Energy profile of Congo-Brazzaville

Energy profiles of countries and regions

Congo (Brazzaville), also known as the Republic ofthe Congo is a mature oil producer with declining output at most of its fields; however, new offshore production in 2008 has recently revived oil output.

The oil sector greatly underpins Congo's domestic economy, as petroleum accounts for 80 percent of government revenue and 90 percent of total exports, according to the U.S. Department of State and the World Bank.

A vast majority of oil exploration activities and production in Congo comes from offshore fields, which many also contain associated gas. Although the country has sizable proven natural gas reserves, only small amounts are monetized due to the lack of gas infrastructure. Congo also may hold large oil sands deposits (unconventional petroleum deposits of bitumen also known as tar sands) and Eni, an Italian company, is currently leading exploration activities. Congo is the second country in Africa, after Madagascar, that may start to produce oil sands for commercial use before the end of this decade.

Although Congo produces considerable amounts of oil, it still imports most of the electricity it consumes, mainly from its neighboring country, the Democratic Republic of the Congo (formerly Zaire). Congo also has extensive hydropower potential, but most of it remains untapped. Despite Congo's rich energy resources, the electrification rate is very low, especially in rural areas, which is mainly due to a lack of electricity infrastructure. The Congolese civil war (1997-1999) left much of the country's transmission and distribution infrastructure damaged, especially in southern Brazzaville and in the Pool, Bouenza, and Niari regions, which has not yet been restored. The government has been looking to restore and expand the distribution network in Brazzaville and Point-Noire, but until then, wood fuel will remain a dominant fuel, especially in rural areas.

Contents

Oil and gas sector organization

Regulation

The Ministry of Mines, Energy, and Water Resources manages the country's oil and gas resources, while exploration and production operations are governed by production sharing agreements (PSAs). Congo's national hydrocarbon company, Societe Nationale des Petroles du Congo (SNPC), manages Congolese government-owned shares in hydrocarbon operations. SNPC has an operating interest alongside international oil companies (IOCs) through PSAs, which also encompass tax breaks and a royalty system. Congo has several active companies, such as Perenco, Murphy Oil, Africa O&G, Prestoil, Chevron, and SOCO Internationals, but the companies that dominant the oil and gas sector are Total and Eni.

Major companies

Total, a French company, and Eni have both been operating in Congo since 1968. Total is the country's leading oil producer through its subsidiary, Total E&P Congo, and produced almost 40 percent of the country's total oil production (117,000 barrels per day (bbl/d)) in 2011. Most of Total's oil production comes from its deepwater Moho-Bilondo license and the Nkosso oil field. The company also produced 30 million cubic feet per day (MMcf/d) of natural gas in 2011, which came from associated gas at its oil fields.

Eni is the leading natural gas producer in Congo, which it uses for reinjection into oil wells or processes it to fuel power plants in populated areas, as a part of Eni's access to energy projects initiative. Eni's gas production in Congo has increased and reached its highest level of 119.1 Mcf/d in 2011. The company also produced nearly 30 percent of the country's total oil production (87,000 bbl/d) in 2011, although this was a 10,000 bbl/d decrease from the previous two years. Most of Eni's oil and gas production is from the M'Boundi field, which it hopes to expand in the future.

Oil

Congo's first deepwater field came online in 2008 and helped to reverse declining oil production.

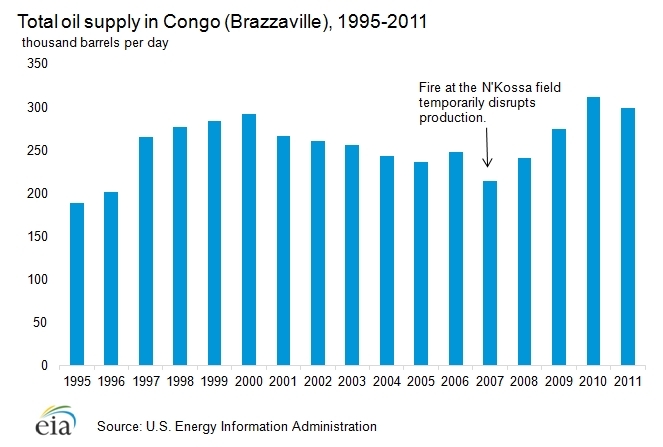

As of the end of 2011, Congo has proven oil reserves of 1.6 billion barrels, according to Oil & Gas Journal (OGJ), the fifth-largest proven reserves in Sub-Saharan Africa. In the late 1970s, Congo emerged as a significant oil producer. Production continued to expand considerably during the 1990s, but at the turn of the century, as oil fields reached maturity, production declined in 2001. However, from 2008 to 2010 oil production has increased every year as a result of several new projects coming online, mainly Congo's first deepwater field Moho-Bilondo. In 2010, Congo produced 311,000 bbl/d of total oil supply, surpassing the country's previous peak of 292,000 bbl/d in 2000. However, in 2011, as most of Congo's oil fields continued to age, total output fell by about 4 percent to 298,000 bbl/d, of which almost 10,000 bbl/d was natural gas liquids (NGLs) and the remainder was crude oil and lease condensate.

Exploration and production

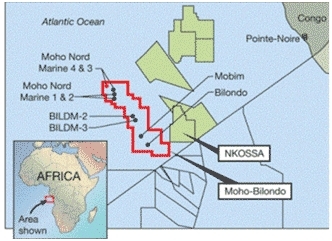

The large offshore Moho-Bilondo oil field, operated by Total, is the chief contributor to the increase in production since 2008. It came online in April 2008 and reached plateau output at 90,000 bbl/d in June 2010, according to Total. Total has the majority operating interest of 53.5 percent, in addition to Chevron's 31.5 percent and SNPC's 15 percent. Moho-Bilondo is the country's first deepwater project and marks the largest successful expedition to tap into Congo's deepwater reserves. Additionally, three other oil fields, the Ikalou complex (6,700 bbl/d), Azurite (19,000 bbl/d), and Libondo (12,000 bbl/d), have come onstream since 2008, according to IHS Global Insight and reports from Total.

Moho-Bilondo Complex in Congo (Brazzaville)

Despite the addition of new fields over the past few years, Congo's total oil production is projected to decline in the short term. Congo's hydrocarbon minister announced that the country's oil production decreased in 2011, and the president warned that output may decline again in 2012. According to EIA estimates, overall production declined consecutively over those two years, and EIA expects this trend to continue in 2013. The decline is attributed to maturing fields and a slowdown in field development, according to IHS Global Insight. As a result, the government is keen to develop offshore fields to supplement declining production from mature fields and is expected to hold a deepwater licensing round in the future.

In the long term, offshore deepwater prospects in Congo have the potential to boost production again. According to Total, two positive appraisal wells, Bilondo Marine 2 and 3, which are located in the southwest end of the deepwater Moho-Bilondo field, have additional growth potential and studies are underway to develop the reserves. Additionally, wells drilled in the northern end of the field, Moho Nord project, also showed potential. Total recently estimated that it will require $10 billion to further develop Moho-Bilondo and expects new production to begin between 2015 and 2017. According to Business Monitor International (BMI), the managing director of Total E&P Congo announced that the two new projects may produce up to 120,000 bbl/d.

In early 2012, Congo and Angola agreed to jointly develop and share profits from the Lianzi field, a deepwater field located within the two country's maritime border in the Lower Congo Basin. Chevron is the field's operator (31.25 percent), with interest held by Total (36.75 percent), ENI (10 percent), Sonangol (10 percent), SNPC (the Republic of Congo National Oil Company — 7.5 percent), and Galp Energia (4.5 percent). According to Chevron, production from Lianzi is expected to start in 2015 and produce a maximum of 46,000 bbl/d.

Eni announced that it launched a small pilot feasibility oil sands project in Congo in 2012. Oil sands are unconventional petroleum deposits of bitumen. In 2008, Eni and the Congolese government signed a deal to explore and develop the oil sands deposit located in Tchikatanga and Tchikatanga-Makola, two areas covering a total of 1,790 square kilometers in the south of Congo. According to preliminary studies, the area is estimated to contain between 500 million barrels and 2.5 billion barrels of oil sands and Eni has said it could potentially cost up to $7.5 billion to develop. According to a 2011 Eni field trip report, the company expects oil sands production to start sometime after 2014.

Downstream

Congo has one refinery, the 21,000 bbl/d Congolaise de Raffinage (CORAF) plant in Point-Noire. EIA estimates that total refinery output of petroleum products in 2010 was 13,800 bbl/d. The refinery operates at nearly half capacity due to poor performance. The vast majority of the refinery's output is used to satisfy domestic demand, and the remainder is exported. For a number of years, the Congolese government has proposed to privatize and expand CORAF, but it has not yet found a committed investor.

Exports

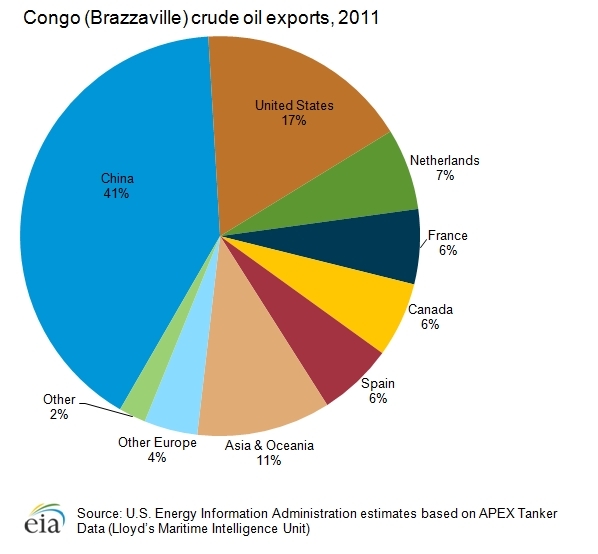

Congo exports nearly all of the crude oil it produces, and sends a small amount to its refinery for domestic consumption. According to analysis of trade data from Global Trade Atlas (GTA) and APEX Tanker Data (Lloyd's Maritime Intelligence Unit), Congo exported about 290,000 bbl/d of crude oil in 2011. China and the United States are the top destinations for Congolese oil and together receive almost 60 percent of the country's total crude oil exports. Europe (23 percent) is another top destination for Congo's crude, followed by Asia and Oceania (11 percent) and Canada (6 percent).

Natural gas

Although Congo holds the fifth-largest proven natural gas reserves in Sub-Saharan Africa, only a small portion is marketed, as a vast majority is reinjected or flared.

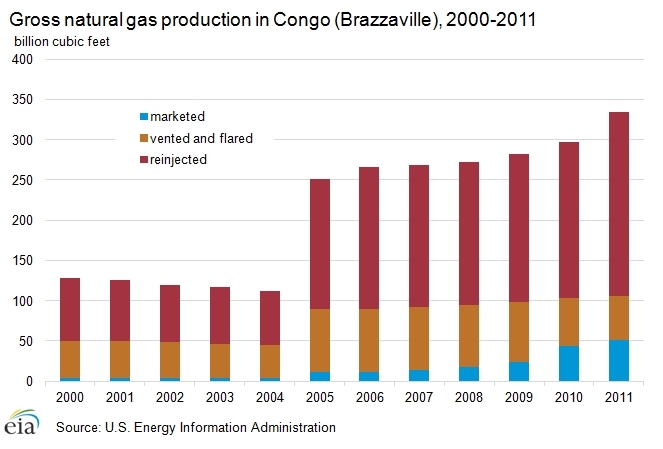

Congo holds the fifth-largest proven reserves of natural gas in Sub-Saharan Africa at 3.2 trillion cubic feet (Tcf), according to OGJ. The country's gross natural gas production was 334 billion cubic feet (Bcf) in 2011, although only 15 percent (51 Bcf) was marketed. A majority of the natural gas, 68 percent (228 Bcf), was reinjected to boost oil production. The remaining 17 percent (55 Bcf) was flared or vented. Due to the lack of gas infrastructure, only 41 Bcf of dry natural gas was domestically consumed.

In 2008, Eni began constructing two gas-fired electric power stations, with the dual purpose of increasing electricity capacity and reducing gas flaring. Eni recently constructed the Centrale Electrique du Congo (CEC), a 300-megawatt (MW) gas-fueled power station that can be expanded to 450 MW by installing steam turbines. The power station is fueled by associated gas from the M'Boundi deposit. The company also recently doubled capacity at the Djeno power station, Centrale Electrique de Djeno (CED), from 25 MW to 50 MW, which also utilizes associated gas that was previously flared. As a result of these efforts to monetize gas, flaring and venting in Congo have gradually decreased by 30 percent to 55 Bcf in 2011 from its peak of 79 Bcf in 2005.

Electricity

New gas-fired power stations have increased electricity capacity in Point-Noire, one of Congo's most populous areas, since 2010. However, the country still relies on electricity imports to satisfy growing power demand in urban hubs.

Société Nationale d'Electricité (SNE), the national electricity company, controls the electricity generation, transmission and distribution sectors. Power consumption is low in Congo due to the limited transmission system that mainly serves the country's principal cities, Brazzaville and Point-Noire. As of 2009, the electrification rate was 37.1 percent and 2.3 million people were without electricity, according to latest estimates from the International Energy Agency (IEA). In urban areas, demand for electricity has increased over the last decade and Congo has had to rely on power imports, especially from the Democratic Republic of Congo, to satisfy domestic consumption.

Eni is reconstructing a 220 kilovolts high-voltage line from Pointe-Noire to Brazzaville and connecting the gas-fueled power station, CEC, to the national electricity network. Construction of the CEC and CED, and the increase in electricity capacity, has led to higher electricity consumption in the densely populated Pointe-Noire area. According to Eni, annual average per capita electricity consumption in the Pointe-Noire area rose to 462 Kilowatthours (KWh) in 2010, more than three times the national per-capita average of 137 KWh per year.

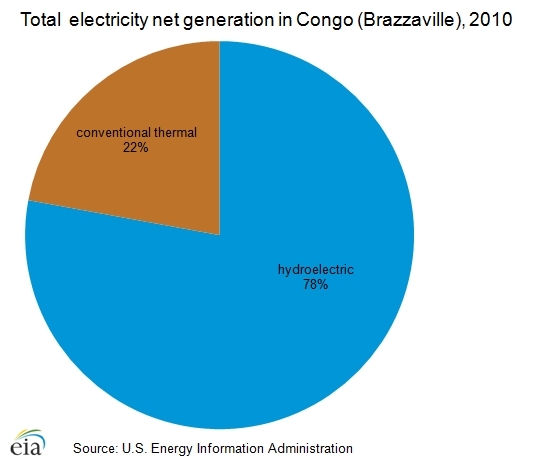

Although Congo's newest electricity projects are gas-fueled power stations, a significant amount of the country's electricity generation derives from hydropower. As of 2010, hydropower accounted for 78 percent of total electricity net generation, while conventional thermal electricity made up the remaining 22 percent. Hydroelectricity is generated from the Imboulou (120 MW), Bouenza (74 MW), and Djoue (15 MW) hydroelectric plants. The Imboulou Hydropower Plant, built by the Chinese company CMEC, came online in 2011 and almost doubled Congo's hydroelectric generation to power Brazzaville and several other towns. Additionally, the capacity at the Djoue plant is being upgraded to 30 MW.

Congo's technically feasible hydropower potential is 3,932 MW, but only 4 percent of this has been developed so far, according to the International Journal on Hydropower and Dams. Projects under consideration include a 150-MW hydroelectric plant in the Bas-Congo Province called Zongo II, a 600-MW plant on the River Tcha in Cameroon to serve both Congo and Cameroon, and a 1,200-MW power station at Sounda Gorge. Congo's ability to capitalize on its hydropower potential depends primarily on the development and restoration of the domestic distribution network.

Notes

- Data presented in the text are the most recent available as of January 31, 2013.

- Data are EIA estimates unless otherwise noted.

Sources

- BloAfriOil : Newsbase Africa Oil & Gas Monitor

- Afrique Avenir

- APEX Tanker Data (Lloyd's Maritime Intelligence Unit)

- CIA, The World Factbook: Republic of the Congo

- Economist Intelligence Unit

- Eni

- Global Insight Energy: Article

- Global Insight Energy: Report

- Global Trade Atlas

- International Energy Agency

- International Monetary Fund

- OECD Development Centre

- Oil & Gas Journal

- Reuters

- Total

- U.S. Department of State: Republic of the Congo

- Wood Mackenzie

- World Development Indicators

Further Reading

- African Union

- AllAfrica.com - Congo

- CIA World Factbook - Congo-Brazzaville

- International Energy Agency: Congo

- International Monetary Fund (IMF) - Congo

- MBendi Country Profile on Congo

- NEPAD

- USAID Africa

- U.S. State Department's Consular Information Sheet - Congo-Brazzaville U.S. State Department's: Human Rights Report for Congo-Brazzaville

- University of Pennsylvania Congo Page

- World Bank - Congo

| Disclaimer: This article is taken wholly from, or contains information that was originally published by, the Energy Information Administration. Topic editors and authors for the Encyclopedia of Earth may have edited its content or added new information. The use of information from the Energy Information Administration should not be construed as support for or endorsement by that organization for any new information added by EoE personnel, or for any editing of the original content. |