Policy responses to climate change

Contents

- 1 Introduction Concern has grown in recent years over the issue of global climate change. (Policy responses to climate change) In terms of economic analysis, greenhouse gas emissions, which cause planetary climate changes, represent both an environmental externality and the overuse of a common property resource.

- 2 Policy Tools: Carbon Taxes

- 3 Policy Tools: Tradable Permits

- 4 The Economics of Tradable Carbon Permits

- 5 Policy Tools: Subsidies, Standards, R&D, and Technology Transfer

- 6 Further Reading

Introduction Concern has grown in recent years over the issue of global climate change. (Policy responses to climate change) In terms of economic analysis, greenhouse gas emissions, which cause planetary climate changes, represent both an environmental externality and the overuse of a common property resource.

The atmosphere is a global commons into which individuals and firms can release pollution (Air pollution emissions). Global pollution creates a “public bad” born by all — a negative externality with a wide impact. In many countries, environmental protection laws limit the release of local and regional air pollutants. In economic terminology, the negative externalities associated with local and regional pollutants have to some degree been internalized. Few controls exist for carbon dioxide (CO2), the major greenhouse gas, which has no short-term damaging effects at ground level. Atmospheric accumulations of carbon dioxide and other greenhouse gases, however, will have significant effects on world weather, although there is uncertainty about the probable scale and timing of these effects.

If indeed the effects of climate change are likely to be severe, it is in everyone’s interest to lower their emissions for the common good. But where no agreement or rules on emissions exist, no individual firm, city, or nation will choose to bear the economic brunt of being the first to reduce its emissions. In this situation, only a strong international agreement binding nations to act for the common good can prevent serious environmental consequences.

Two types of measures can be used to address climate change (Causes of climate change); preventive measures tend to lower or mitigate the greenhouse effect, and adaptive measures deal with the consequences of the greenhouse effect and trying to minimize their impact. Preventive measures include:

- Reducing emissions of greenhouse gases, either by reducing the level of emissions-related economic activities or by shifting to more energy-efficient technologies that would allow the same level of economic activity at a lower level of CO2 emissions.

- Enhancing carbon sinks. Forests recycle CO2 into oxygen; preserving forested areas and expanding reforestation have a significant effect on net CO2 emissions.

Adaptive measures include the following:

- Construction of dikes and seawalls to protect against rising sea level and extreme weather events such as floods and hurricanes.

- Shifting cultivation patterns in agriculture to adapt to changed weather conditions in different areas.

An economic approach suggests that we should apply cost-effectiveness analysis in considering such policies. This differs from cost-benefit analysis in having a more modest goal: rather than attempting to decide whether or not a policy should be implemented, cost-effectiveness analysis asks what is the most efficient way to reach a policy goal.

In general, economists favor approaches that work through market mechanisms to achieve their goals. Market-oriented approaches are considered to be cost-effective – rather than attempting to control market actors directly, they shift incentives so that individuals and firms will change their behavior to take account of external costs and benefits. Examples of market-based policy tools include pollution taxes and transferable, or tradable, permits. Both of these are potentially useful tools for greenhouse gas reduction. Other relevant economic policies include measures to create incentives for the adoption of renewable energy sources and energy-efficient technology.

Policy Tools: Carbon Taxes

The release of greenhouse gases in the atmosphere is a clear example of a negative externality that imposes significant costs on a global scale. In the language of economic theory, the market for carbon-based fuels such as coal, oil, and natural gas takes into account only private costs and benefits, which leads to a market equilibrium that does not correspond to the social optimum.

A standard economic remedy for internalizing external costs is a per-unit tax on the pollutant. In this case, what is called for is a carbon tax, levied exclusively on carbon-based fossil fuels. Such a tax will raise the price of carbon-based energy sources, and so give consumers incentives to conserve energy and to shift demand to alternative sources. Demand may also shift from carbon-based fuels with a higher proportion of carbon, such as coal, to those with relatively lower carbon content, such as natural gas.

| Table 1. Alternative Carbon Taxes on Fossil Fuels | |||

|---|---|---|---|

| Coal | Oil | Natural Gas | |

| Tons of carbon per unit of fuel |

0.605/ton | 0.130/barrel | 0.016/ccf (hundred cubic feet) |

| Average price (2003) | $17.98/ton | $27.56/barrel | $4.98/ccf |

| Carbon tax amount per unit of fuel: | |||

| $10/ton of carbon | $6.05/ton | $1.30/barrel | $0.16/ccf |

| $100/ton of carbon | $60.50/ton | $13/barrel | $1.60/ccf |

| $200/ton of carbon | $121/ton | $26/barrel | $3.20/ccf |

| Carbon tax as a percent of fuel price: | |||

| $10/ton of carbon | 34% | 5% | 3% |

| $100/ton of carbon | 340% | 47% | 32% |

| $200/ton of carbon | 673% | 94% | 64% |

|

Source: adapted from Poterba, 1993. Price data from | |||

Carbon taxes would appear to consumers as energy price increases. But since taxes would be levied on primary energy, which represents only one part of the cost of delivered energy (such as gasoline or electricity) and more important, since one fuel can in many cases be substituted for another, overall price increases may not be jolting. Consumers can respond to new prices by reducing energy use and buying fewer carbon-intensive products (those that require great amounts of carbon-based fuels to produce). In addition, some of these savings could be used to buy other less carbon-intensive goods and services.

Clearly, a carbon tax creates an incentive for producers and consumers to avoid paying the tax by reducing their use of carbon-intensive fuels. Contrary to other taxed items and activities, this avoidance has social benefits – reduced energy use and reduced CO2 emissions. Thus, declining tax revenues over time indicate policy success – just the opposite of what happens when tax policy seeks to maintain steady or increasing revenues.

Consider Table 1, which shows the impact different levels of a carbon tax would have on the prices of coal, oil and gas. A $10/ton carbon tax, for example, raises the price of a barrel of oil by $1.30, which is about 3 cents a gallon. Will this affect people’s driving or home heating habits very much? Probably not – we would not expect a high elasticity of demand for gasoline or heating oil, since these are viewed as necessities.

Most analysts conclude that a $10/ton carbon tax would be insufficient to promote a major shift away from fossil fuels. According to several studies, stabilizing global CO2 emissions would require a carbon tax in the range of $200/ton. This would approximately double the price of oil and increase the price of coal by nearly a factor of seven (see Table 1). That would certainly affect consumption patterns. In addition, the long-term elasticity of demand would be significantly greater, as higher prices for carbon-based fuels promoted development of alternative technologies.

Figure 1. Gasoline Price versus Use in Industrial Countries, 2003. (Source: U.S. Department of Energy, 2004)

Figure 1. Gasoline Price versus Use in Industrial Countries, 2003. (Source: U.S. Department of Energy, 2004) We can use existing cross-country data on gasoline prices and consumption to gain some insight into potential impacts of carbon taxes on consumer behaviors. Figure 1 shows that as the price of gasoline goes up, consumption declines. Notice that this relationship is similar to that of a demand curve — higher prices are associated with lower consumption, lower prices with higher consumption. However, the relationship shown here is not exactly the same as a demand curve – since we are looking at data from different countries, the assumption of “other things equal”, which is needed to construct a demand curve, does not hold.

People in the United States, for example, may drive more partly because travel distances (especially in the U.S. West) are greater than in many European countries. But there does seem to be a clear price/consumption relationship. The data shown here suggest that it would take a fairly big price hike – in the range of $0.50- $1.00 per gallon or more – to affect fuel use substantially.

Would such a tax ever be politically feasible? Especially in the United States, high taxes on gasoline and other fuels would face much opposition, especially if people saw it as infringing on their freedom to drive. Note that in Figure 1 the U.S. has by far the highest consumption per person and nearly the lowest price. But let’s note two things about the proposal for substantial carbon taxes:

- First, revenue recycling could redirect the revenue from carbon and other environmental taxes to lower other taxes. Much of the political opposition to high energy taxes comes from the perception that they would be an extra tax – on top of the income, property, and social security taxes that people already pay. If a carbon tax was matched, for example, with a substantial cut in income and social security taxes, it might be more politically acceptable. The idea of increasing taxes on economic “bads” such as pollution and reducing taxes on things we want to encourage, such as labor and capital investment, is fully consistent with principles of economic efficiency. Rather than a net tax increase, this would be revenue-neutral tax shift - that is, the total amount which citizens pay to the government in taxes would be unchanged.

- Second, if such a revenue-neutral tax shift did take place, individuals or businesses whose operations were more energy-efficient would actually save money overall. The higher cost of energy would also create a powerful incentive for energy-saving technological innovations and stimulate new markets. Economic adaptation would be easier if the higher carbon taxes (and lower income and capital taxes) were phased-in over time.

Policy Tools: Tradable Permits

As we have seen, one alternative to a pollution tax is a system of tradable pollution permits. In the international negotiations over greenhouse gas reduction, the United States has advocated the implementation of a tradable permit system for carbon emissions. Such a system would work as follows:

- Each nation would be allocated a certain permissible level of carbon emissions. The total number of carbon permits issued would be equal to the desired goal. For example, if global emissions of carbon are 6 billion tons and the goal is to reduce this by 1 billion, permits for 5 billion tons of emissions would be issued.

- Permit allocation would meet agreed-on targets for national or regional reductions. For example, under the Kyoto Protocol of 1997, the U.S. agreed to set a goal of cutting its greenhouse gas emissions 7% below 1990 levels by 2008-2012. Japan agreed to a 6% cut, and Europe to an 8% cut.

- Nations could then trade permits among themselves. For example, if the U.S. failed to meet its target, but Europe exceeded its target, the U.S. could purchase permits from Europe.

- The permits might also be tradable among firms, with countries setting targets for major industrial sectors, and allocating permits accordingly. Firms could then trade among themselves, or internationally.

- Nations and firms could also receive credit for reductions that they help to finance in other countries. For example, U.S. firms could get credit for installing efficient electric-generating equipment in China, replacing highly polluting coal plants.

From an economic point of view, the advantage of a tradable permit system is that it would encourage the least-cost carbon reduction options to be implemented. Depending on the allocation of permits, it might also mean that developing nations could transform permits into a new export commodity by choosing a non-carbon path for their energy development. They would then be able to sell permits to industrialized nations who were having trouble meeting their reduction requirements.

A system of tradable permits has been incorporated into negotiations among nations on global climate change policies. However, countries have disagreed whether constraints should be placed on the number of permits a nation could buy or sell. With unlimited buying and selling, a nation may be able to continue emissions at current levels by buying enough permits.

Another stumbling block has been whether developing nations should be required to meet emissions standards. As discussed previously, per-capita carbon emissions in developing nations will continue to be far below the levels found in industrial countries. Developing nations, such as China and India, believe the wealthy countries are using climate change policy to limit their ability to improve living standards and compete in international markets. Thus, developing nations have resisted any limitations on their emissions until the developed nations show significant progress in reducing theirs. But some developed nations, such as the U.S. and Australia, are reluctant to implement a reduction policy until developing nations have agreed to some commitments.

The Economics of Tradable Carbon Permits

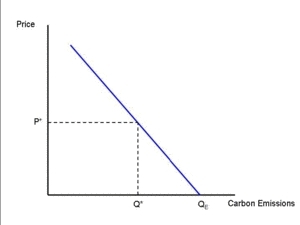

To demonstrate the economic impacts of a tradable carbon permit system, we can use the analytical concept of marginal net benefit. Figure 2 shows the marginal net benefit of carbon emissions to producers and consumers. The emissions level QE will result if there are no limits on emissions – this is the market equilibrium, where consumers and producers maximize total net benefits, without taking into account environmental externalities.

Under a permit system, Q* represents the total number of permits issued. The equilibrium permit price will then be P*, reflecting the marginal net benefit of carbon emissions at Q*. It is advantageous for emitters who gain benefits greater than P* from their emissions to purchase permits, while those with emissions benefits less than P* will do better to reduce emissions and sell any excess permits.

Figure 3 shows how this system affects carbon reduction strategies. Three possibilities are shown. Replacement of power plants using existing carbon-emitting technologies is possible, but will tend to have high marginal costs – as shown in the first graph in Figure 3. Reducing emissions through greater energy efficiency has lower marginal costs, as seen in the middle graph. Finally, carbon storage through forest area expansion has the lowest marginal costs. The permit price P* will govern the relative levels of implementation of each of these strategies. We see that forest expansion is used for the greatest share of the reduction while plant replacement is used for the lowest share.

Nations and corporations who are subject to the trading scheme can decide for themselves how much of each control strategy to implement, and will naturally favor the least-cost methods. This will probably involve a combination of different approaches. Suppose one nation undertakes extensive reforestation. They are then likely to have excess permits, which they can sell to a nation with few low-cost reduction options. The net effect will be the worldwide implementation of the least-cost reduction techniques. This system combines the advantages of economic efficiency with a guaranteed result – reduction to overall emissions level Q*. The problem, of course, is to achieve agreement on the initial allocation of permits. There may also be measurement problems, and issues such as whether to count only commercial carbon emissions, or to include emissions changes resulting from land-use patterns.

Policy Tools: Subsidies, Standards, R&D, and Technology Transfer

Although political problems may prevent the adoption of sweeping carbon taxes or transferable permit systems, there are a variety of other policy measures which have potential to lower carbon emissions. These include:

- Shifting subsidies from carbon-based to noncarbon-based fuels. Many countries currently provide direct or indirect subsidies to fossil fuels. The elimination of these subsidies would alter the competitive balance in favor of alternative fuel sources. If these subsidy expenditures were redirected to renewable sources, especially in the form of tax rebates for investment, it could promote a boom in investment in solar photovoltaics, fuel cells, biomass and wind power – all technologies which are currently at the margin of competitiveness in various areas.

- The use of efficiency standards to require utilities and major manufacturers to increase efficiency and renewable content in power sources. A normal coal-fired generating plant achieves about 35% efficiency, while a high-efficiency gas-fired co-generation facility achieves from 75% to 90% efficiency. Current automobile fuel-efficiency standards do not exceed 27.5 miles per gallon, while efficiencies of up to 50 miles per gallon are achievable with proven technology. Tightening standards over time for plants, buildings, vehicles, and appliances would hasten the turnover of existing, energy-inefficient capital stock.

- Research and development (R&D) expenditures promoting the commercialization of alternative technologies. Both government R&D programs and favorable tax treatment of corporate R&D for alternative energy can speed commercialization. The existence of a non-carbon “backstop” technology significantly reduces the economic cost of measures such as carbon taxes, and if the backstop became fully competitive with fossil fuels carbon taxes would be unnecessary.

- Technology transfer to developing nations. The bulk of projected growth in carbon emissions will come in the developing world. Many energy development projects are now funded by agencies such as the World Bank and regional development banks. To the extent that these funds can be directed towards non-carbon energy systems, supplemented by other funds dedicated specifically towards alternative energy development, it will be economically feasible for developing nations to turn away from fossil-fuel intensive paths, achieving significant local environmental benefits at the same time.

The future course of energy and global climate change policy will undoubtedly be affected by further scientific evidence regarding the impact of atmospheric carbon dioxide accumulation. Political barriers that prevent significant policy action may eventually be overcome. Some combination of the policies discussed in this article will certainly be centrally relevant to energy policies for the next half-century and beyond.

Further Reading

- Cline, William R. The Economics of Global Warming. Washington D.C.: Institute for International Economics, 1992. ISBN: 088132132X

- Dower, Roger C. and Zimmerman, Mary. The Right Climate for Carbon Taxes, Creating Economic Incentives to Protect the Atmosphere. Washington D.C.: World Resources Institute, 1992. ISBN: 0915825783

- Fankhauser, Samuel. Valuing Climate Change: the Economics of the Greenhouse. London: Earthscan Publications, 1995. ISBN: 1853832375

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 1995, Volume 1: The Science of Climate Change. Cambridge, UK: Cambridge University Press, 1996. ISBN: 0521564336

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2001, Volume 1: The Scientific Basis. Cambridge, UK: Cambridge University Press, 2001. ISBN: 0521807670

- Manne, Alan S. and Richels, Richard G. Buying Greenhouse Insurance: The Economic Costs of CO2 Emissions Limits. Cambridge, Mass: The MIT Press, 1992. ISBN: 026213280X

- Nordhaus, William D., 1993. “Reflections on the Economics of Climate Change,” Journal of Economic Perspectives, Vol. 7 No. 4 (Fall 1993), pp. 11-25.

- Poterba, James. 1993. “Global Warming Policy: A Public Finance Perspective,” Journal of Economic Perspectives, Vol. 7 No. 4 (Fall 1993), pp. 47-63.

- Repetto, Robert and Austin, Duncan. The Costs of Climate Protection: A Guide for the Perplexed. Washington, D.C.: World Resources Institute, 1997. ISBN: 1569732221

- Roodman, David M. Getting the Signals Right: Tax Reform to Protect the Environment and the Economy. Worldwatch Paper # 134. Washington, D.C.: Worldwatch Institute, 1997. ISBN: 187807136X

- Trenberth, Kevin E. “Stronger Evidence of Human Influence on Climate: The 2001 IPCC Assessment,” Environment 43 (May 2001): 8-19.

- U.S. Department of Energy, Energy Information Administration. International Energy Outlook 2004, Report No. DOE/EIA-0484 (2004), 2004.

- U.S. Department of Energy, Energy Information Administration. Annual Energy Review 2003. Report No. DOE/EIA-0384 (2003).

|

|