Waxman-Markey Bill, H.R. 2454

H.R. 2454, the American Clean Energy and Security Act of 2009, was introduced May 15, 2009, by Representatives Waxman and Markey, and was subsequently modified (both technical and substantive changes) and ordered reported by the House Committee on Energy and Commerce on May 21, 2009. The bill was reported (amended) June 5 (H.Rept. 111-137, Part I). It was passed in the House on June 26, 2009, by a recorded vote of 219-212. The five titles of the legislation cover clean energy, energy efficiency, reducing global warming pollution, transitioning to a clean energy economy, and agriculture and forestry related offsets. Among the many provisions contained in the bill, several of the major provisions are summarized in this overview.

H.R. 2454 contains provisions that would amend the Clean Air Act to establish a cap-and-trade system designed to reduce greenhouse gas emissions from covered sources 17% below 2005 levels by 2020 and 83% below 2005 levels by 2050. The market-based approach would establish an absolute cap on the emissions and would allow trading of emissions permits (“allowances”). The bill achieves its broad coverage through an upstream compliance mandate on petroleum and most fluorinated gas producers and importers, and a downstream mandate on electric generators and industrial sources, and a midstream mandate on natural gas local distribution companies (LDCs). The bill allocates a substantial percentage of the allowances for the benefit of energy consumers and low-income households. As the program proceeds through the mid-2020s it shifts to more government auctioning with most of the proceeds returned to households. The bill’s allocation scheme includes free allowance allocations to energy-intensive, trade-exposed industries, merchant coal-fired electric generators, and petroleum refiners. An important cost control mechanism in the cap-and-trade program is the availability of domestic and international offsets.

The bill contains energy efficiency provisions that cover grants, standards, rebates and other programs for buildings, lighting and commercial equipment, water-using equipment, wood stoves, industrial equipment, and healthcare facilities.

H.R. 2454 contains several provisions related to vehicles and fuels, including incentives to produce plug-in vehicles and other advanced technology vehicles. Three percent of allowances from the greenhouse gas cap-and-trade program would be allocated to the automotive sector to provide grants to refit or establish plants to build plug-ins and other advanced vehicles. The bill directs the Environmental Protection Agency (EPA) to establish greenhouse gas emissions standards for various transportation sectors. The bill would also significantly modify the definition of “renewable biomass” under the renewable fuel standard (RFS), expanding the allowable pool of agricultural and forestry feedstocks that could be used. The bill requires EPA to develop a unified national strategy for addressing the key legal and regulatory barriers to deployment of commercial scale carbon capture and sequestration. The legislation would amend the Public Utility Regulatory Policies Act of 1978 (PURPA) to create an integrated energy efficiency and renewable electricity standard starting in 2011, requiring retail electricity suppliers to meet 20% of their electricity demand through renewable energy sources and energy efficiency by 2020.

The bill provides for smart grid technologies, including products that can be equipped with smart grid capability, requirements for electric power retailers to reduce their peak loads using smart grid and other energy efficient technologies, and requirements that power suppliers ensure that utility smart grid systems will be compatible with plug-in electric drive vehicles.

Contents

Combined Efficiency and Renewable Electricity Standard

The legislation would amend the Public Utility Regulatory Policies Act of 1978 (PURPA) to create an integrated energy efficiency and renewable electricity standard starting in 2012, requiring retail electricity suppliers to meet 20% of their electricity demand through renewable energy sources and energy efficiency by 2020. Under the standard, each retail electricity supplier with annual sales of 4 million megawatt-hours (mwh) or more would be required to submit Renewable Electricity Credits (RECs) equal to at least three-quarters of its annual combined target. One REC would be awarded for each mwh of renewable energy generated from renewable energy resources such as wind, solar, geothermal, marine or hydrokinetic, biomass, landfill gas, or qualified hydropower (as defined in Sec. 101). The credits can be awarded to generators or to “central procurement states.”[1]

RECs could be traded or banked, but would be retired after being submitted in proof of compliance. “Distributed renewable generation”—small-scale, renewable power production located at consumer sites—would qualify for three RECs for each mwh of eligible renewable electricity. Funds collected from alternative compliance payments and civil penalties for noncompliance would be redistributed annually to help deploy renewable energy technologies and fund cost-effective energy efficiency programs. In establishing regulations for this program, the Secretary of Energy would be required, to the extent practicable, to incorporate and preserve best practices of existing state renewable electricity standards and cooperate with states on minimizing administrative costs and burdens.

Retail electric suppliers would be required to submit an amount of federal renewable electricity credits and demonstrated total annual electricity savings equal to the annual combined targets, as shown in the following schedule for each year:

2012 and 2013: 6%

2014 and 2015: 9.5%

2016 and 2017: 13%

2018 to 2019: 16.5%

2020 through 2039: 20%

The definition of renewable electricity is augmented by adding other qualifying energy resources (i.e., landfill gas, wastewater treatment gas, coal mine methane, and qualified waste-to-energy) to

the list of renewable energy resources.

Geologic Sequestration of Carbon Dioxide

H.R. 2454 would require the Administrator of the Environmental Protection Agency (EPA) to submit a report to Congress, within one year of enactment, detailing a unified national strategy for addressing the key legal and regulatory barriers to deployment of commercial scale carbon capture and sequestration. The bill requires two other reports from studies examining: (1) how, and under what circumstances, the environmental statutes for which EPA has responsibility would apply to CO2 injection and geologic sequestration activities, due within 12 months of enactment; and (2) the legal framework for geologic sequestration sites, including existing federal environmental statutes, state environmental statutes, and state common law, due within 18 months of enactment.

The legislation would amend the Safe Drinking Water Act(SDWA) by inserting a provision directing the EPA Administrator to promulgate, within one year of enactment, regulations for the development, operation, and closure of carbon dioxide geologic sequestration wells, and to take into consideration the ongoing SDWA rule-making regarding these wells. It would also amend Title VIII of the Clean Air Act and establish a coordinated certification and permitting process for geologic sequestration sites. Within two years of enactment, the Administrator would be required to promulgate regulations to protect human health and the environment by minimizing the risk of atmospheric release of carbon dioxide injected for geologic sequestration, including enhanced hydrocarbon recovery combined with geologic sequestration. This provision broadens the scope of regulatory authority beyond protecting underground sources of drinking water under SDWA to protecting against atmospheric releases of CO2 under the Clean Air Act.

H.R. 2454 would authorize a Carbon Storage Research Corporation to establish and administer a program to accelerate the commercial availability of carbon dioxide capture and storage technologies and methods by awarding grants, contracts, and financial assistance to electric utilities, academic institutions, and other eligible entities. The corporation would be established by a referendum if providers of at least two-thirds of the total quantity of fuel-based electricity delivered to retail consumers vote for approval. If 40% or more of state regulatory authorities were to submit written notices of opposition to the creation of the corporation, the corporation would not be established. If established, the corporation would levy an assessment on distribution utilities for all fossil fuel-based electricity delivered to retail customers, and would adjust the assessment rates to generate between $1.0 billion and $1.1 billion per year.

The bill would amend Title VII of the Clean Air Act to require that the EPA Administrator promulgate regulations to distribute emission allowances to support the commercial deployment of carbon capture and sequestration technologies in both electric power generation and industrial operations. Among other eligibility requirements, it would require that the owner or operator geologically sequester captured carbon dioxide or convert it to a stable form that can be safely

and permanently sequestered.

The legislation would also amend Title VIII of the Clean Air Act (CAA) by adding performance standards for new coal-fired power plants and, in some instances, for existing plants retrofitted with carbon capture and sequestration technology. Covered electric generating units (EGUs) that are initially permitted on or after January 1, 2020, would be required to reduce their annual emissions of carbon dioxide produced by the unit by 65%. EGUs initially permitted before January 1, 2020, would need to achieve a 50% reduction.

Vehicles and Fuels

H.R. 2454 contains several provisions related to vehicles and fuels. Most notably, the bill would provide significant incentives for automakers and parts suppliers to produce plug-in vehicles and other advanced technology vehicles. For example, in early years, 3% of allowances from the greenhouse gas cap-and-trade program would be allocated to the automotive sector to provide grants to refit or establish plants to build plug-ins and other advanced vehicles. Depending on the allowance price in the cap-and-trade system, this allocation could easily be worth billions of dollars each year.

H.R. 2454 also directs the Environmental Protection Agency to establish greenhouse gas emissions standards for various transportation sectors. The bill would require EPA to establish standards for heavy-duty vehicles and non-road vehicles (including marine vessels and locomotives). A provision from the version reported by the Energy and Commerce Committee requiring emissions standards for aircraft and aircraft engines was not included in the House-passed version.

The bill would expand the definition of “renewable biomass” for the renewable fuel standard (RFS) established in the Energy Policy Act of 2005 and expanded in the Energy Independence and Security Act of 2007 (EISA). The RFS requires an increasing amount of biofuels to be blended into gasoline and diesel fuel. By 2022, the mandate reaches 36 billion gallons of biofuels. However, the amendments to the RFS in EISA restricted the feedstocks that would qualify as renewable biomass under the RFS, effectively excluding a large potential pool of woody biomass, as well as biomass from federal lands and from lands not previously cultivated. H.R. 2454 would amend the biomass definition to allow fuel produced from some of these feedstocks to qualify under the RFS.

Not included in the bill is a low carbon fuel standard (LCFS) similar to that established in California. An LCFS would require that fuel suppliers reduce the life-cycle greenhouse gas emissions from motor fuels relative to a baseline year. Such an LCFS would not be an explicit mandate for biofuel use, but would likely promote some biofuels, as well as other low-carbon transportation fuels such as natural gas and electricity produced from renewable resources. An LCFS was part of an earlier draft of the bill but was not included in the bill as introduced. Further, a “cash for clunkers” provision was removed from the bill because a nearly identical program was enacted as part of P.L. 111-32.

Smart Grid

H.R. 2454 includes several provisions aimed at supporting development and installation of smart grid[2] technologies. The bill would direct the Department of Energy and Environmental Protection Agency to identify products that could be cost-effectively equipped with smart grid capability. An example would be a dishwasher that could wirelessly communicate with a “smart meter” installed by a utility in a home. This linkage would allow the utility to temporarily stop operation of the dishwasher when electricity was scarce or expensive (assuming the homeowner had agreed to the procedure). The legislation would also direct the Federal Trade Commission to initiate a rulemaking to determine whether smart grid information, such as potential dollar savings to the consumer, should be added to ENERGY GUIDE product labels. (ENERGY GUIDE is an existing federal program for labeling energy efficient products.)

The legislation would establish requirements for electric power retailers to reduce their peak loads using smart grid and other energy efficient technologies; it would modify an energy efficiency public information program authorized by the Energy Policy Act of 2005 (EPACT05) to make it into a smart grid and energy efficiency information program authorized through 2020. H.R. 2454 would also modify an EPACT05 energy efficiency appliance rebate program to add appliances with smart grid capabilities. Authorized funding would be increased from $50 million annually to $100 million, and the authorization would be extended to run through FY 2015.

Additionally, H.R. 2454 would require state regulatory authorities and self-regulating power suppliers (such as municipal utilities) to consider implementing standards intended to ensure that utility smart grid systems would be compatible with plug-in electric drive vehicles.

Energy Efficiency

The bill includes a variety of energy efficiency provisions that cover grants, standards, rebates and other programs for buildings, lighting and commercial equipment, water-using equipment, wood stoves, industrial equipment, and healthcare facilities.

Two new programs would be established that aim to facilitate the use of energy efficiency and renewable energy programs to more directly support the goals of curbing greenhouse gas emissions to mitigate climate change. First, the Department of Energy (DOE) would be required to create a State Energy and Environment Development (SEED) program, which allows each state to collect major federal energy grant appropriations (Weatherization, State Energy, Efficiency Block Grants, and LIHEAP) into a common fund designed to support clean energy, energy efficiency, and climate change mitigation. Second, EPA would be directed to implement a legislated carbon allowance distribution program that would be used to help support several energy efficiency and renewable energy programs.

Building energy efficiency improvements would be addressed by expanded responsibilities at DOE and EPA. DOE would be required to regularly update its model building energy codes, which are available for states to adopt and adapt to local circumstances. Further, DOE would be directed to establish a rebate program designed to encourage replacement of manufactured homes owned by low-income families. Also, DOE would be required to develop a program that supports efficiency retrofits of existing commercial buildings. EPA, in parallel, would be required to develop a program to support efficiency retrofits of existing residential buildings. Also, EPA would be directed to establish a building energy efficiency labeling program that would be similar to its existing energy labeling program for cars and appliances.

For lighting and commercial equipment, new efficiency standards would be set by law and some new procedures and programs would be put in place. Lighting efficiency standards would be set for the niche categories of outdoor luminaires, outdoor high output lamps, portable light fixtures, and incandescent reflector lamps. Commercial equipment standards would be legislated for the niche categories of water dispensers, commercial hot food holding cabinets, portable electric spas, and commercial furnaces. Also, in general, existing criteria for setting appliance efficiency standards would be expanded to include criteria related to greenhouse gas emissions and other factors. Further, DOE would be directed to create an incentive program that aims to encourage consumer purchases of the most energy-efficient appliances, while also providing an incentive to remove the least efficient appliances from commercial use. An explicit cost-effectiveness purpose

would be set by law for EPA’s Energy Starprogram.

Water use efficiency improvements would be addressed by three provisions. First, EPA’s WaterSense program, a voluntary labeling program to reduce water use, would be given statutory authority. Second, federal agencies would be directed to use WaterSense-labeled and DOE Federal Energy Management Program (FEMP)-designated water-using products and services. Third, EPA would be required to provide funds to support state rebate or voucher programs for consumer purchases of residential water-efficient products and services. New residential wood stoves and pellet stoves would have to meet an environmental performance standard set by EPA. Further, EPA would be authorized to provide funds to state and local governments, American Indian tribes, Alaskan Native villages, and certain nonprofit organizations to replace stoves that do not meet the standards. To address a concern that technological improvements gradually erode the true energy efficiency of products identified with the EPA Energy Star label, EPA would be required to establish a grading system that ranges from “A” (most efficient) to “F” (least efficient) and periodically test products to verify compliance.

Industrial energy efficiency would be addressed by four provisions. First, DOE would be directed to expand an existing industrial standards program to include industrial plant energy efficiency certification standards. Second, DOE would be required to establish a monetary award program to spur innovation in the recovery of thermal energy in power plants and industrial facilities. Third, DOE would be directed to assess the electric motor market, identify energy efficiency improvement opportunities, and develop methods to estimate energy and cost savings and certain program impacts. Fourth, DOE would be required to establish a rebate program for purchasers and distributors of energy efficient motors.

Regulation of energy savings performance contracts (ESPCs) for federal agencies would be revised to require that agencies establish competitions for task and delivery orders. Further, the allowable types of energy transactions under ESPCs would be expanded to include thermal forms of renewable energy. Also, onsite renewable energy production would become eligible for helping to meet agency requirements for use of renewable energy.

Energy efficiency in public institutions is addressed by three provisions. First, under the Energy Conservation Program for Schools and Hospitals, the list of eligible facilities would be expanded to specifically include not-for-profit hospitals and not-for-profit inpatient health facilities. Further, the authorization for grants would be increased from $1 billion to $2.5 billion annually. Second, the definition of community eligibility for DOE’s Energy Efficiency and Conservation Block Grant programwould be expanded to include regional groups of small local governments. Third, DOE would be authorized to create a new grant program for nonprofit community development organizations that provide energy efficiency and renewable energy financing for businesses and projects in low-income communities.

A national carbon labeling and disclosure program would be established at EPA, which would likely have some parallels to EPA’s existing energy labeling program. DOE would be required to provide affiliated islands (U.S. trust territories) with energy planning and implementation assistance. Each federal agency, in collaboration with OMB, would be required to create an implementation strategy for the purchase and use of energy efficient information and communications technologies, infrastructure, and practices. A national goal would be established to improve energy productivity by at least 2.5% per year from 2012 through 2030.

A new subtitle was added in the Manager’s Amendment that provides a number of provisions for energy efficient neighborhoods. The bill requires The Secretary of Housing and Urban Development (HUD) to promulgate regulations to encourage energy efficiency in HUD housing programs. The language defines standards for energy efficiency to be applied, as appropriate, in the implementation of a number of housing programs. Different programs apply to single-family residences, multi-family residences, rural residences, and some non-residential buildings. Programs provide incentives to improve energy efficiency through mortgage and loan instruments, loans to upgrade existing residential properties, and grants to increase sustainable low-income community development capacity.

Major Cap-and-Trade Provisions

As passed, Title III of H.R. 2454 would amend the Clean Air Act to set up a cap-and-trade system that is designed to reduce greenhouse gas (GHG) emissions from covered entities 17% below 2005 levels by 2020 and 83% below 2005 levels by 2050. Covered entities are phased into the program over a four-year period from 2012 to 2016. When the phase-in schedule is complete, the cap will apply to entities that account for 84.5% of U.S. total GHG emissions. By including other

provisions contained in the legislation (e.g., a separate cap-and-trade program for hydrofluorocarbons (HFCs)), the World Resources Institute (WRI) estimates that the overall potential net reductions in GHG emissions from H.R. 2454 could range from 28%-33% below 2005 levels in 2020 and 75%-81% in 2050.[3]

The market-based approach adopted by H.R. 2454 would establish an absolute cap on the emissions from covered sectors and would allow trading of emissions permits (“allowances”) among covered and non-covered entities.[4] The bill achieves its broad coverage through an upstream compliance mandate on petroleum, most fluorinated gas producers and importers, and a downstream mandate on electric generators and industrial sources, and a midstream mandate on natural gas local distribution companies (LDCs).[5] Generally, the emissions cap would limit greenhouse gas emissions from entities that produce or import more than 25,000 metric tons annually (carbon dioxide equivalent) of greenhouse gases (or produce or import products that when used will emit greenhouse gases).

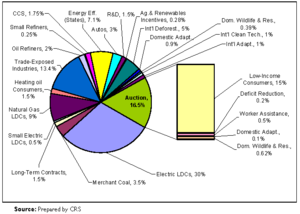

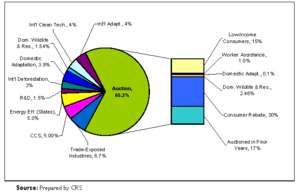

If left unmitigated, any greenhouse gas cap-and-trade program (as well as a carbon tax alternative) would be regressive. In an attempt to mitigate this distributional problem, H.R. 2454 allocates a substantial percentage of the allowances available for the benefit of energy consumers and low-income households. In some cases, these allowances are allocated at no cost to entities such as LDCs, with the express purpose of mitigating energy cost increases; in other cases, such as low-income assistance, the allowances are auctioned by EPA and the proceeds distributed to eligible recipients. As the program proceeds through the mid-2020s, the energy cost relief, along with other free allocations are phased out in favor of more government auctioning with most of the proceeds returned to households on a per-capita basis. See Figure 1 and Figure 2 for a summary of how emission allowances are distributed in 2016 and 2030, respectively.

H.R. 2454’s allocation scheme also attempts to smooth the economy’s transition to a less carbon-intensive future through free allowance allocations to energy-intensive, trade-exposed industries, merchant coal-fired electric generators, and petroleum refiners. Bonus allotments of allowances are allocated for emission reductions achieved by carbon capture and storage technology. Except for carbon capture and storage, these free allocations of allowances are phased out by the early to mid-2030s.

Finally, H.R. 2454’s allocation scheme attempts to address greenhouse gas emissions by providing allowances to help prevent further tropical deforestation and to fund climate adaptation activities.

Because allowance prices can be volatile, cap-and-trade bills generally provide some mechanisms to address either the potential gyrations, or allowance prices more generally. H.R. 2454 does not have a “safety valve”—an alternative compliance option that permits covered entities to pay an excess emissions fee instead of reducing emissions. Instead, the legislation addresses cost control through five main mechanisms: (1) unlimited banking and limited borrowing, (2) a two-year compliance period, (3) a strategic reserve auction with a pool of allowances available at a minimum reserve price, (4) periodic auctions with a reserve price, and (5) broad limits on the use of offsets.

With respect to allowance price volatility, the bill includes two design elements that may dampen volatility to some degree. First, the bill allows entities to borrow (without interest) allowances from the year immediately following the current year, effectively creating a rolling two-year compliance period. Second, EPA is directed to hold strategic reserve auctions. A strategic reserve of allowances borrowed from future years is auctioned off in the early years of the program. This increases the availability of allowances early, but maintains the overall emissions cap. The strategic reserve auction would include a reserve price: $28/allowance in 2012 that would increase annually in 2013 and 2014. Starting in 2015, the reserve price would be 60% above the 36-month rolling average allowance price.

Regular auctions mandated by the bill also have a reserve price: $10 (in 2009 dollars) in 2012, increasing at 5% real annually. An auction reserve price would help create an allowance price floor, and help dampen allowance price spikes. The auctions, along with the other mechanisms listed above, attempt to bracket volatility. Whether they would work is subject to debate, particularly with respect to short-term price volatility.

With respect to overall cost control, analysis indicates that an important cost control mechanism in the cap-and-trade program is the availability of domestic and international offsets. The bill limits the availability of domestic and international offsets to two billion tons of emissions annually—divided equally between domestic and international pools. According to analysis done by EPA, the Congressional Budget Office, and CRA International, the availability of these offsets reduces projected allowance prices under the program by half.[6]

Another concern with respect to a cap-and-trade program is potential allowance market abuse and manipulation. The size of a U.S. carbon market could be in the hundreds of billions of dollars, and involve all of the financial instruments, particularly derivatives, that any other commodity market includes. To provide oversight of the newly created carbon allowance market, the bill has detailed provisions for Federal Energy Regulatory Commission (FERC) oversight of the cash allowance market, and enhanced Commodity Futures Trading Commission (CFTC) oversight of allowance derivatives. With respect to the latter, the bill would remove energy commodities (including carbon allowances) from the category of “exempt commodity” and require that over-the-counter transactions be cleared through a clearing house (a standard feature of a futures exchange). In addition the CFTC is required to establish position limits, thus setting ceilings on the number of energy contracts that any person could hold.

Besides the two emission caps created under Title III, the bill contains other provisions in Titles III and IV to reduce greenhouse gas emissions and potential carbon leakage. Among the most important of these provisions are (1) preventing tropical deforestation, (2) performance standards for uncovered entities that emit over 10,000 metric tons annually, (3) a 1.25 offset requirement for international offsets after 2017; and (4) programs designed to reduce potential carbon leakage.

First, H.R. 2454 has a supplemental greenhouse gas reduction program that requires EPA to use some of the allowances available under the cap-and-trade program to fund international projects to reduce deforestation. The goal of the program is to achieve 720 million metric tons of additional emission reductions in 2020 (about 10% of U.S. 2005 emissions), and a total of 6 billion metric tons by 2025 (about equal the U.S. emissions in 1990). If achieved, this would have significant effect on the net emission reductions achieved in the early years of the program, as suggested by the WRI study cited earlier.

Second, as noted above, not all greenhouse gas emitting sources are covered by the Title III capand- trade programs. Under other provisions of Title III, stationary sources not covered by the Title III caps are potentially subject to greenhouse gas performance standards. WRI estimates that standards for uncapped sources could reduce emissions from such sources by about 115 million metric tons annually.

Third, as passed, the cap-and-trade program requires that international offsets submitted for compliance beginning in 2018 be discounted (i.e., it takes 1.25 offset credits to equal 1.00 allowance). Depending on the number of international offsets used for compliance after 2017, the discount factor could add up to 375 million metric tons of reductions annually.

H.R. 2454 takes two primary approaches to mitigating the potential impact of carbon leakage on the net greenhouse gas reductions to be achieved under the bill.[[[7]]] The first is the allocation of allowances at no cost to energy-intensive, trade-exposed industries, as identified above. The second is an international reserve allowance scheme that essentially imposes a shadow allowance requirement on importers of energy-intensive, trade-exposed products, creating a de facto tariff. Basically, the scheme would require importers of energy-intensive products from countries with insufficient carbon policies to submit a prescribed amount of “international reserve allowances,” or IRAs, for their products to gain entry into the United States. Based on the greenhouse gas emissions generated in the production process, IRAs would be submitted on a per-unit basis for each category of covered goods from a covered country.

Whether the international reserve allowance scheme would actually work is unclear. The daunting administrative, informational, and analytical resources necessary to implement such a program would create significant issues in any attempt to implement it. Likewise, it is not clear that the potentially severe World Trade Organization (WTO) implications of the provision have been fully exposed and accommodated.

Provisions in Title V Added by the “Manager’s Amendment”

The June 26, 2009, “Manager’s Amendment” included a new Title V to H.R. 2454—“Agriculture and Forestry Related Offsets.” Most of this title concerns the establishment of a separate offsets program for agriculture and forestry practices that is to be implemented by the U.S. Department of Agriculture (USDA), rather than EPA under Title III. However, the title also includes provisions that are not part of the new offsets program. Some of these provisions have been the subject of intense debate.

Subtitle A of Title V would create within USDA an offsets program that covers domestic agriculture and forestry-related practices. For the most part, the provisions in Title V are similar to those found in Title III, the most striking exception being the difference in implementing agencies. The separate offset jurisdictions between EPA and USDA are made by the revised definitions of “domestic offset credit” and “offset credit.” These terms now have different meanings between Parts C and D of Title III. In effect, these changes allow (domestic) offset credits generated under Title V (agriculture and forestry offsets) to be used for compliance per Title III, Part C, but would separate the implementation of offsets generated under Title III (Part

D) and Title V.

In the reported version of the bill, many stakeholders were concerned that the Title III offset program did not include an explicit list of offset practices. Such a list is now part of the proposal in Title V. However, as written, USDA is not required to include the practices specifically identified in the regulatory program that would carry out the statutory provisions.

Title V would set up a domestic offset development process almost identical to the one in Title III: Offset project developers would submit a petition to USDA; USDA would approve or reject the petition; and third-party verification would be required before USDA would issue offset credits. But there are several differences identified in the section-by-section analysis below.

One key difference is that Title V would allow USDA to issue (in lieu of offset credits) a “term offset credit.” The inclusion of “term offset credits” is a new concept in U.S. cap-and-trade proposals. This mechanism is similar to the temporary certified emission reductions (tCER) that are allowed under the Kyoto Protocol for forestry and agriculture projects. Term offset credits are temporary offsets that may be submitted for compliance per the conditions of Section 722(d)(2). These credits expire at their term’s conclusion and must be replaced with emission allowances, other offsets, or unexpired term offset credits. Term offset credits address concerns regarding the permanence of particular offset practices, such as agriculture sequestration efforts. In contrast to offset credits, reversals from term offset credits are only relevant during their crediting period.

In addition to the offsets program, Title V includes several other provisions. Within Section 501 (definitions), the bill specifically excludes “agriculture and forestry sectors” from the definition of “capped sector” in Title III (i.e., the cap-and-trade program). However, neither the phrase “agriculture and forestry sectors” nor “capped sector” appear elsewhere in the bill.

Common Terms

Allowance. A limited authorization by the government to emit 1 metric ton of carbon dioxide equivalent. Although used generically, an allowance is technically different from a credit. A credit represents a ton of pollutant that an entity has reduced in excess of its legal requirement. However, the terms tend to be used interchangeably, along with others, such as permits.

Auctions. Auctions can be used in market-based pollution control schemes to allocate some or all of the allowances. Auctions may be used to: (1) ensure the liquidity of the credit trading program; and/or (2) raise (potentially considerable) revenues for various related or unrelated purposes.

Banking. The limited ability to save allowances for the future and shift the reduction requirement across time.

Cap-and-trade program. An emissions reduction program with two key elements: (1) an absolute limit (“cap”) on the emissions allowed by covered entities; and (2) the ability to buy and sell (“trade”) those allowances among covered and

non-covered entities.

Coverage. Coverage is the breadth of economic sectors covered by a particular greenhouse gas reduction program, as well as the breadth of entities within sectors.

Emissions cap. A mandated limit on how much pollutant (or greenhouse gases) affected entities can release to the atmosphere. Caps can be either an absolute cap, where the amount is specified in terms of tons of emissions on an annual basis, or a rate-based cap, where the amount of emissions produced per unit of output (such as electricity) is specified but not the absolute amount released. Caps may be imposed on an entity, sector, or economy-wide basis.

Greenhouse gases. The six gases recognized under the United Nations Framework Convention on Climate Change are carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), sulfur hexafluoride (SF6), hydrofluorocarbons (HFC), and perfluorocarbons (PFC). H.R. 2454 adds nitrogen trifluoride (NF3). Of these gases, carbon dioxide is the least potent in terms of greenhouse forcing, while nitrogen trifluoride, nitrous oxide and the other fluoring containing gases are the most potent.

Leakage. The shift in greenhouse gas (GHG) emissions from an area subject to regulation (e.g., cap-and-trade program) to an unregulated area, so reduction benefits are not obtained. This would happen, for example, if a GHG emitting industry moved from a country with an emissions cap to a country without a cap.

Offsets. Emission credits achieved by activities not directly related to the emissions of an affected source. Examples of offsets would include forestry and agricultural activities that absorb carbon dioxide, and reductions achieved by entities

that are not regulated by a greenhouse gas control program.

Revenue recycling. How a program disposes of revenues from auctions, penalties, and/or taxes. Revenue recycling can have a significant effect on the overall cost of the program to the economy, as well as its effect on income classes.

Sequestration. Sequestration is the process of capturing carbon dioxide from emission streams or from the atmosphere and then storing it in such a way as to prevent its release to the atmosphere.

References

Note: The first version of this article was drawn from R40643 Greenhouse Gas Legislation: Summary and Analysis of H.R. 2454 as Passed by the House of Representatives by Mark Holt and Gene Whitney, Congressional Research Service, July 27, 2009.

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Congressional Research Service. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Congressional Research Service should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |

Citation

(2012). Waxman-Markey Bill, H.R. 2454. Retrieved from http://editors.eol.org/eoearth/wiki/Waxman-Markey_Bill,_H.R._2454- ↑ A central procurement state is state that as of January 1, 2009, has adopted and implemented a program under which the state, rather than individual utilities, procures renewable electricity.

- ↑ The “smart grid” is intended to give the power grid some of the characteristics of a computer network, in which information concerning, and control of, power supply and demand will flow between and be shared by individual customers and utility control centers. The smart grid primarily involves the development of software and small-scale technology (e.g., smart meters for homes and businesses that would interface with grid controls) rather than construction of new transmission lines.

- ↑ John Larsen and Robert Hellmayr, Emission Reductions Under the American Clean Energy and Security Act of 2009 (World Resources Institute, May 19, 2009).

- ↑ See “Common Terms” box for definitions of terms in boldface.

- ↑ For a full discussion of carbon leakage, see CRS Report R40100, “Carbon Leakage” and Trade: Issues and Approaches, by Larry Parker and John Blodgett.

- ↑ U.S. Environmental Protection Agency, EPA Preliminary Analysis of the Waxman-Markey Discussion Draft: The American Clean Energy and Security Act of 2009 in the 111th Congress (April 20, 2009); Congressional Budget Office, Congressional Budget Office Cost Estimate: H.R. 2454, American Clean Energy and Security Act of 2009 (as Ordered Reported by the House Committee on Energy and Commerce) (June 5, 2009); and, CRA International, Impact on the Economy of the American Clean Energy and Security Act of 2009 (H.R. 2454), prepared for the National Black Chamber of Commerce (May 2009).