of heavy crude oil varieties, with the largest concentration of reserves occurring offshore in the southern part of the country, especially in the Campeche Basin. There are also sizable reserves in Mexico's onshore basins in the northern parts of the country.

Sector organization

Mexico nationalized its oil sector in 1938, and Petróleos Mexicanos (PEMEX) was created as the sole oil operator in the country. PEMEX is the largest company in Mexico and one of the largest oil companies in the world. The energy sector is regulated by the Secretaría de Energía (SENER), while the Comisión Nacional de Hidrocarburos (CNH) provides additional oversight of PEMEX and its oil and gas activities.

In 2008, Mexico enacted new legislation that sought to reform the country's oil sector. The goal of these reforms was to enable PEMEX to curb the ebb in oil production experienced over the past several years. The measures included several administrative changes, such as adding new seats to PEMEX's administrative board for outside industry experts; creating a new advisory board designed to provide independent coordination of long-term energy strategies; and establishing a new, technically-oriented, and functionally independent hydrocarbons agency — CNH — to supervise and regulate oil and gas exploration and production.

The reforms permit PEMEX to create incentive-based service contracts with foreign oil companies. PEMEX also received greater autonomy, including the ability to establish more flexible mechanisms for procurement and investment. In March 2011, PEMEX announced Mexico's first production licensing round in more than 70 years, with 20 blocks to be tendered to international bidders. The foreign firms will have no ownership rights over any oil they produce, but they are expected to provide Mexican fields with much needed technological improvements. The first three service contracts under the new framework, which provides incentives to contractors for increased production, were awarded in August 2011 for relatively small, mature fields in Tabasco state. Debates about the future direction of Mexico's oil sector featured prominently in the 2012 presidential election that was won by Enrique Peña Nieto, who included energy reform as one of the planks of his campaign platform.

Exploration and production

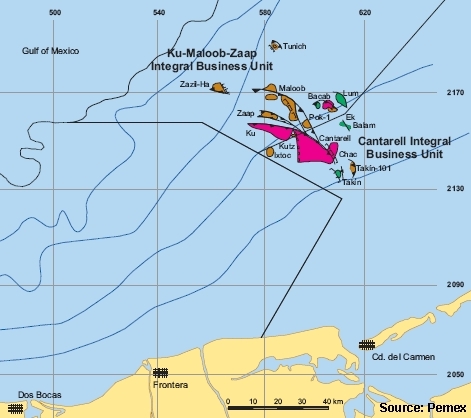

Most of Mexico's oil production occurs in the Bay of Campeche of the Gulf of Mexico, near the states of Veracruz, Tabasco, and Campeche. The two main production centers in the area include Cantarell and Ku-Maloob-Zaap (KMZ), with additional increased volumes coming from the fields off the coast of Tabasco state. In total, approximately 1.9 million bbl/d — or three-quarters — of Mexico's crude oil is produced offshore in the Bay of Campeche. Due to the concentration of Mexico's oil production offshore, any tropical storms or hurricanes passing through the area can disrupt oil operations.

Offshore

Over half of Mexico's oil production comes from two offshore fields in the northeastern region of the Bay of Campeche, Ku-Maloob-Zaap (KMZ) and Cantarell. Another quarter of Mexico's oil production occurs further to the southwest in the same bay, offshore Tabasco state. Most of the oil produced at KMZ and Cantarell is heavy and marketed as the Maya blend, while the oil produced offshore Tabasco is of a lighter grade.

Cantarell was once one of the largest oil fields in the world, but its output has been declining dramatically for almost a decade. Production at Cantarell began in 1979, but stagnated due to falling reservoir pressure. In 1997, PEMEX developed a plan to reverse the field's decline by injecting nitrogen into the reservoir to maintain pressure, which was successful for a few years. However, production at Cantarell fell rapidly beginning in the middle of the last decade — initially at extremely rapid rates, and more gradually in recent years. In 2011, Cantarell produced 500,000 bbl/d of crude oil, which was roughly 10 percent below the 2010 level and more than 75 percent below the peak production level of 2.1 million bbl/d that was reached in 2004. As production at the field has declined, so has its relative importance to Mexico's oil sector: Cantarell accounted for less than 20 percent of Mexico's total crude oil production in 2010, compared with 63 percent in 2004.

Meanwhile, KMZ, which is adjacent to Cantarell, has emerged as Mexico's most prolific field. Production doubled between 2006 and 2009, when it reached 810,000 bbl/d, as PEMEX employed a nitrogen re-injection program similar to that used at Cantarell. Production has grown more gradually since then, and currently stands at approximately 860,000 bbl/d. PEMEX hopes to increase output further over the next few years, including through the development of the 100,000-bbl/d Ayatsil satellite field, though views differ about whether or not the KMZ complex has already reached its peak level.

Mexico's other center of offshore production is to the southwest in the Bay of Campeche, near the state of Tabasco. There the Abkatun-Pol-Chuc and Litoral de Tabasco projects, which each consist of several smaller fields, together accounted for 560,000 bbl/d in 2011. The production trajectories of the two field complexes differ considerably. Output from Litoral de Tabasco has increased from less than 200,000 bbl/d in 2008 to over 300,000 bbl/d thus far in 2012, thereby offsetting some of the declines witnessed in Cantarell. Litoral de Tabasco also includes the promising Tsimin and Xux discoveries, which according to some sources could contain up to 1.5 billion barrels of total reserves. Production from Abkatun-Pol-Chuc, on the other hand, has declined considerably from peak levels achieved in the mid-1990s, when output exceeded 700,000 bbl/d.

Mexico is believed to possess considerable hydrocarbon resources in the deepwater Gulf of Mexico, which have not yet been commercially developed. PEMEX has been drilling deepwater exploratory wells since 2006, and made its first significant find in the Perdido Fold Belt, near the U.S. border, in August 2012. In February 2012, the United States and Mexico signed a Transboundary Hydrocarbon Agreement concerning the development of oil and gas reservoirs that extend across their maritime border. The agreement establishes a cooperative process and legal framework for safely managing and jointly utilizing transboundary reserves, and would end the current moratorium on exploration and production in the Western Gap when it enters into force.

Onshore

Onshore fields represent only around 25 percent of Mexico's total crude oil production. Most of this production consists of light or superlight oil in the southern part of the country, especially in the states of Tabasco and Veracruz, where more than 80 percent of Mexico's onshore production occurs. The largest oilfield in the south is Samaria-Luna, which produced about 200,000 bbl/d in 2010.

The most notable onshore prospect in the north is the Aceite Terciario del Golfo (ATG) project, which is better known as Chicontepec. Located to the northeast of Mexico City, PEMEX has heavily invested in and promoted Chicontepec as a potentially significant source of future production, with 442 million barrels of proven crude oil reserves and 11 billion more barrels of probable and possible reserves. Production averaged only 53,000 bbl/d in 2011, and stands at about 70,000 bbl/d as of late 2012.

Despite its promise, Chicontepec has heretofore failed to live up to expectations due to the unique technical challenges associated with its development. In fact, Chicontepec is not a single field but a formation that consists of dozens of small fields, spread over hundreds of square miles, which are highly fractured and at low pressure. As a result, many costly development wells are necessary, recovery rates are low, and decline rates are high. Moreover, the region does not yet have much of the supporting infrastructure necessary for large-scale oil development. PEMEX hopes to increase production dramatically through an aggressive drilling program and aspires to pump 300,000 bbl/d from Chicontopec by the next decade. However, many industry analysts expect production to peak far earlier, and at a much lower level, unless significant foreign investment is allowed. Mexico's energy regulator, CNH, has raised concerns about the project's profitability and PEMEX's development plan, given that Chicontopec accounts for a significant share of the company's exploration and production budget.

Outlook

EIA expects Mexican oil production to continue declining over the next decade, assuming no dramatic changes in policy or technology. Recent editions of the Short-Term Energy Outlook forecast that Mexican oil production will decrease by 50,000-100,000 bbl/d between 2012 and 2013, a slightly steeper rate of decline than that experienced for most of 2012. Although the shortage of investment in Mexico is expected to lead to a mid-term decline, Mexico has the potential resources to support a long-term recovery in total production, primarily in the Gulf of Mexico. The reference case of EIA's 2011 edition of the International Energy Outlook projected that total Mexican liquid fuels would sink to approximately 1.4 million bbl/d in 2025, before increasing slowly to 1.7 million bbl/d. The production rebound depends entirely on the development of resources in the deepwater Gulf of Mexico and the extent and timing of a recovery will depend in part on the level of economic access granted to foreign investors and operators. PEMEX does not currently have the technical capability or financial means to develop potential deepwater projects in the Gulf of Mexico or shale oil deposits in the north.

Crude oil exports

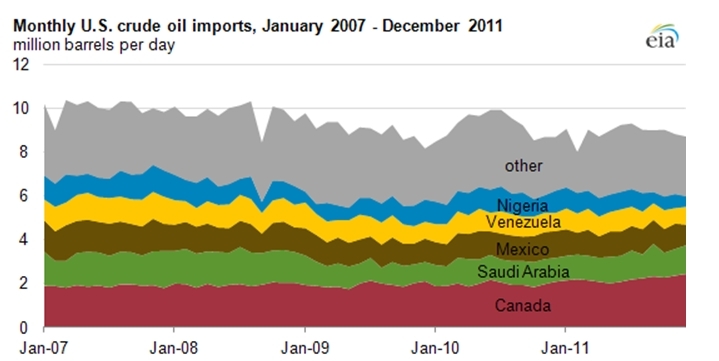

Mexican authorities report that the country exported 1.34 million bbl/d of crude oil in 2011, down slightly from 2010, when EIA estimated that it was the world's tenth largest crude oil exporter. The United States is the destination for the vast majority — approximately 85 percent — of Mexico's oil exports, which arrive via tanker. Most Mexican crude oil exports into the United States are of the Maya blend, while Mexico retains most of the output from its lighter crude streams — Isthmus and Olmeca — for domestic consumption. The United States will continue to attract the bulk of Mexico's oil exports due to the countries' close proximity to each other and because the U.S. Gulf Coast possesses the sophisticated refineries necessary to process heavier Maya crudes.

Mexico is typically among the top three exporters of oil to the United States. In 2011, the United States imported 1.1 million bbl/d of crude oil from Mexico, behind Canada and Saudi Arabia. Mexico's crude oil exports to the United States rose steadily through the 1980s and 1990s, before peaking in 2004 at 1.6 million bbl/d. The volume of crude oil that the United States imported from Mexico in 2011 was 4.5 percent below the levels of the year before and the second-lowest level since 1995, reflecting the steady decline in Mexico's crude oil production, its rising domestic fuel demand, and other developments related to U.S. supply.

Petroleum products exports and imports

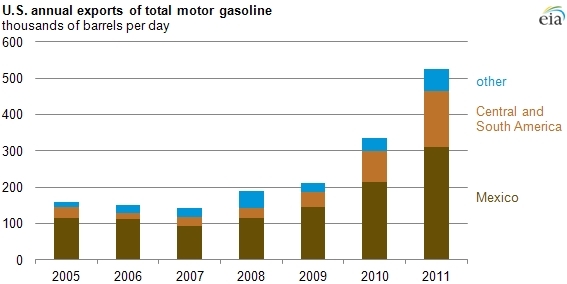

Despite its status as one of the world's largest crude oil exporters, Mexico is a net importer of refined petroleum products. According to PEMEX, Mexico imported 680,000 bbl/d of refined petroleum products in 2011, of which 60 percent was gasoline and most of the rest was diesel and liquefied petroleum gases (LPG). Mexico is the destination for most U.S. exports of motor gasoline, which now stand at a historically high level, and exports to Mexico accounted for almost 60 percent of the overall growth in total U.S. motor gasoline exports between 2007 and 2011.

Mexico's net imports of refined petroleum products have increased on average over the past few years, as resumed economic growth has led to a slight increase in domestic consumption and refinery runs have been insufficient to meet local needs. Nonetheless, Mexico still exported 180,000 bbl/d of refined petroleum products in 2011. The United States imported 105,000 bbl/d of that total, most of which was residual fuel oil, naphtha, and other unfinished oils.

Source: Today in Energy, March 27, 2012, U.S. Energy Information Administration

Source: Today in Energy, August 14, 2012, U.S. Energy Information Administration

Pipelines and export terminals

PEMEX operates an extensive pipeline network in Mexico that connects major production centers with domestic refineries and export terminals. This network consists of close to 500 pipelines spanning over 3,000 miles, with the largest concentration occurring in the southern part of the country.

Theft of oil from pipelines has become increasingly problematic in Mexico, as insecurity continues to plague the onshore oil industry and other aspects of the economy. Organized crime groups and armed gangs, some of them believed to have ties to drug cartels, control areas transited by pipelines and fuel trucks, from which they steal oil. The scale of the problem is uncertain and estimates of the stolen oil vary, but Mexican officials have declared that thefts of up to 20,000 bbl/d of oil costs PEMEX hundreds of millions of dollars per year. Sinaloa and Veracruz have been cited as the most affected states in recent years.

Mexico does not have any international oil pipeline connections. Most of its exports leave the country via tanker from three export terminals on the Gulf Coast in the southern part of the country: Cayo Arcas, Dos Bocas, and the Pajaritos terminal at the port of Coatzacoalcos. There is also an export terminal on the Pacific Coast at Salina Cruz.

Downstream

Mexico's total oil consumption has increased slightly since 2009, and averaged 2.1 million bbl/d in 2011. According to Mexican government data, gasoline accounts for roughly 45 percent of the country's petroleum product sales and diesel for another 20 percent.

Mexico has six refineries, all operated by PEMEX, with a total refining capacity of 1.54 million bbl/d as of the end of 2011. According to PEMEX statistics, actual refinery output was considerably below capacity in 2011, at 1.19 million bbl/d, and has declined for the last two years due in part to operational mishaps. The two refineries that have more than 300,000 bbl/d of capacity — one in Salina Cruz, Oaxaca and another in Tula, Hidalgo — were responsible for nearly half of the country's refinery runs in 2011. Outside of Mexico, PEMEX controls 50 percent of the 334,000-bbl/d Deer Park refinery in Texas.

Mexico has plans to reduce its import of refined products by improving its refinery capacity. In February 2012, PEMEX awarded a contract for the design of a new 300,000-bbl/d facility at Tula. It is supposed to be operational by 2016, but has already experienced delays. The Tula plant would be the first new refinery built in Mexico in thirty years. An expansion of the Minatitlan refinery was completed in early 2012, and will allow it to produce an additional 34,000 bbl/d of diesel and 47,300 bbl/d of gasoline. Despite these developments, some industry analysts contend that Mexico does not have a natural competitive advantage in refining, given the country's close proximity to a sophisticated U.S. refining center, and that it would be more productive to apply PEMEX's limited capital to the upstream sector.

Natural gas

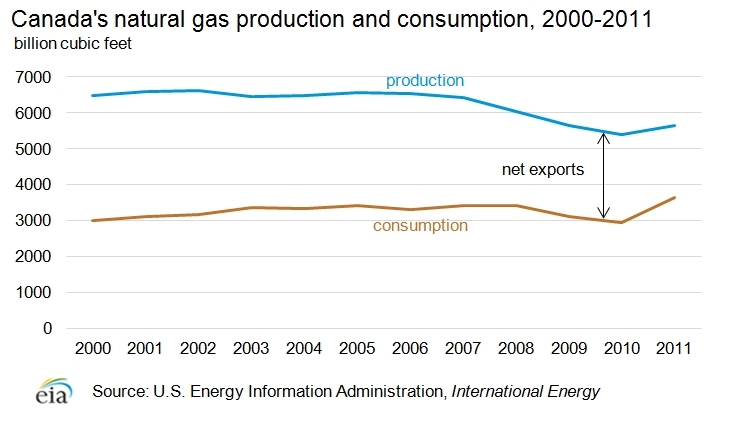

Mexico is a net importer of natural gas, mostly via pipeline from the United States, and its natural gas demand is rising due to greater use of the fuel for power generation.

Mexico has considerable natural gas resources, but its production pales in comparison to other North American countries and the development of its unconventional shale gas resources is proceeding slowly. Mexico's import needs are rising as production stagnates and demand increases, particularly in the electricity sector. Consequently, Mexico will rely on increased pipeline natural gas imports from the United States and liquefied natural gas (LNG) from other countries.

Reserves

According to OGJ, Mexico had 17.3 trillion cubic feet (Tcf) of proven natural gas reserves as of the end of 2011, a sharp increase of more than 5 Tcf from the year before. The southern region of the country contains the largest share of proven reserves. However, the northern region will likely be the center of future reserves growth, as it contains almost ten times as much probable and possible natural gas reserves as the southern region.

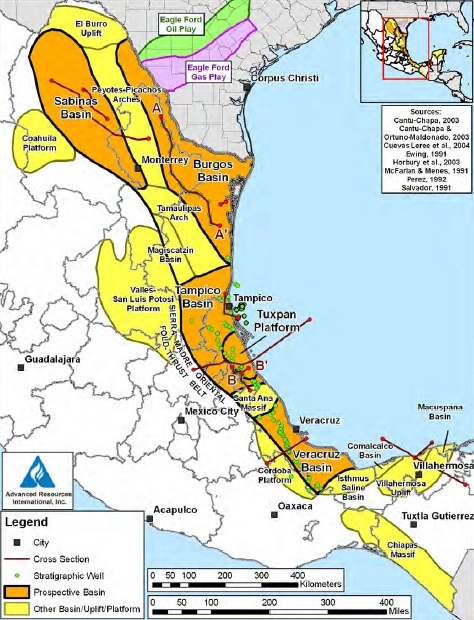

Mexico has one of the world's largest shale gas resource bases, which could support increased levels of natural gas reserves and production. According to an initial EIA assessment of world shale gas resources, Mexico has an estimated 681 Tcf of technically recoverable shale gas resources — the fourth largest of any country examined in the study. The figure of technically recoverable shale gas resources is far smaller than the total resource base due to the geologic complexity and discontinuity of Mexico's onshore shale zone, and other assessments are more pessimistic about the country's true potential. Most of Mexico's shale gas resources are in the northeast and east-central regions of the country. The Burgos Basin accounts for two-thirds of Mexico's technically recoverable shale gas resources. Burgos includes parts of the Eagle Ford shale play, which is considered to be Mexico's most promising prospect and has been a prolific source of production in Texas.

Onshore shale gas basins of Eastern Mexico

Source: World Shale Gas Resources: An Initial Assessment of 14 Regions Outside the United States, U.S. Energy Information Administration

Sector organization

PEMEX has a monopoly on natural gas exploration. However, private participation is permitted in non-associated gas production. The Mexican government opened the downstream natural gas sector to private operators in 1995, though no single company may participate in more than one industry function (transportation, storage, or distribution). It also created the Comisión Reguladora de Energía (CRE) to monitor the sector.

Exploration and production

Mexico produced an estimated 1.8 Tcf of dry natural gas in 2011, according to revised figures, which represents a slow rate of decline from the year before. Preliminary Mexican government data suggest that natural gas production has continued to fall in 2012. Part of the decline is due to a divergence in the prices for natural gas and crude oil, which encouraged PEMEX to favor exploitation of the latter.

Regulatory bodies report that approximately 250 Bcf of natural gas was vented and flared in 2011. More than half of the country's venting and flaring occurred at Cantarell. However, PEMEX and government agencies have prioritized a reduction in gas flaring for economic and environmental reasons. Efforts to improve the infrastructural capacity to capture, process, and transport associated natural gas production, particularly at Cantarell, have been effective and gas utilization rates have recently increased.

The geographic distribution of Mexico's marketed natural gas production is slightly different and more dispersed for natural gas than it is for oil. According to statistics from Mexico's CNH, more than three-fifths of Mexico's natural gas production derived from associated oil and gas fields. Unlike in the oil industry, the onshore (Samaria-Luna) and offshore fields of Tabasco yield more natural gas than Cantarell or KMZ. Of the country's non-associated natural gas production, over 60 percent occurred in the Burgos Basin in the northern part of the country, which accounted for 23 percent of the country's total production. Most of the remainder was due to non-associated fields in Veracruz.

Mexico has taken preliminary steps to explore for and produce shale gas, but lags the United States considerably in terms of the development of its unconventional hydrocarbon potential. PEMEX produced its first shale gas in early 2011 from an exploratory well in northern Mexico. Later that year, the government announced a significant discovery in the same region, which could multiply the country's proven natural gas reserves. In September 2012, PEMEX announced a $200 million program to explore for shale gas, including in the Eagle Ford formation, as part of its broader investment plan for the sector. Nonetheless, PEMEX has devoted a small share of its budget to shale gas development and the sector is unlikely to grow rapidly, as it has in the United States, without improved access and better fiscal terms for investors. Other obstacles include the availability of cheap natural gas from the United States, security concerns, and a shortage of water, which would be required for drilling and hydraulic fracturing, that prevails in the arid region in which most of Mexico's shale gas resources are situated.

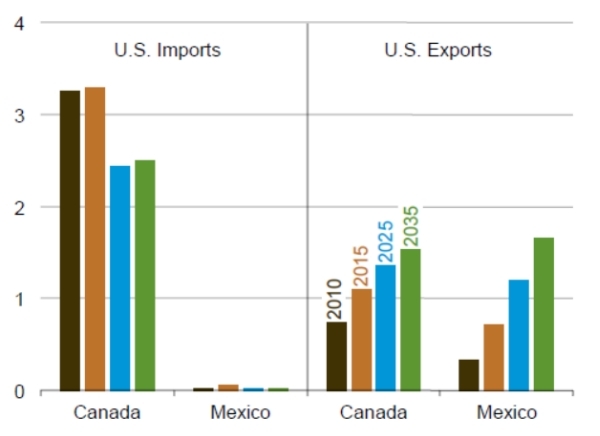

Trade

Pipeline imports from the United States

Mexico is a net importer of natural gas, with most of its natural gas imports arriving via pipeline from the United States. Mexico imported 499 Bcf of natural gas from the United States in 2011, which represented an increase of nearly 50 percent from the levels of 2010, as U.S. unconventional output boomed, North American natural gas prices fell, and Mexico's consumption needs further outstripped its productive capacity. U.S. natural gas exports to Mexico accounted for approximately one-third of total U.S. natural gas exports, and more than three-quarters of Mexico's natural gas imports. The United States also imports a very small amount of natural gas from Mexico, but the trade balance is expected to tip even further in the direction of the United States as recent supply and demand trends in both countries are projected to continue.

Liquefied natural gas (LNG)

Mexico meets some of its natural gas demand through LNG, but the volume of its imports fell by roughly 20 percent in 2011 as pipeline imports from the United States grew dramatically. According to data from the International Energy Agency, Mexico imported roughly 42 percent of its LNG from Qatar, 28 percent from Nigeria, and 16 percent from Peru, and smaller volumes from Indonesia and elsewhere. Mexico's LNG supply mix has changed in recent years, as increased volumes from Qatar displaced LNG from Egypt, Trinidad and Tobago, and most notably Nigeria, which had been Mexico's largest source of LNG.

The vast majority of Mexico's LNG imports — over 90 percent in 2011 — arrive at the Altamira plant in Tamaulipas state, on Mexico's northeastern coast. Altamira is a joint venture of Royal Dutch Shell (50 percent), Total (25 percent), and Mitsui (25 percent). The plant, which has a capacity of 500 million cubic feet per day (MMcf/d), received its first LNG cargo in August 2006. CFE, the state-owned electricity monopoly, has signed a 15-year contract to purchase the entire volume of natural gas received at the terminal.

Mexico has two operational LNG regasification terminals besides Altamira. The Costa Azul terminal near Ensenada, on Baja California, began receiving LNG in 2008. It is operated by Sempra Energy. The current send-out capacity of the plant is about 1 Bcf/d. Most of the natural gas imported at Costa Azul supplies domestic customers in northwest Mexico. A new LNG import terminal at the port of Manzanillo, also on the Pacific Coast, reportedly began initial operations in 2012. However, Mexican government data do not cite significant LNG flows into Manzanillo as of September 2012. According to industry reports, LNG supplies for the Manzanillo plant will come from Peru under a long-term contract. The plant was built by a consortium of Mitsui, Korea Gas Corporation, and Samsung, with an initial capacity of 500 MMcf/d.

In addition to the operational LNG trains, there have been several proposals — and some failed ones — to build additional LNG import capacity. Two proposals would expand the import terminals at Altamira and Costa Azul. In addition, two greenfield plants have been proposed at Lazaro Cardenas and on the Yucatan Peninsula, according to PFC Energy. However, four proposed plants have recently been cancelled.

North American natural gas trade, 2010-2035 (trillion cubic feet)

Source: Source: U.S. Energy Information Administration, Annual Energy Outlook 2012

Pipelines and storage

PEMEX operates over 5,700 miles of natural gas pipelines in Mexico. The company has eleven natural gas processing centers, with liquids extraction capacity of 5.8 Bcf/d. PEMEX also operates most of the country's natural gas distribution network, which supplies processed natural gas to consumption centers. The natural gas pipeline network includes thirteen operational interconnections with the United States, and at least two new pipeline interconnections are planned to supply the growth in Mexico's gas demand.

Consumption

Mexican natural gas consumption is dominated by PEMEX operations and electricity demand. According to SENER statistics, PEMEX is the country's single largest consumer of natural gas, representing around 40 percent of the country's total. Most of the natural gas consumed by PEMEX is used in the upstream exploration and production sector, but significant amounts are also used in refineries and petrochemical plants. The power sector accounts for one-third of Mexico's natural gas consumption. Most of the remainder, slightly more than 20 percent, is sold to non-PEMEX industrial consumers. Domestic natural gas prices are subject to a certain degree of control by PEMEX.

Electricity

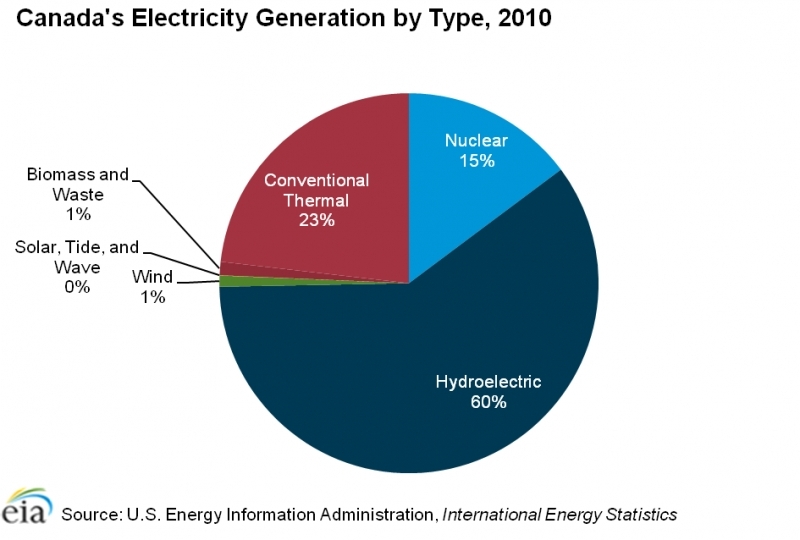

Most of Mexico's electricity generation comes from conventional thermal plants, the fuel source for which is increasingly natural gas.

Mexico had 59.3 gigawatts (GW) of installed electricity generating capacity in 2009, according to the latest complete EIA estimate. The country generated an estimated 247 billion kilowatthours (kWh) of electric power in 2009 and consumed an estimated 204 billion kWh. Preliminary Mexican government statistics suggest that electricity generation increased by at least three percent per year in 2010 and 2011. Conventional thermal plants provide most of Mexico's electricity capacity and generation. Industry accounts for almost 60 percent of Mexico's electricity sales, according to SENER statistics, while the residential sector is responsible for approximately one-quarter of sales.

Electricity trade between the United States and Mexico has existed since 1905, when privately owned utilities located in remote towns on both sides of the border helped meet one another's electricity demand with a few cross-border low voltage lines. Over the years, both countries developed highly regulated and structured electricity sectors and a number of major and minor cross-border transmission lines were constructed. However, for a variety of technical and market reasons, U.S.-Mexico electricity trade has remained small. Existing electrical interconnections between Mexico and the United States are relatively limited in capacity and operationally constrained by non-synchronous cross-border ties, except in the Southern California-Baja California region.

Mexico has been a very small net exporter of electricity to the United States since 2006. Power sales from Mexico to California more than offset exports from Texas to Mexico in 2010, though preliminary 2012 data suggest that Mexico has begun to import more electricity from the United States. Electricity sales from Mexico to the United States could increase in the mid-term, as the Department of Energy recently issued a Presidential permit to a subsidiary of Sempra International for construction, operation, maintenance, and connection of a 230,000-volt transmission line across the U.S.-Mexico border. When completed, the transmission line will supply electricity from a Mexican wind farm to the California market. Mexico also exports smaller amounts of electricity to Belize and Guatemala.

Sector organization

The state-owned Comisión Federal de Electricidad (CFE) is the dominant player in the generation sector, controlling over three-fourths of installed generating capacity. CFE also holds a monopoly on electricity transmission and distribution. In 2009, CFE absorbed the operations of Luz y Fuerza del Centro, a state-owned company that managed the distribution of electricity in Mexico City. The Comisión Reguladora de Energía (CRE) has principal regulatory oversight of the electricity sector.

The Public Electricity Service Act of 1975 established exclusive Federal responsibility over the electricity industry through CFE, but amendments to Mexican law in 1992 partially opened electricity generation to the private sector. Private participation in electricity generation is now permitted in certain categories, including for the purposes of construction and operation of private plants for self-supply, cogeneration, Independent Power Producer (IPP), small production (under 30 MW), and import/export. Any company seeking to establish private electricity generating capacity or begin importing and/or exporting electric power must obtain a permit from CRE. As of mid-2012, independent generators — Productores Independientes de Energía (PIE) — held about 12.2 GW of generation capacity, mostly consisting of combined-cycle, gas-fired turbines.

Mexico's national transmission grid, which is operated by CFE, includes over 31,000 miles of mostly high and medium voltage lines. According to statistics from the federal electricity commission, over 97 percent of Mexico's population has access to electricity.

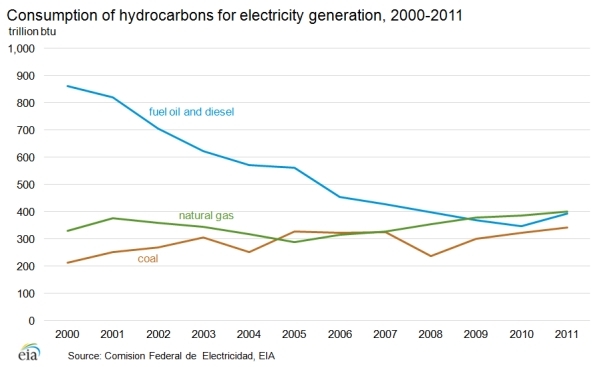

Conventional thermal

Conventional thermal power plants comprise the overwhelming majority of Mexico's electricity generation. In the past, petroleum products were the leading feedstocks in Mexico's thermoelectric generation mix. However, natural gas consumption for electricity generation has risen appreciably in recent years, a shift that has been a leading driver behind Mexico's rising natural gas consumption. Coal consumption by the electricity sector has also risen in recent years.

Nuclear

Mexico has a single nuclear power plant, the Laguna Verde, in Veracruz. Laguna Verde's reactors are operated by CFE. In April 2007, CFE awarded a contract to an international consortium headed by Alstom to modernize the plant, and this project has increased total generating capacity from 1,400 megawatts (MW) in 2007 to 1,610 MW as of early 2012.

Renewables

Hydroelectricity supplied about 14 percent of Mexico's electricity generation in 2010. The largest hydroelectric plant in the country is the 2,400-MW Manuel Moreno Torres, at Chicoasén dam in Chiapas. Another major hydroelectric project, the 750-megawatt La Yesca facility, is scheduled for completion by the end of 2012. The 900-megawatt La Parota project has been effectively cancelled due to local opposition.

Non-hydro renewables represented almost 4 percent of Mexico's electricity generation in 2010. The most significant source is currently geothermal, including the 645-MW Cerro Pietro plant in Baja California, followed by biomass and waste combusted in thermoelectric power plants. At present, there is relatively little wind and solar generation in Mexico.

Several significant wind projects are in development in Baja California and southern Mexico. The Isthmus of Tehuantepec in Oaxaca has especially favorable wind resources and has been a focus of government goals to increase wind capacity. The Oaxaca II, III, and IV wind farms came online in the first half of 2012, and are due to be joined by the Oaxaca I and La Venta III projects later in the year. Each project phase includes just over 100 MW of capacity. In Baja, Sempra International is developing the Energía Sierra Juarez (ESJ) wind farm, the electricity from which will be exported to the United States on a new transmission line. The first phase of ESJ will be completed in 2014, with a capacity of 156 MW. ESJ's long-term development plan includes additional phases, with a potential total capacity of over 1.2 GW. With these developments, Mexico is poised to become one of the fastest-growing wind energy markets in the world.

Sources

- Associated Press

- Business News Americas

- Cambridge Energy Research Associates

- CIA World Factbook

- Comisión Federal de Electricidad

- Comisión Nacional de Hidrocarburos

- Comisión Reguladora de Energía

- Deutsche Bank

- Dow Jones

- The Economist

- Economist Intelligence Unit

- IHS Global Insight

- International Energy Agency

- LatAmOil

- Oil and Gas Journal

- Offshore

- PEMEX

- Petroleum Economist

- Pipeline and Gas Journal

- Platts

- Repsol-YPF

- Reuters

- Secretaria de Energia

- Shell

- U.S. Department of State

- U.S. Energy Information Administration

- Wood Mackenzie

Further Reading

- Comisión Federal de Electricidad (CFE)

- EIA: Country Information on Mexico

- Iberdrola

- Sempra Energy LNG Corporation

- Union Fenosa

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |