Microeconomics and the environment

| Topics: |

Contents

Theoretical Perspectives on the Environment

The Two Paradigms of Economics and Ecology

There are many controversies over environmental issues. Should oil drilling be permitted in important wildlife habitat? Should air pollution (Air pollution emissions) regulations be tightened? Should we reduce our society’s dependence on fossil fuels to prevent global climate change (Causes of climate change)?

There are different approaches to addressing these important issues. The approach you consider appropriate depends on which paradigm you subscribe to. A paradigm is a vision of the world that corresponds to a certain set of values and principles. When dealing with the environment, two major paradigms exist:

- the ecological paradigm, based on the science of ecology, stresses the health and survival of ecosystems.

- the economic paradigm relies on environmental economics – the application of economic theory to environmental issues – and emphasizes maximizing the welfare of humans, even if this means harming the environment.

In some cases these two perspectives seem incompatible. But in other cases it may be possible to combine insights from the two different viewpoints. The field of ecological economics has emerged out of efforts to resolve the differences between the two paradigms. There may be bridges that can be built so that economics and ecology may have a constructive dialogue, leading to new insights on environmental issues and policies.

Ecosystems and economic systems

Ecosystems are natural systems composed of a diverse and complex set of plant and animal species in interaction with each other, as well as with physical systems including soils, minerals, fresh and salt-water environments, and the atmosphere. Most natural systems are characterized by cycles, such as the water cycle, carbon cycle, nitrogen cycle, and others. It is through these cycles that natural systems maintain themselves over long periods of time.

Scales of ecosystems can vary from local to regional to global. A regional ecosystem like the ecosystem of the Rocky Mountains is a system of local ecosystems including valleys, plateaus, streams, and high-altitude mountaintops. The biosphere as a whole represents the global ecosystem of planet Earth, regulating all the biological and geochemical cycles at the global scale.

Environmentalists, who advocate the vision embodied in the ecological paradigm, are interested in keeping in equilibrium the innumerable cycles of renewal, regeneration and reproduction that characterize all ecosystems. In this perspective, a crucial factor is the resilience of ecosystems — their ability to return to equilibrium after having experienced shocks and disturbances.

Beyond a certain threshold of ecological irreversibility, the damage done to the regenerative functions of the ecosystem can be so great that the ecosystem may never recover from it. For example, rainforest ecosystems, which are extremely complex and host a great variety of species, are threatened by human activities including burning, logging, and clearing for agriculture. These activities can irreversibly destroy rainforest ecosystems, sometimes leaving the soil so depleted that it can support neither forest nor agriculture.

Economic values and environmental values

From the ecological perspective, a major goal is to make sure that ecosystems remain in a resilient state and do not suffer irreversible damage to their regenerative functions. The goal of environmental policy, in this view, should be maintaining the sustainability of ecosystems.

Economists, on the other hand, are concerned with the environment in so far as it affects the wellbeing of human societies. Whereas environmentalists are concerned about natural systems, economists are primarily interested in natural resources or natural services — elements of physical and biological systems, which can be used for human benefit.

In this utilitarian perspective, the environment is taken into consideration only to the extent that it is useful to humans. Standard economic analysis does not consider the environment to have an intrinsic value, a value in itself. In contrast, the ecological paradigm suggests that natural systems need to be protected for their own sake, independently of their use value to humans.

The economic paradigm focuses on the efficiency of the use of natural resources in the production process, as a measure of how well natural resources are used to satisfy human needs. The ecological paradigm places value on the long-term sustainability of natural systems. These different criteria imply different goals for economic activity. We will look first at the economic perspective, then compare it to the broader ecological view of a number of environmental issues.

Economic Analysis of the Environment

Economists have given increased attention to environmental issues during recent years, as it has become apparent that increased pollution and ecological degradation creates significant costs for human societies.

In economic theory, environmental issues are separated into two main categories:

- The generation of wastes and pollutants as unwanted by-products of human activities

- The management of natural resources, including renewable and non-renewable resources.

When it comes to wastes and pollution, the key issue is how much should be permitted. Are current pollution levels too high … or too low? Ideally, we would all like pollution levels to be as low as possible, or eliminate pollution altogether. But in most cases, we have to consider the tradeoffs associated with lowering pollution levels. Economic analysis provides us with important insights on the “optimal” levels of pollution and the policies that can be instituted to reach these levels.

For natural resources, we need to determine which resources to use for different tasks. For example, to generate electricity should we rely on coal, natural gas, wind (Wind farm), or solar power? Fossil fuels are a non-renewable resource – how much should we use and how much should we leave for future generations? Again, economic analysis provides techniques which can help society answer these important questions.

Externalities and the “social optimum”

The concept of externalities is central to environmental economics. In economic terms, there is an externality when an activity creates spillovers on people who are not directly involved in the activity. For example, a firm which pollutes a river creates involuntary costs (a negative externality) for people who use the river for fishing, swimming, or for drinking water. Some of these costs might be measured in money terms – for example, the lost revenues of professional fishers. Some might be more difficult to measure but no less important – for example, health costs caused by toxins in the water or loss of enjoyment by those who can no longer swim in the polluted water.

Some economic activities may bring benefits to people other than those involved in the activity. These third parties benefit from what economists call positive externalities. An example of a positive externality is the case of bee-keeping. A honey-farmer raises bees for his own benefit – in order to sell the honey they produce. This is a private activity with private benefits and costs. However, bees contribute to the pollenization of flowers in the gardens and orchards of other people, who benefit freely from this positive externality. The owners of these gardens, harvesting flowers and fruits, receive an external benefit from the fact that their neighbor is a honey-farmer.

In the presence of negative or positive externalities, unregulated private markets will fail to produce the optimal allocation of resources. We now consider the implications of negative and positive externalities in more detail.

The case of a negative externality

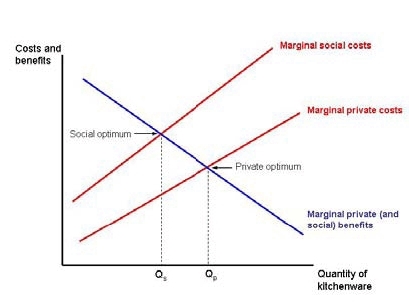

Figure 1 analyzes the case of an activity that creates a negative externality. Let’s take the example of water pollution caused by a factory producing plastic kitchenware. The private costs are the firm’s costs of production. The private benefits go to consumers of the firm’s products, and to the producers as income. The private optimum occurs when marginal private costs equal marginal private benefits, at a quantity produced and consumed equal to Qp.

Under competitive conditions, the marginal private cost curve will be the supply curve and the marginal private benefit curve will be the demand curve. Thus in a market economy, under the conditions of perfect competition the private optimum will occur at the natural market equilibrium, balancing the costs of production with the benefits of consumption.

In this example, however, there are other costs that are not included in the marginal private cost curve. There may be professional fishers downstream who are suffering financial losses due to water pollution. There are also losses to other people. Perhaps there used to be a beach downstream on the river with an ice cream shop that had to close because nobody is going swimming there anymore. People who used to use the beach are unhappy, and the owners of the shop have lost their incomes. If we can find a way of adding all these external costs to the private costs of production, we will have a measure of marginal social costs.

The social optimum is reached when marginal social costs equal marginal social benefits. Since there are no external social benefits in this example, total benefits are accurately captured by the marginal private benefit curve. In other words, the marginal private benefit curve is also the marginal social benefit curve. The intersection of marginal social costs and marginal private benefits gives us the social optimum at quantity Qs, which is a lower level of production than the market equilibrium Qp.

Let’s consider this concept of the social optimum. Note that it represents a level of output at which there will be less pollution than the private optimum — but not zero pollution. In effect, it represents a compromise between society’s desire for goods — in this case plastic kitchenware — and society’s desire for clean water. From the economist’s point of view, a tradeoff exists between goods output and an unpolluted environment.

It will rarely be possible to produce goods with absolutely no pollution. Therefore we must decide how much pollution to tolerate if we wish to have the benefits of goods production. In doing so, we must in some way measure or estimate the social costs of pollution to balance against the social benefits of goods production.

Economic policies to deal with externalities: a pollution tax

The existence of externalities illustrates a case of market failure. Market failure occurs when the market process leads to a solution which is not socially optimal – and perhaps very far from optimal. In serious cases of pollution, for example when children’s developing brains are damaged by lead poisoning from uncontrolled industrial emissions, it is clear that some policy is urgently needed to correct the market result. The solution which economic theory offers to bridge the gap between the private optimum and the social optimum is to “internalize” the externalities.

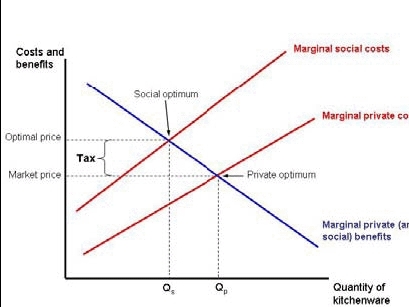

Suppose that a tax is imposed on the polluting firm in our example, based on the amount of pollution it emits. The social cost of pollution now becomes a private cost – a dollar amount that the firm will have to pay for each unit of pollution. The object of this tax is not just to penalize the firm. It is to send an economic message: firms that create less pollution will pay less tax. This creates an incentive for the firm to control its pollution.

Figure 2 shows how such a pollution tax works in the market. It creates a new market equilibrium at which less of the polluting good is produced. At the same time, it raises the market price of the good. The external cost is thus internalized by making both buyers and sellers aware of the cost to third parties of creating pollution. Consumers will tend to buy less of the pollution-creating good (because it costs more) and producers will tend to produce less of it (because including the tax it is now less profitable).

Of course, it may be possible to find ways to produce kitchenware that involve less pollution. Types of kitchenware that can be produced with less pollution will be taxed less heavily, encouraging both producers and consumers to favor them. In that case the social optimum will be achieved not by cutting back production, but by shifting to different kinds of production. The tax provides the necessary incentive for this socially beneficial economic shift.

The British economist Arthur Pigou was the first economist to propose this solution in order to “internalize” the total costs of an activity into the market. A tax of this type is therefore sometimes referred to as a Pigovian tax. From a theoretical point of view, the Pigovian tax is a fine solution to the problem of externalities. There is just one problem – how do we know how much the tax should be?

In our example, the tax should reflect the true social costs of water pollution. But these costs can be complex. Some costs might be relatively easily to measure – for example, the lost revenues of commercial fisheries. But how about health costs? Recreational costs? And how about another type of costs which we have not mentioned – the ecological costs of damage to non-commercial fish and other species in the river? If we are not sure that we know the dollar value of these costs, we cannot be confident that the tax policy will really lead to a socially optimal solution.

A different economic policy approach – tradable pollution permits

It is possible to design a market-oriented pollution control policy that avoids the problem of having to measure the dollar value of environmental costs. In the tradable pollution permit approach, policy-makers decide first on the level of pollution reduction that is needed. A certain quantity of pollution permits is issued. These permits may be distributed to existing firms, or may be sold at auction to firms that are producing the goods responsible for the pollution.

This system is designed to reach the same overall level of pollution as a traditional system of regulation but at a lower economic cost. In a regulation system, every company has to comply with environmental regulation even if it costs one firm twice as much as another to do so. Under the trading system, a firm could even choose to increase its level of pollution as long as it is able to purchase credits from another firm. Producers whose technical processes are cleaner than others - and therefore who do not need many permits to pollute - can sell permits on the market to more polluting industries, allowing them to postpone costly controls until new technologies become available.

Under this system, the price of a pollution permit will be determined by market supply and demand, not by the government. Over time, it is possible to tighten pollution standards by reducing the number of available permits. Over time, the price of permits may increase (if fewer permits are available) or decrease (as improved technology makes it easier to cut emissions).

Economic policy for positive externalities

Just as it is in society's interest to internalize the social costs of pollution, it is also socially beneficial to internalize the social benefits of activities that generate positive externalities. For example, many suburban and rural towns have instituted open land preservation programs. Using tax incentives or public purchases they seek to maintain or increase the amount of open and rural land. Why do they do this?

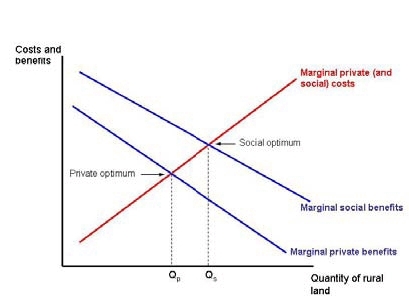

A private landowner may have his/her own reasons for keeping land open or using it as farmland. But there are significant third-party benefits from such uses. Others who live in the town enjoy the sight of natural areas and farmland close to their homes. A beautiful setting may significantly increase surrounding property values while an industrial or residential development nearby would lower them. The external benefits are not limited to residents of the town. Passers-by, hikers, bicyclists, and out-of-state tourists may all draw satisfaction – utility, to use the economic theory term – from the pleasant scenery.

An economic analysis of the situation is shown in Figure 3. Marginal social benefits are higher than marginal private benefits because they include gains to neighbors and passers-by as well as to private land-owners. At the social optimum, there is a higher quantity of open and rural land than at the private market equilibrium.

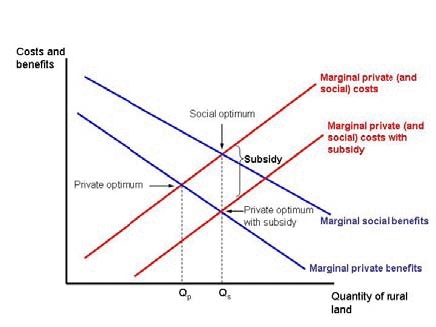

How can we increase the quantity of open land supplied? From an economic point of view, one policy that could achieve the social optimum would be a subsidy to encourage the provision of open land. It is in the social interest to encourage landowners, through tax rebates or purchase of development rights, to keep land in an undisturbed state.

By lowering the costs (through tax rebate) or offering a payment (through purchase of development rights), public authorities encourage landowners to maintain open and rural land (Figure 4). The effect is exactly parallel to the use of a tax to discourage economic activities which create negative externalities — except that in this case we want to encourage economic uses of land which have socially beneficial side-effects.

Cost-Benefit Analysis

One of the advantages of using environmental policy tools which work through market mechanisms — like taxes, subsidies, and transferable permits — is that the final decisions on resource use and goods production are left up to firms and individuals. The government acts to modify market outcomes, but not to determine the exact result. But in some cases governments must make specific decisions which have both economic and environmental implications. In such cases, cost-benefit analysis (CBA) is a tool used by decision makers to balance the positive and negative consequences of a proposed action.

Take the example of a proposed government project: the construction of a large dam. The project will have some major economic benefits: hydroelectric power, a stable water supply for irrigation, and flood control. But it will also have negative impacts. Farmland and wildlife habitat will be flooded, some communities will have to relocate, and some fish species may become extinct. There may be new recreational opportunities created for lake boating and fishing, but there will be a loss of scenic whitewater rafting and hiking.

How can we evaluate whether to build the dam or not? Some costs and benefits are relatively easy to assess. We can probably get good estimates of the construction costs of the dam, and of the value of hydroelectric power and irrigation water, for example. But how can we put a dollar value on the social and ecological losses that will result?

Different kinds of value

Economists use various techniques to estimate different kinds of [[value]s]. The most obvious kind of value is use value – the values placed on a resource by those who directly use it. In this example, the value of farmland used for raising crops is a direct use value, which can be measured by its market price. Certainly farmers whose farms are submerged by the dam waters will suffer losses at least equal to the value of their farms. These should be included in our estimates of costs associated with dam construction. The impacts of the dam on other users are also important, such as the loss of whitewater rafting or hiking opportunities. These use values are more difficult to measure because information from markets is not readily available in dollar terms.

In addition to use values, there are three important kinds of non-use values. One of these is option value. If we decide to go ahead and build the dam, the farms and forests which are flooded will be lost forever — the decision is irreversible. On the other hand, if we decide not to build the dam today, we could still decide to build it ten or twenty years from now. Thus we can preserve the option of building, or of not building, the dam by simply doing nothing.

Option values are important because economies change over time, and so do the values of different goods, services, and environmental assets. Farmland or undeveloped natural areas might become much more valuable in future; on the other hand, the need for hydroelectric power or irrigation water might become much greater. In either case, the decision on the dam could be made with better information at a later date.

Another non-use value is existence value. Consider the fish species that might be made extinct by building the dam. Even if these species have no commercial value, many people might feel that they should be preserved. Some might feel that other species have their own rights to exist, independent of human valuations. Other might argue that the existence of many different species means that we ourselves live in a richer world — richer in a spiritual rather than a monetary sense. Thus we might seek to preserve other species for our own sense of wellbeing, even if those species are never of economic use to humans.

It is also important to consider the value of leaving an undamaged world to future generations, something which economists identify as bequest value. Clearly existence, option, and bequest values will be difficult to put in monetary terms — but may nonetheless be very important. Economists use a technique called contingent valuation to measure non-use values. This is essentially a survey technique, in which people are asked how much they would be willing to pay to preserve rafting or hiking opportunities. The resulting estimate of willingness to pay can be included in a cost-benefit analysis — although its reliability is debatable.

Suppose that we can succeed in measuring all the costs and benefits associated with dam construction. If the benefits outweigh the costs, should we then proceed with dam construction? Not necessarily. We should also consider the benefit/cost ratio, obtained by dividing total benefits by total costs. Suppose that this ratio is only slightly larger than one (i.e., benefits exceed costs, but only slightly). Then it may well be that some other project will offer a better benefit/cost ratio. For example, a series of small dams rather than one large one might offer us the same hydropower and irrigation benefits, while avoiding the social and ecological damage.

Economists generally feel that cost-benefit analysis is a useful tool. Critics of cost-benefit analysis point to the many difficulties involved in obtaining reliable estimates, and the fact that some things, like spiritual value or the value of community, are essentially impossible to estimate in dollar terms. It seems that we should use cost-benefit analysis with caution — as we will see when we consider the issue of global climate change (Causes of climate change).

Public Goods and Common Property Resources

When we think of markets, we usually think of typical examples of goods and services: markets for apples, CDs, computers, cars, or perhaps markets for factor services such as labor and capital. In these markets, firms and individuals exchange goods and services for money payments. All these goods and services, although very different in nature, share two essential properties. First, their use is typically limited to one user. If I eat an apple, there is nothing left for someone else; while I am using my computer, no one else can check out the web on it; if I rent a car, it is not available for anyone else to rent while I am driving it.

Goods whose use is limited to one user at a time are called rival. For most goods, it is usually easy to identify a legal owner or renter who is entitled to use or consume them. These goods are called excludable. The right to use or consume the good can be refused to others. A good that is both rival and excludable is called a private good.

Are all goods rival and excludable? What about going to a concert? There are one thousand other listeners like myself and we all enjoy the same good at the same moment. The fact that I am listening certainly doesn’t prevent anyone else in the concert hall from listening as well. Here is a good (music in a concert hall) which is non-rival. Of course, I did have to pay for a ticket to enter the hall. The concert is therefore an excludable but non-rival good. This type of goods, which require an “access-right” to be enjoyed, but can be consumed jointly by all the authorized users, are sometimes called club goods (in a club, the “access-right” is the membership, which allows the members to enjoy all the club’s facilities in common).

What kind of good is an apartment shared by roommates? Each room is the “private property” of each roommate, therefore rival and excludable (a private good), but the common parts like the kitchen, the bathroom, and the living room are shared. They are in joint, or non-excludable, use among the roommates. However, these common areas may be rival: if my roommate uses the bathroom, I cannot use it at the same time. We have here a case where the common parts of the apartment are rival and non-excludable. Goods that are both rival and non-excludable are called common property resources.

Are there goods that are both non-rival and non-excludable? Think of the ocean, the mountains: can’t you go sailing or hiking without preventing anyone from doing the same? And who could forbid you to go there and enjoy yourself if you wanted to? These natural goods are accessible to everyone in joint use (non-excludable) and use by one person does not prevent others from using them as well (non-rival). Goods that are both non-rival and non-excludable are called public goods.

However, the property of non-rivalry can disappear if too many users are involved in the process of jointly using a resource or amenity. On a beautiful summer day mountains and public beaches are often crowded, which may make them significantly less enjoyable. A quiet canoe trip down a river may be ruined by the presence of many noisy powerboats. The limit to non-rivalry is reached when the level of density or concentration of users is such that everyone is disturbing everyone else. This is called the congestion threshold.

| Table 1: The Four Types of Goods | ||

|---|---|---|

| Non-excludable | Excludable | |

| Non-rival | Public goods | Club goods |

| Rival | Common property resources | Private goods |

| Source: Adapted from V. & E. Ostrom, 1977. | ||

The four types of goods or amenities, according to their property of rivalry/non-rivalry and excludability/non-excludability are represented in Table 1.

There is a connection here with our earlier analysis of externalities. The issue of “rivalry” between users of a common property resource is nothing but an example of negative externalities between them. If my action disturbs someone else – and at the same time his disturbs me – we both create negative externalities for each other. The problem of congestion is an illustration of a situation where all users impose negative externalities on everyone else; my presence in the crowd or the traffic jam contributes to the problem.

Some public goods, on the other hand, represent strong cases of positive externalities. A public park in the middle of a city is a good example. Individuals do not have to pay to enter the park, but all benefit from the relief it offers from traffic and concrete. You don’t even have to enter the park to enjoy it – just walking past is more pleasant than walking down a treeless street. All who live nearby also enjoy the view of the park.

It would be possible to divide the public park up into building lots and construct businesses or residences instead – but who would favor that? Private benefits would be created for the new owners of these buildings, but the great public benefits of the park would be lost, degrading the quality of life for the whole city.

The concepts of public good and common property resource are extremely useful when dealing with environmental goods and amenities. Oceans, the atmosphere, and many natural ecosystems like tropical rainforests and mountains are sometimes referred to as open access, meaning that they are available for anyone to use (non-excludable). To a certain extent they are limitless and can be considered as public goods. However many of the resources they contain are finite, degradable or depletable, which means that the economic analysis of common property resources will apply to them.

All the living species found in terrestrial or marine ecosystems are potentially depletable if the rate of extraction is higher than their natural rate of renewal. This means that there is always a threshold of extraction beyond which the resource is over-harvested, over-fished, or over-hunted, leading to its depletion. This is a particular case of the congestion threshold. Below this threshold, the resource seems abundant. Once the threshold is reached, the resource starts declining. Then all the users become competitors for this scarcer and scarcer resource, until it finally disappears.

Even the atmosphere can be overused. The release of pollutants beyond a certain level can significantly modify natural cycles. Chlorofluorocarbons (CFCs) which destroy the stratospheric ozone layer are an illustration, as well as greenhouse gases, which contribute to global climate change (Causes of climate change). Below the threshold, the atmosphere is taken for granted — as a pure public good available to all — whereas in fact the atmosphere, like other natural systems, is vulnerable to overuse. Overuse of non-excludable or open access resources is a phenomenon that has been called the tragedy of the commons.

The origin of the tragedy comes from a paradox of aggregation: if everyone tries to obtain more for themselves, this behavior results in less for everyone. The pursuit of personal interest leads each individual user to take as much as possible of the resource, which increases the overall level of extraction of the resource and drives it irremediably to its destruction – and to the ruin of all the users.

Successful local management, communal fisheries, grazing land, forests, and irrigation systems have often proved that the tragedy of the commons is not inevitable. However, when rules governing access to the commons cannot be enforced or are not strong enough to prevent free-riders (either outsiders or insiders) from using the resource without authorization, degradation and perhaps complete destruction of the resource is likely to follow.

When the scope of a resource is regional or even global (oceans and the atmosphere are often called global commons), enforcement of rules of access must be decided at the international level, to prevent the damages associated with open access.

In the next sections we will examine several environmental issues involving externalities, common property resources and public goods. We will also extend the analysis of environmental issues to the industrial system as a whole, and consider possible policy solutions for the sustainable management of resources and the environment.

|

|