Workplace Basics

Completing I-9 and W-4 Forms

Introduction

By the end of this lesson, you should be able to:

- Identify Form I-9

- Identify Form W-4

- Identify your state's withholding form

- Identify what important documents you should bring to your first day of work

Be prepared for your first day of work

"Will I be able to manage my workload?" "Will I get along with my supervisor?" "What will my workstation be like?" These are probably just a few of the questions you've had when anticipating starting a new job.

While you may not be able to anticipate what exactly will happen on your first day of work, you can expect to complete some paperwork.

Form I-9 (Employment Eligibility Verification)

For every new employee hired to work in the United States, employers are responsible for completing Form I-9 (Employment Eligibility Verification) and keeping it on file. Issued by the Immigration and Naturalization Service (INS), this form verifies that employers have verified the employment eligibility and proper identification documents presented by each employee.

For more information, go to Employment Eligibility Verification on the U.S. Citizenship and Immigration Services website.

Form W-4 and state withholding form

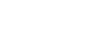

W-4 form (employee's withholding allowance certificate)

If you work in the United States, you are required by federal law to pay federal income tax. Using information you provide, your employer uses the W-4 form to withhold the correct amount of income tax from your pay. Issued by the Internal Revenue Service, Form W-4 includes three types of information your employer will use to determine your withholding:

- Whether to withhold at the single rate or at the lower married rate

- How many withholding allowances you claim (each allowance reduces the amount withheld)

- Whether you want an additional amount withheld

Learn more at IRS.gov or review this sample W-4 form.

W4 Form

W4 FormState withholding form

You will also file a state income tax withholding form. Using the information you provide, your employer uses this form to determine the correct amount of state income tax to withhold from your pay. Types of information that are used to determine your withholding may include your marital status, age, and number of dependents.

To learn more about your state withholding form, visit your state's Department of Revenue website.

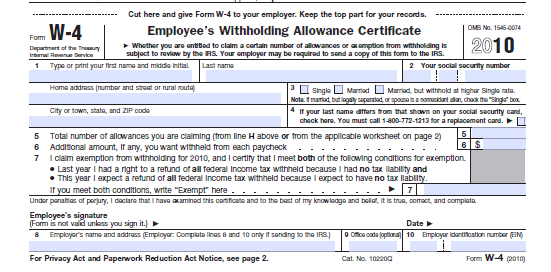

Bring proper identification

In order to complete this paperwork, many U.S. citizens wishing to work in the United States typically bring a state-issued driver's license or identification card and a Social Security card. However, there are several forms of verification that can be used.

Go to Part 8 of the USCIS Handbook for Employers (M-274) to see more forms of acceptable documentation.

Sample I9 Acceptable Identification

Sample I9 Acceptable IdentificationBe prepared to produce other personal information such as your maiden name if applicable, Social Security Number, driver's license number, current address and phone number, and the name and information of an emergency contact.