Sales tax

Depending on where you live, you might pay a sales tax on the things you buy. A sales tax is an extra charge added to the price of an item. The amount you pay in tax is almost always a percentage of that price.

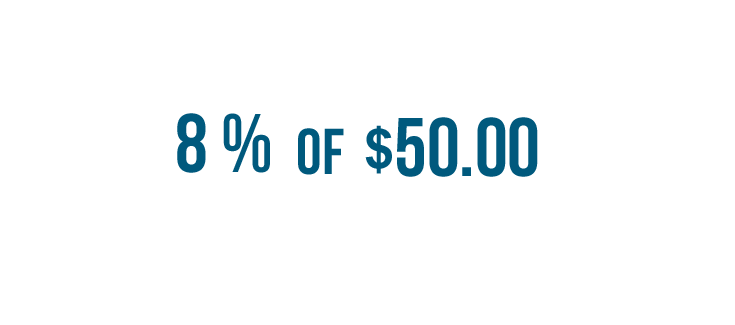

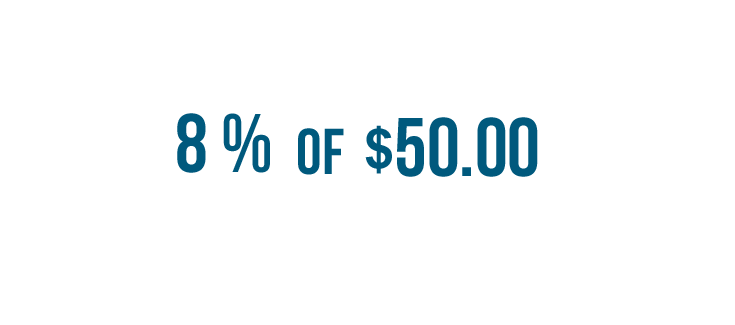

Suppose you buy a $50 coffeemaker in an area where the sales tax is 8%. When you check out, 8% of $50 would be added to your total price. How much would you pay total?

Click through the slideshow to learn how to calculate sales tax.

Let's say you want to buy a $50 coffeemaker, and the sales tax is 8%.

Sales tax is a percentage of the price of the item. This means the sales tax is eight percent of fifty dollars.

Whenever you see the phrase "of something" in a math sentence, it's usually a hint that you'll need to multiply.

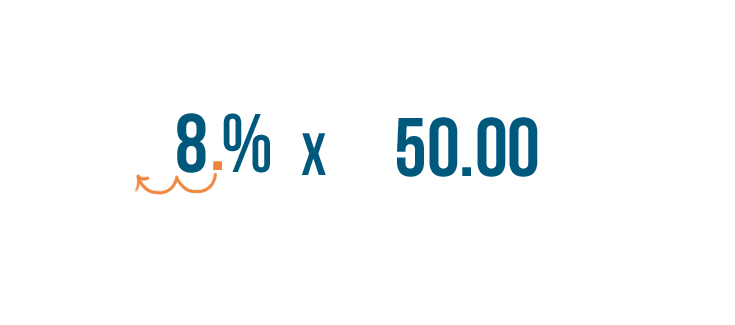

So we'll multiply 50 by 8%.

Before we can do that, we'll need to convert 8% into a decimal.

We'll move the decimal point two places to the left...

We'll move the decimal point two places to the left...so 8% becomes 0.08.

Now we can multiply: 0.08 times 50 equals 4.00.

So the sales tax is $4.00. Another way to say this is that 8% of $50.00 is $4.00.

Remember, sales tax is an extra charge added to the price of an item. So we'll add the sales tax to our original price.

$4.00 plus $50.00 equals $54.00.

The final price of the coffeemaker is $54.00 after adding sales tax.

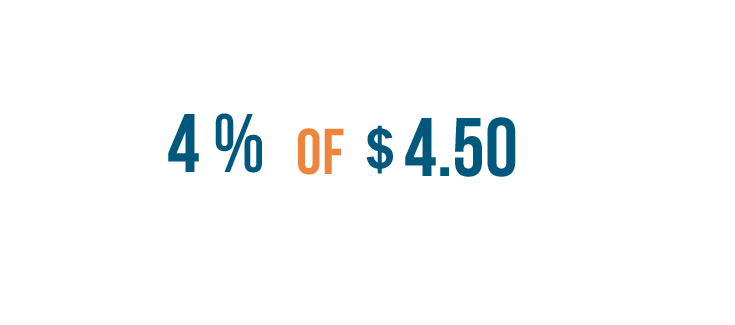

Let's try another example. Let's say you want to buy a six pack of soda that costs $4.50, and the sales tax on food is 4%.

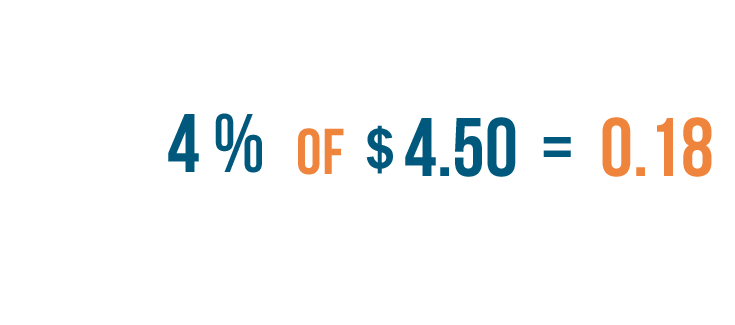

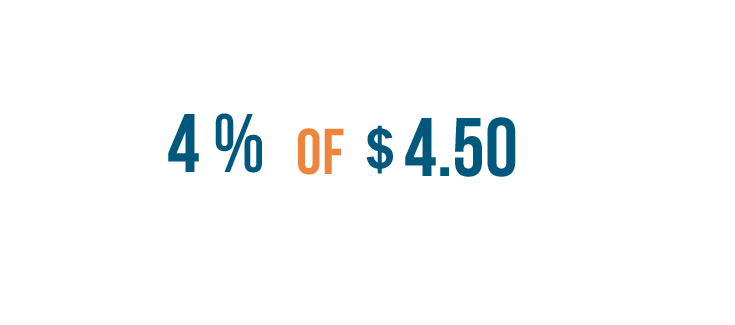

This means the sales tax is 4% of $4.50.

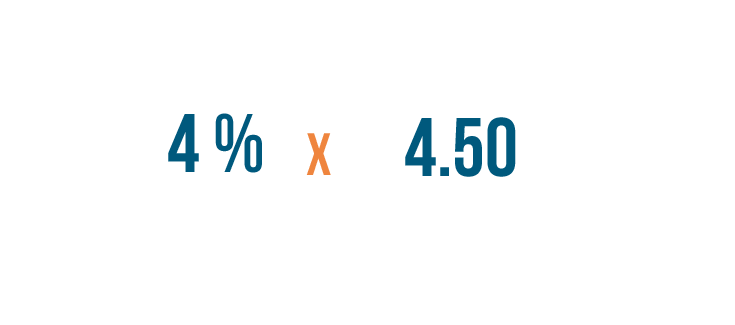

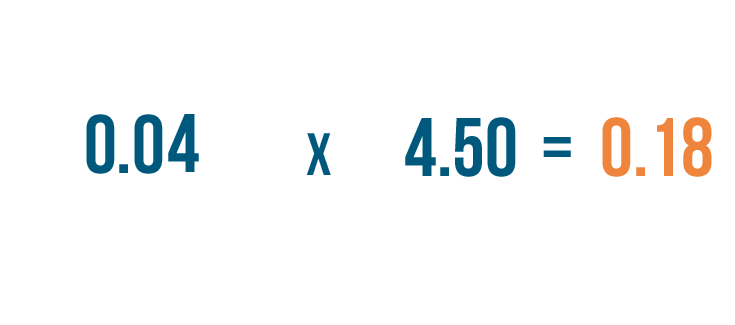

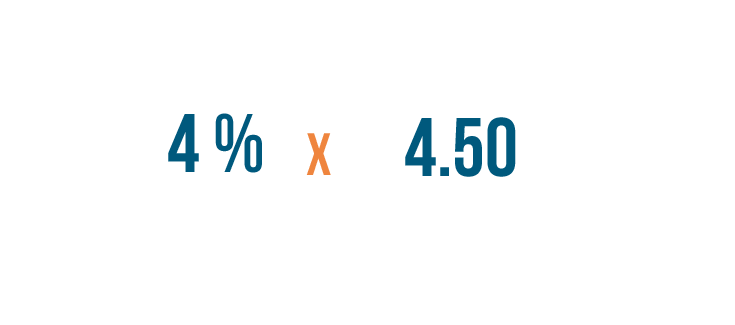

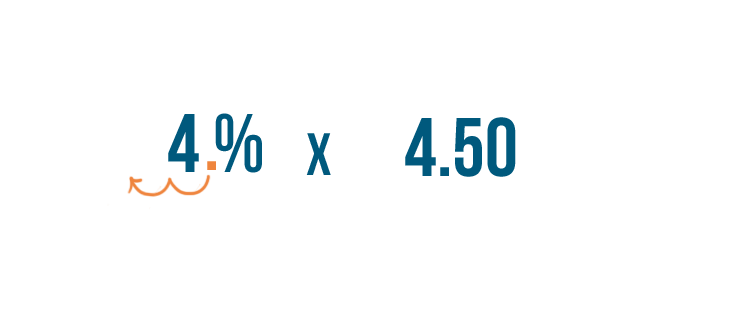

So we'll multiply 4% by 4.50.

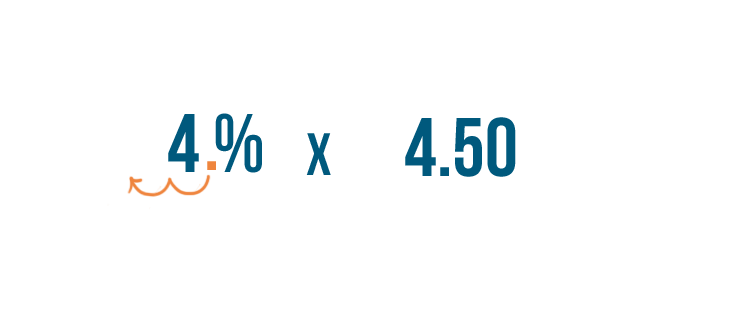

First, we need to convert 4% into a decimal, so we'll move the decimal point two places to the left.

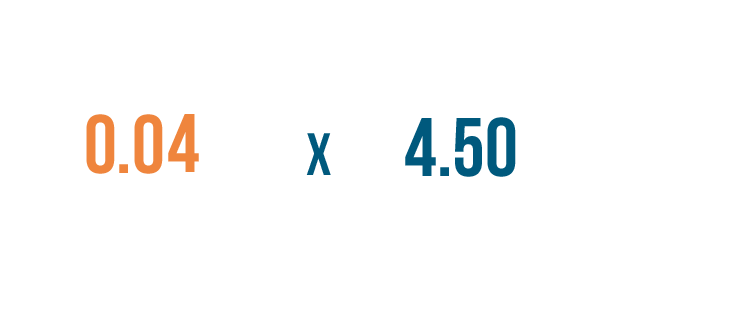

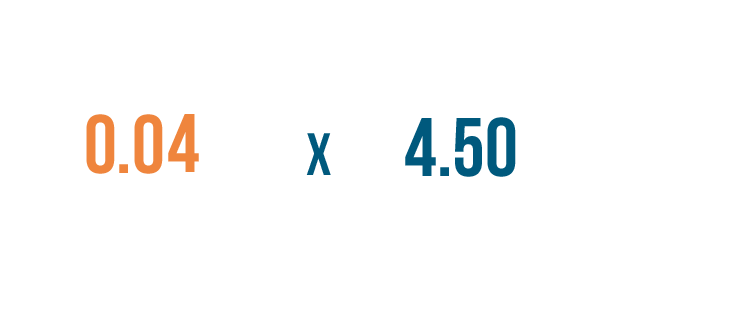

4% is the same as 0.04.

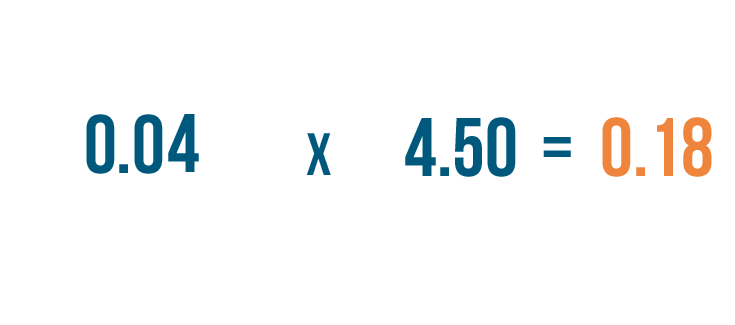

Now we'll multiply: 4.5 times 0.04 is 0.18, so the sales tax is $0.18, or 18 cents.

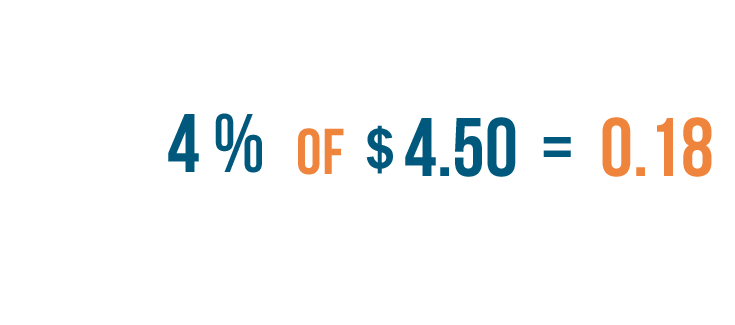

We could also say that 4% of $4.50 is $0.18.

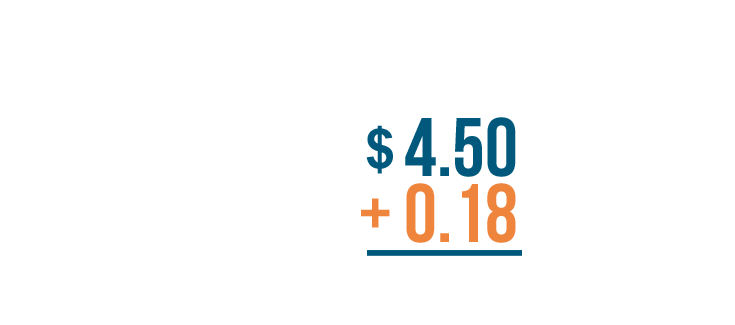

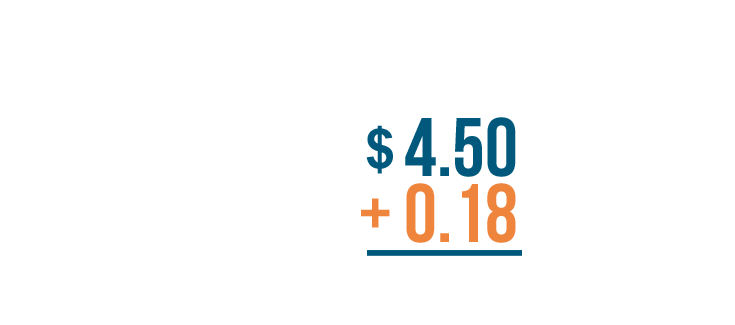

Finally, we'll add the sales tax to the original price.

4.50 plus 0.18 is 4.68.

So the final price is $4.68 after adding sales tax.

Now it's your turn! Find the total cost of each item after sales tax.

You buy a pair of sunglasses for $49.00. The sales tax is 7%.

You need to purchase $326.00 worth of vinyl siding. The sales tax is 4%.

You buy $32.19 worth of groceries. The sales tax is 5.7%.

Curious about the sales tax where you live?

You can use this list of State and Local Sales Tax Rates from the Tax Foundation to look up the sales tax rate where you live.