Energy profile of the North Sea

Contents

Introduction Map of the North Sea. (Source: EIA (Energy profile of the North Sea) , International Energy Annual)

Significant North Sea oil and natural gas reserves were discovered in the 1970s. However, the North Sea did not emerge as a key, non-OPEC oil producing area until the 1980s and 1990s, when major projects began coming onstream. Oil and natural gas extraction in the North Sea's inhospitable climate and great depths requires sophisticated offshore technology. Consequently, the region is a relatively high-cost producer, but its political stability and proximity to major European consumer markets have allowed it to play a major role in world oil and natural gas markets. Five countries operate crude oil and natural gas production facilities in the North Sea: Denmark, Germany, the Netherlands, Norway, and the United Kingdom.

Although the region will continue to be a sizable crude oil producer, output from its largest producers - the UK and Norway - has peaked and entered a period of long term decline. In the near term, improved oil recovery technologies, continued high oil prices and new projects coming online could temporarily delay declines in North Sea crude oil output. Nonetheless, only new discoveries of sizable volumes could reverse the current downward trend of oil production from the North Sea.

In regards to natural gas, the North Sea is also seen as a mature region. Only Norway has seen an increase in natural gas production in recent years, while the UK will likely become a net gas importer in the midterm. Nevertheless, the North Sea’s importance as a key supplier of natural gas will continue, as natural gas consumption in Europe will increase significantly in the future. Imports from outside sources, such as Africa, the Middle East and Russia, will have to increase to compensate for the North Sea decline.

Oil

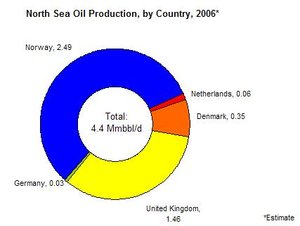

Oil production in the North Sea region, by country 2006. (Source: EIA, International Energy Annual Short Term Energy Outlook)

Oil production in the North Sea region, by country 2006. (Source: EIA, International Energy Annual Short Term Energy Outlook) Transnational Cooperation

Because five countries control different parts of the North Sea, transnational cooperation is necessary for both the development of crude oil deposits straddling maritime boundaries. In April 2005, Norway and the UK signed a bilateral treaty detailing the handling of such resources. The treaty was the first step toward a general framework for inter-boundary oil projects, as previous projects have been governed by separate treaties and negotiations. Talisman Energy planned to bring the Enoch and Blane fields onstream by the end of 2006, which straddle the border between Norway and the UK.

There is a single international crude oil pipeline in the North Sea, the 270-mile Norpipe operated by ConocoPhillips. The system has a capacity of 810,000 bbl/d and connects Norway’s Ekofisk field with the crude oil terminal and refinery at Teesside, England.

Crude Oil Exports

Norway and the United Kingdom are significant oil exporters, though Denmark is also a small net exporter. Because Norway only consumes a relatively small amount of oil each year, the country is able to export the vast majority of its oil production. According to Statistics Norway, the country exported 2.2 million bbl/d of crude oil and petroleum products in 2005. The largest single recipient of Norway's exports in 2005 was the United Kingdom, which imported 808,000 bbl/d from Norway, or 36 percent of Norway's total exports. Other significant destinations included the Netherlands, France, and the United States.

The UK has been a net exporter of crude oil since 1981, though the country does import sizable volumes of crude oil from Norway. According to the British Department of Trade and Industry (DTI), the largest destinations of crude oil exports in 2004 were the United States (28 percent), the Netherlands (21 percent), Germany (17 percent), and France (14 percent). Much of the crude oil exported to the Netherlands is not actually consumed there, but rather sold at the Rotterdam spot market. In 2005, the UK exported 219,000 bbl/d of crude oil and 167,000 bbl/d of petroleum products to the U.S., contributing 2.2 percent and 4.8 percent to total U.S. crude oil and petroleum product imports, respectively.

Natural Gas

According to OGJ, the five countries in the North Sea region had combined, proven natural gas reserves of 176.9 trillion cubic feet (Tcf). Two countries, Norway and the Netherlands, account for over three-fourths of these reserves, while the United Kingdom is currently the largest producer. The North Sea region is an important source of natural gas for Europe, second only to Russia (Energy profile of Russia) in total supply sent to the European Union (EU).

Exploration and Production

Natural gas production in the region has increased dramatically since the early 1980s, with a 2004 production level of 10.4 Tcf. However, regional natural gas production has begun to flatten, with only Norway adding any significant new capacity in recent years. As mentioned above, the UK is the largest producer of natural gas in the North Sea. In its sector, the most important production center is the Shearwater-Elgin area, which contains five large fields (Elgin, Franklin, Halley, Scoter, and Shearwater) producing a combined 1.2 Tcf in 2005, according to IHS Energy.

The second largest producer in the North Sea region is the Netherlands. However, most of that country’s natural gas production comes from the giant onshore Groningen field, which represents about one-half of total national production. The largest center of natural gas production in the Dutch sector of the North Sea is L7, operated by Total.

The bulk of Norway’s natural gas reserves are located in the North Sea, but there are also significant reserves in the Norwegian and Barents Sea areas. In 2004, Norway produced 2.95 Tcf of natural gas, making it the eighth-largest producer in the world; however, due to the country’s low domestic consumption, Norway is the third-largest natural gas exporter in the world, behind Canada (Energy profile of Canada) and Russia (Energy profile of Russia)). A small group of fields account for the bulk of Norway’s natural gas production: four fields (Troll, Sleipner Ost, Asgard, and Oseberg) comprise over 70 percent of Norway’s total natural gas production. Despite the maturation of its major natural gas fields in the North Sea, Norway has been able to sustain annual increases in total natural gas production by incorporating new fields. In October 2004, the Kvitebjorn field came onstream with an expected production level of 710 million cubic feet per day (Mmcf/d). In November 2005, Statoil brought the Halten Bank West project onstream, which includes the Kristin field and four additional satellite fields (Lavrans, Erlend, Morvin, and Ragnfrid).

In the German sector of the North Sea, Wintershall operates the A6 field. According to IHS Energy, A6 produced 90 Mmcf/d of natural gas in 2005. Most of Germany’s natural gas production is onshore. Denmark’s natural gas production reached 333 Bcf in 2004. According to the Danish Energy Authority, more than one-quarter of production is re-injected to boost oil production.

Pipelines

The natural gas production platforms in the North Sea are well integrated by a network of domestic and international pipelines. This network facilitates the movement of natural gas both within the North Sea basin and exports to continental Europe. The Germany (Energy profile of Germany), Norway , and UK Country Analysis Briefs contain additional information about the most important segments of this network.

Liquefied Natural Gas (LNG)

Regasification Capacity

Currently, the UK has a single LNG import terminal, the NGT’s Grain LNG on the Isle of Grain. The facility has a sendout capacity of 420 Bcf/d, which NGT plans to expand to 1.3 Bcf/d by the end of 2007. Algeria (Energy profile of Algeria)’s Sonatrach and BP are the principle importers using the terminal. ExxonMobil and Qatar Petroleum have received regulatory approval for the South Hook LNG receiving terminal in Milton Haven, Wales. The terminal will receive its LNG from the Qatargas II liquefaction project in Ras Laffin, Qatar (Energy profile of Qatar), which is also a joint project between the two companies. The South Hook LNG project should come online by the end of 2007, with an initial capacity of 1.0 Bcf/d and a maximum capacity of 2.1 Bcf/d by 2009. Finally, BG has collaborated with Netherlands-based Petroplus and Malaysia-based Petronas to also build an LNG receiving terminal in Milton Haven, on the site of an existing natural gas storage facility owned by Petroplus. Dragon received regulatory approval from Ofgem in early 2005, and the project should start receiving cargos by the end of 2008 at an initial send-out capacity of 580 Mmcf/d.

There has been discussion concerning the construction of two LNG receiving terminals in the Netherlands, at Eemshaven and Rotterdam, though neither project has progressed beyond the initial planning stages. These LNG terminals would likely facilitate re-exports to the rest of Europe, as the Netherlands is able to meet it own consumption through domestic production. E.ON has also proposed an LNG terminal for Wilhelmshaven, Germany (Energy profile of Germany).

Liquefaction Capacity

Norway has a collection of micro-LNG facilities, mostly used by domestic distributors with occasional exports to Sweden. One such plant in Tjeldergodden has a capacity of 11,800 tons per year (t/y), while another in Snurrevardenin has a capacity of 21,600 t/y. In late 2005, UK engineering firm Hamworthy has received a tender to build a micro-LNG plant at Kollsnes, with a capacity of 82,3000 t/y.

On a much larger scale, Statoil plans to construct an LNG export terminal at Melkoya, near Hammerfest. The Melkoya facility, which will be the first, large-scale LNG export terminal in Europe, will consist of an anchored barge with pipeline connections to the Snohvit project. Statoil plans to have the the project online by the end of 2006, with an initial capacity of 4.1 million t/y and a potential expansion to 8.2 million t/y. Most of the output from the Melkoya facility has already been contracted to El Paso for delivery to the United States, with smaller amounts going to Iberdrola in Spain.

Further Reading

- CIA, 2007. Country Profiles: Denmark. World Factbook. Central Intelligence Agency.

- CIA, 2007. Profiles: Germany.World Factbook. Central Intelligence Agency.

- CIA, 2007. Country Profiles: The Netherlands. World Factbook. Central Intelligence Agency.

- CIA, 2007. Country Profiles: Norway. World Factbook. Central Intelligence Agency.

- CIA, 2007. Country Profiles: the United Kingdom. World Factbook.Central Intelligence Agency.

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |