Agriculture (Greenhouse Gases)

The agriculture sector is a major source of greenhouse gas (GHG) emissions, which some scientists say are contributing to terrestrial temperature increase. Agriculture is also a “sink” for sequestering carbon, which partially offsets GHG emissions by capturing and storing carbon in agricultural soils. The two key types of GHG emissions associated with agricultural activities are methane (CH4) and nitrous oxide (N2O). Agricultural sources of CH4 emissions mostly occur as part of the natural digestive process of animals and manure management at livestock operations; sources of N2O emissions are associated with soil management and fertilizer use on croplands. This article describes these emissions on a carbon-equivalent basis to illustrate agriculture’s contribution to total national GHG emissions and to contrast emissions against estimates of sequestered carbon.

Emissions from agricultural activities account for 6%-8% of all GHG emissions in the United States. Carbon captured and stored in U.S. agricultural soils partially offsets these emissions, sequestering about one-tenth of the emissions generated by the agriculture sector, but less than 1% of all U.S. emissions annually. Emissions and sinks discussed in this article are those associated with agricultural production only. Emissions associated with on-farm energy use or with food processing or distribution, and carbon uptake on forested lands or open areas that might be affiliated with the farming sector, are outside the scope of this article.

Most land management and farm conservation practices can help reduce GHG emissions and/or sequester carbon, including land retirement, conservation tillage, soil management, and manure and animal feed management, among other practices. Many of these practices are encouraged under most existing voluntary federal and state agricultural programs that provide cost-sharing and technical assistance to farmers, predominantly for other production or environmental purposes. However, uncertainties are associated with implementing these types of practices depending on site-specific conditions, the type of practice, how well it is implemented, the length of time a practice is undertaken, and available funding, among other factors. Despite these considerations, the potential to reduce emissions and sequester carbon on agricultural lands is reportedly much greater than current rates.

Congress is currently considering a range of climate change policy options, including GHG emission reduction programs that would either mandate or authorize a cap-and-trade program to reduce GHG emissions. In general, the current legislative proposals would not require emission reductions in the agriculture and forestry sectors. However, several GHG proposals would allow farmers and landowners to receive emissions allowances (or credits) and/or generate carbon offsets, which could be sold to facilities covered by a cap-and-trade program.

Contents

- 1 Introduction

- 2 Agricultural Emissions and Sinks

- 3 Agricultural Emissions

- 4 Agricultural Carbon Sinks

- 5 Potential for Additional Uptake

- 6 Mitigation Strategies in the Agriculture Sector

- 7 Congressional Action

Introduction

Agriculture is a source of greenhouse gas (GHG) emissions, which many scientists agree are contributing to observed climate change. Agriculture is also a “sink” for sequestering carbon, which partly offsets these emissions. Carbon sequestration (the capture and storage of carbon) in agricultural soils can be an important component of a carbon mitigation strategy, limiting the release of carbon from the soil to the atmosphere. Congress is considering a range of climate change policy options, including GHG emission reduction programs that would either mandate or authorize a cap-and-trade program to reduce GHG emissions. In general, the current legislative proposals would not require emission reductions in the agriculture and forestry sectors. However, some of these proposals would allow farmers and landowners to generate offsets in support of a cap-and-trade program. Other proposals that Congress has considered would give farmers and landowners a share of available allowances (or credits) for sequestration and/or emission reduction activities. These offsets and allowances could be sold to facilities (e.g., power plants) covered by a cap-and-trade program. Some bills have also specified that the proceeds from auctioned allowances be used to promote certain activities, including farmland conservation and developing bio-energy technologies. This article is organized in three parts. First, it discusses the extent of GHG emissions associated with the U.S. agriculture sector, and cites current and potential estimates for U.S. agricultural soils to sequester carbon and partly offset national GHG emissions. Second, the article describes the types of land management and farm conservation practices that can reduce GHG emissions and/or sequester carbon in agricultural soils, highlighting those practices that are currently promoted under existing voluntary federal agricultural programs. The Appendix provides a summary primer of the key background information presented in these first two sections. Finally, the article describes legislative action within the ongoing climate change debate as well as enacted changes in the 2008 farm bill (Food, Conservation, and Energy Act of 2008, P.L. 110-246) that could expand the scope of existing farm and forestry conservation programs in ways that could more broadly encompass certain aspects of these climate change initiatives. The article concludes with a discussion of some of the types of questions that may be raised regarding the role of the U.S. agriculture sector in the broader climate change debate. This article does not address the potential effects of global climate change on U.S. agricultural production. Such effects may arise because of increased climate variability and incidence of global environmental hazards, such as drought and/or flooding, pests, weeds, and diseases, or temperature and precipitation changes that might cause locational shifts in where and how agricultural crops are produced.endnote_1 This article also does not address how ongoing or anticipated initiatives to promote U.S. bioenergy production may effect efforts to reduce GHG emissions and/or sequester carbon, such as by promoting more intensive feedstock production and by encouraging fewer crop rotations and planting area setbacks, which could both raise emissions and reduce carbon uptake.endnote_2 (Agriculture and Climate Change)

Agricultural Emissions and Sinks

Agriculture is a both a source and a sink of greenhouse gases, generating emissions that enter the atmosphere and removing carbon dioxide (CO2) from the atmosphere through photosynthesis and storing it in vegetation and soils (a process known as sequestration). Sequestration in farmland soils partially offsets agricultural emissions. Despite this offset, however, the U.S. agriculture sector remains a net source of GHG emissions. Some countries are promoting fringes of agricultural lands as reforestation areas; these efforts add to forests as carbon sinks.

Source of National Estimates

Estimates of GHG emissions and sinks for the U.S. agriculture sector presented in this article are the official U.S. estimates of national GHG emissions and carbon uptake, as published annually by the U.S. Environmental Protection Agency (EPA) in its Inventory of U.S. Greenhouse Gas Emissions and Sinks.[1] EPA’s Inventory data reflect annual national emissions by sector and fuel, including estimates for the agriculture and forestry sectors. EPA’s estimates rely on data and information from the U.S. Department of Agriculture (USDA), the Department of Energy, the Department of Transportation, the Department of Defense, and other federal departments. The EPA-published data are rigorously and openly peer reviewed through formal interagency and public reviews involving federal, state, and local government agencies, as well as private and international organizations. For the agriculture and forestry sectors, USDA publishes a supplement to EPA’s Inventory, which builds on much of the same data and information, but in some cases provides a more detailed breakout by individual states and sources.[2]

In this article, emissions from agricultural activities are aggregated in terms of carbon dioxide or CO2-equivalents, and expressed as million metric tons (MMTCO2-Eq.).[3] This aggregation is intended to illustrate agriculture’s contribution to national GHG emissions and to contrast emissions against estimates of sequestered carbon.

Agricultural Emissions

Total GHG emissions from U.S. agricultural activities have averaged 514 MMTCO2-Eq. in the past few years (Table 1). As a share of total U.S. GHG emissions, the agriculture sector represents about 7% of all estimated annual emissions. Data dating back to 1990 indicate that emissions associated with the U.S. agriculture activities have been increasing, rising from estimated total emissions of 460 MMTCO2-Eq. in 1990.[4] EPA’s reported emissions are expressed in terms of CO2-equivalent units, and cover both estimated direct emissions and indirect emissions related to electricity use in the sector. These estimates do not cover other types of emissions associated with some agricultural activities, such as carbon monoxide, nitrogen oxides, and volatile organic compounds.

Although the agriculture sector is a leading economic sector contributing to national GHG emissions, its share of total emissions is a distant second compared to that of the energy sector. Fossil fuel combustion is the leading source of GHG emissions in the United States (about 80%), with the energy sector generating 85% of annual emissions across all sectors.[5]

Table 1. Estimated Current GHG Emissions and Carbon Sequestration: U.S. Agricultural and Forestry Activities, Average 2003-2007 (million metric tons CO2 equivalent (MMTCO2-Eq.))

|

Source |

Emissions |

Sequestrationa |

Net |

|

Agricultural Activities |

513.8 | (43.9) | 469.9 |

|

Direct Emissionsb |

484.8 | — | — |

|

Indirect electricity-related |

29.0 | — | — |

|

Land Use Change, Forestryc |

31.2 | (1,105.2) | (1,074.0) |

|

Subtotal |

545.0 | (1,149.1) | (604.1) |

|

U.S. Total, All Sources |

7,071.2 | (1,159.2) | 5912.0 |

|

% U.S. Total, Agriculture Share |

7% | 4% | — |

|

% U.S. Total, Forestry Share |

<0.5% | 95% | — |

Source: Compiled by Congressional Research Service from EPA Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2007, April 2009 (Tables 2-14, 7-3, 7-1, and 6-1), http://epa.gov/climatechange/emissions/usinventoryreport.html. Data shown are five-year average (2003-2007).

Notes: a. Measured agricultural sequestration categories include land converted to grassland, grassland remaining grassland, land converted to cropland, and cropland remaining cropland. Forestry includes change in forest stocks and carbon uptake from urban trees. Total also includes landfilled yard trimmings and food scraps. b. Includes CO2, CH4, and N2O. Based on reported emissions attributable to the “agriculture” economic sector, but includes land use and forestry values (EPA Inventory, Table 2-14), which are excluded here. c. Reported as “Emissions from land-use, land-use changes, and forestry” (EPA Inventory, Table 7-3). (Agriculture and Climate Change)

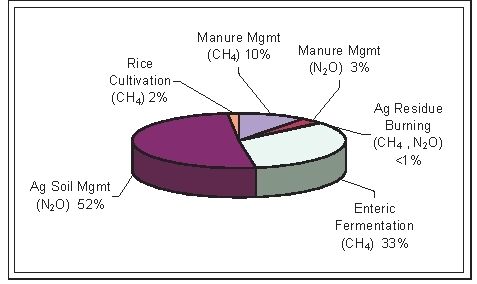

Direct Emissions

The types of direct GHG emissions associated with agricultural activities are methane (CH4) and nitrous oxide (N2O), which are among the key gases that contribute to GHG emissions.[6] These gases are significant contributors to atmospheric warming and have a greater effect warming than the same mass of CO2. [7] Agricultural sources of CH4 emissions mostly occur as part of the natural digestive process of animals and manure management in U.S. livestock operations. Sources of N2O emissions are mostly associated with soil management and commercial fertilizer and manure use on U.S. croplands, as well as production of nitrogen-fixing crops.[8] Emissions of N2O from agricultural sources account for about two-thirds of all reported agricultural emissions; emissions of CH4 account for about one-third of all reported emissions. Across all economic sectors, the U.S. agriculture sector is the leading source of N2O emissions (about 70%) and a major source of CH4 emissions (about 25%).[9]

These direct emissions account for the bulk (more than 90%) of estimated emissions associated with U.S. agriculture activities, totaling 530 MMTCO2-Eq. in 2007. Estimates dating back to 1990 indicate that direct emissions from the U.S. agriculture sector have increased steadily, up from about 430 MMTCO2-Eq. in 1990.[10] These estimates do not include emissions associated with on-farm energy use and forestry activities.

Sources of CH4 and N2O emissions from agricultural activities are measured across five categories.

- Agriculture soil management: Nitrous oxide emissions from farmland soils are associated with cropping practices that disturb soils and increase oxidation, which can release emissions into the atmosphere. The types of practices that contribute to emissions releases are fertilization; irrigation; drainage; cultivation/tillage; shifts in land use; application and/or deposition of livestock manure and other organic materials on cropland, pastures, and rangelands; production of nitrogen-fixing crops and forages; retention of crop residues; and cultivation of soils with high organic content.

- Enteric fermentation: Methane emissions from livestock operations occur as part of the normal digestive process in ruminant animals[11] and are produced by rumen fermentation in metabolism and digestion. The extent of such emissions is often associated with the nutritional content and efficiency of feed utilized by the animal.[12] Higher feed effectiveness is associated with lower emissions.

- Manure management: Methane and nitrous oxide emissions associated with manure management occur when livestock or poultry manure is stored or treated in systems that promote anaerobic decomposition, such as lagoons, ponds, tanks, or pits.

- Rice cultivation: Methane emissions from rice fields occur when fields are flooded and aerobic decomposition of organic material gradually depletes the oxygen in the soil and floodwater, causing anaerobic conditions to develop in the soil, which releases methane.

- Agricultural residue burning: Methane and nitrous oxide emissions are released by burning residues or biomass.[13] The share of GHG emissions for each of these categories is as follows: agriculture soil management (68% of emissions), enteric fermentation (21%), manure management (10%), rice cultivation (1%), and field burning of agricultural residues (less than 1%). Approximately 70% of agricultural emissions are associated with the crop sector and about 30% with the livestock sector (Figure 1).[14]

Electricity-Related Emissions

The sector also emits CO2 and other gases through its on-farm energy use, for example, through the use of tractors and other farm machinery. These emissions are generally aggregated along with other transportation and industrial emissions in the “energy” sources, where they constitute a very small share of the overall total emissions for the sector, estimated at 30 MMTCO2-Eq. (Table 1). Estimates over the time period since 1990 indicate that emissions associated with electricity use in agriculture activities have been steady or decreasing.[15] These estimates do not include emissions associated with food processing or distribution, which are generally aggregated with emissions for the transportation and industrial sectors.

Land Use and Forestry Emissions

Land use and forestry activities account for less than 1% of total estimated GHG emissions in the United States (Table 1). Emissions associated with forestry activities are estimated based on information about forest fires and also land use changes on croplands, wetlands, and peatlands, as well as land conversion and input limitations and management changes. In fact, forests provide a major carbon sink.

Uncertainty Estimating Emissions

Agricultural activities may also emit other indirect greenhouse gases, such as carbon monoxide, nitrogen oxides, and volatile organic compounds from field burning of agricultural residues.[16] These emissions are not included in EPA’s annual Inventory estimates because they contribute only indirectly to climate change by influencing tropospheric ozone, which is a greenhouse gas. Agricultural activities may also release other types of air emissions, some of which are regulated under the federal Clean Air Act, including ammonia, volatile organic compounds, hydrogen sulfide, and particulate matter.[17] These types of emissions are typically not included in proposals to limit GHG emissions.EPA’s estimates are based on annual USDA data on crop production, livestock inventories, and information on conservation and land management practices in the agriculture sector. Actual emissions will depend on site-specific factors, including location, climate, soil type, type of crop or vegetation, planting area, fertilizer and chemical application, tillage practices, crop rotations and cover crops, livestock type and average weight, feed mix and amount consumed, waste management practices (e.g., lagoon, slurry, pit, and drylot systems), and overall farm management. Emissions may vary from year to year depending on actual growing conditions. The EPA-reported data reflect the most recent data and historical updates, and reflect underlying methodological changes, in keeping with Intergovernmental Panel on Climate Change (IPCC) guidelines.[18] More detailed information is in EPA’s Inventory.

Potential for Additional Emission Reductions

There is potential to lower GHG emissions from U.S. agricultural facilities at both crop and livestock operations through further adoption of certain conservation and land management practices. In most cases, such practices may both reduce emissions and sequester carbon in agricultural soils.

Improved Soil Management

Options to reduce nitrous oxide emissions associated with crop production include improved soil management, more efficient fertilization, and implementing soil erosion controls and conservation practices. In the past 100 years, intensive agriculture has caused a soil carbon loss of 30%-50%, mostly through traditional tillage practices.[19] In contrast, conservation tillage practices preserve soil carbon by maintaining a ground cover after planting and by reducing soil disturbance compared with traditional cultivation, thereby reducing soil loss and energy use while maintaining crop yields and quality. Practices include no-till and minimum, mulch, and ridge tillage. Such tillage practices reduce soil disturbance, which reduces oxidation and the release of carbon into the atmosphere. Therefore, conservation tillage practices reduce emissions from cultivation and also enhance carbon sequestration in soils (discussed later in this article). Nearly 40% of U.S. planted areas are under some type of conservation tillage practices.[20]

Improved Manure and Feed Management

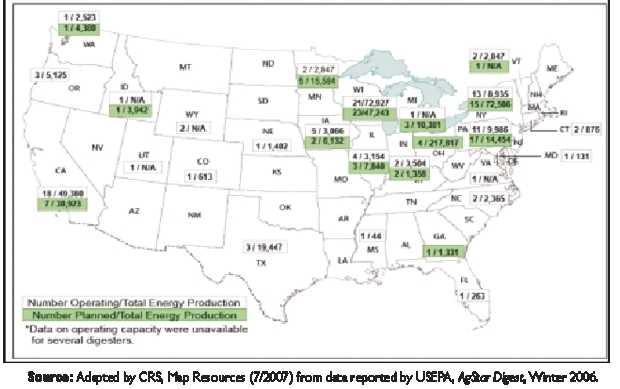

Methane emissions associated with livestock production can be reduced through improved manure and feed management. Improved manure management is mostly associated with installing certain manure management systems and technologies that trap emissions, such as an anaerobic digester[21] or lagoon covers. Installing such systems generates other principal environmental benefits. Installing an anaerobic digester to capture emissions from livestock operations, for example, would also trap other types of air emissions, including air pollutants such as ammonia, volatile organic compounds, hydrogen sulfide, nitrogen oxides, and particulate matter that are regulated under the federal Clean Air Act. Other benefits include improved water quality through reduced nutrient runoff from farmlands, which may be regulated under the federal Clean Water Act.[22] Many manure management systems also control flies, produce energy, increase the fertilizer value of any remaining biosolids, and destroy pathogens and weed seeds.[23]

Manure management systems, however, can be costly and difficult to maintain, given the typically high start-up costs and high annual operating costs. For example, the initial capital cost of an anaerobic digester with energy recovery is between $0.5 million and $1 million at a largesized dairy operation, and annual operating costs are about $36,000. Initial capital costs for a digester at a larger hog operation is about $250,000, with similar operating costs.[24] Upfront capital costs tend to be high because of site-specific conditions at an individual facility, requiring technical and engineering expertise. Costs will vary depending on site-specific conditions but may also vary by production region. Costs may be higher in areas with colder temperatures, where some types of digesters may not be appropriate or may require an additional heat source, insulation, or energy requirements to maintain constant, elevated temperatures.[25] Energy requirements to keep a digester heated are likely be lower in warmer climates.

Incentives are available to assist crop and livestock producers in implementing practices and installing systems that may reduce GHG emissions. Such incentives include cost-sharing and also low-interest financing, loan guarantees, and grants, as well as technical assistance with implementation. Funding for anaerobic digesters at U.S. livestock operations has been available to livestock producers under various farm bill programs.[26] Despite the availability of federal and/or state-level cost-sharing and technical assistance, adoption of such systems remains low throughout the United States. There are currently about 100 digester systems in operation or planned at commercial dairy and hog farms, accounting for only 1% of operations nationwide (Figure 2).[27]

Improved feed strategies may also lower methane emissions at livestock operations. Such strategies may involve adding supplements and nutrients to animal diets, substituting forage crops for purchased feed grains, or instituting multi-phase feeding to improve digestive efficiency. Other options involve engineering genetic improvements in animals.[28] Purchasing feed supplements and more intensely managing animal nutrition and feeding practices may add additional costs and management requirements at the farm level.

Agricultural Carbon Sinks

Carbon Loss and Uptake

Agriculture can sequester carbon, which may offset GHG emissions by capturing and storing carbon in agricultural soils. On agricultural lands, carbon can enter the soil through roots, litter, harvest residues, and animal manure, and may be stored primarily as soil organic matter (SOM; see Figure 3).[29] Soils can hold carbon both underground in the root structure and near the soil surface and in plant biomass. Loss of soil carbon may occur with shifts in land use, with conventional cultivation (which may increase oxidation), and through soil erosion. Carbon sequestration in agricultural soils can be an important component of a climate change mitigation strategy, since the capture and storage of carbon may limit the release of carbon from the soil to the atmosphere.

Voluntary land retirement programs and programs that convert or restore grasslands and wetlands promote carbon capture and storage in agricultural soils. Related practices include afforestation (including the conversion of pastureland and cropland), reforestation, and agro-forestry practices. Conservation practices that raise biomass retention in soils and/or reduce soil disturbance, such as conservation tillage and/or installing windbreaks and buffers, also promote sequestration. More detailed information is provided in the following section, “Mitigation Strategies in the Agriculture Sector.” Measuring and Monitoring Carbon in the Agricultural and Forestry Sectors, summarizes estimated sequestration rates for selected types of farm and forestry practices, based on the current literature as summarized by USDA and EPA.[30]

Agriculture-Based Sequestration

Total carbon sequestration from U.S. agricultural activities has averaged about 44 MMTCO2-Eq. during the 2003-2007 time period (Table 1). Compared to total agriculture-based emissions, sequestration within the sector accounts for only a small share (less than 10%) of its annual emissions. Compared to total U.S. GHG emissions, agriculture-based sequestration accounts for less than 1% of emissions each year.[31] Data dating back to 1990 indicate that carbon sequestration associated with U.S. agriculture activities has decreased significantly, from an estimated total storage of 96 MMTCO2-Eq. in 1990 to 45 MMTCO2-Eq. in 2007.[32] Carbon sequestration in the U.S. agriculture sector currently offsets only about 5% of the carbon-equivalent of reported GHG emissions generated by the agriculture sector each year. Thus the sector remains a net source of GHG emissions.

Other Land Use and Forestry Sequestration

These estimates do not include estimates for the forestry sector, or sequestration activities on forested lands or open areas that may be affiliated with the agriculture sector. Forests and trees account for a majority (about 95%) of all estimated carbon uptake in the United States, mostly through forest restoration and tree-planting. As shown in Table 1, land use and forestry practices account for a much larger share of annual carbon storage from land-based systems, and are estimated to have averaged 1,105 MMTCO2-Eq. during the past few years. Compared to total U.S. GHG emissions, sequestration from land use and forestry practices accounts for about 16% of emissions each year. Historical data show that carbon sequestration from land use and forestry activities has increased, rising from an estimated storage of 660 MMTCO2-Eq. in 1990 to 910 MMTCO2-Eq. in 2007.[33]

The agriculture and forestry sectors are only part of the overall carbon sequestration debate. Carbon sequestration by these sectors is usually referred to as indirect or biological sequestration.[34] Biological sequestration is considered to have less potential for carbon sequestration than direct sequestration, also referred to as carbon capture and storage, and is typically associated with oil and gas production.

Uncertainty Estimating Carbon Sinks

EPA’s Inventory estimates of carbon uptake in agricultural soils are based on annual data and information on cropland conversion to permanent pastures and grasslands, reduced summer fallow areas in semi-dry areas, increased conservation tillage, and increased organic fertilizer use (e.g, manure) on farmlands, as well as information on adoption rates and use of certain conservation and land management practices. However, actual carbon uptake in agricultural soils depends on several site-specific factors, including location, climate, land history, soil type, type of crop or vegetation, planting area, tillage practices, crop rotations and cover crops, and farm management in implementing certain conservation and land management practices. Estimates of the amount of carbon sequestered may vary depending on the amount of site-specific information included in the estimate, as well as on the accounting procedures and methodology used to make such calculations.

In general, the effectiveness of adopting conservation and land management practices will depend on the type of practice, how well the practice is implemented, and also on the length of time a practice is undertaken. For example, time is needed for a certain conservation practice to take hold and for benefits to accrue, such as buildup of carbon in soils from implementing conservation tillage or other soil management techniques, and growing time for cover crops or vegetative buffers. The overall length of time the practice remains in place is critical, especially regarding the sequestration benefits that accrue over the time period in which land is retired. In addition, not all conservation and land management practices are equally effective or appropriate in all types of physical settings. For example, the use and effectiveness of conservation tillage practices will vary depending on soil type and moisture regime, which may discourage some farmers from adopting or continuing this practice in some areas.

The potential impermanence of conservation and land management practices raises concerns about the effectiveness and limited storage value of the types of conservation practices that sequester carbon, given that the amount of carbon stored depends on the willingness of landowners to adopt or continue to implement a particular voluntary conservation practice. There are also concerns that the addition of other conservation practices may not significantly enhance the sequestration potential of practices that might already be in place.[35] This raises questions about the cost-effectiveness of sequestering carbon on farmlands relative to other climate change mitigation strategies in other industry sectors. Finally, implementing conservation practices and installing new technologies may be contingent on continued cost-sharing and other financial incentives contained in the current farm bill; programs funded through this legislation help offset the cost to farmers for these practices and technologies, which some farmers may not be willing to do otherwise.

Potential for Additional Uptake

USDA reports that the potential for carbon uptake in agricultural soils is much greater than current rates. USDA forecasts that the amount of carbon sequestered on U.S. agricultural lands will more than double from current levels by 2012, adding roughly an additional 40 MMTCO2- Eq. of sequestered carbon attributable to the sector.[36] This additional uptake is expected through improved soil management (roughly 60%), improved manure and nutrient management (about 30%), and additional land-retirement sign-ups (about 10%). Longer-term estimates from USDA and EPA report that the potential for net increases in carbon sequestration in the agriculture sector could reach an estimated 590 to 990 MMTCO2-Eq. per year (Table 2).

An additional carbon uptake potential of 590 to 990 MMTCO2-Eq. per year would more than offset the agriculture sector’s annual GHG emissions, or offset 8% to 14% of total current national emissions from all sources. Currently, carbon uptake in agricultural soils sequesters under 1% of total national GHG emissions annually (Table 1). Many U.S. farm groups claim that the U.S. agriculture sector has the potential to store between 15% and 25% of total annual U.S. emissions,[37] but it is unclear whether this cited potential also includes already substantial sequestration from current land use and forestry practices. An estimated 16% of all GHG emissions are currently sequestered annually, with the bulk through growth in forest stocks.

Studies by both the USDA and EPA provide aggregate annual estimates of the additional carbon storage potential for various agricultural and forestry activities (Table 2). These aggregate estimates are in addition to current estimated sequestration rates in these sectors (Table 1).

The USDA and EPA studies both account for current conditions, as well as expected direct costs and opportunity costs in modeling landowners’ decision-making. These estimates are measured in terms of carbon storage over time (15 to 100 years) across a range of assumed carbon market prices (roughly $3 to $50/MT CO2-Eq.). These published results show a range of carbon prices by type of farming and forestry activity. The presumed relationship between carbon sequestration and price shows that as carbon prices rise, this will likely attract more investment and adoption of additional and differing types of mitigation activities. These estimates are reported as a national total and are also broken out by select U.S. regions.

Table 2 shows the estimated carbon mitigation potential reported by EPA and USDA for two mitigation categories—afforestation and soil sequestration—across a range of assumed carbon prices. In general, the low end of this price range indicates that carbon sequestration potential is mostly associated with cropland management practices, whereas higher-end prices are mostly associated with land retirement and conversion, and a longer sequestration tenure. EPA’s analysis includes estimates of other mitigation activities, including forest management on private lands. These estimates reflect the net reduction compared to baseline conditions, or current estimated sequestration (Table 1).

USDA reports that the potential for net increases in carbon sequestration through afforestation and in agricultural soils is estimated to range widely from 0 to 587 MMT CO2-Eq. per year, following the implementation of a 15-year program (Table 2).[38] Sequestration potential is estimated to be greatest at the high end of the assumed price range for carbon (about $30/MT CO2-Eq.). At this price level, USDA projects sequestration levels could increase by 587 MMT CO2-Eq. annually. Even at lower prices (about $3/MT CO2-Eq.), the projected mitigation potential is double the current estimated sequestration for these types of agricultural activities. Comparable EPA estimates (15-year period) project a higher sequestration potential for the U.S. agricultural sector across the range of assumed carbon prices, reported at 160 MMT CO2-Eq. per year at lower carbon prices to 990 MMTCO2-Eq. per year at the higher price levels.[39] For information on USDA and EPA estimates and how these estimates were derived, see Measuring and Monitoring Carbon in the Agricultural and Forestry Sectors.

Table 2. Carbon Sequestration Potential in the U.S. Agriculture Sector, Alternative Scenarios and Payment Levels (dollars per million metric ton of sequestered CO2)

|

Source |

$3-$5 range |

$14-$15 range |

$30-$34 range |

|

USDA Estimate |

(million mt of sequestered CO2) | ||

|

Afforestation |

0-31 |

105-264 |

224-489 |

|

Agricultural soil carbon sequestration |

0.4-4 |

3-30 |

13-95 |

|

Total |

0.4-35 |

108-295 |

237-587 |

|

EPA Estimate |

|||

|

Afforestation |

12 |

228 |

806 |

|

Agricultural soil carbon sequestration |

149 |

204 |

187 |

|

Total |

161 |

432 |

994 |

Afforestation (creation of forested areas mostly through conversion of pastureland and cropland) reflects the majority of the estimated uptake potential, with agricultural soil carbon sequestration accounting for a smaller share at the high end of the estimated range. However, large projected gains in mitigation from afforestation could be overly optimistic, given that afforestation is highly dependent on land availability and may only come from available cropland or pastureland. However, as reported by the Congressional Budget Office (CBO), estimates of the future mitigation potential from afforestation and cropland soil sequestration often vary significantly across different studies.[40]

In March 2009, EPA indicated that it had updated its underlying model and subsequently its estimates of the carbon mitigation potential from farm and forestry practices.[41] Previously EPA’s estimates for mitigation from agriculture soil carbon activities were questionably higher than USDA’s own estimates. EPA’s estimates for various mitigation activities, including agriculture soil carbon activities, were likely overstated compared to USDA’s for a variety of reasons, including recent market changes, shifts to biofuel feedstocks, land availability, and EISA requirements, among others. For more information about EPA’s model and estimates, see Estimates of Carbon Mitigation Potential from Agricultural and Forestry Activities.

The recent changes to EPA’s simulation models have implications for the agency’s analysis of the overall estimated mitigation potential from agriculture and forestry activities. These differences are reflected in EPA’s April 2009 analysis of the mitigation potential of H.R. 2454 (Waxman- Markey), which has since been reported by the House Energy and Commerce Committee. As estimated by EPA, for some mitigation activities, underlying changes to EPA’s models translate into significant differences compared to previous EPA estimates.[42] Specifically, EPA’s current estimates of the mitigation potential from agriculture soil carbon activities are much lower. EPA’s current analysis shows that, at lower carbon prices, agriculture soil carbon activities are negligible, and at higher prices agriculture soil carbon activities account for a smaller share of overall mitigation activities than previously estimated. Other mitigation activities, including forest, manure, and crop management, account for a greater share than previously estimated.

Enhancing Carbon Sinks

There is potential to increase the amount of carbon captured and stored in U.S. agricultural lands by adopting certain conservation and land management practices. In most cases, such practices may both sequester carbon in farmland soils and reduce emissions from the source. Estimates of representative carbon sequestration rates for selected types of farm and forestry practices are provides in Measuring and Monitoring Carbon in the Agricultural and Forestry Sectors.

Improved Soil and Land Management

The main carbon sinks in the agriculture sector are cropland conversion and soil management, including improved manure application.[43] More than half of all carbon sequestered on U.S. agricultural lands is through voluntary land retirement programs and programs that convert or restore land (e.g., conversion to open land or grasslands, conversion to cropland, restoration of grasslands or wetlands, etc.). Undisturbed open lands, grasslands and wetlands can hold carbon in the soil both underground in the root structure and above ground in plant biomass. The amount of carbon sequestered will vary by the type of land management system. Afforestation and cropland conversion have the greatest potential to store the most carbon per acre annually, compared with other types of systems, such as tree plantings and wetlands conversion, or storage in croplands.[44] Conservation tillage is another major source of sequestration on farmlands, accounting for about 40% of the carbon sequestered by the U.S. agriculture sector. [45] Improved tillage practices improve biomass retention in soils and reduce soil disturbance, thereby decreasing oxidation. The amount of carbon sequestered will vary by the type of tillage system. Among conservation tillage practices, no-till stores about 30% more than the amount of carbon stored by reduced tillage but more than five times that stored on intensive tilled croplands. (Conservation tillage practices are explained in the section on “Potential for Additional Emission Reductions”).

Improved Manure and Feed Management

Mitigation strategies at U.S. livestock operations are not commonly associated with carbon uptake and are not included in EPA’s carbon sink estimates. However, installing manure management systems, such as an anaerobic digester, captures and/or destroys methane emissions from livestock operations and may be regarded as avoided emissions or as a form of direct sequestration capturing emissions at the source. As a result, some carbon offset programs are beginning to promote manure management systems as a means to capture and store methane at dairy operations, which may also be sold as carbon offset credits and as a renewable energy source. [46] Given that there are currently few anaerobic digesters in operation, estimates of the actual or potential uptake may be difficult to estimate. (Manure management systems are further explained in the section on “Potential for Additional Emission Reductions”)

Mitigation Strategies in the Agriculture Sector

Existing conservation and farmland management programs administered at both the federal and state levels often encourage the types of agricultural practices that can reduce GHG emissions and/or sequester carbon. These include conservation, forestry, energy, and research programs within existing farm legislation. These programs were initiated predominantly for other production or environmental purposes, and few specifically address climate change concerns in the agriculture and forestry sectors. However, some USDA and state-level programs have started to place additional attention on the potential for emissions reduction and carbon storage under certain existing programs.

Agricultural conservation and other farmland practices broadly include land management, vegetation, and structures that can also reduce GHG emissions and/or sequester carbon, such as:

- Land retirement, conversion, and restoration—conversion/restoration to grasslands, wetlands, or rangelands; and selected structural barriers, such as vegetative and riparian buffers, setbacks, windbreaks;

- Cropland tillage practices—reduced/medium- till, no-till, ridge/strip-till vs. conventional tillage;

- Soil management/conservation—soil supplements/amendments, soil erosion controls; precision agriculture practices, recognized best management practices;

- Cropping techniques—crop rotations, cover cropping, precision agriculture practices, efficient fertilizer/nutrient (including manure) and chemical application;

- Manure and feed management—improved manure storage, e.g., anaerobic digestion, methane recovery; and improved feed efficiency, dietary supplements;

- Grazing management—rotational grazing, improved forage practices;

- Bioenergy/biofuels substitution—on-farm use, replacing fossil fuels or deriving bioenergy from land-based feedstocks, renewable energy); and

- Energy efficiency and energy conservation (on-farm).

In general, conservation programs administered by USDA and state agencies encourage farmers to implement certain farming practices and often provide financial incentives and technical assistance to support adoption. Participation in these programs is voluntary, and farmers may choose to discontinue participating in these programs. The effectiveness of these practices depends on the type of practice, how well the practice is implemented, and also on the length of time a practice is undertaken. These programs are generally designed to address site-specific improvements based on a conservation plan developed with the assistance of USDA or state extension technical and field staff that considers the goals and land resource base for an individual farmer or landowner. Such a conservation plan is typically a necessary precursor to participating in USDA’s conservation programs.

Federal Programs

Conservation Programs

Conservation programs administered by USDA are designed to take land out of production and to improve land management practices on land in production, commonly referred to as “working lands” (Table 3). These programs are provided for in Title II (Conservation) of the 2008 farm bill (P.L. 110-246, the Food, Conservation, and Energy Act of 2008).

- Land retirement/easement programs. Programs focused on land management, including programs that retire farmland from crop production and convert it back into forests, grasslands, or wetlands, including rental payments and cost-sharing to establish longer term conservation coverage. Major programs include the Conservation Reserve Program (CRP), the Wetlands Reserve Program (WRP), the Grasslands Reserve Program (GRP), the Farmland Protection Program (FPP), among other programs.

- Working lands programs. Programs focused on improved land management and farm production practices, such as changing cropping systems or tillage management practices, are supported by cost-sharing and incentive payments, as well as technical assistance. Major programs include the Environmental Quality Incentives Program (EQIP), the Conservation Stewardship Program (CSP), the Agricultural Management Assistance (AMA) program, and the Wildlife Habitat Incentives Program (WHIP).

Prior to the 2008 farm bill, few USDA conservation programs were specifically intended to address climate change concerns in the agriculture sector. One exception is USDA’s Conservation Innovation Grants program, a subprogram under EQIP that provides for competitive awards, and is intended to accelerate technology transfer and adoption of innovative conservation technologies, mostly through pilot projects and field trials. Past grants have supported development of approaches to reduce ammonia emissions from poultry litter, promote conservation tillage and solar energy technologies, and develop private carbon sequestration trading credits.[48]

USDA has expanded some of its existing farmland conservation programs to further encourage emission reductions and carbon sequestration. For example, many of the practices encouraged under EQIP and CSP reduce net emissions. USDA has provided additional technical guidance to make GHG a priority resource concern in EQIP and CSP by giving greater weight to projects that promote anaerobic digestion, nutrient management plans, and other types of cropland practices, such as installing shelter belts and windbreaks, encouraging conservation tillage, and providing resources for biomass energy projects. Programs such as CTA, AMA, EQIP, and CSP list a reduction in emissions as a national priority for the program, which effects the funding and ranking of projects. Under CRP, USDA has modified how it scores and ranks offers to enroll land in CRP in order to place greater weight on installing vegetative covers that sequester carbon. USDA also has an initiative under CRP’s continuous enrollment provision to plant up to 500,000 acres of bottomland hardwoods, which are among the most productive U.S. lands for sequestering carbon. As of April 2009, more than 45,000 acres have been enrolled in this initiative. In addition, USDA has recognized that marketable credits may be generated by these conservation programs and has removed any claim on these credits through recent changes to many of its conservation program rules.[49]

a. Renewable energy projects receive additional program funding in farm bill under Title IX (Energy) and Title VI (Rural Development), as well as other federal and state program.

Not including funding increases authorized under the 2008 farm bill, actual total funding for USDA’s conservation programs has totaled more than $5 billion annually. Voluntary land retirement programs and programs that convert or restore land account for roughly 37% annually of all USDA conservation spending (Figure 4). Programs that provide cost-sharing and technical assistance to farmers to implement certain practices, such as EQIP, CSP, and AMA, provide another 21% annually. USDA’s conservation technical assistance and extension services account for about one-fourth of all funding. Other federal funding through other programs also generally promotes natural resource protection on U.S. farms. Generally, the decision on how and where this funding is ultimately used is made at the individual state level.

Other Farm Programs

Aside from USDA’s conservation programs, there are other farm bill programs that encourage the types of agricultural practices that can reduce GHG emissions and/or sequester carbon. These include programs in the farm bill’s forestry, energy, and research titles.[50] Renewable energy projects receive additional program funding across three farm bill titles: Title II (Conservation), Title IX (Energy), and Title VII (Research). In addition to cost-sharing provided under USDA’s conservation programs, one energy title provision in the 2008 farm bill is the Rural Energy for America Program (Section 9007). This program provided mandatory funding for grants for energy audits, renewable energy development, and financial assistance to promote energy efficiency and renewable energy development for farmers and rural small businesses. [51] In the past this program has provided funding to support construction of anaerobic digesters in the livestock sector.[52] Other renewable energy funding is also available through other federal programs.[53] The 2008 farm bill also created the Biomass Crop Assistance Program to assist in the development of renewable energy feedstocks, including cellulosic ethanol, and to provide incentives for producers to harvest, store, and transport biomass. The farm bill’s Title VII (Research) also provided for research on renewable fuels, feedstocks, and energy efficiency and for competitive grants for on-farm research and extension projects.

Forestry programs, administered by USDA’s Forest Service, are provided for in Title VIII (Forestry) of the farm bill. Typically, there is often little overlap between the various agriculture and forestry programs administered by USDA, and few forestry programs provide support to agricultural enterprises.[54] One program with an agroforestry component is the Healthy Forests Reserve Program, which was reauthorized in the 2008 farm bill. This program assists with restoring and enhancing forest ecosystems; however, funding for this program is usually limited to a few states. The 2008 farm bill also created new programs with possible agroforestry benefits, including (1) the Community Forest and Open Space Conservation Program, authorizing new cost-share grants for local governments, tribes, and non-profits to acquire lands threatened by conversion to non-forest uses; and (2) the Emergency Forest Restoration Program, providing for the rehabilitation of croplands, grasslands, and private non-industrial forests following natural disasters. The farm bill also expanded or created other programs to protect and restore privately owned forests, which could also contribute to retaining or increasing carbon storage capacity on forest lands.

State Programs

Agriculture Conservation and Land Management Programs

State-level agriculture conservation and land management programs are available to farmers in most states, and operate in much the same manner as federal conservation programs. These programs may also provide financial and technical assistance to farmers to implement certain practices, using additional state resources and in consultation with state agriculture agencies and extension staff. No single current compendium exists outlining the different types of agriculture conservation programs across all states; instead information is available through individual state government websites. [55] Many states have cost-share programs that provide financial assistance to landowners to implement practices that benefit a state’s forests, fish, and wildlife. Many of these programs provide technical assistance and up to 75% of the eligible costs of approved conservation projects to qualified landowners. Several states also provide low-interest financing to farmers and landowners to encourage conservation practices or to implement best management practices for the agriculture sector. Many states also have buffer strip programs, which may provide rental payments to landowners who agree to create or maintain vegetative buffer strips on croplands near rivers, streams, ponds, and wetlands. Typically states that have taxing authority for conservation purposes, such as Nebraska, Missouri, and Oregon, tend to have more stable funding and staffing to support conservation improvements.

The Pew Center on Global Climate Change has identified several ongoing state programs and demonstration projects specifically intended to promote carbon storage and emissions reduction in the U.S. agriculture sector. [56] For example, several states, including Oregon, Wisconsin, Vermont, and North Carolina, are promoting methane recovery and biofuels generation from livestock waste. A program in Iowa is providing support and funding to promote switchgrass as a biomass energy crop. In Maryland, state income tax credits are provided for the production and sale of electricity from certain biomass combustion. Georgia has a program that leases no-till equipment to farmers. In addition, several states, including Nebraska, Oklahoma, Wyoming, North Dakota, and Illinois, have formed advisory committees to investigate the potential for state carbon sequestration. In California, an accounting program is being developed to track possible future costs to mitigate GHG emissions in the U.S. agriculture sector.

State and Regional Climate Initiatives

Mandatory Programs

There are a number of state programs and initiatives geared toward climate change mitigation strategies across sectors including agriculture.[57] For example, the Center for Climate Strategies (CCS) has assisted public officials in several states to develop climate action plans. Most of these plans incorporate strategies for emissions reduction goals in selected economic sectors, including the agriculture and forestry sectors. Plans for states such as Maryland, Michigan, and Florida include farm and forestry management activities ranging from forest and land use management to soil carbon management, tree planting, farmland conservation, expanded use of biomass feedstocks, methane capture and utilization, nutrient efficiency, and on-farm energy efficiency, among other practices. [58]

California is actively developing programs to support the state’s enacted emission reductions legislation.[59]California’s climate change statute requires state agencies to identify GHG emissions reduction strategies that can be pursued before most of the law takes effect in 2012. The state has identified several agriculture sector strategies that it plans to consider as early actions, including (1) adopting a manure digester protocol for calculating GHG mitigation; (2) establishing collaborative research on how to reduce GHG emissions from nitrogen land application; (3) replacing stationary diesel agricultural engines with electric motors; and (4) evaluating potential measures for enclosed dairy barns, modified feed management, and manure removal strategies to reduce methane emissions at dairies.[60]These early action strategies would be in addition to funding for the state’s manure digester cost-share program and other agriculture projects, including carbon sequestration projects involving rice straw utilization, energy and water conservation, biofuels support, soil management, and other types of renewable energy and manure management programs for dairies.

Other regional climate initiatives include the Regional Greenhouse Gas Initiative (RGGI) and the Western Climate Initiative (WCI), among others. RGGI is a partnership of 10 northeastern and mid-Atlantic states that creates a cap-and-trade system aimed at limiting carbon dioxide emissions from power plants. Seven western states (and four Canadian provinces) have formed the WCI, which set an economy-wide GHG emissions target of 15% below 2005 levels by 2020.[61] Both RGGI and WCI include agricultural programs among their list of eligible offset and allowance project categories for trading emissions as part of their programs, along with other non-agricultural projects. Under RGGI, eligible agricultural and forestry project categories include sequestration of carbon due to afforestation, and avoided methane emissions from agricultural manure management operations.[62] Under WCI and California’s climate statute, agriculture and forestry sector actions being considered for inclusion as offset and allowance projects cover forestry protocols, manure digester protocols, measures for enclosed dairy barns, modified feed management, manure removal strategies to reduce methane emissions at dairies, emission reductions from nitrogen land application, soil sequestration, and replacing stationary diesel agricultural engines with electric motors.[63]

Voluntary Carbon Market Programs

The voluntary carbon offset market allows businesses, interest groups, and individuals the opportunity to purchase carbon credits generated from projects that either prevent or reduce an amount of carbon entering the atmosphere, or that capture carbon from the atmosphere. Companies and individuals purchase carbon credits for varied reasons. For example, some may purchase credits to reduce their “carbon footprint,” using credits to offset all or part of a GHGemitting activity (e.g., air travel, corporate events, or personal automobile use); others may purchase credits to bank the reductions in anticipation of a mandatory GHG reduction program. [64] In the United States, the current offset framework operates on a voluntary basis since there is no federal requirement that GHG emissions be curtailed. Some states and/or regional GHG reduction initiatives may limit the use of carbon offsets.

Several states have programs that support the voluntary carbon offset exchange, often involving U.S. farmers and private landowners. Farmer participation in voluntary carbon credit trading programs has been growing rapidly. As of mid-2009, participation involved an estimated roughly 10,000 farmers across about 35 states covering more than more than 10 million acres. [65] One program, operated by the National Farmers Union (NFU), involves more than 4,000 producers in more than 30 states, with more than 5 million acres of farmland enrolled. Another program operated by the Iowa Farm Bureau involves 5,000 to 6,000 producers also in more than 30 states (mostly Iowa, Kansas, and Nebraska, but also Illinois, Ohio, Michigan, Wisconsin, Minnesota, South Dakota, Missouri, Indiana, and Kentucky), also with more than 5 million acres of farmland enrolled. The types of practices covered by this program include no-till crop management; conversion of cropland to grass; managed forests, grasslands, and rangelands; new tree plantings; anaerobic digesters and methane projects; wind, solar, or other renewable energy use; and forest restoration. Similar programs also have been initiated in Illinois (Illinois Conservation and Climate Initiative), Indiana (Environmental Credit Corporation), and the Northwest (Upper Columbia Resource Conservation and Development Council). Another, Terrapass, has among its projects two large-scale dairy farms that use anaerobic digesters and methane capture for energy production. [66]

These programs “aggregate” carbon credits across many farmers and landowners. These credits may later be sold on the Chicago Climate Exchange.[67] Farmer participation in such programs may help offset farm costs to install emissions controls and/or practices that sequester carbon by providing a means for them to earn and sell carbon credits.

Congressional Action

Starting in the 110th Congress, Congress debated a range of climate change policy options, including mandatory GHG emission reduction programs. These actions have continued into the 111th Congress. The current legislative proposals generally would not require emission reductions in the agriculture and forestry sectors. However, some of the GHG proposals would allow for regulated entities (e.g., power plants) to purchase carbon offsets, including those generated in the agriculture and forestry sectors. These and related bills and issues are currently being debated in Congress. Some of these proposals dovetail with provisions that were enacted as part of the 2008 farm bill, including a provision that directs USDA to develop guidelines and standards for quantifying carbon storage by the agriculture and forestry sectors, among other farm bill provisions that indirectly encourage emissions reductions and carbon capture and storage. In addition, the omnibus 2008 farm bill (Food, Conservation, and Energy Act of 2008, P.L. 110- 246) could expand the scope of existing farm and forestry conservation programs in ways that could more broadly encompass certain aspects of these climate change initiatives. The enacted farm bill provides incentives to encourage farmers and landowners to sequester carbon and reduce emissions associated with climate change, as well as to produce renewable energy feedstocks. The farm bill also contains a new provision that will facilitate the participation of the agriculture and forestry sectors in emerging environmental services markets, focusing first on carbon storage.

Congressional Proposals

During the 110th and 111th Congress, several proposals were introduced that would either mandate or authorize a cap-and-trade program to reduce GHG emissions. A cap-and-trade program provides a market-based policy tool for reducing emissions by setting a cap or maximum emissions limit for certain industries. Sources covered by the cap can choose to reduce their own emissions, or can choose to buy emission credits that are generated from reductions made by other sources. Applying this type of market-based approach to GHG reductions and trading would be similar to the acid rain reduction program established by the 1990 Clean Air Act Amendments. For more information about these GHG legislative proposals, see CRS Report R40556, Market- Based Greenhouse Gas Control: Selected Proposals in the 111th Congress; CRS Report RL33846, Greenhouse Gas Reduction: Cap-and-Trade Bills in the 110th Congress; andCRS Report RL34067, Climate Change Legislation in the 110th Congress.

Covered Sources of Emissions Reductions

Historically, climate-related legislative initiatives have not specifically focused on emissions reductions in the agriculture sector. In part, this may reflect the general consensus, as reflected by the 110th Congress’s House Energy and Commerce Committee, that GHG “emissions from the agriculture sector generally do not lend themselves to regulation under a cap-and-trade program,” given the “large number of sources with small individual emissions that would be impractical to measure.”[68]

In general, the current legislative proposals have not included the agriculture sector as a covered industry, and therefore do not require farmers and landowners to reduce emissions associated with climate change.[69] For example, a bill introduced by Chairman Waxman of the House Committee on Energy and Commerce, H.R. 2454 (Waxman-Markey), does not specifically include agricultural operations among its “covered entities” under a mandatory emissions cap. However, some interest groups continue to question whether certain types of agricultural operations could eventually be brought in under some proposals. Some of the bills introduced in the 110th Congress would provide authority to EPA to determine covered entities by applying cost-effective criteria to reduction options; other 110th Congress bills would cover biogenic emissions resulting from biological processes, which some interpret as potentially including animal agriculture facilities. Still others continue to argue that U.S. agriculture will be affected by anticipated climate legislation in terms of generally increasing energy and production input costs that will negatively impact the farming sector.[70]

Eligible Sources of Offsets and Allowances

Several of the cap-and-trade proposals do incorporate the agriculture and forestry sectors either as a source of carbon offsets or as a recipient of set-aside allowances. In the context of these legislative proposals, a carbon offset is a measurable avoidance, reduction, or sequestration of carbon dioxide (CO2) or other GHG emissions, expressed in carbon-equivalent terms.[71] A setaside allowance refers to a set percentage of available allowances under the overall emissions cap that is allocated to non-regulated entities, in this case domestic agriculture and forestry entities. Some bills also specify that the proceeds from auctioned allowances be used to promote certain objectives, which could further encourage farmland conservation and bio-energy technologies and practices, among other activities.[72]

110th Congress

During the 110th Congress, several GHG bills were debated that would have explicitly allowed for the use of carbon offsets, including agricultural activities and other land-based practices, under a cap-and-trade framework. This builds on the concept, also expressed by the 110th Congress’s House Energy and Commerce Committee, that emissions reductions and carbon sequestration by the agriculture sector may provide an appropriate source of credits or offsets within a cap-andtrade program.[73] Some proposed bills did not allow for offsets, but would have set aside a percentage of allowances for various purposes, including biological sequestration. Participating farmers and landowners who receive these allowances for sequestration and/or emission reduction activities could sell them to facilities that could become covered by a cap-and-trade program.

For example, one 110th Congress bill, S. 3036 (Boxer; formerly S. 2191 (Leiberman/Warner)), contained several agriculture- and forestry-based provisions. The cap-and-trade framework outlined in S. 3036 established a tradeable allowance system that included a combination of auctions and free allocation of tradeable allowances. As part of this overall framework, S. 3036 included three design mechanisms that could provide financial incentives to encourage landbased agricultural and forestry activities: carbon offsets, set-aside allowances, and auction proceeds. S. 3036 provided for a range of agriculture and forestry offset projects, including agricultural and rangeland sequestration and management practices, land use change and forestry activities, manure management and disposal, and other terrestrial offset practices identified by USDA. S. 3036 also would have directly allocated 5% of the overall emissions allowances to domestic agriculture and forestry entities, and allocated a set percentage of available auction proceeds to carry out a cellulosic biomass ethanol technology deployment program. For more information on the agriculture and forestry provisions in S. 3036, see CRS Report RS22834, Agriculture and Forestry Provisions in Climate Change Bills in the 110th Congress .

Also during Senate floor debate of the 110th Congress’s S. 3036, Senator Stabenow introduced an amendment to the bill that sought to replace the offset provisions in S. 3036 with an even more expansive version of the agriculture and forestry offset program provisions. This amendment was not adopted, but the general provisions of this proposed amendment continue to be promoted by the farm community during the 111th Congress as a desired option for establishing an offset program as part of a cap-and-trade program.[74]

111th Congress

In the 111th Congress, Members have introduced seven bills that include provisions to impose or permit some form of market-based controls on GHG emissions. Among the leading bills is H.R. 2454 (Waxman-Markey), which is actively being debated in Congress. It was reported by the House Energy and Commerce Committee and has been referred to the House Agriculture and Ways and Means Committees, among others. As already noted, H.R. 2454 does not specifically include agricultural operations among its “covered entities” under a mandatory emissions cap. However, the extent to which the agricultural and forestry sectors will be allowed to participate in an offset and allowance program is still being actively debated in Congress. Although H.R. 2454 sets the aggregate number of submitted offsets at 2 billion tons annually, it does not identify which projects would be eligible as offsets. Instead, eligible domestic offset types would be determined through the EPA rulemaking process. For more information, see Waxman-Markey Bill, H.R. 2454, and CRS Report R40556, Market-Based Greenhouse Gas Control: Selected Proposals in the 111th Congress.

The potential inclusion of agricultural and forestry offsets in a carbon reduction program could provide opportunities to some farmers and landowners by allowing them to directly participate in and potentially gain a significant part of this emerging carbon market. The offset and allowance provisions could allow farmers and landowners to participate in the emerging market by granting them the use of allowances and credits for sequestration and/or emission reduction activities. These allowances and credits could be sold to regulated facilities (e.g., power plants) covered by a cap-and-trade program to meet their emission reduction obligations. Proceeds from the sale of these allowances, credits, and auctions could be used to further promote and support activities in these sectors that reduce, avoid, or sequester emissions.

The inclusion of provisions that allow for agriculture and forestry offset and allowances as part of a cap-and-trade scheme is generally supported by a broad-based industry coalition. This coalition consists of agricultural groups representing commodity crops, livestock and dairy, the American Farm Bureau Federation, the National Farmers Union, the American Farmland Trust, and other agriculture support and utility companies.[75] Former Senators and Majority Leaders Bob Dole and Tom Daschle are also advocating on behalf of the Bipartisan Policy Center that farmers be fully integrated into any cap-and-trade program.[76] Most groups, including many within the environmental community, generally support the inclusion of carbon offset projects within a capand- trade scheme since this is likely to help contain overall costs of a carbon reduction program. In March 2009, the House Agriculture Committee issued a climate change questionnaire, which was distributed to more than 400 organizations, to solicit input on proposals to reduce GHG emissions. The published survey responses are available on the committee’s website and highlight some concerns, as well as the potential market opportunities issues for farmers and landowners.[77] Similar issues were raised at a 110th Congress subcommittee hearing of the Senate Agriculture Committee in May 2008.[78] These and other issues were discussed at a House Agriculture Committee hearing in June 2009 as part of its review of pending climate change legislation.[79]

Issues Regarding Agriculture and Forestry Offsets

The inclusion of agriculture and forestry offsets with a carbon reduction program has remained controversial since the Kyoto Protocol negotiations.[80] During those negotiations, there was marked disagreement among countries and interest groups, arguing either for or against the inclusion of offsets from the agriculture and forestry sectors.[81]

The EU’s GHG emission program, the Emission Trading System (ETS), which was established in 2005, does not provide for agricultural or forestry projects and activities. Among the reasons are (1) pragmatic concerns regarding measurement and verification, given the sheer number of farmers and landowners, and (2) ideological concerns about granting too much flexibility in how emission reductions are met, which could undermine overall program goals. Among the areas of concern regarding biological sequestration offsets are those highlighted in two previous sections of this report, “Uncertainty Estimating Emissions” and “Uncertainty Estimating Carbon Sinks.”

In summary, primary areas of concern include:

- Permanence/Duration, given that land uses can change over time (e.g., forest lands to urban development, other natural events such as fires or pests);

- Measurement/Accounting, given that biological sequestration measurement is difficult and estimates can vary, actual emission reduction or sequestration depends on site-specific factors (e.g., location, climate, soil type, crop/vegetation, tillage practices, farm management, etc.);

- Effectiveness, the success of the mitigation practice will depend on the type of practice, how well implemented and managed by the farmer or landowner, and the length of time the practice is undertaken;

- Additionality/Double Counting, given that some of the activities generating offsets would have occurred anyway under a pre-existing program or practice, and thus may not go beyond business as usual (BAU); and/or given that some reductions may be counted by another program (e.g., attributable to other environmental goals under various farm conservation programs) or toward more than one GHG reduction target; and

- Leakage, given that reductions in one place could result in additional emissions elsewhere.

A more detailed discussion of some of these issues is available in various reports by CRS,[82] the Government Accountability Office (GAO),[83] and other groups.

2008 Farm Bill Provisions

To help address some of the measurement and quanitification issues surrounding agricultural and forestry carbon credits, the omnibus 2008 farm bill (Food, Conservation, and Energy Act of 2008, P.L. 110-246) included a new conservation provision that expanded the scope of existing farm and forestry conservation programs in ways that could more broadly encompass certain aspects of these climate change initiatives. Specifically, the enacted bill contains a new conservation provision that seeks to facilitate the participation of farmers and landowners in environmental services markets, including carbon storage. The bill also expands existing voluntary conservation and other farm bill programs, providing incentives that could accelerate opportunities for agriculture and forestry to reduce emissions associated with climate change, adopt energy efficiency measures, and produce renewable energy feedstocks.

In particular, the so-called environmental services market provision seeks to “establish technical guidelines that outline science-based methods to measure the environmental services benefits from conservation and land management activities in order to facilitate the participation of farmers, ranchers, and forest landowners in emerging environmental services markets.” The intended purpose of these technical guidelines is to develop (1) a procedure to measure environmental services benefits; (2) a protocol to report these benefits; and (3) a registry to collect, record and maintain the benefits measured. The provision also requires that USDA provide guidelines for establishing a verification process as part of the protocol for reporting environmental services, but it allows USDA to consider the role of third parties in conducting independent verification. In carrying out this directive, USDA is directed to work in consultation with other federal and state government agencies, non-governmental interests, and other interested persons as determined by USDA. However, the enacted bill did not specifically address funding for this provision. Nevertheless, the inclusion of this provision in the farm bill is expected to expand the scope of existing farm and forestry conservation programs in ways that will more broadly encompass certain aspects of the climate change debate. For more detailed background information, see CRS Report RL34042, Environmental Services Markets in the 2008 Farm Bill.

In December 2008, USDA announced it would create a federal government-wide “Conservation and Land Management Environmental Services Board” to assist USDA with the “development of new technical guidelines and science-based methods to assess environmental service benefits which will in turn promote markets for ecosystem services including carbon trading to mitigate climate change.”[84] A federally chartered public advisory committee will advise the board, and will include farmers, ranchers, forest landowners, and tribal representatives, as well as representatives from state natural resource and environmental agencies, agriculture departments, and conservation and environmental organizations. USDA’s press release also announced that USDA was establishing a new Office of Ecosystem Services and Markets (OESM), which will be located within the Office of the Secretary. OESM will provide administrative and technical assistance in developing the uniform guidelines and tools needed to create and expand markets for ecosystem services in the farming and forestry sectors.

Related Initiatives Involving U.S. Agriculture

Various other regulatory and potentially legislative initiatives affecting U.S. agriculture are indirectly related to the climate change debate. These include two separate EPA rulemakings: a proposal for mandating GHG emissions from selected sectors and also a solicitation for comment on how EPA should respond to GHGs under the Clean Air Act. In addition, EPA has proposed revisions to the national Renewable Fuel Standard (RFS) that would establish new specific volume standards and requirements for renewable fuels.

EPA’s Proposed Mandatory Reporting Rule

In April 2009, EPA announced its proposal to require mandatory greenhouse gas reporting from all sectors of the economy, which would apply to fossil fuel suppliers and industrial gas suppliers, as well as to direct greenhouse gas emitters. The proposed rule does not require control of greenhouse gases, rather it requires only that sources above certain threshold levels monitor and report emissions.[85] The Waxman/Markey bill (H.R. 2454), as reported by House Energy and Commerce Committee, includes similar language, but it is unclear to what extent the U.S. agriculture sector would be affected.

The only agricultural production category subject to EPA’s proposed mandatory reporting rule is manure management, defined in the proposal as systems that stabilize or store livestock manure, or both. For those facilities that would be subject to the rule, the emission threshold for reporting is 25,000 metric tons of CO2-equivalent. The proposed regulatory thresholds (based on number of animals) for reporting at the 25,000 MT CO2-Eq. level in the livestock sectors are 89,000 head of beef, 5,000 dairy cows, 73,000 hogs, and 895,000 broilers. However, EPA estimates that the threshold will vary considerably depending on the type of manure management system used. EPA estimates that “between 40 and 50 of the largest manure management systems at beef, dairy, poultry, and swine facilities across the nation would be required to report under the proposal.”[86] The EPA proposal specifically excludes other agriculture categories that are known to contribute to GHG emissions, including “enteric fermentation” (livestock digestion), rice cultivation, field burning of agricultural residues, composting (except when associated with manure management), agricultural soils, settlements, forestland or other land uses and land-use changes, or emissions associated with deforestation, and carbon storage in living biomass or harvested wood products. Facilities subject to reporting would report annually, beginning March 31, 2011. For more information, see EPA’s preamble, fact sheets, and cost analysis.[87]

EPA’s Advanced Notice of Proposed Rulemaking