Workplace Basics

Completing I-9 and W-4 Forms

Form W-4 and state withholding form

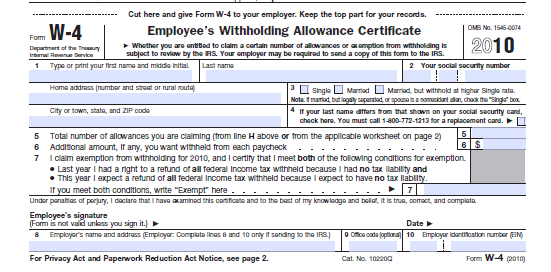

W-4 form (employee's withholding allowance certificate)

If you work in the United States, you are required by federal law to pay federal income tax. Using information you provide, your employer uses the W-4 form to withhold the correct amount of income tax from your pay. Issued by the Internal Revenue Service, Form W-4 includes three types of information your employer will use to determine your withholding:

- Whether to withhold at the single rate or at the lower married rate

- How many withholding allowances you claim (each allowance reduces the amount withheld)

- Whether you want an additional amount withheld

Learn more at IRS.gov or review this sample W-4 form.

W4 Form

W4 FormState withholding form

You will also file a state income tax withholding form. Using the information you provide, your employer uses this form to determine the correct amount of state income tax to withhold from your pay. Types of information that are used to determine your withholding may include your marital status, age, and number of dependents.

To learn more about your state withholding form, visit your state's Department of Revenue website.