International finance (About the EoE)

Contents

International finance

In addition to trade in goods, countries are also linked through exchange of currencies, flows of income, and by purchases and sales of real and financial assets across national borders. As we move into considering how international finance is related to trade and to domestic macroeconomic policies, the realization that “everything is linked to everything else” can get overwhelming. We will discuss many topics, such as supply and demand, interest rates, inflation, aggregate demand, and the Federal Reserve (the Fed). In order to ease into the topic, we will focus on relatively simple concepts and models, starting with the market for currency exchange.

Purchasing Power Parity

Purchasing power parity (PPP) refers to the notion that, under certain idealized conditions, the exchange rate between the currencies of two countries should be such that the purchasing power of currencies is equalized. Consider, for example, the exchange rate between United States dollars ($) and European euros (€). At the time of this writing, one dollar is worth about 0.79 euros. When we say “the exchange rate” for the dollar, what we mean is the number of unit of the foreign currency you can get for a dollar.

If currencies can be traded freely against each other, goods are freely traded and totally identical across countries, and transportation costs are not important, then there is a certain logic to this theory. Suppose a gold chain costs $200 in New York. If you live in the United States and change $200 into euros, the theory of PPP says that that the number of euros you get for your dollars should be exactly enough for you to buy the identical gold chain in Paris. If, indeed, the chain costs €158 (= 200 dollars × .79 euros per dollar) in Paris, PPP holds. You might notice that this theory is similar to that of “factor price equalization,” and the logic behind the two theories is the same. If economies really were as smoothly integrated as we are assuming in our idealized world, an item (whether a gold chain or an hour of labor services) should cost the same, no matter where you are.

If this isn’t true, there should be pressures leading towards change. For example, suppose the gold chain costs $200 in New York and €158 in Paris, but the exchange rate is higher, at 1 euro per dollar. Why would anyone buy a chain in New York, if by changing their money into euros they could order the chain from Paris and save €42? For chains to be sold in both locations—in this idealized world—the price in New York would have to be bid down, the price in Paris would have to be bid up, or the exchange rate would have to fall.

Of course, in the real world, national economies are not nearly as integrated as this theory assumes. Transportation costs do matter; there are many varieties of goods; markets for goods and services do not work as quickly, smoothly, and rationally as was assumed; and exchange rates are often “managed”. Any of these factors can mean that converting monetary figures from one country to another using the prevailing exchange rates may be misleading. If the price of a gold chain in New York is higher than in Paris, this might, for example, reflect the fact that the general cost of living in New York is higher.

Sometimes you will see comparisons of international income levels expressed “in PPP terms.” Rather than simply using going exchange rates to convert all the various income levels into a common currency, purchasing power parity adjustments try to take into account the fact that the cost of living varies among countries. The “Big Mac Index” published each year by The Economist magazine is a somewhat lighthearted attempt to determine how much goods prices and exchange rates vary from PPP predictions, by comparing the prices (converted into dollars using market exchange rates) of a MacDonald’s hamburger across various countries. More sophisticated analysis uses a larger “basket” of goods to make such comparisons and estimate appropriate PPP adjustments.

Foreign Exchange Markets

An idealized foreign exchange market in which United States dollars are traded for European euros is illustrated in Figure 1. The quantity of dollars traded is given on the horizontal axis, and the “price” of a dollar is given on the vertical axis, in terms of the number of euros it takes to buy one.

In a well-behaved foreign exchange market, the supply curve of dollars is largely determined by domestic residents, who decide how many dollars they are willing to offer. While the actual trading is usually done by professional currency traders and banks, underlying the supply of dollars on the international foreign exchange market is the desire of domestic residents for foreign-produced goods and services and for foreign assets. Since these must be paid for in the currency of the country from which they will be purchased, dollars must be traded in the foreign exchange market. The more euros United States residents can get for their dollars, the cheaper European items are to them, and the more they will want to buy from Europe rather than from domestic producers. Thus, the higher the exchange rate, the more dollars they will offer on the market. The supply curve slopes upwards.

The demand curve for dollars is largely determined by foreign residents, who may want to buy goods and services from the United States, or to invest in United States bonds or businesses. To make these purchases, they must acquire dollars. The more euros they have to pay to get a dollar, the more likely they are to go elsewhere than the United States for what they want, and the lower will be the quantity of dollars they demand. So the demand curve slopes downward. Market equilibrium is established at point E.

Figure 2: A Supply Shift in a Foreign Exchange Market. When people become more eager to sell a currency, this causes it to lose value, that is, to depreciate. (Source: GDAE)

Figure 2: A Supply Shift in a Foreign Exchange Market. When people become more eager to sell a currency, this causes it to lose value, that is, to depreciate. (Source: GDAE) Even in this simple representation, however, we must mention another reason that many traders buy and sell currency, and that is speculation. Sometimes people buy something not because they need it (for example, in this case, for facilitating a trade in real items), but because they are betting that its price will go up or down in the future. Speculative buying and selling of currencies often plays a large role in foreign exchange markets.

When the exchange rate falls, we say a currency has depreciated. Suppose, for example, a European technology firm comes out with a new music-listening device that everyone wants to buy. In their desire to get euros to buy the good, people in the United States will offer more dollars on the foreign exchange market, shifting the supply curve to the right. Excess supply will, as in any other market, cause the price to fall, as shown in Figure 2. Commentators may say that the dollar is now “weaker” against the euro. (Conversely, of course, the euro is now “stronger” against the dollar.)

On the other hand, if demand for United States products or assets rises, this will lead to an appreciation of the dollar. For example, if investors become eager to buy United States real estate, the demand curve for dollars will shift outwards and the dollar will appreciate, that is, gain in value.

The story is a bit more complicated when different levels of inflation in different countries are taken into account. What matters to people is the real exchange rate between currencies. A country with high inflation, for example, will generally experience a steady depreciation of its nominal exchange rate against the currencies of lower-inflation countries, even without any changes in demand for its items. Foreigners will only be willing to purchase the country’s products at the higher prices resulting from inflation if they can get also more currency units per unit of foreign exchange they offer, so that the real price remains the same.

Financial Flows and the Balance of Payments

| Table 1: United States Balance of Payments Account (2005, Billions of Dollars) | ||||

|---|---|---|---|---|

| Balance of Payments | 0 | |||

| Balance on Current account | -792 | |||

| Inflows: | 1,750 | |||

| -- Payments for Exports of Goods | 895 | |||

| -- Payments for Exports of Services | 381 | |||

| -- Income Receipts | 475 | |||

| Outflows: | -2,541 | |||

| -- Payments for Imports of Goods | -1,677 | |||

| -- Payments for Imports of Services | -315 | |||

| -- Income Payments | -463 | |||

| -- Net transfers | -86 | |||

| Balance on Financial account | 785 | |||

| Outflows (e.g., U.S. lending abroad, or FDI abroad) | -427 | |||

| Inflows (e.g., U.S. borrowing from abroad, or FDI in the U.S.) | 1,212 | |||

| Statistical discrepancy (and "capital account") | 6 | |||

|

Source: U.S. BEA, U.S. International Transactions Accounts Data, Table 1, | ||||

The flows of payments into and out of a country are summed up in its balance of payments (BOP) account, as shown in Table 1 for the United States in 2005. The top part of the table tallies the current account, which tracks flows arising from trade in goods and services, earnings, and transfers.

Various kinds of transactions lead to payments flowing into this country (and to a demand for dollars in the foreign exchange market). Obviously, when we export goods, we get payments in return. So the first entry under “Current account transactions leading to inflows of payments” is the $895 billion the United States earned from exports. Exports of services (such as travel, financial, or intellectual property) also bring in inflows, as do profits, wage incomes, and interest payments earned abroad by U.S. residents. All told, inflows into the United States from exports and incomes totaled $1.75 trillion in 2005.

Other transactions lead to payments going abroad (and to a supply of dollars to the foreign exchange market). When we import goods and services, we need to make payments to foreign residents. Foreign residents can earn profits, wages, and interest from the U.S. The BOP account also includes a line for net transfers abroad, such as monies paid out in government foreign aid programs. All told, outflows of payments from the United States due to these transactions totaled over $2.5 trillion in 2005.

Figure 3: U.S. Imports and Exports of Goods and Services, 1950-2005. In 1950 imports and exports were each only about 4% of Gross domestic product (GDP). Since then, however, trade—and trade deficits—have increased. In 2005 the United States imported goods and services with a value equal to about 16% of GDP, while exports were equivalent to about 10% of GDP. (Source: GDAE)

Figure 3: U.S. Imports and Exports of Goods and Services, 1950-2005. In 1950 imports and exports were each only about 4% of Gross domestic product (GDP). Since then, however, trade—and trade deficits—have increased. In 2005 the United States imported goods and services with a value equal to about 16% of GDP, while exports were equivalent to about 10% of GDP. (Source: GDAE) The balance on the current account is measured as inflows minus outflows. Since outflows exceeded inflows on the current account in 2005, the United States ran a current account deficit. When a country imports more than it exports of goods and services, it runs a trade deficit. As you can see in Table 1, imports of goods exceeded exports by a very large amount. Since income flows and transfers were relatively balanced, it was the trade deficit that largely accounts for the current account deficit of $792 billion. In fact, as you can see in Figure 3, the United States has had trade deficits fairly steadily since about 1980, with the gap between imports and exports widening to about 5.5% of gross domestic product (GDP) in recent years.

How can a country steadily import more than it exports? If you, personally, want to buy something that costs more than you have the income to pay for, you might take out a loan or perhaps sell something you own such as your bicycle or your car. Likewise, countries can finance a trade deficit by borrowing or selling assets. These are the sorts of transactions listed in the financial account.

To the extent the United States lends abroad (for example, when the government extends loans to other countries, foreigners borrow from U.S. banks, or people in the U.S. buy foreign bonds), financial capital outflows are generated. This terminology may be confusing. Think about financial flows as going in the direction of the country that ends up with “the cash” or the power to purchase goods, and away from the country that “buys something.” In the case of a loan, the borrower gets “the cash,” while the creditor “buys” a bond or other security representing a promise to repay; thus a loan is an outflow to the lender. Similarly, if a U.S. firm buys all or part of a business in another country—what is called foreign direct investment (FDI)—it is the people abroad who end up with “the cash,” while the U.S. company gets the interest in the business. This is also counted as an outflow. From Table 1, we can see that the United States had $427 billion in financial outflows during 2005.

A country gets financial inflows when it borrows from foreigners, or when foreigners invest in businesses here. In the case of the United States, a great many people abroad buy United States government bonds, since they are considered a very secure investment. For similar reasons, many also put funds into bank accounts here. These are both capital inflows—the sellers of the U.S. securities or the U.S. banks get “the cash.” Likewise, if a foreign multinational buys an interest in a United States publishing company, that is a capital inflow. In 2005, the United States received over $1.2 trillion in capital inflows.

The balance on the financial account is measured as inflows minus outflows. The United States, hence, ran a $785 billion financial account surplus in 2005. It was this willingness of foreigners to buy United States securities (and other assets), that financed the deficit in the current account. Many commentators worry that the United States is putting itself in a vulnerable position by relying on borrowing to “spend beyond its means” on imports. Notice that present-day financial inflows create the obligation to pay future income outflows: Interest on U.S. government bonds sold abroad, and profits made by firms located in the U.S. that are now foreign-owned, are part of “income payments” in the outflows section of the current account.

The last item in Table 1 represents a statistical discrepancy (that is, an inability of the BEA to make the accounts exactly balance, given problems in the quality of the data) and some small items we will not get into here. Allowing for this discrepancy, the balance in the current account and the balance in the financial account have to add to zero. A surplus in one account has to be matched by a deficit in the other.

Monetary Policy in an Open Economy

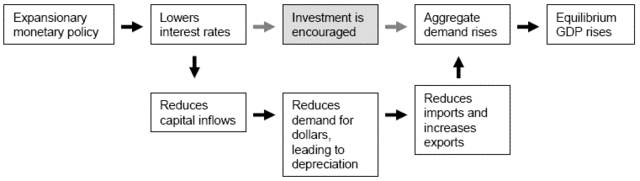

In an open economy, monetary policy is more effective in changing aggregate demand than in a closed economy, because it works through two channels rather than only one. Suppose the Federal Reserve (the Fed) believes the United States economy needs a boost, and lowers interest rates in an attempt to stimulate aggregate demand. The decrease in interest rates should tend to encourage investment spending. But in an open economy, the fall in interest rates should also increase net exports, another component of aggregate demand.

This is because the fall in United States interest rates should tend to drive away some foreign financial capital. If interest rates here fall, people abroad will be less inclined to buy U.S. government bonds or put their money in United States bank accounts. As they choose to send their financial capital elsewhere, this decreases the demand for United States dollars. This would be portrayed as a leftward shift of the demand curve in a market such as pictured in Figure 1. A decrease in the demand for dollars will cause the dollar to depreciate.

A depreciation in the dollar means that a dollar now buys fewer units of foreign exchange, which will discourage spending on imports. Meanwhile, the fact that a dollar can be purchased for fewer units of foreign exchange means that U.S. exports become “cheap” to foreign buyers. Exports should increase. Because it is demand for U.S.-produced goods and services, less imports, that enters into aggregate demand, aggregate demand rises. Thus both an increase in exports and a decrease in imports will tend to raise aggregate demand.

The openness of the economy can be thought of as adding an extra loop to the chain of causation, as illustrated below:

Managed versus Flexible Foreign Exchange

So far, we have assumed that exchange rates are determined by market forces, as modeled in Figure 1. In a flexible or floating exchange rate system, countries let their exchange rates be directed by the forces of supply and demand. But this is not always the case.

Flexible exchange rates can create significant uncertainties in an economy. A manufacturer may negotiate the future delivery of an imported component, for example, only to find that exchange rate changes make it much more expensive than expected to complete the deal. Foreign exchange markets are also very susceptible to wild swings from speculation. A mere rumor of political upheaval in a country, for example, can sometimes create a rush of capital outflows as people try to move their financial assets into foreign banks, causing a precipitous drop in the exchange rate. Or an inability to obtain short-term foreign loans may put an economy into crisis—and send its exchange rate swinging—even if over a longer period the economy would be considered financially sound. It can be hard to maintain normal economic activities when exchange rates fluctuate wildly.

So creating a more rational and predictable environment for foreign trade is one reason why many countries have tried to control the value of their currencies. The strictest kind of control is a fixed exchange rate system. In this case, a group of countries commits to keeping their currencies trading at fixed ratios over time. Starting in 1944, many countries including the United States had fixed exchange rates under what was known as the Bretton Woods system.

The exchange rates in such a system do not, however, all usually stay firmly fixed over the long term. In a fixed rate system, governments retain the power to alter their exchange rates from time to time. When a government lowers the level at which it fixes its exchange rate, this is called a devaluation, and when it raises it, that is called a revaluation. But too many changes undermine the system, and when key currencies such as the dollar come under too much selling pressure a fixed exchange rate system can break up. This is what happened to the Bretton Woods system in 1972.

Since the break-up of the Bretton Woods system, some countries have moved to “floating” while others have tried to exert some management over their currencies by trying to maintain certain target exchange rates, by “pegging” their currency to some particular foreign currency, or by letting it “float” but only within certain bounds.

How does a country keep its exchange rate fixed, or at least within bounds? There are two main tools a government can use. One way is to impose capital controls. For example, a country that wants to limit foreign exchange trading may require that importers apply for licenses to deal in foreign exchange, or impose quotas on how much they can get. By only allowing highly regulated transactions, it can control the prices at which exchange transactions are made. The other technique is foreign exchange market intervention.

To see how intervention works, consider Figure 4. Suppose the government would like to keep the exchange rate of its domestic currency at (or above) the level e*, but market pressures are represented by the curves Smarket and Dmarket. At the exchange rate e*, there is an excess supply of domestic currency, and so there is pressure on the exchange rate to fall. The central bank must artificially create more demand for the domestic currency, as shown by demand curve Dwith intervention. It does this by going into the market and exchanging foreign currency for domestic currency—essentially “soaking up” the surplus domestic currency. The problem is that the central bank can only do this as long as it has sufficient reserves on hand of foreign exchange. If it runs out of foreign exchange, it will no longer be able to support the currency, and will be forced to devalue.

Is devaluation a bad thing? The answer to this question is complex. Devaluation is generally thought to be good for exporters, since it makes the country’s goods cheaper abroad. But it also means that people in the country will find that imports are now more expensive. And sometimes devaluation is taken as a sign of instability or poor policy in a country, or leads to international runs of speculation or competitive devaluation. Many economists have become cautious about too-easily recommending devaluation as a cure for international imbalances.

On the other hand, a country can keep its exchange rate lower than market forces would dictate by supplying lots of its domestic currency on the market and amassing large amounts of foreign reserves. Recently, China has used this tactic, keeping the value of its Yuan artificially low in order to stimulate exports. China has, in the process, become a large holder of United States dollars, as well as other currencies. China has been under pressure from many countries to revalue the Yuan.

One complication with fixed exchange rates is that they make it impossible for a country to conduct independent monetary policy. The reason is that if the central bank is intervening on money markets to buy and sell its currency for foreign exchange reasons, this will necessarily affect its domestic money supply, and vice versa. A country can choose to set its exchange rate or its interest rate, but not both. If it chooses to keep its exchange rate fixed relative to some other currency, the interest rates in the two countries will tend to move together.

The adoption of the euro by a number of countries of the European Union is a dramatic recent example of fixed exchange rates—taken a step further. In 1999 eleven member countries established fixed exchange rates between their national currencies and the euro—although, at that time, the euro was just an accounting notation. Then, in 2002, euro banknotes and coins were put into circulation and national currencies were withdrawn. The countries that have adopted the euro have given up having separate monetary policies, putting the European Central Bank in control of monetary policymaking for the group as a whole.

International Financial Institutions

The Bretton Woods system of fixed exchange rates was only one of the international financial institutions established in the 1940s. Also established during this period were the World Bank, established to promote economic development through loans and programs aimed at poorer countries, and the International Monetary Fund (IMF), established to oversee international financial arrangements. Although fixed exchange rates have been abandoned, the World Bank and the IMF continue—with considerable controversy—to play significant roles in international affairs.

The IMF was charged with overseeing exchange rates, international payments, and balance of payments issues, and with giving advice to countries about their financial affairs. IMF has a complicated governance structure based on voting shares allocated to member countries, but in fact its policy-making has historically been dominated by the United States and Europe. The appointed members of its Executive Board represent the United States, United Kingdom, Germany, France, and Japan. The IMF recently restructured its voting system to give China, South Korea, Turkey and Mexico slightly larger shares. Both the World Bank and IMF have their central offices in Washington DC.

When a country is in financial trouble—for example, when it is unable to pay the interest it owes on its foreign debts, or is experiencing wild swings in its exchange rate, the IMF (in conjunction with the World Bank, if the country is poor) often advises the government on how to remedy the problem. The IMF has tended to encourage poor- and medium-income countries with debt problems to remove their barriers to trade and capital flows, arguing that such liberalization promotes economic growth. The countries are also advised to minimize the size of their government and its expenditures, as a way to reduce the need for borrowing. They are told to keep their inflation rates down, and are often advised about their exchange rate policies as well. The policy prescriptions of trade liberalization, privatization, deregulation, and small government became known as the "Washington Consensus" during the 1980s and 1990s. The policies have also become the source of much controversy, as many economists have come to believe that rigid, "one size-fits-all" application of such policies often works against, rather than for, human welfare and international stability.

While the lending power of the IMF gives it considerable say in the affairs of many countries—for better or worse—the powers of any international organization are limited, especially with regard to the countries that are larger and more powerful. The international financial scene would probably be much more stable—for example, the Japanese crisis and deflation would not have occurred—if all countries had well-designed, transparent and responsible banking systems. But these cannot be forced on a country from the outside. Many commentators worry about the overvalued Chinese Yuan, but there is currently no international institution with the power to force China to change its policies. The volume of foreign debt being taken on by the United States likewise has many commentators worried. If foreigners become less willing to lend to the United States, a deep international and domestic crisis could result.

Currently, many are calling for reforms in the international financial system, and perhaps for new international institutions. Dissatisfaction over the IMF prescriptions for liberalization has caused some changes within the organization itself. But some argue that these changes are not enough, and more radical changes are necessary. Increased regulation of international banking, substantial reforms and increased transparency in multinational corporate governance, restrictions on short-term capital flows, a “Tobin Tax” on speculative transactions in foreign exchange, and establishment of an international bankruptcy court, are among the suggestions for new international institutions.

Further Reading

- Global Development And Environment Institute, Tufts University

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Global Development And Environment Institute. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Global Development And Environment Institute should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |