Energy profile of Australia

| Topics: |

Energy profiles of countries and regions

Australia has considerable petroleum, natural gas and coal reserves and is one of the few countries belonging to the Organization for Economic Cooperation and Development (OECD) that is a significant net hydrocarbon exporter, exporting about two-thirds of its total energy production. Australia was the world's largest coal exporter and, according to Cedigaz, the fourth largest exporter of liquefied natural gas (LNG) in 2010, after Qatar, Indonesia, and Malaysia. Australia is a net importer of crude oil and refined petroleum products, but a net exporter of liquefied petroleum gas (LPG). Hydrocarbon exports accounted for 34 percent of total commodity export revenues in its fiscal year 2009-2010.

|

Australia was the world's largest coal exporter and the fourth largest LNG exporter in 2010 |

Australia's stable political environment, substantial hydrocarbon reserves, and proximity to Asian markets make it an attractive place for foreign investment.

Oil

|

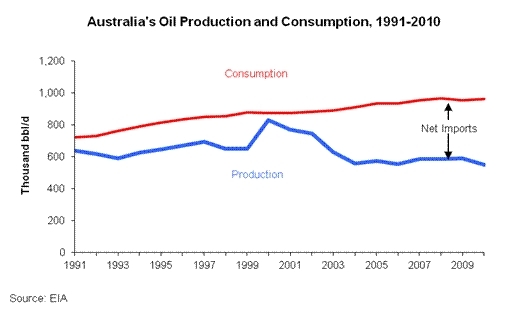

Australia's dependence on oil imports is projected to increase as domestic consumption increases and production continues to decline |

According to The Oil and Gas Journal (OGJ), Australia had 3.3 billion barrels of proven oil reserves as of January 1, 2011. Australian crude oil is of the light variety, typically low in sulfur and wax, and therefore of higher value than the heavier crudes. The majority of reserves are located off the coasts of Western Australia, Victoria, and the Northern Territory. Western Australia has 64 percent of the country's proven crude oil reserves, as well as 75 percent of its condensate and 58 percent of its LPG. The two largest producing basins are the Carnarvon Basin in the northwest and the Gippsland Basin in the southeast. While Carnarvon Basin production, accounting for 72 percent of total liquids production, is mostly exported, Gippsland Basin production, accounting for 24 percent, is predominantly used in domestic refining.

Sector Organization

Australia's management of oil exploration and production is divided between the states' and the Federal (Commonwealth) governments. Australia's states manage the applications for onshore exploration and production projects, while the Commonwealth shares jurisdiction over Australia's offshore projects with the adjacent state or territory. The Department of Resources, Energy and Tourism (RET) and the Ministerial Council on Energy (MCE) function as regulatory bodies over Australia's oil sector. In place of a national oil company, the Australian government supports privately held Australian companies, of which the largest are Woodside Petroleum and Santos. ExxonMobil is the largest foreign oil producer; other international oil companies include Shell, Chevron, ConocoPhillips, Japex, Total, BHP Billiton, and Apache.Production

Oil production totaled 549,000 barrels per day (bbl/d) in 2010, of which 79 percent (435,000 bbl/d) was crude oil. Oil production in Australia peaked in 2000 at 828,000 bbl/d and since has been declining. According to the Australian Petroleum Production and Exploration Association (APPEA), oil liquids production will continue to decline unless major new fields are discovered.

Australia's main frontier for oil exploration has moved in recent years to the deepwater area of the Timor Sea, although the nearby Carnarvon Basin off the coast of Western Australia remains the busiest area in terms of overall drilling activity. After a spike in drilling activity in the past decade, several significant discoveries are now in the process of being put into commercial operation.

The Pyrenees and Van Gogh projects offshore Western Australia came online in the first quarter of 2010, with production capacities of 96,000 bbl/d and 150,000 bbl/d, respectively. In fiscal year 2010-2011, these projects are projected by the Australian Bureau of Agricultural and Resource Economics (ABARE) to increase oil exports by 7 percent in line with higher production. The Kipper and Turum oilfields in the Gippsland Basin, southeastern Australia are expected to start up in 2012 at 20,000 bbl/d. These additions to production are expected to help offset the declining output in other fields in the short term.

Pipelines

Australia has a well-developed domestic oil and gas pipeline network. The Australian Pipeline Trust, with 6,200 miles of pipeline, is the largest operator. Epic Energy is the second-largest, with 2,500 miles of pipeline. Santos operates two major domestic pipelines that are used for carrying oil and oil products, which include the Jackson to Brisbane line that spans 500 miles, and the Mereenie to Alice Springs line that covers 167 miles. Esso Australia Ltd. operates the 115-mile Longford to Long Island Point pipeline.Imports and Exports

According to the Australian Bureau of Agricultural and Resource Economics (ABARE), in fiscal year 2009-2010 Australia had net total oil imports of about 440,000 bbl/d. Australia's crude oil and condensate imports mainly come from South East Asia; Malaysia, Indonesia, and Vietnam are currently the largest sources, while Australia's refined product imports come largely from Singapore.

Because the majority of Australia's oil production is located off its northwest coast, Australia exports much of its crude and condensates to Asian refineries as Australia's domestic refineries are located on its east coast, close to its major domestic consuming markets.

According to ABARE, in fiscal year 2009-2010, Australia exported of 311,000 bbl/d of crude oil and condensates and 47,841 bbl/d of LPG, amounting to about 70 percent of its total oil production of 511,304 bbl/d. These volumes were exported to Asian markets, mainly Singapore, South Korea, China, and Japan. Australia's 2009-2010 gross exports of refined petroleum products were 14,786 bbl/d, about 3 percent of its total oil production; its largest markets were New Zealand and Singapore.

Refining

According to The Oil and Gas Journal, in January 2011, Australia had 7 major refineries, with a total crude oil refining capacity of 757,000 bbl/d. Capacity has increased from 725,000 bbl/d in 2009. Crude oil feedstock for these refineries comes from oil produced in the Bass Strait offshore southeastern Australia in addition to increasing imports.

Natural Gas

|

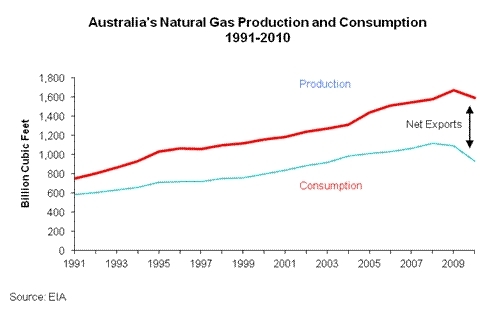

Australian natural gas production and exports have been increasing since the mid-1990s |

According to The Oil and Gas Journal (OGJ), Australia had 110 trillion cubic feet (Tcf) of proven natural gas reserves as of January 2011, making Australia the twelfth largest holder of conventional natural gas reserves in the world. Australia also had 396 Tcf of technically recoverable shale gas reserves in 2009, according to an EIA study World Shale Gas Resources.

Sector Organization

The Australian government has no ownership stake in the domestic oil and natural gas industry. The industry is regulated by the Department of Resources, Energy and Tourism (RET) and the Ministerial Council of Energy (MCE). The MCE was created in 2001 to foster policy coordination between the Commonwealth and the state governments. The MCE functions as the national policy and governance body for the Australian energy market and is comprised of Ministers with responsibility for energy from the Australian government and all states and territories.

Major domestic and foreign companies operating in Australia include Santos, Woodside, Chevron, ConocoPhillips, ExxonMobil, Origin Energy, BG Group, Apache, INPEX, Total, and Shell.

Production

Natural gas production in Australia reached 1.6 Tcf in 2010. Conventional gas is largely produced from the Carnarvon Basin offshore North Western Australia, the Cooper/Eromanga basin in central Australia, and Gippsland/Victoria. These 3 basins account for 96 percent of Australia's conventional natural gas production. Queensland and New South Wales are the main sources for coal bed methane, which accounted for 13 percent of gas production in 2010. About half of natural gas production is converted into LNG for export and the other half is consumed domestically. Several major new LNG projects are under construction or advanced planning as the Asian LNG market continues to expand and domestic demand increases. Four projects currently under construction or advanced planning will use conventional gas from offshore the northwest coast and four will be based on LNG extraction from CSG in Queensland.

Major new conventional LNG production projects include:

The first stage of the Pluto project near Karratha offshore Western Australia is expected to be online in March 2012, with estimated capacity of 200 billion cubic feet (Bcf) of LNG per year. Woodside Energy owns 90 percent of the venture supported by 15-year sales contracts with Kansai Electric and Tokyo Gas, which have 5 percent equity each. The Pluto project includes an offshore platform connecting 5 subsea wells and a 112-mile pipeline to an onshore LNG facility on the Burrup Peninsula. Plans for a second train are on hold as additional gas supplies are sought.

The Gorgon project, led by Chevron (50 percent), with Shell and ExxonMobil (25 percent each), is under construction and is on track to be completed in 2014. The Gorgon gas field, which is 80-124 miles off the northwest coast, is believed to contain 40 Tcf of natural gas and is currently Australia's largest known natural gas resource. The project includes development of the Gorgon gas fields, with connection by subsea pipelines to Barrow Island, where gas processing facilities will have production capacity of 700 Bcf per year. Also planned are LNG shipping facilities to transport products to international markets, and greenhouse gas management via injection of carbon dioxide into deep formations beneath Barrow Island. In the beginning of 2011, Chevron signed long-term sales agreements with Nippon and Kyushu corporations for sales of Gorgon LNG. The project is expected to annually produce 390 Bcf of LNG and 19 million bbl of LPG, as well as 100,000 bbl/d of condensate when completed.

The Icthys project, located offshore the northwest coast in the Browse Basin, is expected to begin construction in early 2012. The project is led by Japan's INPEX (74 percent) and Total (26 percent). A 528-mile undersea pipeline will connect the fields to a new export LNG terminal to be built near Darwin. When the project comes onstream in 2016, its production is expected to be 380 Bcf of LNG and 19 million barrels of LPG per year, as well as 100,000 bbl/d of condensate. The final investment decision is expected in the fourth quarter of 2011, following the June 2011 environmental approval by the Australian government.

The Wheatstone project in northwestern Australia reportedly will begin construction in November 2011. It is led by Chevron (73.6 percent) and Apache (23 percent), Kuwait Petroleum (KUFPEC) (7 percent) and Shell (6.4 percent). KUFPEC and Apache joined the project as gas suppliers from their nearby Julimar and Brunello fields, which will extend the life of the project. Wheatstone is supported by long-term LNG sales contracts with Tepco and Kogas. When complete in 2016, the first two trains of its LNG export plant are expected to export 433 Bcf per year.

Major new unconventional LNG production projects under development include:

The Gladstone project will be the world's first major coal seam gas (CSG) to LNG operation. Located onshore Queensland, construction reportedly began in September 2011. This project is a joint venture between Santos (30 percent), Petronas (27.5 percent), Total (27.5 percent), and Kogas (15 percent). A long-term sales agreement with Kogas has been signed. Gladstone LNG will have initial capacity of 362 Bcf when it comes online in 2015, later increasing to 464 Bcf.

Three other major CSG to LNG projects in Queensland are also underway: the Arrow project, a joint venture of Shell and PetroChina; the Australia Pacific project, a joint venture between Origin and ConocoPhillips; and the Queensland Curtis project being developed by BG Group. Together, they could deliver 1,232 Bcf/year by 2016.

LNG Exports

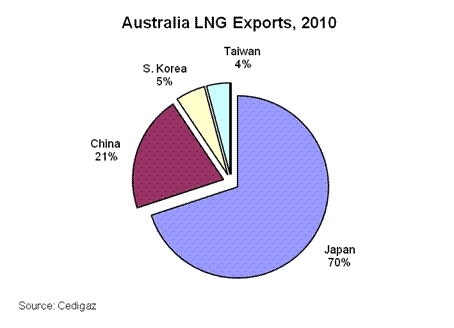

The distances between Australia and its key natural gas export markets in Asia discourage any pipeline trade; all exports are in the form of LNG. Over the past decade, Australian LNG exports have increased by 60 percent and they are expected to continue to increase over the short to medium term. In 2010, Australia exported 872 Bcf of LNG, up from 714 Bcf in 2009. Japan is the primary destination, but other purchasers include China, South Korea, and Taiwan.

Australia currently has two LNG export facilities. The largest is the North West Shelf Venture (NWSV), a consortium of 6 energy companies (Woodside, Shell, BP, Chevron, Japan Australia LNG, BHP Billiton), which operates five offshore LNG trains with a total capacity of 761 Bcf per year. It relies on natural gas supplied from nearby fields in the Northwest Shelf (NWS). The majority of LNG produced by the NWSV is exported to Japan by long-term contracts. Darwin LNG is the second facility, a consortium of ConocoPhillips, Santos, Eni, SPA, and INPEX. It has one production train with capacity of 140 Bcf per year and exports LNG under contracts to Tokyo Gas Corp. and Tokyo Electric. Darwin is located on Australia's northern coast and is supplied with natural gas from fields in the Timor Sea. However, as new LNG facilities come online beginning with the Pluto project, Australia's LNG export capacity will be expanding substantially.

Coal

|

Coal is Australia's largest export commodity |

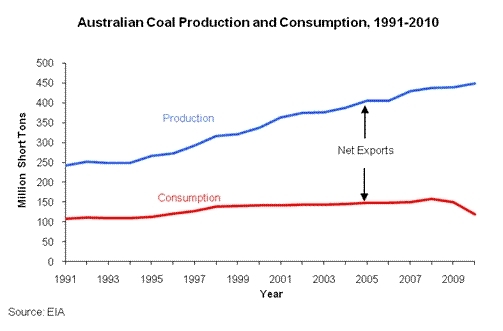

As of the end of 2010, Australia contained 84 billion short tons (Bst) of recoverable coal reserves, according to the British Petroleum (BP) 2011 Statistical Energy Review. Australia is the world's fourth largest coal producer, after China, the United States, and India, but it is the largest exporter. Coal is Australia's largest export commodity, and it is also a significant component of domestic energy needs, accounting for about 77 percent of Australian electricity generation in 2008-2009.

Sector Organization

Australia has around 107 privately owned coal mines located throughout the country. About 74 percent of Australia's coal production comes from open pit operations, with the remainder coming from underground mines. International companies such as BHP Billiton, Anglo American (UK), Rio Tinto (Australia-UK), and Xstrata (Switzerland) play a significant role in Australia's coal industry.

Production

In 2010, Australia produced 449 million short tons (MMst) of coal. According EIA estimates, over the last two decades, coal production in Australia has grown by 99 percent, with new projects continuing to come online every year. This growth has been supported by strong global demand and by continuing investment in new mining and export capacity, and it is expected to continue over the medium term.

The states of Queensland and New South Wales (NSW) together account for 95 percent of Australia's black coal production, while Victoria accounts for 96 percent of brown coal reserves. Brown coal is used largely for domestic electricity generation.

Exports

According to RET, Australia exported about 70 percent of its coal production in 2009-2010, or about 322 MMst. According to the Australian Coal Association, Japan was the destination for 43 percent of Australia's coal exports during Australian fiscal year 2009-2010. Other important export markets included South Korea (15 percent), China (14 percent), and India (11 percent). About 8 percent of Australia's coal exports went to Europe.

Coal exports are serviced by 9 major coal ports and export terminals located in Queensland and NSW. These terminals in 2009 had a combined handling capacity of 400 MMst. Several new port infrastructure projects are in various stages of development and are expected to add about 130 MMst to annual coal export capacity by 2014. These include the Dalrymple Bay capacity expansion and the Newcastle Coal Infrastructure Group's capacity expansion at the Port of Newcastle.

Further Reading

EIA Links

EIA - Australia Country Energy Profile

U.S. Government

CIA World Factbook - Australia

U.S. State Department Background Notes on Australia

Associations and Institutions

Australian Bureau of Agricultural and Resource Economics

Australian Institute of Petroleum

Australian Petroleum Production and Exploration Association

Foreign Government Agencies

Australian Department of Resources, Energy and Tourism

Australian Embassy in the United States

Geoscience

Gorgon Project

Chevron

ConocoPhillips Australia

Epic Energy

ExxonMobil Australia

Inpex Japan

National Gas Market Bulletin Board

Santos

Woodside Energy

Coal

Australian Coal Association

Sources:

- Country Data on Australia, Energy Information Administration

- Australian Greenhouse Office

- Australia Institute

- Australian Institute of Petroleum

- Australian Gas Association

- Australian Petroleum Production and Exploration Association

- Australian Pipeline Trust

- Australia's Uranium Information Centre

- Energy Supply Association of Australia

- Enviromission Limited

- Securing Australia’s Energy Future (“The White Paper”)

- Australian Coal Association

- Australian Bureau of Agricultural and Resource Economics

- Australia's Department of Industry, Tourism, and Resources

- Australian Embassy in the United States

- AGSO-Geoscience Australia

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |