In this section we elaborate on insurance and employee benefits selections of the hypothetical Smith family based on their specific needs:

The purpose of this project is to build a portfolio of risk management and insurance coverages for a hypothetical family. This report is typical of those produced by students as a group project in the author’s risk and insurance classes. The students present sections of the types of coverage they design throughout the semester and submit the complete project at the end of the semester as part of their final grade. The students live the project during the semester and provide creativity along with hands-on knowledge and information about the best risk management for their fictional families. Many groups develop special relationship with helpful agents who volunteer to speak to the class. The help that agents provide receives high marks from most students.

This report, as all the others produced by the students, considers property, auto, disability, life, health, and long-term care insurance, as well as retirement planning. The group project presented here does not involve the agent-customer relationship. Many other reports do include the relationship as a reason to buy from a specific company.

WeThis project was prepared by Kristy L. Blankenship, Crystal Jones, Jason C. Lemley, and Fei W.Turner, students in the author’s fall 2000 class in risk and insurance. Many other groups also prepared excellent projects, which are available upon request from the author. examined different types of insurance and selected the best coverage for our hypothetical family—the Smith family. Several insurance quotes were found through Insweb.com, and others were benefits offered by Virginia Power, a utility company in Richmond, Virginia. We also talked to some agents.

John is a thirty-five-year-old nuclear engineer who has been working for Virginia Power since 1999. His wife, Karen, is a thirty-year-old homemaker. They have been married for five years. John and Karen have a nine-month-old infant named Tristian. John and Karen are in good health. They are looking forward to having another child, but Karen has high pregnancy risk. This has to be taken into consideration when selecting health insurance coverage for the family. Their annual net income is $72,000 (John’s salary of $100,000, less taxes and other deductions). They own two cars. John drives a 1996 Toyota Corolla and Karen drives a 1997 Toyota Camry. They need good insurance coverage because John is the only one who is working. All the insurance providers examined have ratings of “A” or better in A.M. Best ratings.

John and Karen purchased a two-story single home for $150,000 in 1996. The house is located on 7313 Pineleaf Drive in Richmond, Virginia. The total footage is 2,014 square feet. There is a two-car attached garage. John and Karen decided not to renew their homeowners insurance with AllState Insurance because of the expensive premium and unacceptable customer service they experienced in the past. John did research on the Internet and found quotes from different companies. He was asked to give detailed information on the house. The house is located within 1,000 feet of a fire hydrant and it is one hundred feet away from a fire station. John promised to install a security system to prevent theft. Karen wanted extra protection on her precious jewelry worth $10,000, Ming china worth $5,000, and antique paintings valued at $7,000. They need scheduled personal property endorsements. Over the last five years, John and Karen’s house has appreciated by $10,000. They want to insure the home to 100 percent of its estimated replacement cost, which is $160,000, rather than 80 percent. In case of a total loss, the insurer will replace the home exactly as it was before the loss took place, even if the replacement exceeds the amount of insurance stated in the policy. Table 23.2 "Homeowners Insurance Plan Options" summarizes the coverage quoted by three insurance companies.

Table 23.2 Homeowners Insurance Plan Options

| Geico Insurance | Travelers Insurance | Nationwide Insurance | |

|---|---|---|---|

| Coverage A: dwelling replacement | $160,000.00 | $160,000.00 | $160,000.00 |

| Coverage B: other structures | $ 16,000.00 | $ 16,000.00 | $ 16,000.00 |

| Coverage C: personal property | $112,000.00 | $112,000.00 | $112,000.00 |

| Coverage D: loss of use | $ 48,000.00 | $ 48,000.00 | $ 48,000.00 |

| Coverage E: personal liability | $300,000.00 | $300,000.00 | $300,000.00 |

| Coverage F: guest medical | $ 2,000.00 | $ 2,000.00 | $ 2,000.00 |

| Deductible | $ 500.00 | $ 250.00 | $ 500.00 |

| Endorsements for collectibles and inflation guard | Yes | Yes | Yes |

| Annual premium | $ 568.00 | $ 512.00 | $ 560.00 |

| S&P rating | AAA | AA | AA− |

The Smith family decided to choose the insurance coverage provided by Travelers because of the company’s good rating and low premium, and because the premium includes a water-back coverage. Under this HO 3 (special form), dwelling and other structures are covered against risk of direct loss to property. All losses are covered except certain losses that are specifically excluded.

John drives a 1996 Toyota Corolla, which he purchased new for $18,109. He had one accident in the past four years in which he was hit by another driver. His estimated driving mileage within a year is 10,000. He drives 190 miles weekly to work. His car is not used for business purposes. Karen bought a new Toyota Camry in 1997 for $20,109. She has never had an accident. Her estimated mileage within a year is 7,500 and the weekly driving is 100 miles.

The Smiths used Insweb.com and found several quotes from various insurance companies that fit their needs. Table 23.3 "Auto Insurance Plan Options" summarizes the results of their research.

Table 23.3 Auto Insurance Plan Options

| Companies | Harford | Integon Indemnity | Dairyland |

|---|---|---|---|

| A.M. Best Rating | A+ | A+ | AA+ |

| Liability | 100,000/300,000/100,000 | 100,000/300,000/100,000 | 100,000/300,000/100,000 |

| Medical payments | $5,000 | $5,000 | $5,000 |

| Uninsured/underinsured motorist | 100,000/300,000/100,000 | 100,000/300,000/100,000 | 100,000/300,000/100,000 |

| Collision | $250 deductible | $250 deductible | $250 deductible |

| Other than collision | $500 deductible | $500 deductible | $500 deductible |

| Monthly premium | $160 | $210 | $295 |

The Smith family decided to choose the insurance coverage provided by Harford Insurance Company. Harford has an A+ rating, the coverage is more comprehensive, and the premium is significantly lower than the other two companies.

John has had this auto insurance for almost half a year. On the way to a business meeting one day, he is hit by an uninsured motorist. John’s car is badly damaged and he is rushed to the emergency room. Luckily, John has only minor cuts and bruises. John reports this accident to the police and notifies his insurer. The insurance company inspects and appraises the wrecked car. The Smiths’ uninsured motorists coverage covers John’s medical expenses (under bodily injury) and property damages caused by the accident. Harford Insurance considers John’s car a total loss and pays him $14,000 (fair market value less the deductible).

The Smith family decided to purchase long-term disability (LTD) insurance for John because he is the only breadwinner in the family. In the event of an accident that would disable John and leave him unable to work, the family would need adequate coverage of all their expenses. The LTD benefit provided by John’s employer, Virginia Power, would pay 50 percent of John’s salary in case of his total disability; however, the family would like to have more coverage.

TransAmerica, an insurance broker that prepares coverage for Erie and Prudential Life, prepared two plans for the Smiths as shown in Table 23.4 "Long-Term Disability Plan Options". Both plans provided benefits to age sixty-five with a ninety-day waiting period. Both plans offer the same level of optional benefits, including residual disability and an inflation rider.

Table 23.4 Long-Term Disability Plan Options

| Erie | Prudential | |

|---|---|---|

| Benefit period | To age sixty-five | To age sixty-five |

| Waiting period | 90 days | 90 days |

| Monthly benefit | $2,917.00 | $3,700 |

| Base annual premium | $1,003.49 | $1,262.10 |

| Total annual premium | $1,414.88 | $1,783.92 |

| Optional benefits | ||

| Residual disability | $183.25 | $232.43 |

| Inflation rider | $228.14 | $289.38 |

The Smith family chose additional disability coverage provided by Erie because of the lower premium, lower residual disability cost, and lower inflation rider cost.

The Smith family realized they needed to invest in additional term life insurance for John because his employer provided only term life coverage in the amount of one times his salary, $100,000. They did not need to worry about life insurance for Karen because her parents bought a ten-year level term coverage in the amount of $250,000 on Karen’s life when Tristian was born. They told Karen that an untimely death would mean an economic loss to the family because John would likely have to hire help for housekeeping and child care.

As noted above, John is thirty-five years old and in very good health. He enjoys working out at the gym after work at least three days a week and has never been a smoker. John’s family history shows no serious health problems, and most of his relatives have lived well into their seventies.

To decide how much life insurance is needed for John, he and Karen worked on a needs analysis with some friends who are familiar with financial planning. They came to the conclusion that he will need to purchase $300,000 additional coverage. The following breakdown shows why they believe they need this amount of coverage:

| Cash needs | ||

| Funeral expenses | $12,000 | |

| Probating will and attorney fees | $3,000 | |

| Income needs | ||

| To get Karen and Tristian on their feet | $192,000 | ($4,000 monthly for 4 years) |

| Special needs | ||

| Balance on mortgage | $120,000 | |

| College fund for Tristian | $50,000 | |

| Emergency fund | $75,000 | |

| Total family needs | $452,000 | |

| Current financial assets | ||

| Savings balance | $20,000 | |

| 401(k) current balance | $32,000 | |

| Group term insurance | $100,000 | |

| Total current financial assets | $152,000 | |

| Additional coverage needed | $300,000 | |

Virginia Power offers additional life insurance that their employees can purchase through North American Life. The Smiths wanted to compare prices of additional coverage, so they looked on the Internet. They found that the Western-Southern Life and John Hancock plans to fit their budget and their needs. All three plans are compared in Table 23.5 "Life Insurance Plan Options".

Table 23.5 Life Insurance Plan Options

| North American (VA Power) | Western-Southern Life | John Hancock | |

|---|---|---|---|

| Amount | $300,000 | $300,000 | $300,000 |

| Term period | 20 years | 20 years | 20 years |

| Initial monthly premium | $21.00 | $19.95 | $18.50 |

| Initial rate guarantee | 5 years | 20 years | 20 years |

| S&P rating | AA | AAA | AA+ |

The Smith family decided to go with Western-Southern Life because of its higher rating, low premiums, and guaranteed initial rate for twenty years. John will have to prove evidence of his insurability when he purchases the coverage (unlike the group life coverage provided by the employer). This is not a major issue to John because he is in excellent health. If John were to leave the company, his life insurance would terminate, but he could convert it to an individual cash-value policy at that time.

Virginia Power offers its employees two preferred provider organization (PPO) options and one health maintenance organization (HMO) option. The Smith family decided to choose one of the PPO plans as opposed to an HMO plan because Karen and John are planning to have another child and, considering her high-risk status, prefer to have more choices and out-of-network options if necessary.

A PPO is a network of health care providers who have agreed to accept a lower fee for their services. A PPO plan gives one the flexibility to select a network provider without having to select a primary care physician to coordinate care or to go out-of-network with higher copayments. All of Virginia Power’s benefit coverage is provided by Anthem, a Blue Cross/Blue Shield company with A++ rating. Employees of Virginia Power and their family members are covered on the date employment begins. Benefits will be provided at the in-network level to an employee who lives outside the network’s geographic area. In-network participants must receive preventative care benefits from PPO providers. Participants who live outside the network’s geographic area may receive these services from PPO and non-PPO providers. Table 23.6 "Health Insurance Plan Options" compares the benefits of the two PPO options.

Table 23.6 Health Insurance Plan Options

| Feature | Medical Plan 1 | Medical Plan 2 |

|---|---|---|

| In-Network/Out-of Network | In-Network/Out-of Network | |

| Annual deductible | $572 | $1,146 |

| Monthly premiums (employee’s portion for the whole family) | $91.41 | $41.13 |

| Out-of-pocket maximum | $2,288/$4,004 | $4,584/$8,022 |

| Lifetime maximum benefits | Unlimited | $1,000,000 |

| Participant coinsurance | 20%/40% | 20%/40% |

| Preventative care | 100% after $10 copay for generalist; $20 copay for specialist | |

| Prescription drugs | ||

| —Deductible | None | None |

| —Participant coinsurance | 20% | 20% |

| —Out-of-pocket maximum | $700 | $700 |

| Out-patient mental health | After deductible, next 20% of $500 of expenses, then 50% of the balance for the remainder of the plan year; no out-of-pocket maximum | |

| In-patient mental health | Up to 30 days per person per year; 60 days maximum per person, per lifetime, for substance abuse | |

| Chiropractic | Maximum benefits $500 per person per year | |

The Smith family chose Plan 1 because of the lower deductible and lower out-of-pocket maximum compared to Plan 2. Also, the lifetime maximum benefit is unlimited.

While vacationing with his family in Orlando, Florida, John keeps up his morning jogging routine. On the third day of the vacation, John suffers chest pains while running and collapses. John is rushed by ambulance to a nearby hospital where he is diagnosed with a bronchial infection. X-rays and lab work total $300. The family pays 20 percent of the bill because they had met their deductible for the year. Their total out-of-pocket expenses for the visit are $60. Though disappointed that he can’t jog for a week or two, John is thankful that, even out of state, he is able to have expert medical care and return to his family to enjoy the remainder of his vacation.

John and Karen are very young, so they do not perceive the need for investing in long-term care. Virginia Power doesn’t offer this option. However, John has heard rumors that long-term care might be offered next year. If Virginia Power does begin offering long-term care, John will consider participating in it.

The Smiths decided to invest in the 401(k) plan offered by Virginia Power. Virginia Power matches contributions at 50 percent. John chose to defer 4 percent of his salary ($240 monthly). When added to Virginia Power’s 2 percent, or $120, the monthly total is $360. The contribution is invested in mutual funds. John’s 401(k) current balance is $32,000 and he hopes he will be able to invest it wisely. He can begin withdrawing his retirement benefits at age fifty-nine and a half with no penalties if he wishes.

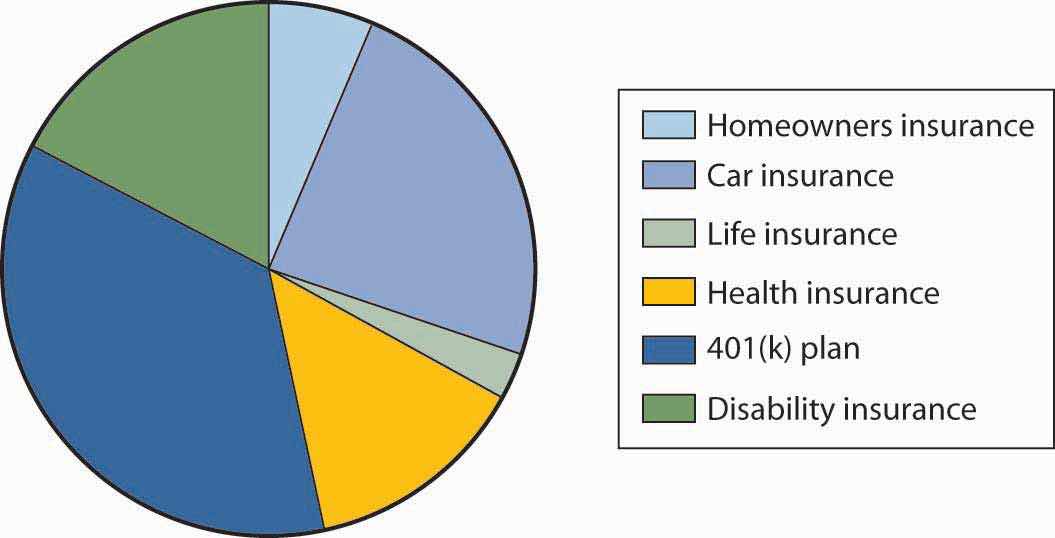

Table 23.7 "Smith Family Income Statement" and Table 23.8 "Smith Family Net Worth" depict the Smith family’s finances. Figure 23.3 "Monthly Cost Allocation" shows the costs of insurance premiums in reference to the Smiths’ income.

Table 23.7 Smith Family Income Statement

| Monthly salary after taxes | $6,000 | |

| Mortgage | $1,200 | |

| Utilities | $350 | |

| Homeowners insurance | $42.67 | |

| Car insurance | $160 | |

| Life insurance | $19.95 | |

| Health insurance | $91.41 | * |

| $401(k) plan | $240 | |

| Disability insurance | $117.91 | |

| Baby needs | $300 | |

| Groceries | $500 | |

| College fund | $100 | |

| Entertainment | $400 | |

| Other expenses | $200 | |

| Possible expenses | $800 | |

| Total | $4,522 | |

| Potential savings | $1,478.07 | |

| * Health premiums are paid on a pretax basis into a premium conversion plan. | ||

|---|---|---|

Table 23.8 Smith Family Net Worth

| Assets | |

| Savings | $20,000 |

| 401(k) current balance | $32,000 |

| House | $160,000 |

| Collectibles | $22,000 |

| Total assets | $234,000 |

| Liability | |

| Mortgage payable | $120,000 |

| Net assets | $114,000 |

Figure 23.3 Monthly Cost Allocation

With the help from all group members working on the project, the Smith family is able to choose the best coverage they can get from various insurance plans. Their homeowners insurance is provided by Travelers Insurance Company; their auto is covered by Harford Insurance Company. They bought additional life insurance from Western-Southern Life Company and additional long-term disability from Erie. Virginia Power provides good health care coverage, term life insurance, a 401(k) retirement plan, and long-term disability. The Smith family chose insurance plans that best fit their needs.

In this section you studied how the needs of a hypothetical family affect the selection of insurance coverage and employee benefits: