Money Basics

Banking Options

Introduction

By the end of this lesson, you should be able to:

- Recognize how banks operate and how deposits are protected

- Calculate interest

- Judge which banking option best fits your needs

- Recognize the difference between a bank and a credit union

What is a bank?

A bank is an organization that receives deposits, honors checks drawn on those deposits, and pays interest on them. Banks also make loans and invest in securities.

A bank account helps you protect and manage your money. Banks offer three main types of accounts: checking, savings and combination accounts. Such accounts allow you to write checks to pay bills or buy products, help you save money for the future, and assist you in building a credit record. You'll learn more about different bank accounts later in this lesson.

How do banks operate, and how is your money protected?

Banks profit from the difference in the interest rates paid on deposits and charged on loans. In other words, the bank uses the money you deposit to loan out. It charges a higher interest rate on loans it pays out to you in interest on your account. You'll learn more about interest rates later in this lesson.

Banks also make money by charging service fees and earn income from securities and investments.

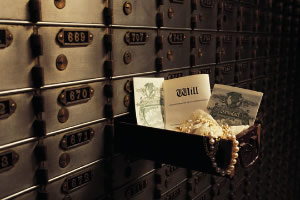

Banks provide a safe place to put your money. Even in the case of a robbery, it's the bank's loss—not yours. This is because banks carry private banking insurance to protect deposits in the case of burglary, robbery, or vandalism.

Also, in the United States, the Federal Deposit Insurance Corporation (FDIC) insures most bank or savings institution deposits. The FDIC is an independent U.S. agency that protects the nation's money supply in case of financial institution failure.

The FDIC typically insures savings deposits, checking deposits, certificates of deposit (CDs), and cashiers' checks. However, securities, mutual funds, and similar investments are not insured.

FDIC-insured institutions must display an official sign at each teller window or teller station. Depositors are typically protected for up to $100,000.

All about interest

If you borrow money from a bank or other institution, you must pay interest on that loan. In this case, interest is the amount paid for the use of money. For example, you pay interest when you obtain a mortgage loan or put charges on a credit card.

When you deposit money into a bank, interest is the return earned on an investment. The bank pays you interest for allowing it to temporarily use your money to loan to others.

While some checking accounts pay interest, banks primarily attract customers by paying interest on money kept in savings accounts.

Interest is calculated as a rate, such as 5 percent or 10 percent. The amount of interest you earn on a savings account is determined by multiplying the principal—the money you deposit—by the rate of interest. Banks typically calculate interest and add it at the end of a certain time period. Interest can be compounded annually, semi-annually, quarterly, monthly, weekly, and even daily.

For example, if you put $100 into a savings account that pays 5 percent every quarter, you will earn $5 in interest at the end of the quarter.

Of course, if you make regular deposits into a savings account, your money will earn more interest.

For more help determining decimals and percentages, review our Decimals and Percents tutorials in our Math section.

Let's imagine that you deposit and keep $400 in an account that earns 6 percent interest per year. How much interest would you earn at the end of the year?

Banking fees

Banks profit, in part, from banking fees. For example, banks often charge a fee of $25 or more for bounced checks. The average fee charged by a bank to a noncustomer using its automated teller machine (ATM) is $2.50 per transaction. The average fee consumers are sometimes charged by their own banks for using another bank's ATM is $1.57. You'll learn more about ATMs later in this tutorial.

To avoid or reduce banking fees:

- Keep track of the checks you write and the money in your account to avoid bouncing checks.

- Consider overdraft protection. This would allow the bank to draw money out of another account—such as your savings account—to cover your checks if there are insufficient funds in your checking account. However, avoid overdraft protection via a credit account because you will have to pay interest.

- Avoid using ATMs operated by other banks.

- Use the cash-back option offered when you use your debit card at a grocery store or other location.

- Research and compare your banking options to find the most convenient service.

Visit ATM in our Everyday Life project to practice using an ATM.

Banking options and services

Take time to think about where you want to put your money and the options offered by different financial institutions.

When choosing a bank, consider:

- The services you want. For example, are you looking for direct deposit of your paycheck, no-interest checking, or no-fee money orders? Do you want a higher interest rate on a savings account or investment options?

- Bank fees. Ask if there are ATM usage fees, overdraft protection fees, fees for going below the minimum balance, and bounced check fees.

- ATM convenience. If you like to use an ATM to perform many of your transactions, can the bank meet your needs?

- Insurance. Are bank deposits insured by the Federal Deposit Insurance Corporation (FDIC)?

- Online banking. Internet banking saves time. Simply dial into the bank's computer using your own computer, or download information to your hard drive. This service may be free at some banks, while others may charge a fee for basic services. There sometimes is an additional fee for making online bill payments.

- Customer service. Visit banks you are considering. Are the employees helpful, courteous, and able to answer your questions?

- Location. Are there branches close to your home and work?

What is a credit union?

A credit union is an alternative to a bank. It is a cooperative financial institution that is owned and controlled by the people who use its services. The people who use a credit union are its members, and they have something in common such as where they work, live, or attend church.

Because credit unions are not-for-profit, they provide more desirable rates and fees than banks. At a credit union, a savings account is sometimes called a share account, while a checking account is a share draft account.

Finding a credit union

Although credit unions are for everyone, the law places some limits on the people they may serve. A credit union's field of membership could be an employer, church, school, or community.

According to the Credit Union National Association (CUNA), there are several ways of finding a credit union you are eligible to join. You can try the following:

- Ask your boss. Your company may sponsor a credit union or could be a select employee group (SEG) that has access to a credit union. Many employers offer direct deposit of your payroll to your credit union.

- Poll your family. Does your spouse's employer sponsor a credit union? Most credit unions allow credit union members' families to join. Each credit union, however, may define this differently. At some credit unions, for example, only members of your immediate family are eligible. At others, family may include extended family members such as cousins, uncles, and aunts.

- Ask your neighbors. Some credit unions have a community field of membership, which serves a region that's defined by geography rather than by employment or another association.

- Use the Credit Union National Association's (CUNA) locator. Visit www.cuna.org, and use the locator to find a credit union near you.

- Call CUNA. Call (800) 356-9655, and you'll get an electronic message listing the name and telephone number of a person at the credit union league in your state who can help you find a credit union to join.

Make sure any credit union you are considering is insured and offers the range of services you need.

Online

Offline

- The Complete Idiot's Guide to Managing Your Money (3rd Edition) - Robert K. Heady and Christy Heady

- Checkbook Management - A Guide to Saving Money - Eric Gelb