After reading this chapter, you should understand the following:

In Chapter 14 "Relationships between Principal and Agent" we considered the relationships between agent and principal. Now we turn to relationships between third parties and the principal or agent. When the agent makes a contract for his principal or commits a tort in the course of his work, is the principal liable? What is the responsibility of the agent for torts committed and contracts entered into on behalf of his principal? How may the relationship be terminated so that the principal or agent will no longer have responsibility toward or liability for the acts of the other? These are the questions addressed in this chapter.

The key to determining whether a principal is liable for contracts made by his agent is authority: was the agent authorized to negotiate the agreement and close the deal? Obviously, it would not be sensible to hold a contractor liable to pay for a whole load of lumber merely because a stranger wandered into the lumberyard saying, “I’m an agent for ABC Contractors; charge this to their account.” To be liable, the principal must have authorized the agent in some manner to act in his behalf, and that authorization must be communicated to the third party by the principal.

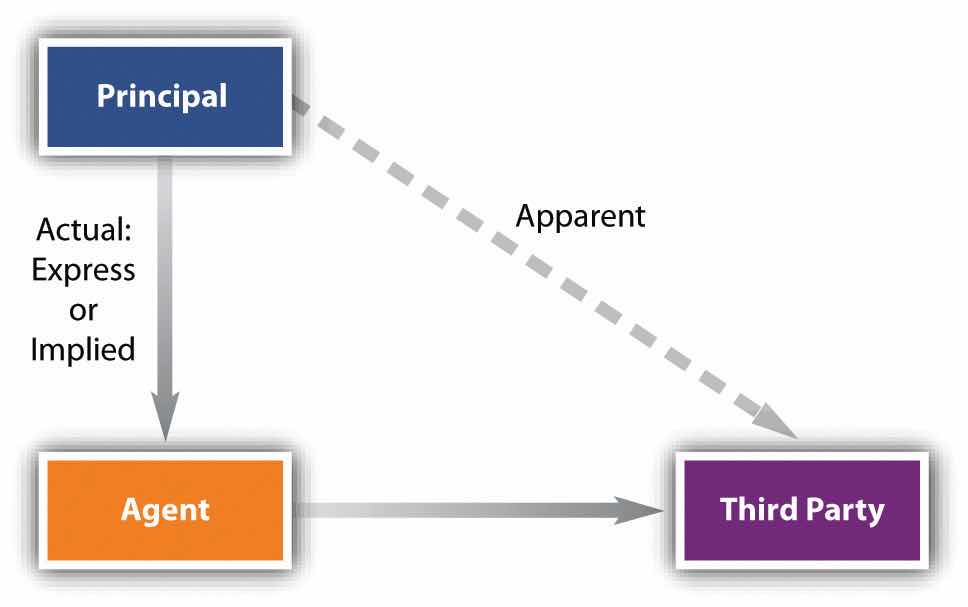

There are three types of authority: express, implied, and apparent (see Figure 15.1 "Types of Authority"). We will consider each in turn.

The strongest form of authority is that which is expressly granted, often in written form. The principal consents to the agent’s actions, and the third party may then rely on the document attesting to the agent’s authority to deal on behalf of the principal. One common form of express authorityContractually given authority to the agent from the principal, orally or in writing, communicated to the third party. is the standard signature card on file with banks allowing corporate agents to write checks on the company’s credit. The principal bears the risk of any wrongful action of his agent, as demonstrated in Allen A. Funt Productions, Inc. v. Chemical Bank.Allen A. Funt Productions, Inc. v. Chemical Bank, 405 N.Y.S.2d 94 (1978). Allen A. Funt submitted to his bank through his production company various certificates permitting his accountant to use the company’s checking accounts.Allen Funt (1914–99) was an American television producer, director, and writer, best known as the creator and host of Candid Camera from the 1940s to 1980s, which was broadcast as either a regular show or a series of specials. Its most notable run was from 1960 to 1967 on CBS. In fact, for several years the accountant embezzled money from the company by writing checks to himself and depositing them in his own account. The company sued its bank, charging it with negligence, apparently for failing to monitor the amount of money taken by the accountant. But the court dismissed the negligence complaint, citing a state statute based on the common-law agency principle that a third party is entitled to rely on the express authorization given to an agent; in this case, the accountant drew checks on the account within the monetary limits contained in the signature cards on file with the bank. Letters of introduction and work orders are other types of express authority.

Figure 15.1 Types of Authority

Not every detail of an agent’s work can be spelled out. It is impossible to delineate step-by-step the duties of a general agent; at best, a principal can set forth only the general nature of the duties that the agent is to perform. Even a special agent’s duties are difficult to describe in such detail as to leave him without discretion. If express authority were the only valid kind, there would be no efficient way to use an agent, both because the effort to describe the duties would be too great and because the third party would be reluctant to deal with him.

But the law permits authority to be “implied” by the relationship of the parties, the nature and customs of the business, the circumstances surrounding the act in question, the wording of the agency contract, and the knowledge that the agent has of facts relevant to the assignment. The general rule is that the agent has implied or “incidental” authority to perform acts incidental to or reasonably necessary to carrying out the transaction. Thus if a principal instructs her agent to “deposit a check in the bank today,” the agent has authority to drive to the bank unless the principal specifically prohibits the agent from doing so.

The theory of implied authorityThe authority of an agent to perform acts that are reasonably necessary to accomplish the purpose of the agency. is especially important to business in the realm of the business manager, who may be charged with running the entire business operation or only a small part of it. In either event, the business manager has a relatively large domain of implied authority. He can buy goods and services; hire, supervise, and fire employees; sell or junk inventory; take in receipts and pay debts; and in general, direct the ordinary operations of the business. The full extent of the manager’s authority depends on the circumstances—what is customary in the particular industry, in the particular business, and among the individuals directly concerned.

On the other hand, a manager does not have implicit authority to undertake unusual or extraordinary actions on behalf of his principal. In the absence of express permission, an agent may not sell part of the business, start a new business, change the nature of the business, incur debt (unless borrowing is integral to the business, as in banking, for example), or move the business premises. For example, the owner of a hotel appoints Andy manager; Andy decides to rename the hotel and commissions an artist to prepare a new logo for the hotel’s stationery. Andy has no implied authority to change the name or to commission the artist, though he does have implied authority to engage a printer to replenish the stationery supply—and possibly to make some design changes in the letterhead.

Even when there is no implied authority, in an emergency the agent may act in ways that would in the normal course require specific permission from the principal. If unforeseen circumstances arise and it is impracticable to communicate with the principal to find out what his wishes would be, the agent may do what is reasonably necessary in order to prevent substantial loss to his principal. During World War II, Eastern Wine Corporation marketed champagne in a bottle with a diagonal red stripe that infringed the trademark of a French producer. The French company had granted licenses to an American importer to market its champagne in the United States. The contract between producer and importer required the latter to notify the French company whenever a competitor appeared to be infringing its rights and to recommend steps by which the company could stop the infringement. The authority to institute suit was not expressly conferred, and ordinarily the right to do so would not be inferred. Because France was under German occupation, however, the importer was unable to communicate with the producer, its principal. The court held that the importer could file suit to enjoin Eastern Wine from continuing to display the infringing red diagonal stripe, since legal action was “essential to the preservation of the principal’s property.”G. H. Mumm Champagne v. Eastern Wine Corp., 52 F.Supp. 167 (S.D.N.Y. 1943).

The rule that a person’s position can carry with it implied authority is fundamental to American business practice. But outside the United States this rule is not applicable, and the business executive traveling abroad should be aware that in civil-law countries it is customary to present proof of authority to transact corporate business—usually in the form of a power of attorney. This is not always an easy task. Not only must the power of the traveling executive be shown but the right of the corporate officer back in the United States to delegate authority must also be proven.

In the agency relationship, the agent’s actions in dealing with third parties will affect the legal rights of the principal. What the third party knows about the agency agreement is irrelevant to the agent’s legal authority to act. That authority runs from principal to agent. As long as an agent has authorization, either express or implied, she may bind the principal legally. Thus the seller of a house may be ignorant of the buyer’s true identity; the person he supposes to be the prospective purchaser might be the agent of an undisclosed principal. Nevertheless, if the agent is authorized to make the purchase, the seller’s ignorance is not a ground for either seller or principal to void the deal.

But if a person has no authority to act as an agent, or an agent has no authority to act in a particular way, is the principal free from all consequences? The answer depends on whether or not the agent has apparent authorityIn agency, the situation in which a principal leads a third party to believe that an agent has authority to bind the principal, even where the agent lacks the actual authority to bind the principal.—that is, on whether or not the third person reasonably believes from the principal’s words, written or spoken, or from his conduct that he has in fact consented to the agent’s actions. Apparent authority is a manifestation of authority communicated to the third person; it runs from principal to third party, not to the agent.

Apparent authority is sometimes said to be based on the principle of estoppel. Estoppel is the doctrine that a person will not now be allowed to deny a promise or assertion she previously made where there has been detrimental reliance on that promise or assertion. Estoppel is commonly used to avoid injustice. It may be a substitute for the requirement of consideration in contract (making the promise of a gift enforceable where the donee has relied upon the promise), and it is sometimes available to circumvent the requirement of a writing under the Statute of Frauds.

Apparent authority can arise from prior business transactions. On July 10, Meggs sold to Buyer his business, the right to use the trade name Rose City Sheet Metal Works, and a list of suppliers he had used. Three days later, Buyer began ordering supplies from Central Supply Company, which was on Meggs’s list but with which Meggs had last dealt four years before. On September 3, Central received a letter from Meggs notifying it of Meggs’s sale of the business to Buyer. Buyer failed to pay Central, which sued Meggs. The court held that Rose City Sheet Metal Works had apparent authority to buy on Meggs’s credit; Meggs was liable for supplies purchased between July 10 and September 3.Meggs v. Central Supply Co., 307 N.E.2d 288 (Ind. App. 1974). In such cases, and in cases involving the firing of a general manager, actual notice should be given promptly to all customers. See the discussion of Kanavos v. Hancock Bank & Trust Company in Section 15.4.1 "Implied Authority".

Even if the agent possessed no actual authority and there was no apparent authority on which the third person could rely, the principal may still be liable if he ratifies or adopts the agent’s acts before the third person withdraws from the contract. Ratification usually relates back to the time of the undertaking, creating authority after the fact as though it had been established initially. Ratification is a voluntary act by the principal. Faced with the results of action purportedly done on his behalf but without authorization and through no fault of his own, he may affirm or disavow them as he chooses. To ratify, the principal may tell the parties concerned or by his conduct manifest that he is willing to accept the results as though the act were authorized. Or by his silence he may find under certain circumstances that he has ratified. Note that ratification does not require the usual consideration of contract law. The principal need be promised nothing extra for his decision to affirm to be binding on him. Nor does ratification depend on the position of the third party; for example, a loss stemming from his reliance on the agent’s representations is not required. In most situations, ratification leaves the parties where they expected to be, correcting the agent’s errors harmlessly and giving each party what was expected.

The principal is liable on an agent’s contract only if the agent was authorized by the principal to make the contract. Such authority is express, implied, or apparent. Express means made in words, orally or in writing; implied means the agent has authority to perform acts incidental to or reasonably necessary to carrying out the transaction for which she has express authority. Apparent authority arises where the principal gives the third party reason to believe that the agent had authority. The reasonableness of the third party’s belief is based on all the circumstances—all the facts. Even if the agent has no authority, the principal may, after the fact, ratify the contract made by the agent.

When is the principal liable for injuries that the agent causes another to suffer?

There is a distinction between torts prompted by the principal himself and torts of which the principal was innocent. If the principal directed the agent to commit a tort or knew that the consequences of the agent’s carrying out his instructions would bring harm to someone, the principal is liable. This is an application of the general common-law principle that one cannot escape liability by delegating an unlawful act to another. The syndicate that hires a hitman is as culpable of murder as the man who pulls the trigger. Similarly, a principal who is negligent in his use of agents will be held liable for their negligence. This rule comes into play when the principal fails to supervise employees adequately, gives faulty directions, or hires incompetent or unsuitable people for a particular job. Imposing liability on the principal in these cases is readily justifiable since it is the principal’s own conduct that is the underlying fault; the principal here is directly liable.

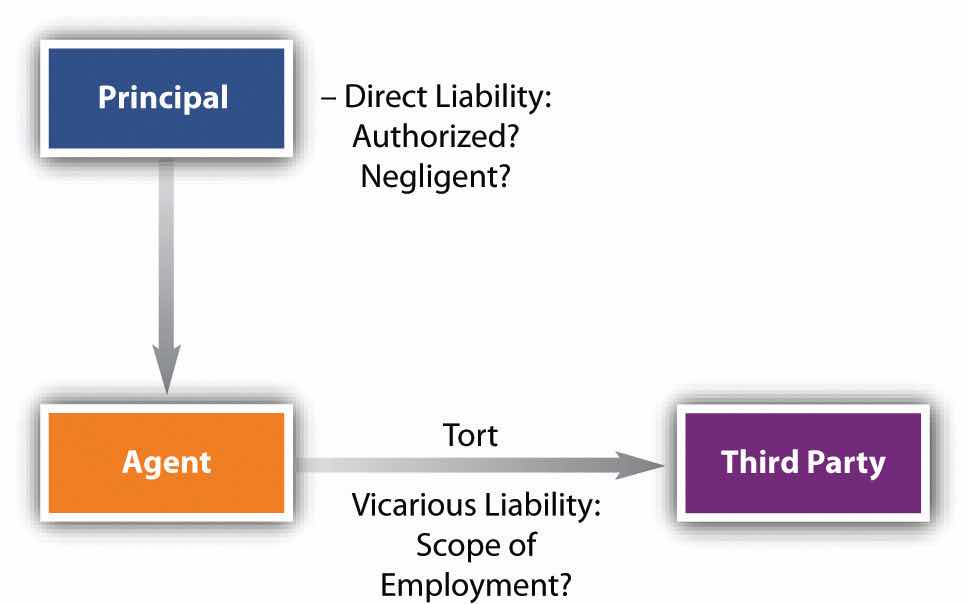

But the principle of liability for one’s agent is much broader, extending to acts of which the principal had no knowledge, that he had no intention to commit nor involvement in, and that he may in fact have expressly prohibited the agent from engaging in. This is the principle of respondeat superiorThe Latin term for the master-servant doctrine. (“let the master answer”) or the master-servant doctrineA doctrine under which the employer is liable for torts committed by the employee in the scope of employment., which imposes on the principal vicarious liabilityLiability incurred indirectly through the actions of another. (vicarious means “indirectly, as, by, or through a substitute”) under which the principal is responsible for acts committed by the agent within the scope of the employment (see Figure 15.2 "Principal’s Tort Liability").

Figure 15.2 Principal’s Tort Liability

The modern basis for vicarious liability is sometimes termed the “deep pocket” theory: the principal (usually a corporation) has deeper pockets than the agent, meaning that it has the wherewithal to pay for the injuries traceable one way or another to events it set in motion. A million-dollar industrial accident is within the means of a company or its insurer; it is usually not within the means of the agent—employee—who caused it.

The “deep pocket” of the defendant-company is not always very deep, however. For many small businesses, in fact, the principle of respondeat superior is one of life or death. One example was the closing in San Francisco of the much-beloved Larraburu Brothers Bakery—at the time, the world’s second largest sourdough bread maker. The bakery was held liable for $2 million in damages after one of its delivery trucks injured a six-year-old boy. The bakery’s insurance policy had a limit of $1.25 million, and the bakery could not absorb the excess. The Larraburus had no choice but to cease operations. (See http://www.outsidelands.org/larraburu.php.)

Respondeat superior raises three difficult questions: (1) What type of agents can create tort liability for the principal? (2) Is the principal liable for the agent’s intentional torts? (3) Was the agent acting within the scope of his employment? We will consider these questions in turn.

In general, the broadest liability is imposed on the master in the case of tortious physical conduct by a servant, as discussed in Chapter 14 "Relationships between Principal and Agent". If the servant acted within the scope of his employment—that is, if the servant’s wrongful conduct occurred while performing his job—the master will be liable to the victim for damages unless, as we have seen, the victim was another employee, in which event the workers’ compensation system will be invoked. Vicarious tort liability is primarily a function of the employment relationship and not agency status.

Ordinarily, an individual or a company is not vicariously liable for the tortious acts of independent contractors. The plumber who rushes to a client’s house to repair a leak and causes a traffic accident does not subject the homeowner to liability. But there are exceptions to the rule. Generally, these exceptions fall into a category of duties that the law deems nondelegable. In some situations, one person is obligated to provide protection to or care for another. The failure to do so results in liability whether or not the harm befell the other because of an independent contractor’s wrongdoing. Thus a homeowner has a duty to ensure that physical conditions in and around the home are not unreasonably dangerous. If the owner hires an independent contracting firm to dig a sewer line and the contractor negligently fails to guard passersby against the danger of falling into an open trench, the homeowner is liable because the duty of care in this instance cannot be delegated. (The contractor is, of course, liable to the homeowner for any damages paid to an injured passerby.)

In the nineteenth century, a principal was rarely held liable for intentional wrongdoing by the agent if the principal did not command the act complained of. The thought was that one could never infer authority to commit a willfully wrongful act. Today, liability for intentional torts is imputed to the principal if the agent is acting to further the principal’s business. See the very disturbing Lyon v. Carey in Section 15.4.2 "Employer’s Liability for Employee’s Intentional Torts: Scope of Employment".

The general rule is that a principal is liable for torts only if the servant committed them “in the scope of employment.” But determining what this means is not easy.

It may be clear that the person causing an injury is the agent of another. But a principal cannot be responsible for every act of an agent. If an employee is following the letter of his instructions, it will be easy to determine liability. But suppose an agent deviates in some way from his job. The classic test of liability was set forth in an 1833 English case, Joel v. Morrison.Joel v. Morrison, 6 Carrington & Payne 501. The plaintiff was run over on a highway by a speeding cart and horse. The driver was the employee of another, and inside was a fellow employee. There was no question that the driver had acted carelessly, but what he and his fellow employee were doing on the road where the plaintiff was injured was disputed. For weeks before and after the accident, the cart had never been driven in the vicinity in which the plaintiff was walking, nor did it have any business there. The suggestion was that the employees might have gone out of their way for their own purposes. As the great English jurist Baron Parke put it, “If the servants, being on their master’s business, took a detour to call upon a friend, the master will be responsible.…But if he was going on a frolic of his own, without being at all on his master’s business, the master will not be liable.” In applying this test, the court held the employer liable.

The test is thus one of degree, and it is not always easy to decide when a detour has become so great as to be transformed into a frolic. For a time, a rather mechanical rule was invoked to aid in making the decision. The courts looked to the servant’s purposes in “detouring.” If the servant’s mind was fixed on accomplishing his own purposes, then the detour was held to be outside the scope of employment; hence the tort was not imputed to the master. But if the servant also intended to accomplish his master’s purposes during his departure from the letter of his assignment, or if he committed the wrong while returning to his master’s task after the completion of his frolic, then the tort was held to be within the scope of employment.

This test is not always easy to apply. If a hungry deliveryman stops at a restaurant outside the normal lunch hour, intending to continue to his next delivery after eating, he is within the scope of employment. But suppose he decides to take the truck home that evening, in violation of rules, in order to get an early start the next morning. Suppose he decides to stop by the beach, which is far away from his route. Does it make a difference if the employer knows that his deliverymen do this?

Court decisions in the last forty years have moved toward a different standard, one that looks to the foreseeability of the agent’s conduct. By this standard, an employer may be held liable for his employee’s conduct even when devoted entirely to the employee’s own purposes, as long as it was foreseeable that the agent might act as he did. This is the “zone of risk” test. The employer will be within the zone of risk for vicarious liability if the employee is where she is supposed to be, doing—more or less—what she is supposed to be doing, and the incident arose from the employee’s pursuit of the employer’s interest (again, more or less). That is, the employer is within the zone of risk if the servant is in the place within which, if the master were to send out a search party to find a missing employee, it would be reasonable to look. See Section 4, Cockrell v. Pearl River Valley Water Supply Dist.

Vicarious liability is not limited to harm caused in the course of an agency relationship. It may also be imposed in other areas, including torts of family members, and other torts governed by statute or regulation. We will examine each in turn.

A problem commonly arises when an automobile owner lends his vehicle to a personal friend, someone who is not an agent, and the borrower injures a third person. Is the owner liable? In many states, the owner is not liable; in other states, however, two approaches impose liability on the owner.

The first approach is legislative: owner’s consent statutesDoctrine under which the owner of an automobile is liable for damages caused by the driver who has permission to use the car. make the owner liable when the automobile is being driven with his consent or knowledge. The second approach to placing liability on the owner is judicial and known as the family purpose doctrineA doctrine under which an owner of an automobile is liable for damages to others incurred while members of his family are driving the vehicle, under the theory that the vehicle is owned for family purposes.. Under this doctrine, a family member who negligently injures someone with the car subjects the owner to liability if the family member was furthering family purposes. These are loosely defined to include virtually every use to which a child, for example, might put a car. In a Georgia case, Dixon v. Phillips, the father allowed his minor son to drive the car but expressly forbade him from letting anyone else do so.Dixon v. Phillips, 217 S.E.2d 331 (Ga. 1975). Nevertheless, the son gave the wheel to a friend and a collision occurred while both were in the car. The court held the father liable because he made the car available for the pleasure and convenience of his son and other family members.

At common law, the husband was liable for the torts of his wife, not because she was considered an agent but because she was considered to be an extension of him. “Husband and wife were only one person in law,”O.W. Holmes, Agency, 4 Harvard Law Rev. 353 (1890–91). says Holmes, and any act of the wife was supposed to have been done at the husband’s direction (to which Mr. Dickens’s Mr. Bumble responded, in the memorable line, “If the law supposes that, the law is a ass—a idiot”Charles Dickens, Oliver Twist, (London: 1838), chap 51.). This ancient view has been abrogated by statute or by court ruling in all the states, so that now a wife is solely responsible for her own torts unless she in fact serves as her husband’s agent.

Unlike wives, children are not presumed at common law to be agents or extensions of the father so that normally parents are not vicariously liable for their children’s torts. However, they can be held liable for failing to control children known to be dangerous.

Most states have statutorily changed the common-law rule, making parents responsible for willful or malicious tortious acts of their children whether or not they are known to be mischief-makers. Thus the Illinois Parental Responsibility Law provides the following: “The parent or legal guardian of an unemancipated minor who resides with such parent or legal guardian is liable for actual damages for the willful or malicious acts of such minor which cause injury to a person or property.”Ill. Rev. Stat. (2005), chapter 70, paragraph 51. http://law.justia.com/illinois/codes/2005/chapter57/2045.html. Several other states impose a monetary limit on such liability.

There are certain types of conduct that statutes or regulation attempt to control by placing the burden of liability on those presumably in a position to prevent the unwanted conduct. An example is the “Dramshop Act,” which in many states subjects the owner of a bar to liability if the bar continues to serve an intoxicated patron who later is involved in an accident while intoxicated. Another example involves the sale of adulterated or short-weight foodstuffs: the employer of one who sells such may be liable, even if the employer did not know of the sales.

As a general proposition, a principal will not be held liable for an agent’s unauthorized criminal acts if the crimes are those requiring specific intent. Thus a department store proprietor who tells his chief buyer to get the “best deal possible” on next fall’s fashions is not liable if the buyer steals clothes from the manufacturer. A principal will, however, be liable if the principal directed, approved, or participated in the crime. Cases here involve, for example, a corporate principal’s liability for agents’ activity in antitrust violations—price-fixing is one such violation.

There is a narrow exception to the broad policy of immunity. Courts have ruled that under certain regulatory statutes and regulations, an agent’s criminality may be imputed to the principal, just as civil liability is imputed under Dramshop Acts. These include pure food and drug acts, speeding ordinances, building regulations, child labor rules, and minimum wage and maximum hour legislation. Misdemeanor criminal liability may be imposed upon corporations and individual employees for the sale or shipment of adulterated food in interstate commerce, notwithstanding the fact that the defendant may have had no actual knowledge that the food was adulterated at the time the sale or shipment was made.

The principal will be liable for the employee’s torts in two circumstances: first, if the principal was directly responsible, as in hiring a person the principal knew or should have known was incompetent or dangerous; second, if the employee committed the tort in the scope of business for the principal. This is the master-servant doctrine or respondeat superior. It imposes vicarious liability on the employer: the master (employer) will be liable if the employee was in the zone of activity creating a risk for the employer (“zone of risk” test), that is—generally—if the employee was where he was supposed to be, when he was supposed to be there, and the incident arose out of the employee’s interest (however perverted) in promoting the employer’s business.

Special cases of vicarious liability arise in several circumstances. For example, the owner of an automobile may be liable for torts committed by one who borrows it, or if it is—even if indirectly—used for family purposes. Parents are, by statute in many states, liable for their children’s torts. Similarly by statute, the sellers and employers of sellers of alcohol or adulterated or short-weight foodstuffs may be liable. The employer of one who commits a crime is not usually liable unless the employer put the employee up to the crime or knew that a crime was being committed. But some prophylactic statutes impose liability on the employer for the employee’s crime—even if the employee had no intention to commit it—as a means to force the employer to prevent such actions.

That a principal is held vicariously liable and must pay damages to an injured third person does not excuse the agent who actually committed the tortious acts. A person is always liable for his or her own torts (unless the person is insane, involuntarily intoxicated, or acting under extreme duress). The agent is personally liable for his wrongful acts and must reimburse the principal for any damages the principal was forced to pay, as long as the principal did not authorize the wrongful conduct. The agent directed to commit a tort remains liable for his own conduct but is not obliged to repay the principal. Liability as an agent can be burdensome, sometimes perhaps more burdensome than as a principal. The latter normally purchases insurance to cover against wrongful acts of agents, but liability insurance policies frequently do not cover the employee’s personal liability if the employee is named in a lawsuit individually. Thus doctors’ and hospitals’ malpractice policies protect a doctor from both her own mistakes and those of nurses and others that the doctor would be responsible for; nurses, however, might need their own coverage. In the absence of insurance, an agent is at serious risk in this lawsuit-conscious age. The risk is not total. The agent is not liable for torts of other agents unless he is personally at fault—for example, by negligently supervising a junior or by giving faulty instructions. For example, an agent, the general manager for a principal, hires Brown as a subordinate. Brown is competent to do the job but by failing to exercise proper control over a machine negligently injures Ted, a visitor to the premises. The principal and Brown are liable to Ted, but the agent is not.

It makes sense that an agent should be liable for her own torts; it would be a bad social policy indeed if a person could escape tort liability based on her own fault merely because she acted in an agency capacity. It also makes sense that—as is the general rule—an agent is not liable on contracts she makes on the principal’s behalf; the agent is not a party to a contract made by the agent on behalf of the principal. No public policy would be served by imposing liability, and in many cases it would not make sense. Suppose an agent contracts to buy $25 million of rolled aluminum for a principal, an airplane manufacturer. The agent personally could not reasonably perform such contract, and it is not intended by the parties that she should be liable. (Although the rule is different in England, where an agent residing outside the country is liable even if it is clear that he is signing in an agency capacity.) But there are three exceptions to this rule: (1) if the agent is undisclosed or partially disclosed, (2) if the agent lacks authority or exceeds it, or (3) if the agent entered into the contract in a personal capacity. We consider each situation.

An agent need not, and frequently will not, inform the person with whom he is negotiating that he is acting on behalf of a principal. The secret principal is usually called an “undisclosed principal.” Or the agent may tell the other person that he is acting as an agent but not disclose the principal’s name, in which event the principal is “partially disclosed.” To understand the difficulties that may occur, consider the following hypothetical but common example. A real estate developer known for building amusement parks wants to acquire several parcels of land to construct a new park. He wants to keep his identity secret to hold down the land cost. If the landowners realized that a major building project was about to be launched, their asking price would be quite high. So the developer obtains two options to purchase land by using two secret agents—Betty and Clem.

Betty does not mention to sellers that she is an agent; therefore, to those sellers the developer is an undisclosed principal. Clem tells those with whom he is dealing that he is an agent but refuses to divulge the developer’s name or his business interest in the land. Thus the developer is, to the latter sellers, a partially disclosed principal. Suppose the sellers get wind of the impending construction and want to back out of the deal. Who may enforce the contracts against them?

The developer and the agents may sue to compel transfer of title. The undisclosed or partially disclosed principal may act to enforce his rights unless the contract specifically prohibits it or there is a representation that the signatories are not signing for an undisclosed principal. The agents may also bring suit to enforce the principal’s contract rights because, as agents for an undisclosed or partially disclosed principal, they are considered parties to their contracts.

Now suppose the developer attempts to call off the deal. Whom may the sellers sue? Both the developer and the agents are liable. That the sellers had no knowledge of the developer’s identity—or even that there was a developer—does not invalidate the contract. If the sellers first sue agent Betty (or Clem), they may still recover the purchase price from the developer as long as they had no knowledge of his identity prior to winning the first lawsuit. The developer is discharged from liability if, knowing his identity, the plaintiffs persist in a suit against the agents and recover a judgment against them anyway. Similarly, if the seller sues the principal and recovers a judgment, the agents are relieved of liability. The seller thus has a “right of election” to sue either the agent or the undisclosed principal, a right that in many states may be exercised any time before the seller collects on the judgment.

An agent who purports to make a contract on behalf of a principal, but who in fact has no authority to do so, is liable to the other party. The theory is that the agent has warranted to the third party that he has the requisite authority. The principal is not liable in the absence of apparent authority or ratification. But the agent does not warrant that the principal has capacity. Thus an agent for a minor is not liable on a contract that the minor later disavows unless the agent expressly warranted that the principal had attained his majority. In short, the implied warranty is that the agent has authority to make a deal, not that the principal will necessarily comply with the contract once the deal is made.

An agent will be liable on contracts made in a personal capacityfor instance, when the agent personally guarantees repayment of a debt. The agents intention to be personally liable is often difficult to determine on the basis of his signature on a contract. Generally, a person signing a contract can avoid personal liability only by showing that he was in fact signing as an agent. If the contract is signed Jones, Agent, Jones can introduce evidence to show that there was never an intention to hold him personally liable. But if he signed Jones and neither his agency nor the principals name is included, he will be personally liable. This can be troublesome to agents who routinely indorse checks and notes. There are special rules governing these situations.

The agency relationship is not permanent. Either by action of the parties or by law, the relationship will eventually terminate.

Certainly the parties to an agency contract can terminate the agreement. As with the creation of the relationship, the agreement may be terminated either expressly or implicitly.

Many agreements contain specified circumstances whose occurrence signals the end of the agency. The most obvious of these circumstances is the expiration of a fixed period of time (“agency to terminate at the end of three months” or “on midnight, December 31”). An agreement may also terminate on the accomplishment of a specified act (“on the sale of the house”) or following a specific event (“at the conclusion of the last horse race”).

Mutual consent between the parties will end the agency. Moreover, the principal may revoke the agency or the agent may renounce it; such a revocationThe principal’s unilateral termination of the agency relationship. or renunciation of agencyThe agent’s unilateral termination of the agency relationship. would be an express termination. Even a contract that states the agreement is irrevocable will not be binding, although it can be the basis for a damage suit against the one who breached the agreement by revoking or renouncing it. As with any contract, a person has the power to breach, even in absence of the right to do so. If the agency is coupled with an interest, however, so that the authority to act is given to secure an interest that the agent has in the subject matter of the agency, then the principal lacks the power to revoke the agreement.

There are a number of other circumstances that will spell the end of the relationship by implication. Unspecified events or changes in business conditions or the value of the subject matter of the agency might lead to a reasonable inference that the agency should be terminated or suspended; for example, the principal desires the agent to buy silver but the silver market unexpectedly rises and silver doubles in price overnight. Other circumstances that end the agency include disloyalty of the agent (e.g., he accepts an appointment that is adverse to his first principal or embezzles from the principal), bankruptcy of the agent or of the principal, the outbreak of war (if it is reasonable to infer that the principal, knowing of the war, would not want the agent to continue to exercise authority), and a change in the law that makes a continued carrying out of the task illegal or seriously interferes with it.

Aside from the express termination (by agreement of both or upon the insistence of one), or the necessary or reasonable inferences that can be drawn from their agreements, the law voids agencies under certain circumstances. The most frequent termination by operation of law is the death of a principal or an agent. The death of an agent also terminates the authority of subagents he has appointed, unless the principal has expressly consented to the continuing validity of their appointment. Similarly, if the agent or principal loses capacity to enter into an agency relationship, it is suspended or terminated. The agency terminates if its purpose becomes illegal.

Even though authority has terminated, whether by action of the parties or operation of law, the principal may still be subject to liability. Apparent authority in many instances will still exist; this is called lingering authorityAuthority that arises where actual authority has been terminated, but third parties are led by the principal’s negligence to believe it still exists.. It is imperative for a principal on termination of authority to notify all those who may still be in a position to deal with the agent. The only exceptions to this requirement are when termination is effected by death, loss of the principal’s capacity, or an event that would make it impossible to carry out the object of the agency.

A person is always liable for her own torts, so an agent who commits a tort is liable; if the tort was in the scope of employment the principal is liable too. Unless the principal put the agent up to committing the tort, the agent will have to reimburse the principal. An agent is not generally liable for contracts made; the principal is liable. But the agent will be liable if he is undisclosed or partially disclosed, if the agent lacks authority or exceeds it, or, of course, if the agent entered into the contract in a personal capacity.

Agencies terminate expressly or impliedly or by operation of law. An agency terminates expressly by the terms of the agreement or mutual consent, or by the principal’s revocation or the agent’s renunciation. An agency terminates impliedly by any number of circumstances in which it is reasonable to assume one or both of the parties would not want the relationship to continue. An agency will terminate by operation of law when one or the other party dies or becomes incompetent, or if the object of the agency becomes illegal. However, an agent may have apparent lingering authority, so the principal, upon termination of the agency, should notify those who might deal with the agent that the relationship is severed.

Kanavos v. Hancock Bank & Trust Company

439 N.E.2d 311 (Mass. 1982)

KASS, J.

At the close of the plaintiff’s evidence, the defendant moved for a directed verdict, which the trial judge allowed. The judge’s reason for so doing was that the plaintiff, in his contract action, failed to introduce sufficient evidence tending to prove that the bank officer who made the agreement with which the plaintiff sought to charge the bank had any authority to make it. Upon review of the record we are of opinion that there was evidence which, if believed, warranted a finding that the bank officer had the requisite authority or that the bank officer had apparent authority to make the agreement in controversy. We therefore reverse the judgment.

For approximately ten years prior to 1975, Harold Kanavos and his brother borrowed money on at least twenty occasions from the Hancock Bank & Trust Company (the Bank), and, during that period, the loan officer with whom Kanavos always dealt was James M. Brown. The aggregate loans made by the Bank to Kanavos at any given time went as high as $800,000.

Over that same decade, Brown’s responsibilities at the Bank grew, and he had become executive vice-president. Brown was also the chief loan officer for the Bank, which had fourteen or fifteen branches in addition to its head office. Physically, Brown’s office was at the head office, toward the rear of the main banking floor, opposite the office of the president—whose name was Kelley. Often Brown would tell Kanavos that he had to check an aspect of a loan transaction with Kelley, but Kelley always backed Brown up on those occasions.…

[The plaintiff, Harold Kanavos, entered into an agreement with the defendant Bank whereby stock owned by the Kanavos brothers was sold to the Bank and the plaintiff was given an option to repurchase the stock. Kanavos’ suit against the Bank was based on an amendment to the agreement offered by Brown.]

Kanavos was never permitted to introduce in evidence the terms of the offer Brown made. That offer was contained in a writing, dated July 16, 1976, on bank letterhead, which read as follows: “This letter is to confirm our conversation regarding your option to re-purchase the subject property. In lieu of your not exercising your option, we agree to pay you $40,000 representing a commission upon our sale of the subject property, and in addition, will give you the option to match the price of sale of said property to extend for a 60 day period from the time our offer is received.” Brown signed the letter as executive vice-president. The basis of exclusion was that the plaintiff had not established the authority of Brown to make with Kanavos the arrangement memorialized in the July 16, 1976, letter.

Whether Brown’s job description impliedly authorized the right of last refusal or cash payment modification is a question of how, in the circumstances, a person in Brown’s position could reasonably interpret his authority. Whether Brown had apparent authority to make the July 16, 1976, modification is a question of how, in the circumstances, a third person, e.g., a customer of the Bank such as Kanavos, would reasonably interpret Brown’s authority in light of the manifestations of his principal, the Bank.

Titles of office generally do not establish apparent authority. Brown’s status as executive vice-president was not, therefore, a badge of apparent authority to modify agreements to which the Bank was a party.

Trappings of office, e.g., office and furnishing, private secretary, while they may have some tendency to suggest executive responsibility, do not without other evidence provide a basis for finding apparent authority. Apparent authority is drawn from a variety of circumstances. Thus in Federal Nat. Bank v. O’Connell…(1940), it was held apparent authority could be found because an officer who was a director, vice-president and treasurer took an active part in directing the affairs of the bank in question and was seen by third parties talking with customers and negotiating with them. In Costonis v. Medford Housing Authy.…(1961), the executive director of a public housing authority was held to have apparent authority to vary specifications on the basis of the cumulative effect of what he had done and what the authority appeared to permit him to do.

In the instant case there was evidence of the following variety of circumstances: Brown’s title of executive vice-president; the location of his office opposite the president; his frequent communications with the president; the long course of dealing and negotiations; the encouragement of Kanavos by the president to deal with Brown; the earlier amendment of the agreement by Brown on behalf of the Bank on material points, namely the price to be paid by the Bank for the shares and the repurchase price; the size of the Bank (fourteen or fifteen branches in addition to the main office); the secondary, rather than fundamental, nature of the change in the terms of the agreement now repudiated by the Bank, measured against the context of the overall transaction; and Brown’s broad operating authority…all these added together would support a finding of apparent authority. When a corporate officer, as here, is allowed to exercise general executive responsibilities, the “public expectation is that the corporation should be bound to engagements made on its behalf by those who presume to have, and convincingly appear to have, the power to agree.” [Citation] This principle does not apply, of course, where in the business context, the requirement of specific authority is presumed, e.g., the sale of a major asset by a corporation or a transaction which by its nature commits the corporation to an obligation outside the scope of its usual activity. The modification agreement signed by Brown and dated July 16, 1976, should have been admitted in evidence, and a verdict should not have been directed.

Judgment reversed.

Lyon v. Carey

533 F.2d 649 (Cir. Ct. App. DC 1976)

McMillan, J.:

Corene Antoinette Lyon, plaintiff, recovered a $33,000.00 verdict [about $142,000 in 2010 dollars] in the United States District Court for the District of Columbia before Judge Barrington T. Parker and a jury, against the corporate defendants, George’s Radio and Television Company, Inc., and Pep Line Trucking Company, Inc. The suit for damages arose out of an assault, including rape, committed with a knife and other weapons upon the plaintiff on May 9, 1972, by Michael Carey, a nineteen-year-old deliveryman for Pep Line Trucking Company, Inc. Three months after the trial, Judge Parker set aside the verdict and rendered judgment for both defendants notwithstanding the verdict. Plaintiff appealed.…

Although the assault was perhaps at the outer bounds of respondeat superior, the case was properly one for the jury. Whether the assault in this case was the outgrowth of a job-related controversy or simply a personal adventure of the deliveryman, was a question for the jury. This was the import of the trial judge’s instructions. The verdict as to Pep Line should not have been disturbed.

Irene Lyon bought a mattress and springs for her bed from the defendant George’s Radio and Television Company, Inc. The merchandise was to be delivered on May 9, 1972. Irene Lyon had to be at work and the plaintiff [Irene’s sister] Corene Lyon, had agreed to wait in her sister’s apartment to receive the delivery.

A C.O.D. balance of $13.24 was due on the merchandise, and Irene Lyon had left a check for $13.24 to cover that balance. Plaintiff had been requested by her sister to “wait until the mattress and the springs came and to check and make sure they were okay.”

Plaintiff, fully clothed, answered the door. Her description of what happened is sufficiently brief and unqualified that it will bear repeating in full. She testified, without objection, as follows:

I went to the door, and I looked in the peephole, and I asked who was there. The young man told me he was a delivery man from George’s. He showed me a receipt, and it said, ‘George’s.’ He said he [needed cash on delivery—COD], so I let him in, and I told him to bring the mattress upstairs and he said, ‘No,’ that he wasn’t going to lug them upstairs, and he wanted the COD first, and I told him I wanted to see the mattress and box springs to make sure they were okay, and he said no, he wasn’t going to lug them upstairs [until he got the check].

So this went back and forwards and so he was getting angry, and I told him to wait right here while I go get the COD. I went to the bedroom to get the check, and I picked it up, and I turned around and he was right there.

And then I was giving him the check and then he told me that his boss told him not to accept a check, that he wanted cash money, and that if I didn’t give him cash money, he was going to take it on my ass, and he told me that he was no delivery man, he was a rapist and then he threw me on the bed.

[The Court] Talk louder, young lady, the jury can’t hear you.

[The witness] And then he threw me on the bed, and he had a knife to my throat.

[Plaintiff’s attorney] Then what happened?

And then he raped me.

Plaintiff’s pre-trial deposition was a part of the record on appeal, and it shows that Carey raped plaintiff at knife point; that then he chased her all over the apartment with a knife and scissors and cut plaintiff in numerous places on her face and body, beat and otherwise attacked her. All of the physical injury other than the rape occurred after rather than before the rape had been accomplished.…

[Carey was convicted of rape and sent to prison. The court determined that George’s was properly dismissed because Pep Line, Carey’s employer, was an independent contractor over which George’s had no control.]

The principal question, therefore, is whether the evidence discloses any other basis upon which a jury could reasonably find Pep Line, the employer of Carey, liable for the assault.

Michael Carey was in the employment of the defendant Pep Line as a deliveryman. He was authorized to make the delivery of the mattress and springs plaintiff’s sister had bought. He gained access to the apartment only upon a showing of the delivery receipt for the merchandise. His employment contemplated that he visit and enter that particular apartment. Though the apartment was not owned by nor in the control of his employer, it was nevertheless a place he was expected by his employer to enter.

After Carey entered, under the credentials of his employment and the delivery receipt, a dispute arose naturally and immediately between him and the plaintiff about two items of great significance in connection with his job. These items were the request of the plaintiff, the customer’s agent, to inspect the mattress and springs before payment (which would require their being brought upstairs before the payment was made), and Carey’s insistence on getting cash rather than a check.

The dispute arose out of the very transaction which had brought Carey to the premises, and, according to the plaintiff’s evidence, out of the employer’s instructions to get cash only before delivery.

On the face of things, Pep Line Trucking Company, Inc. is liable, under two previous decisions of the Court of Appeals for the District of Columbia Circuit. [Citation (1953)] held a taxi owner liable for damages (including a broken leg) sustained by a customer who had been run over by the taxi in pursuit of a dispute between the driver and the customer about a fare. [Citation (1939)], held a restaurant owner liable to a restaurant patron who was beaten with a stick by a restaurant employee, after a disagreement over the service. The theory was that:

It is well established that an employer may be held responsible in tort for assaults committed by an employee while he is acting within the scope of his employment, even though he may act wantonly and contrary to his employer’s instructions. [Citations] “…having placed [the employee] in charge and committed the management of the business to his care, defendants may not escape liability either on the ground of his infirmity of temperament or because, under the influence of passion aroused by plaintiff’s threat to report the circumstances, he went beyond the ordinary line of duty and inflicted the injury shown in this case. [Citations]”

Munick v. City of Durham ([Citation], Supreme Court of North Carolina, 1921), though not a binding precedent, is informative and does show that the theory of liability advanced by the plaintiff is by no means recent in origin. The plaintiff, Munick, a Russian born Jew, testified that he went to the Durham, North Carolina city water company office on April 17, 1919, and offered to pay his bill with “three paper dollars, one silver dollar, and fifty cents in pennies.” The pennies were in a roll “like the bank fixes them.” The clerk gave a receipt and the plaintiff prepared to leave the office. The office manager came into the room, saw the clerk counting the pennies, became enraged at the situation, shoved the pennies onto the floor and ordered Munick to pick them up. Bolton, the manager, “locked the front door and took me by the jacket and called me ‘God damned Jew,’ and said, ‘I want only bills.’ I did not say anything and he hit me in the face. I did not resist, and the door was locked and I could not get out.…” With the door locked, Bolton then repeatedly choked and beat the plaintiff, finally extracted a bill in place of the pennies, and ordered him off the premises with injuries including finger marks on his neck that could be seen for eight or ten days. Bolton was convicted of unlawful assault [but the case against the water company was dismissed].

The North Carolina Supreme Court (Clark, C. J.) reversed the trial court’s dismissal and held that the case should have gone to the jury. The court…said [Citation]:

“‘It is now fully established that corporations may be held liable for negligent and malicious torts, and that responsibility will be imputed whenever such wrongs are committed by their employees and agents in the course of their employment and within its scope * * * in many of the cases, and in reliable textbooks * * * ‘course of employment’ is stated and considered as sufficiently inclusive; but, whether the one or the other descriptive term is used, they have the same significance in importing liability on the part of the principal when the agent is engaged in the work that its principal has employed or directed him to do and * * * in the effort to accomplish it. When such conduct comes within the description that constitutes an actionable wrong, the corporation principal, as in other cases of principal and agent, is liable not only for ‘the act itself, but for the ways and means employed in the performance thereof.’

“In 1 Thompson, Negligence, s 554, it is pointed out that, unless the above principle is maintained:

“‘It will always be more safe and profitable for a man to conduct his business vicariously than in his own person. He would escape liability for the consequences of many acts connected with his business, springing from the imperfections of human nature, because done by another, for which he would be responsible if done by himself. Meanwhile, the public, obliged to deal or come in contact with his agent, for injuries done by them must be left wholly without redress. He might delegate to persons pecuniarily irresponsible the care of large factories, of extensive mines, of ships at sea, or of railroad trains on land, and these persons, by the use of the extensive power thus committed to them, might inflict wanton and malicious injuries on third persons, without other restraint than that which springs from the imperfect execution of the criminal laws. A doctrine so fruitful of mischief could not long stand unshaken in an enlightened jurisprudence.’ This court has often held the master liable, even if the agent was willful, provided it was committed in the course of his employment. [Citation]”

“The act of a servant done to effect some independent purpose of his own and not with reference to the service in which he is employed, or while he is acting as his own master for the time being, is not within the scope of his employment so as to render the master liable therefor. In these circumstances the servant alone is liable for the injury inflicted.” [Citation].…”The general idea is that the employee at the time of doing the wrongful act, in order to fix liability on the employer, must have been acting in behalf of the latter and not on his own account [Citation].”

The principal physical (as opposed to psychic) damage to the plaintiff is a number of disfiguring knife wounds on her head, face, arms, breasts and body. If the instrumentalities of assault had not included rape, the case would provoke no particular curiosity nor interest because it comes within all the classic requirements for recovery against the master. The verdict is not attacked as excessive, and could not be excessive in light of the physical injuries inflicted.

It may be suggested that [some of the cases discussed] are distinguishable because in each of those cases the plaintiff was a business visitor on the defendant’s “premises.”…Home delivery customers are usually in their homes, sometimes alone; and deliveries of merchandise may expose householders to one-on-one confrontations with deliverymen. It would be a strange rule indeed which, while allowing recovery for assaults committed in “the store,” would deny a master’s liability for an assault committed on a lone woman in her own home, by a deliveryman required by his job to enter the home.…

If, as in [one case discussed], the assault was not motivated or triggered off by anything in the employment activity but was the result of only propinquity and lust, there should be no liability. However, if the assault, sexual or otherwise, was triggered off or motivated or occasioned by a dispute over the conduct then and there of the employer’s business, then the employer should be liable.

It is, then, a question of fact for the trier of fact, rather than a question of law for the court, whether the assault stemmed from purely and solely personal sources or arose out of the conduct of the employer’s business; and the trial judge so instructed the jury.

It follows that, under existing decisions of the District of Columbia Circuit, plaintiff has made out a case for the jury against Pep Line Trucking, Inc. unless the sexual character of one phase of the assault bars her from recovery for damages from all phases of the assault.

We face, then, this question: Should the entire case be taken from the jury because, instead of a rod of wood (as in [one case]), in addition to weapons of steel (as in [one case, a knife]); and in addition to his hands (as in [the third case, regarding the dispute about the pennies]), Carey also employed a sexual weapon, a rod of flesh and blood in the pursuit of a job-related controversy?

The answer is, No. It is a jury’s job to decide how much of plaintiff’s story to believe, and how much if any of the damages were caused by actions, including sexual assault, which stemmed from job-related sources rather than from purely personal origins.…

The judgment is affirmed as to the defendant George’s and reversed as to the defendant Pep Line Trucking Company, Inc.

Cockrell v. Pearl River Valley Water Supply Dist.

865 So.2d 357 (Miss. 2004)

The Pearl River Valley Water Supply District (“District”) was granted summary judgment pursuant to the Mississippi Tort Claims Act (MTCA) dismissing with prejudice all claims asserted against it by Sandra Cockrell. Cockrell appeals the ruling of the circuit court citing numerous errors. Finding the motion for summary judgment was properly granted in favor of the District, this Court affirms the final judgment entered by the Circuit Court of Rankin County.

On June 28, 1998, Sandra Cockrell was arrested for suspicion of driving under the influence of alcohol by Officer Joey James who was employed as a security patrol officer with the Reservoir Patrol of the Pearl River Valley Water Supply District. Officer James then transported Cockrell to the Reservoir Patrol office and administered an intoxilyzer test. The results of the test are not before us; however, we do know that after the test was administered, Officer James apologized to Cockrell for arresting her, and he assured her that he would prepare her paperwork so that she would not have to spend much time in jail. As they were leaving the Reservoir Patrol office, Officer James began asking Cockrell personal questions such as where she lived, whether she was dating anyone and if she had a boyfriend. Officer James then asked Cockrell for her cell phone number so that he could call and check on her. As they were approaching his patrol car for the trip to the Rankin County jail, Officer James informed Cockrell that she should be wearing handcuffs; however, he did not handcuff Cockrell, and he allowed her to ride in the front seat of the patrol car with him. In route to the jail, Cockrell became emotional and started crying. As she was fixing her makeup using the mirror on the sun visor, Officer James pulled his patrol car into a church parking lot and parked the car. He then pulled Cockrell towards him in an embrace and began stroking her back and hair telling her that things would be fine. Cockrell told Officer James to release her, but he continued to embrace her for approximately five minutes before continuing on to the jail.

On June 30, 1998, Cockrell returned to the Reservoir Patrol office to retrieve her driver’s license. Officer James called Cockrell into his office and discussed her DUI charge with her. As she was leaving, Officer James grabbed her from behind, turned her around, pinned both of her arms behind her and pulled her to his chest. When Officer James bent down to kiss her, she ducked her head, thus causing Officer James to instead kiss her forehead. When Officer James finally released Cockrell, she ran out of the door and drove away. [Subsequently, Cockrell’s attorney threatened civil suit against Patrol; James was fired in October 1998.]

On September 22, 1999, Cockrell filed a complaint for damages against the District alleging that on the nights of June 28 and June 30, 1998, Officer James was acting within the course and scope of his employment with the District and that he acted with reckless disregard for her emotional well-being and safety.…On April 2, 2002, the District filed its motion for summary judgment alleging that there was no genuine issue of material fact regarding Cockrell’s claim of liability. The motion alleged that the conduct described by Cockrell was outside the course and scope of Officer James’s public employment as he was intending to satisfy his lustful urges. Cockrell responded to the motion arguing that the misconduct did occur in the course and scope of Officer James’s employment with the District and also that the misconduct did not reach the level of a criminal offense such that the District could be found not liable under the MTCA.

The trial court entered a final judgment granting the District’s motion for summary judgment and dismissing the complaint with prejudice. The trial court found that the District could not be held liable under the MTCA for the conduct of Officer James which was both criminal and outside the course and scope of his employment. Cockrell…appeal[ed].

Summary judgment is granted in cases where there is “no genuine issue as to any material fact and that the moving party is entitled to a judgment as a matter of law.”…

Cockrell contends there is a genuine issue of material of fact regarding whether Officer James was acting in the course and scope of his employment with the District during the incidents which occurred on the nights of June 28 and June 30, 1998. Cockrell argues Officer James’s conduct, although inappropriate, did not rise to the level of criminal conduct. Cockrell contends Officer James’s action of hugging Cockrell was similar to an officer consoling a victim of a crime. Cockrell does admit that Officer James’s action of kissing her is more difficult to view as within the course and scope of his employment…

The District argues that although Officer James acted within the course and scope of his duties when he arrested Cockrell, his later conduct, which was intended to satisfy his lustful desires, was outside the scope of his employment with it.…

“Mississippi law provides that an activity must be in furtherance of the employer’s business to be within the scope and course of employment.” [Citation] To be within the course and scope of employment, an activity must carry out the employer’s purpose of the employment or be in furtherance of the employer’s business. [Citations] Therefore, if an employee steps outside his employer’s business for some reason which is not related to his employment, the relationship between the employee and the employer “is temporarily suspended and this is so ‘no matter how short the time and the [employer] is not liable for [the employee’s] acts during such time.’” “An employee’s personal unsanctioned recreational endeavors are beyond the course and scope of his employment.” [Citation]

[In one case cited,] Officer Kerry Collins, a Jackson Police officer, was on duty when he came upon the parked car of L.T., a minor, and her boyfriend, who were about to engage in sexual activity. [Citation] Officer Collins instructed L.T. to take her boyfriend home, and he would follow her to make sure she followed his orders. After L.T. dropped off her boyfriend, Officer Collins continued to follow her until he pulled L.T. over. Officer Collins then instructed L.T. to follow him to his apartment or else he would inform L.T.’s parents of her activities. L.T. followed Officer Collins to his apartment where they engaged in sexual activity. Upon returning home, L.T. told her parents everything that had happened. L.T. and her parents filed suit against Officer Collins, the City of Jackson and the Westwood Apartments, where Officer Collins lived rent free in return for his services as a security guard.…The district court granted summary judgment in favor of the City finding that Officer Collins acted outside the course and scope of his employment with the Jackson Police Department. [Citation]

In [Citation] the plaintiff sued the Archdiocese of New Orleans for damages that allegedly resulted from his sexual molestation by a Catholic priest. The Fifth Circuit found that the priest was not acting within the course and scope of his employment. The Fifth Circuit held that “smoking marijuana and engaging in sexual acts with minor boys” in no way furthered the interests of his employer.

The Southern District of Mississippi and the Fifth Circuit, applying Mississippi law, have held that sexual misconduct falls outside the course and scope of employment. There is no question that Officer James was within the course and scope of his employment when he first stopped Cockrell for suspicion of driving under the influence of alcohol. However, when Officer James diverted from his employment for personal reasons, he was no longer acting in the furtherance of his employer’s interests…Therefore, the District cannot be held liable…for the misconduct of Officer James which occurred outside the course and scope of his employment.

Affirmed.

A contract made by an agent on behalf of the principal legally binds the principal. Three types of authority may bind the principal: (1) express authority—that which is actually given and spelled out, (2) implied authority—that which may fairly be inferred from the parties’ relationship and which is incidental to the agent’s express authority, and (3) apparent authority—that which reasonably appears to a third party under the circumstances to have been given by the principal. Even in the absence of authority, a principal may ratify the agent’s acts.

The principal may be liable for tortious acts of the agent but except under certain regulatory statutes may not be held criminally liable for criminal acts of agents not prompted by the principal. Under the doctrine of respondeat superior, a principal is generally liable for acts by a servant within the scope of employment. A principal usually will not be held liable for acts of nonservant agents that cause physical damage, although he will be held liable for nonphysical torts, such as misrepresentation. The principal will not be held liable for tortious acts of independent contractors, although the principal may be liable for injuries resulting from his failure to act in situations in which he was not legally permitted to delegate a duty to act. Whenever an agent is acting to further the principal’s business interests, the principal will be held vicariously liable for the agent’s intentional torts. What constitutes scope of employment is not easy to determine; the modern trend is to hold a principal liable for the conduct of an agent if it was foreseeable that the agent might act as he did.

Most states have special rules of vicarious liability for special situations; for example, liability of an automobile owner for use by another. Spouses are not vicariously liable for each other, nor are parents for children, except for failing to control children known to be dangerous.

In general, an agent is not personally liable on contracts he has signed on behalf of a principal. This general rule has several exceptions recognized in most states: (1) when the agent is serving an undisclosed or partially disclosed principal, (2) when the agent lacks authority or exceeds his authority, and (3) if the agent entered into the contract in a personal capacity.

The agency relationship may be terminated by mutual consent, by express agreement of the parties that the agency will end at a certain time or on the occurrence of a certain event, or by an implied agreement arising out of the circumstances in each case. The agency may also be unilaterally revoked by the principal—unless the agency is coupled with an interest—or renounced by the agent. Finally, the agency will terminate by operation of law under certain circumstances, such as death of the principal or agent.

Authority that legally may bind the principal includes

As a general rule, a principal is not

An agent may be held personally liable on contracts signed on behalf of a principal when

An agency relationship may be terminated by

The principal’s liability for the agent’s acts of which the principal had no knowledge or intention to commit is called