Energy profile of United Arab Emirates

| Topics: |

Energy profiles of countries and regions

Since declaring independence from the United Kingdom in 1971, the United Arab Emirates (UAE) has relied on its large hydrocarbon endowments to support its economy, but through concerted efforts over the past several decades that has begun to change. While the UAE is making notable progress in diversifying its economy through tourism, trade, and manufacturing, in the near-term oil, natural gas, and associated industries will continue to account for the majority of economic activity in the seven Emirates (Abu Dhabi, Ajman, Al Fujayrah, Dubai, Ras al Khaymah, Sharjah, and Umm al Qaywayn).

|

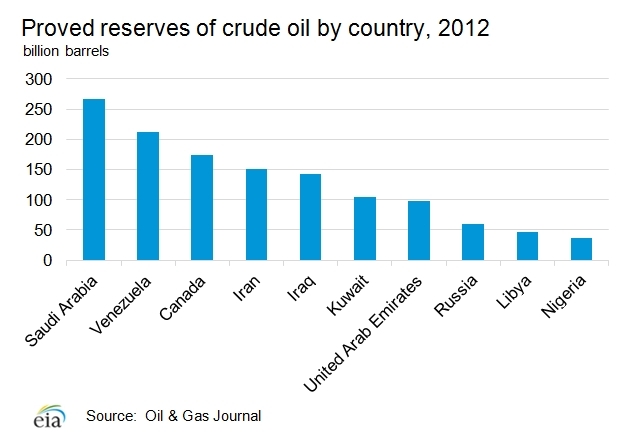

The United Arab Emirates has the seventh-largest proved reserves of both crude oil and natural gas in the world. |

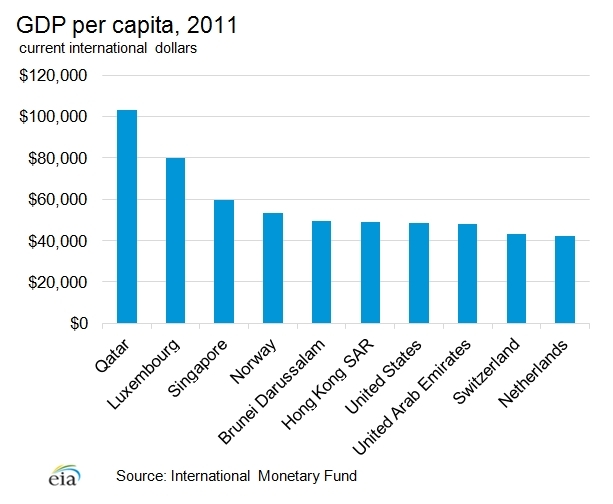

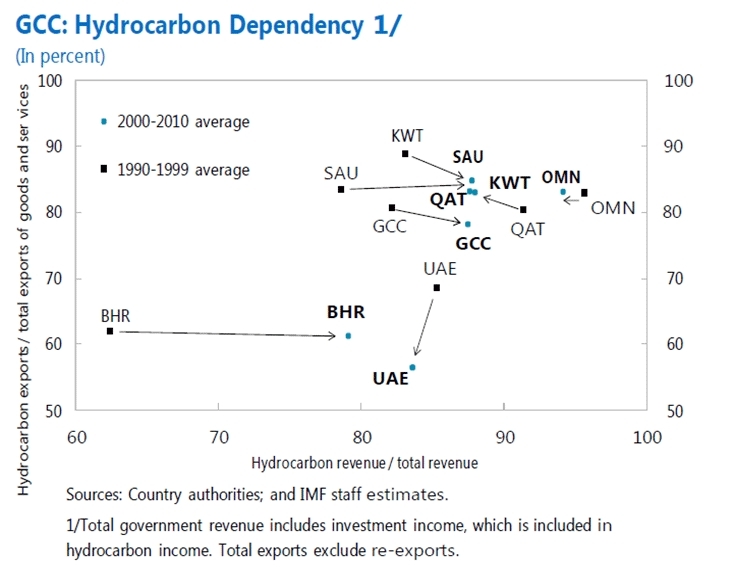

On the strength of its hydrocarbon sector the UAE is one of the world's wealthiest nations, with a gross domestic product (GDP) per capita (at purchasing power parity) estimated at $48,158 in 2011, ranking it eighth in the world in 2011 (directly behind the United States). Beyond the hydrocarbon economy—which continues to account for approximately 80 percent of total government revenues—the UAE is becoming one of the world's most important financial centers and a major trading center in the Middle East. Investments in infrastructure and technology, and the development of projects such as the Khalifa Industrial Zone Abu Dhabi (KIZAD) and other economic "free zones," continue to provide the UAE with insurance against oil price declines and global economic stagnation.

Since the bottom of the economic recession in 2009, the UAE solidified its economic portfolio, but it continues to rely on its vast hydrocarbon resources for the majority of its economic activity. Recovering oil prices and robust trade growth have buoyed the economy, and IMF forecasts of GDP expect growth of 4 percent in 2012. This figure could change significantly if the geopolitical pressures of the region worsen—for example, through an expansion of international sanctions on key trading partner Iran—or oil prices decline as a result of economic slowdowns in developed economies. The UAE is likely to be in a better position to cope with such disruptions than most of its neighbors, but its economy is still heavily dependent on its energy resources. The diversification of its economy is likely to continue over the next several years, but for economists studying the UAE the most important indicator to watch remains the price of crude oil.

Hydrocarbon dependency in Gulf Cooperation Council (GCC) countries

Reproduced with permission from the International Monetary Fund.

Contents

Oil

|

Enhanced oil recovery techniques continued to underpin strong crude oil and lease condensate production in 2011, when the UAE produced 2.7 million barrels per day, and are an important strategy for extending the life of the country's aging oil fields. |

A member of the Organization of the Petroleum Exporting Countries (OPEC) since 1967, the UAE is one of the most significant oil producers in the world. According to Oil & Gas Journal 2012 estimates, the UAE holds the seventh-largest proved reserves of oil in the world at 97.8 billion barrels, with the majority of reserves located in Abu Dhabi (approximately 94 percent). The other six emirates combined account for just 6 percent of the UAE's crude oil reserves, led by Dubai with approximately 4 billion barrels. Production of these resources is dominated by the state-owned Abu Dhabi National Oil Company (ADNOC) in partnership with a few large international oil companies under long-term concessions.

The impending expiration of two existing concession licenses could create opportunities for new entrants into the UAE's energy sector. The ADNOC-led consortia continue to keep the UAE near the top of the list of the world's largest crude oil producers, ranking seventh in 2011 at 2.7 million barrels per day (bbl/d).

The likelihood of further major oil discoveries in the UAE is low, but enhanced oil recovery (EOR) techniques are being successfully used to increase the extraction rates of the UAE's mature oil fields; the recovery of oil prices following the global financial crisis will help maintain the commercial viability of such endeavors. Leaders in the UAE hope to increase crude oil production to 3.5 million bbl/d over the next few years, and levels are expected to approach 3 million bbl/d by the end of 2012.

Sector organization

Each of the seven Emirates is responsible for regulating the oil industry within their borders, creating a mix of production-sharing arrangements and service contracts among the seven Emirates. In Abu Dhabi, the Supreme Petroleum Council (SPC) is the entity charged with setting Abu Dhabi's petroleum-related objectives and policies. Given Abu Dhabi's status as the central player in the UAE's oil industry, the SPC is the most important entity in the country when it comes to establishing oil policy.

The Abu Dhabi National Oil Company—which operates 15 subsidiaries throughout the oil, gas, and petrochemical sector—leads the day-to-day operations and implementation of SPC directives, and is the key shareholder in nearly all upstream activity in the Emirate. ADNOC's subsidiaries are organized into six different categories, including oil and gas exploration, processing, and distribution, among others. Some of the most notable of these subsidiaries are the Abu Dhabi Company for Onshore Oil Operations (ADCO), the Abu Dhabi Marine Operating Company (ADMA-OPCO), the Zakum Development Company (ZADCO), and the Abu Dhabi National Tanker Company (ADNATCO), which is operated under the same management team as the National Gas Shipping Company (NGSCO). ADNATCO has a fleet of 22 vessels, including two oil tankers, nine bulk carriers, and four crude tankers, and is responsible for the transport of a range of products, including crude oil, petrochemicals, and sulfur.

Dubai's energy sector is run by the Dubai Supreme Council of Energy (DSCE), which oversees the Emirate's energy-policy development and coordination. The SCE includes representatives from several key entities, including the Emirates National Oil Company (ENOC), the Dubai Petroleum Establishment (DPE), and the Dubai Nuclear Energy Committee (DNEC). The SCE seeks to ensure that Dubai's economy has adequate and sustainable access to energy resources.

Information about energy sector organization in the other Emirates is limited.

Contracts

In Abu Dhabi, contract structures are based on long-term, production-sharing agreements between the state-run ADNOC and private actors (primarily large international oil companies), with the state required to hold a majority share in all projects. With the exceptions of Dubai and Sharjah—which both have service contracts to manage their declining reserves—the smaller Emirates all use some form of production-sharing agreements similar to those found in Abu Dhabi. Major international oil companies involved in the oil and gas sector in the UAE include BP, Shell, Total, ExxonMobil, and Occidental Petroleum—which in 2008 secured the first new concession offered by the UAE in more than 20 years.

Exploration and production

With the world's seventh-largest proved reserves of crude oil (97.8 billion barrels), the UAE holds more than 7 percent of the world total. Nevertheless, recent exploration has not yielded any significant discoveries of crude oil. What it lacks in new discoveries, however, it makes up for with an emphasis on EOR techniques designed to extend the lifespan of the Emirates' existing oil fields. By improving the recovery rates at those fields, such techniques helped the UAE to nearly double the proved reserves in Abu Dhabi over the last decade-plus. These gains helped make the UAE the seventh-largest oil producer in the world in 2011, producing 2.7 million bbl/d of crude. Production targets are set by the Organization of the Petroleum Exporting Countries (OPEC), and any increase of UAE's output requires approval from fellow members.

Fields

The Zakum system—the third-largest oil system in the Middle East and the fourth-largest in the world—is the center of the UAE's oil industry, accounting for nearly 30 percent of the country's total production in 2010. The Upper Zakum field is run by the ZADCO—which is owned by ADNOC (68 percent share), ExxonMobil (28 percent), and the Japan Oil Development Company (JODCO; 12 percent)—and currently produces 550,000 bbl/d. In July 2012, ZADCO awarded an $800-million engineering, procurement, and construction contract to Abu Dhabi's National Petroleum Construction Company—along with French firm Technip—with the goal of expanding production to 750,000 bbl/d by 2016. The Lower Zakum field operated by the Abu Dhabi Marine Operating Company (ADMA-OPCO) is also being expanded, with production expected to reach 425,000 bbl/d; up from the 300,000 bbl/d it currently produces.

Other significant fields include the Bu Hasa (600,000 bbl/d), Ghasha-Butini (up to 300,000 bbl/d by year-end 2012), Murban Bab (320,000 bbl/d), and the Sahil, Asab, and Shah (SAS) fields (385,000 bbl/d), all located in Abu Dhabi. Dubai and Sharjah also have producing basins, but nothing approaching the scale of those found in Abu Dhabi. The largest fields in those Emirates are the Fateh-Southwest Fateh-Falah fields (80,000 bbl/d) operated by the Dubai Petroleum Establishment and the Mubarak field (8,000 bbl/d) operated by Crescent Petroleum in Sharjah.

With limited prospects for major discoveries, production increases in the UAE will come almost exclusively from EOR techniques in Abu Dhabi's existing oil fields. Nevertheless, the government is pursuing production capacity of 3.5 million bbl/d in 2018 through the investment of $60 billion in Abu Dhabi's oil sector. ADCO—which oversees onshore operations in the emirate—plans to increase production in the Bu Hasa, Bab, and SAS fields over the coming years, with increases expected to approach 200,000 bbl/d as soon as 2014. Some newer fields will also contribute to production gains: Qusahwira is targeted to provide an additional 30,000 bbl/d by the end of 2012 and another 20,000 bbl/d by 2016 (to 90,000 bbl/d), while the Bida al-Qemzan field could add 75,000 bbl/d by 2016 bringing it to 300,000 bbl/d overall.

Smaller offshore fields like the Nasr, Umm Lulu, and Umm Shaif are also the targets of increased investments, with ADMA-OPCO seeking to boost production levels at the Umm Shaif field to 280,000 bbl/d and attempting to bring the combined production of the Nasr and Umm Lulu fields up to 170,000 bbl/d as soon as 2018. Exploration and production in the other Emirates is limited, with reserves nearly exhausted and the cost of recovery continuing to climb.

Major oil fields in the UAE

Source: http://paleopolis.rediris.es/

| Field name | Production (bbl/d) |

|---|---|

| Bu Hasa | 600,000 |

| Sahil, Asab, and Shah (SAS) | 385,000 |

| Murban Bab | 320,000 |

| Bida al-Qemzan | 225,000 |

| Upper Zakum | 450,000 |

| Lower Zakum | 300,000 |

| Umm Shaif | 220,000 |

| Al-Dabbiya, Rumaitha, Shanayel, and Jarn Yarhour | 120,000 |

| Source: IHS, trade reports, U.S. Energy Information Administration | |

Oil pipelines

The UAE has a well-developed domestic pipeline network used to link oil fields with processing plants and export terminals. The newest export pipeline, the Abu Dhabi Crude Oil Pipeline (ADCOP), runs 230 miles from Habshan to Fujairah and began operations in June 2012. This pipeline gives the UAE a direct link from the rich fields of its western desert to the Gulf of Oman, and from there to global markets. ADCOP provides the UAE—and global markets—a strategic alternative to the problematic Strait of Hormuz, which is the world's most important energy chokepoint (see EIA’s World Oil Transit Chokepoints analysis brief). In 2011 17 million bbl/d of crude oil passed through the Strait of Hormuz, which was almost 20 percent of the world's traded oil and 35 percent of all seaborne-traded oil.

The inauguration of the ADCOP is the most significant development in the UAE's midstream profile to date. With a capacity of 1.5 million bbl/d—and expectations of that figure reaching 1.8 million bbl/d in the near future—this pipeline will provide the UAE with the ability to export close to two-thirds of its daily production without passing through the Strait of Hormuz. The International Petroleum Investment Company (IPIC)—owned by the government of Abu Dhabi—led the pipeline project, and it will be operated by ADCO.

Abu Dhabi Crude Oil Pipeline (ADCOP)

Source: Embassy of the United Arab Emirates

Exports and consumption

The ADCOP boosted UAE crude oil export capacity when it began operations in June of 2012, and will add to the already-impressive total of 2.1 million bbl/d that the UAE exported in 2010. That total ranked fifth in the world, behind only Saudi Arabia, Russia, Iran, and Nigeria. Approximately 95 percent of UAE's exports are sent to Asian markets—with the largest share going to Japan—and are primarily sold on a term basis (although some crude is sold in spot markets). Currently the UAE has six export terminals with the capability to handle crude oil, but only the terminal in Fujairah is free from the risks associated with the Strait of Hormuz.

Already one of the world's largest bunkering ports, the export terminal in Fujairah is slated to expand its capabilities significantly over the coming years. Plans to expand the terminal include three new subsea loading lines, an intermediate pumping station, and three offshore buoys designed for deepwater tanker loading. A 250,000 bbl/d refinery is also in the works which will provide fuel for both domestic and export markets. With a storage capacity of 8 million barrels of crude—and plans to increase that total to 12 million barrels in the near future—Fujairah is quickly becoming a critical node in a well-developed export network.

Domestic petroleum consumption—including refined products—was 487,000 bbl/d in 2011, down by more than 130,000 bbl/d from 2010. Gasoline is heavily subsidized in the country, and while the subsidies are politically popular, some analysts believe they encourage wasteful practices. Over the past 10 years, the annual growth rate of oil consumption was 4.3 percent, and positive economic growth forecasts indicate this trend is likely to continue.

| Export terminal | Products | Source (Field) |

|---|---|---|

| Jebel Dhana | crude oil | Asab, Bab, Bu Hasa, Murban, Sahil Shah |

| Zirku Island | crude oil | Upper Zakum, Umm al-Dakh, Satah |

| Das Island | crude oil | Lower Zakum, Umm Shaif |

| Ruwais | petrochemicals, jet fuel, gas oil | N/A |

| Umm al-Nar | crude oil, refined products | Bab |

| Fujairah | crude oil, petrochemicals, refined products | Habshan |

| Jebel Ali | crude oil, liquefied petroleum gas (LPG), refined products | Fateh, Southwest Fateh, Falah, Rashid |

Downstream/refining

The UAE has five refining facilities, the largest of which are the Ruwais (400,000 bbl/d) and Jebel Ali (120,000 bbl/d) refineries. Total refining capacity is reported by the Oil & Gas Journal to be 620,000 bbl/d, however some estimates place the figure slightly higher. IPIC plans to invest $3 billion on a new Fujairah refining complex with a targeted capacity of 250,000 bbl/d; once completed, it will be the second-largest in the Emirates behind the facilities in Ruwais. Further, the Emirates National Oil Company (ENOC)—which is owned by the government of Dubai—announced in June 2012 plans to boost the refining capacity of the Jebel Ali refinery off the coast of Dubai by 20,000 bbl/d as part of a larger port-expansion project. Finally, talks recently re-started between the UAE and its neighbor Oman to build a jointly-operated refinery that would have a capacity exceeding 200,000 bbl/d. No further details about the project have emerged thus far.

Natural gas

|

Rapid growth in domestic energy demand over the past few years has caused the UAE to become a net importer of natural gas. |

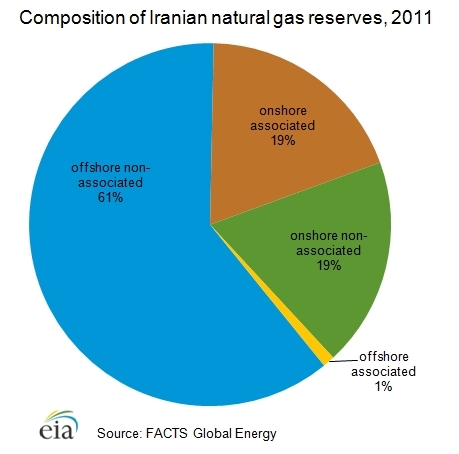

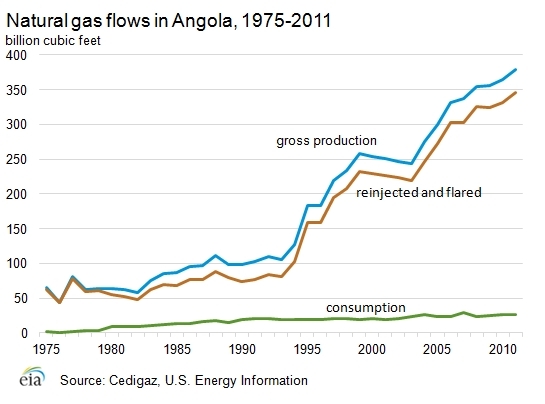

Beyond its vast oil reserves, the UAE has 215 trillion cubic feet (Tcf) of proved natural gas reserves, ranking it seventh in the world, according to Cedigaz. The UAE is a more prolific oil producer, but it was the 11th-largest producer of natural gas in the world in 2011 (2.91 Tcf). Despite its large endowment, the UAE became a net importer of natural gas earlier this decade. This phenomenon is a product of two things: (1) nearly 30 percent of natural gas produced in recent years was re-injected into existing fields as part of enhanced oil recovery (EOR) techniques, and (2) the country's inefficient and rapidly expanding electricity grid—which is being taxed by the rapid economic and demographic growth of recent decades—relies on natural gas for the majority of its feedstock. To help meet the growing demand for natural gas, the UAE boosted imports from neighboring Qatar via the Dolphin Gas Project's export pipeline. The pipeline runs from Qatar to Oman via the UAE, and is one of the principal points of entry for the UAE's natural gas imports. In addition to the imports from Qatar, Dubai and Abu Dhabi both engage in LNG trading; the former as an importer and the latter as an exporter.

As with oil, Abu Dhabi holds the largest share of reserves, accounting for approximately 94 percent of the country's total; Sharjah (4 percent), Dubai (1.5 percent), and Ras al-Khaimah (0.5 percent) make up the balance. Most of the UAE's natural gas has relatively high sulfur content, making the development and processing of the country's vast reserves economically challenging. Because of this, nearly 30 percent of the UAE's gross production of more than 2.91 Tcf is re-injected into oilfields as part of the nation's EOR techniques; marketed production in 2011 was just 1.85 Tcf, placing the UAE 17th in the world.

Sector organization

Natural gas production and regulation falls to the individual Emirates and is often carried out under the same leadership as their oil sectors. Abu Dhabi's natural gas sector is led by ADNOC through its subsidiaries, with the exploration and production of gas resources carried out by ADCO and ADMA-OPCO, just as they do with oil. The Abu Dhabi Gas Industries Limited (GASCO) was created as a joint venture between ADNOC, Shell, Total, and Partex, and is tasked with processing Abu Dhabi's onshore natural gas, as well as the associated gas recovered from onshore oil operations. Another important player in Abu Dhabi's natural gas sector is Abu Dhabi Gas Liquefaction Limited (ADGAS), which controls the production and export of Abu Dhabi's liquefied natural gas (LNG) and liquefied petroleum gas (LPG). ADGAS was created in 1973 and its first load of LNG left Das Island in 1977 bound for Tokyo as part of a long-term deal with the Tokyo Electric Power Company (TEPCO), thus making it the first LNG exporter in the Middle East. The third major player in Abu Dhabi's gas industry is the Abu Dhabi Gas Development Company Limited (Al Hosn Gas), which is responsible for the development of the sour-gas reservoirs in the Emirate's large Shah field.

As it is to Dubai's oil sector, the Supreme Energy Council (SEC) is the central figure in Dubai's natural gas sector. Dubai's natural gas endowments are substantially smaller than those found in Abu Dhabi, so it is not surprising that its major gas players are less well-known than their counterparts in Abu Dhabi. Led by the ENOC group—a state-owned entity made up of dozens of subsidiaries—Dubai's natural gas sector operates similarly to its counterpart in Abu Dhabi. One such subsidiary, The Dubai Natural Gas Company Limited (DUGAS), is the leader in engineering, construction, management, and operation of Dubai's natural gas infrastructure.

Information on the structure of the natural gas sectors in the other Emirates is limited.

Exploration and production

The past several years brought a new focus on the UAE's natural gas reserves. Often overlooked in the pursuit of crude oil, the country's large reserves and growing demand recently forced investors to take notice. New discoveries have been limited over the past several years, but exploration continues.

The UAE's natural gas has a relatively high sulfur content that makes it highly corrosive and difficult to process. For decades the country simply flared the gas from its oil fields rather than undertake the extensive—and expensive—processes associated with separating the sulfur from the gas. The technical difficulties of producing the country's sulfur-rich (sour) gas once posed a great impediment to the development of the nation's reserves, but advances in technology and the growing domestic demand for natural gas make the country's vast reserves an enticing alternative to Qatari imports.

Based on Cedigaz data for 2011, the UAE's proved natural gas reserves of 215 Tcf are located almost entirely in Abu Dhabi, which controls approximately 94 percent of the country's endowment (201.7 Tcf in 2011). Sharjah has the second-highest volume of proved reserves (8.65 Tcf), followed by Dubai (3.53 Tcf) and Ras al-Khaimah (1.06 Tcf). Production in the UAE is also dominated by Abu Dhabi, with reported gross production of 2.42 Tcf in 2011, far outstripping production in the other emirates combined (491 billion cubic feet).

The UAE's total gross production of 2.91 Tcf in 2011 ranked 11th in the world, but its marketed production was almost 40 percent lower at just 1.85 Tcf (17th in the world in 2011). Most of this difference is attributable to the UAE's extensive—and increasing—use of enhanced recovery techniques, although the country continues to engage in a small amount of flaring. As techniques for processing sour gas improve, it is possible that the UAE will be able to increase its marketed production levels without diverting critical natural gas volumes away from its oil fields.

Projects

Despite the challenges of producing natural gas domestically, the UAE hopes to boost production to help meet the country's growing demand. The Abu Dhabi Economic Vision 2030 report laid out Abu Dhabi's strategies for enhancing economic growth in the coming decades, and increasing the viability of domestic natural gas production plays a key role in that plan. The report stresses the importance of greater sour-gas development, as well as research into alternatives to natural gas re-injection in the Emirate's oil fields. One possibility is to use carbon dioxide, which would serve the parallel goal of advancing the country's carbon capture and storage (CCS) capabilities.

Several recent and ongoing projects—the Onshore Gas Development (OGD), Integrated Gas Development (IGD), and Offshore Associated Gas (OAG) projects—seek to boost production of the country's reserves, and are intended to help meet the rapidly growing demand for natural gas in the country. OGD phases one and two expanded associated gas production to 300 million cubic feet per day (MMcf/d) at the Asab and Sahil fields to help increase reservoir pressure in the oil fields, while phase three—completed in 2008—brought production of the Bab field gas to 1.2 billion cubic feet per day (Bcf/d). A phase-three expansion in the Asab and Sahil fields is primed to boost production to 450 MMcf/d by the end of 2012.

The IGD project—led by GASCO, ADGAS, and ADNOC, and in collaboration with Shell, Total, and Partex—is in the process of developing the new Habshan-5 facility that is designed to process the associated gas from the Umm Shaif field and the sour gas from the nearby Habshan fields. Habshan-5 is designed to process 1 Bcf/d of onshore gas and sour-gas from the Habshan field in addition to 1 Bcf/d of offshore gas from Umm Shaif. The Habshan facility will eventually have five gas processing trains and have a capacity of 7 Bcf/d, and the ability to process nearly 125,000 bbl/d of natural gas liquids (NGLs). The $9 billion project is a major part of the UAE's plan to develop its domestic natural gas reserves, and could be operational earlier than initially planned; in June 2012 GASCO announced that it is 90 percent done with the Habshan-5 project, 17 months ahead of schedule. GASCO also awarded a contract to add a fourth NGL train at the Ruwais facility to Petrofac. The gas for that project will be sourced from the Umm Shaif oil field and will be operated by ADMA-OPCO.

Another major project undertaken in the UAE's natural gas sector is the Offshore Associated Gas project (OAG), which was commissioned in 2010 as a part of the larger IGD project. Two new gas processing plants on Das Island—with a combined capacity of 200 MMcf/d of associated gas—and a 30-inch subsea pipeline are intended to help provide additional volumes to the Habshan facilities for processing, and eventual consumption, in the Emirates.

Despite the technical challenges of processing UAE's natural gas, ADNOC is pursuing a large-scale sour-gas development at the Shah field. One of the difficulties of the project is that production of the ultra-sour gas yields relatively small quantities of marketable gas; in this case, just 540 cubic feet per 1,000 cubic feet produced, even after extensive treatment. The project hit a snag in 2010 when ConocoPhillips pulled out suddenly, leaving many analysts to wonder if the project was possible without the involvement of a major international oil company. ADNOC pressed on and eventually brought Occidental Petroleum on board, although details of the arrangement are still unknown.

The project to develop the ultra-sour gas of the Shah field initially went to tender with the Bab field, but after a tepid response from potential partners, the two were split and the Shah field went to tender on its own. ADNOC still plans to develop the sour gas of the Bab field, but plans to wait until 2015 to begin so it can incorporate the lessons it learns from the Shah development to the project at Bab. The Shah gas is set to come on-line in 2014, with an estimated capacity of 1 Bcf/d of raw, unprocessed gas and 500 MMcf/d of marketable gas; an estimated 35,000 bbl/d of condensate is also expected.

Beyond the Shah development, ADNOC is working with U.S.-based company Occidental Petroleum on new developments at the Jarn Yaphour and Ramhan fields. That concession was the first in Abu Dhabi in nearly 50 years and is expected to produce more than 100,000 cubic feet per day. Exploration in the emirates of Sharjah, Ras al-Khaimah, Fujairah, and Umm al-Qawain is ramping up, but there have not been significant finds to date. Production in the Zorah field (between Umm al-Qawain and Ajman) and in Sharjah could boost production to 300 MMcf/d in the near future, but details on the status of those projects are limited.

Imports, exports, and consumption

In 2011, total natural gas imports amounted to 616 Bcf, with 300 Bcf going to Abu Dhabi, 298 Bcf to Dubai, and small amounts to the other Emirates according to Cedigaz data. The UAE received nearly 97 percent of its natural gas imports from neighboring Qatar, with 95 percent coming via pipeline and the remaining 5 percent in the form of LNG shipments to Dubai. The Emirates also export to one another, but those totals are not included in these figures.

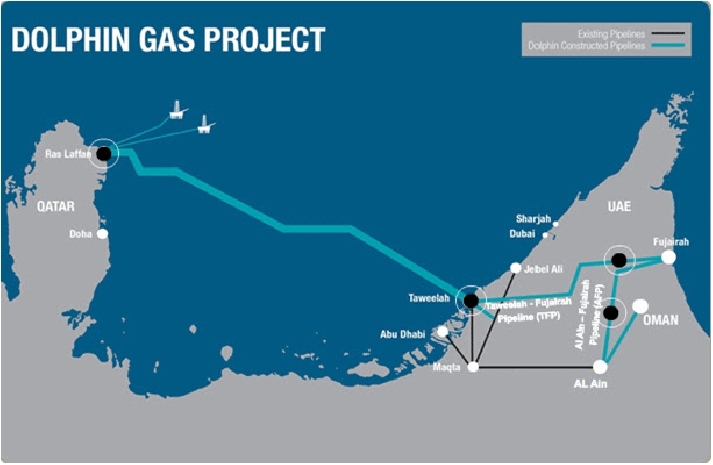

Most of the imported gas from Qatar is sent via the Dolphin Energy pipeline project—the first major inter-state project of its kind in the Persian Gulf—which sends Qatari gas from its vast North field to the UAE and Oman. The pipeline runs from Qatar to Abu Dhabi's Taweelah power stations via a 226-mile subsea pipeline, and from there is distributed to the other Emirates and Oman. The project is led by Dolphin Energy Limited, a group composed of the Mubadala Development Company from Abu Dhabi (51 percent), Total (24.5 percent), and Occidental Petroleum (24.5 percent). This project helps free up Abu Dhabi's natural gas for oil-recovery and export during the 30-year contract, which began in 2007. The pipeline supplies all seven Emirates, and meets roughly 30 percent of the country's natural gas demand. In 2010 Dolphin Energy completed the 152-mile Taweelah-Fujairah section of the pipeline, enabling the delivery of natural gas to two power stations in Fujairah.

Plans to send natural gas from Iran's Salman field to the Emirate of Sharjah continue to be on hold while the UAE waits for Iran to finish construction on its side of the shared maritime border. Iranian officials voiced displeasure over the price they would be paid—agreed upon at a time when natural gas prices were low—and the dispute is likely to head to arbitration at some point. The contract would have sent 500 million cubic meters per day (17.65 Bcf/d) to Sharjah, where it would then be incorporated into the UAE's national grid.

Another plan by Iran—to turn Sirri Island in the Gulf into a major gas hub—is also designed to provide additional natural gas volumes to the UAE. Sirri Island is already connected to the Kish and Qeshm islands, but Iran plans to link it to Abu Musa island as well. This is significant because Abu Musa is one of the three islands whose legal status is contested by Iran and the UAE (the other two are the Greater Tunb and Lesser Tunb islands) in a dispute that began decades ago. The UAE is unlikely to support the plan to connect a pipeline to Abu Musa, because doing so could be viewed as offering de-facto recognition of Iranian claims to the island. The three islands are of geo-strategic importance because of their location at the mouth of the Gulf and proximity to the major shipping lanes of the Strait of Hormuz. An April 2012 visit to Abu Musa by the Iranian President further strained relations between the two Gulf neighbors.

LNG exports

In 1977 the UAE became the first country in the Middle East to export LNG, sending its first load to the Tokyo Power Company (TEPCO) as part of a long-term supply agreement; a second contract was signed in 1990 to double LNG exports to Japan, and in 1994 a third LNG train at Das Island began operation to help fulfill the terms of the agreement. The terminal at Das Island has a capacity of 6 million tons per year of LNG (over 470 MMcf), 2.7 million tons per year of LPG (approximately 31 million barrels of oil equivalent), and almost 1 million tons per year of other associated products. Plans are moving forward to increase the capacity of the first two LNG trains substantially—reportedly by up to 10 million tons per year (788 MMcf)—and they should come on-line around the same time the contract with TEPCO expires (2019).

The UAE exported LNG to four countries in 2011: Japan, India, Kuwait, and Taiwan. The majority of shipments went to Japan (258.75 MMcf), while the other three countries combined received roughly 2.8 mcf, for a total of 267 MMcf. This total placed the UAE just inside the top-30 globally, but it does not include inter-Emirate trade. With planned expansion at the terminal at Das Island and the country's new focus on developing its vast natural gas reserves, many are expecting that the UAE could become a major LNG exporter sometime in the next decade.

Consumption

Most of the UAE's domestically produced and imported gas is used in the country's extensive EOR operations and to operate their many power plants and desalinization plants. While the global macroeconomic crises of the last several years served to dampen energy demand in the UAE—even declining slightly in 2009—solid economic growth over the past few years is again straining the country's natural gas supplies. Plans to develop domestic natural gas resources for use in electricity generation are underway, but meeting domestic demand will require large import volumes for the foreseeable future. Advances in EOR techniques and carbon capture and storage could free up additional volumes for domestic consumption, and improvements to the domestic electricity grid will further alleviate supply problems.

Early in 2012, the UAE announced plans to add a second re-gasification terminal—Emirates LNG—offshore at Fujairah, with an initial capacity of 600 MMcf/d and the potential for expansion to 1.2 Bcf/d. The project will help the country meet its growing demand for natural gas, and should be operational in late 2014. Further, its location in the Gulf of Oman ensures that the country could still receive LNG shipments if the Strait of Hormuz were to become impassable.

Electricity

|

Alternatives to hydrocarbon-based electricity generation are making gains in the UAE, including the use of nuclear and renewable energy technologies. |

Rapid economic and demographic growth over the past decade is pushing the UAE's electricity grid to its limits. Electricity consumption in 2010 is estimated at 85.2 billion kilowatt hours (kWh), 8.5 percent higher than in 2009. Installed capacity in the country continues to rise, reaching 23.25 gigawatts in 2009. There were several service disruptions during the last decade, most as a result of natural gas shortages rather than insufficient generating capacity. In 2007, natural gas that was destined for re-injection in the country's oil fields had to be re-directed to fuel its power plants after initial supplies from the Dolphin Pipeline project failed to arrive on schedule. Most of the UAE's electricity is generated using gas-fed thermal generation, and plans to integrate the seven Emirates' gas distribution networks (for example, through the Dolphin Pipeline project) should help alleviate some of the peak-demand shortfalls experienced in the past. These issues are exacerbated by ongoing subsidy programs that keep domestic prices artificially low, and contribute to wasteful energy practices. Privatization of the electricity sectors in the seven Emirates is little more than a rumor at this time.

The domestic electricity grid is operated by state-led entities in each of the seven Emirates, but the UAE is making progress towards integrating them into a more efficient national grid. These plans coincide with the development of the Gulf Cooperation Council (GCC) grid that will link Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE under one regional grid. This project is designed to help reduce the number of power outages in the short term, and to facilitate power exchanges across seasons and time zones as necessary. The third and final phase was completed in early 2012. With each of the UAE's transmission and distribution networks currently managed by the individual Emirates, the GCC grid should help to improve transmission efficiency in the country. There is speculation that the grid may be expanded outside the Gulf region, perhaps as far as North Africa and Europe.

Despite holding some of the largest deposits of hydrocarbons in the world, the UAE is planning to diversify its energy mix beyond hydrocarbon-based electricity generation, including nuclear (Nuclear power) and renewable-energy technologies. In December 2009, the UAE awarded a $20 billion contract to the Korea Electric Power Corporation (KEPCO) to construct four nuclear reactors, and in July 2012 the licenses were approved for KEPCO to begin construction on the first two 1,400-megawatt reactors. The first reactor is scheduled to come on-line in 2017, with the others expected to be completed by 2020. Upon completion of the first reactor, the UAE will become the second country in the region (after Iran) to have a domestic nuclear program. To avoid concerns about their use of nuclear technologies, the UAE sought—and received—International Atomic Energy Agency (IAEA) approval for its nuclear project, and committed itself to forgoing the domestic enrichment and reprocessing of nuclear fuel by signing a law that banned that practice within the country. In addition, the UAE signed a nuclear cooperation agreement with the United States in 2009, and it is a signatory of the Nuclear Non-Proliferation Treaty.

The UAE is also investing in renewable energy technologies, most notably through the Masdar initiative. Established in 2006, Masdar is a subsidiary of Abu Dhabi's state-owned Mubadala Development Company, and is focused on being a leader in the development of renewable and sustainable energy technologies. Masdar City is the flagship project of the initiative, and aims to be the world's first zero-carbon city. It already houses the Masdar Institute—a joint effort between the Massachusetts Institute of Technology and Masdar—and plans are in the works to bring hundreds of other high-technology and renewable energy businesses into the city over the coming years.

Masdar announced plans to develop the Sir Bani Yas wind farm—with a target capacity of 28.8 megawatts (MW)—and the Shams 1 concentrated solar power (CSP) plant (100 MW capacity) over the next several years, and should continue to help the UAE find new ways to diversify its energy mix. This progress recently helped spur the International Renewable Energy Agency (IRENA) to establish its headquarters in Abu Dhabi.

Notes

- Data presented in the text are the most recent available as of January 3, 2013.

- Data are EIA estimates unless otherwise noted.

Sources

- Abu Dhabi National Oil Company

- Asia Pulse

- Bloomberg

- Business Monitor International

- Cedigaz

- CIA World Factbook

- Dow Jones Commodities Service

- The Economist

- Economist Intelligence Unit

- Energy Intelligence Group

- Financial Times

- Gulf News

- IHS CERA

- IHS Global Insight

- The International Monetary Fund

- Masdar

- Middle East Economic Digest

- Middle East Economic Survey

- NewsBase

- Offshore Magazine

- Oil & Gas Journal

- Organization of the Petroleum Exporting Countries

- Petroleum Economist

- Platts Commodity News

- PFC Energy

- Reuters

- Rigzone

- Tenders Info

- Upstream

- U.S. Energy Information Administration

- U.S. Department of State

- The World Bank

Further Reading

- EIA – UAE Country Energy Profile

- CIA World Factbook - United Arab Emirates

- U.S. State Department Background Notes on UAE

- U.S. State Department Consular Information Sheet, UAE

- U.S. Embassy, Abu Dhabi

- Embassy of UAE in Washington, DC

- Official Portal of Abu Dhabi Government

- Official Portal of Dubai Government

- Abu Dhabi Future Energy Company (MASDAR)

- Abu Dhabi National Oil Company (ADNOC)

- Abu Dhabi Water and Electricity Authority (ADWEA)

- British Petroleum

- Dolphin Energy

- Dubai Electricity and Water Authority (DEWA)

- ArabianBusiness.com

- AME Info Middle East Business Information

- UAE Interact

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |